|

市场调查报告书

商品编码

1683772

印尼建筑涂料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Indonesia Architectural Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

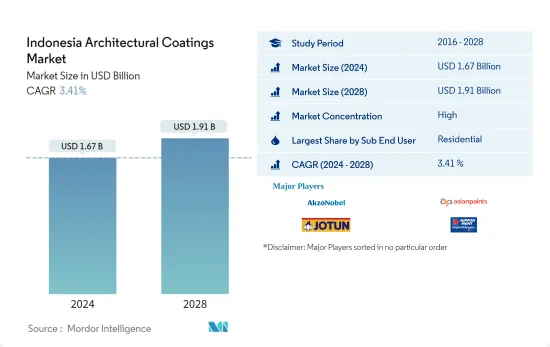

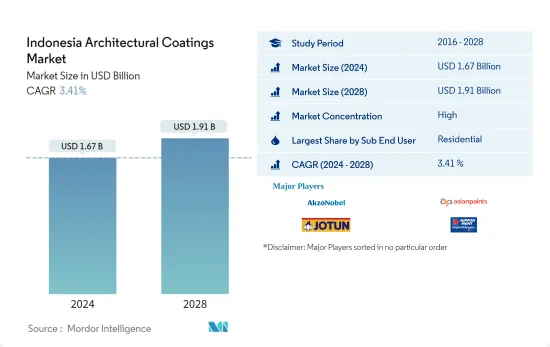

印尼建筑涂料市场规模预计在 2024 年为 16.7 亿美元,预计在 2028 年达到 19.1 亿美元,预测期内(2024-2028 年)的复合年增长率为 3.41%。

主要亮点

- 按最终用户分類的最大细分市场:住宅:由于政府为满足人口的快速增长而不断努力进行住宅建设,因此住宅行业占据了市场主导地位。

- 按技术分類的最大细分市场:水性:由于对 VOC排放的认识,水性涂料略有优势,但缺乏政府监管阻碍了市场的发展。

- 按树脂分類的最大细分市场:丙烯酸:由于住宅外墙使用压克力型涂料压克力型涂料在该国的建筑涂料消费中占据主导地位。

印尼建筑涂料市场趋势

按终端用户细分,住宅是最大的。

- 受销售和新品上市的影响,印尼建筑涂料消费量在 2016 年和 2017 年有所下降。此外,2016 年印尼房地产行业出现成长放缓,因为潜在买家(尤其是高端买家)因等待税收特赦实施而推迟购买,导致该行业内流通的资本减少。

- 消费迅速復苏,并在 2018 年达到顶峰,这得益于住宅占地面积的增加,因为该国实现了建造 100 万套住宅的目标,作为减少该国住宅债务存量的努力的一部分,2018 年建造了 113 万套房屋。 2019年,建筑涂料的消费量出现温和增长,但由于COVID-19在该国的蔓延和为期50天的全国范围的部分封锁导致住宅和商业领域的新建设数量下降,建筑涂料的消费量在2020年开始下降。

- 由于该国人口不断增长以及对蓬勃发展的建筑业的积极投资,预计到 2022 年及预测期内,消费量和销售额将显着增长。根据世界人口调查,印尼目前每年增长人口约 273 万人。

印尼建筑涂料产业概况

印尼建筑涂料市场较为分散,前五大企业占比为17.22%。市场的主要企业有:阿克苏诺贝尔公司、亚洲涂料公司、佐敦公司、日本涂料控股公司和TOA Paint Public Company Limited。 (按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第 2 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第三章 产业主要趋势

- 占地面积趋势

- 法律规范

- 价值链与通路分析

第 4 章 市场细分

- 次级终端用户

- 商业的

- 住宅

- 科技

- 溶剂型

- 水性

- 树脂

- 丙烯酸纤维

- 醇酸

- 环氧树脂

- 聚酯纤维

- 聚氨酯

- 其他树脂类型

第五章 竞争格局

- 重大策略倡议

- 市场占有率分析

- 业务状况

- 公司简介

- AkzoNobel NV

- Asian paints

- Avian Brands

- DAI NIPPON TORYO CO.,LTD.

- Guangdong Maydos building materials limited company

- Jotun

- Kansai Paint Co.,Ltd.

- Mowilex

- Nippon Paint Holdings Co., Ltd.

- PT Propan Raya

- SKK(S)Pte. Ltd

- TOA Paint Public Company Limited.

第六章 执行长的关键策略问题

第七章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 93091

The Indonesia Architectural Coatings Market size is estimated at USD 1.67 billion in 2024, and is expected to reach USD 1.91 billion by 2028, growing at a CAGR of 3.41% during the forecast period (2024-2028).

Key Highlights

- Largest Segment by End-user - Residential : The residential sector dominated the market due to the continuous efforts by the government to build houses to accompany the fast growing population in the country

- Largest Segment by Technology - Waterborne : The waterborne coatings has slightly dominated the segment due to the awareness for VOC emissions, however lack of government regulations still hinders the market.

- Largest Segment by Resin - Acrylic : The acrylic coating has dominated the architectural coating consumption as the country has its houses coated with acrylic coating on the outer surface of the houses.

Indonesia Architectural Coatings Market Trends

Residential is the largest segment by Sub End User.

- The architectural coating consumption in Indonesia dipped in 2016 and 2017 due to the affected sales and new launches. Furthermore, The Indonesian property sector experienced a slowdown in 2016 as prospective buyers, especially in the premium segment, delayed their purchase to wait for the tax amnesty realisation, therefore leading to the less circulation of money in the sector.

- The consumption recovered quickly and peaked in 2018 due to the higher addition of floor area in the residential sector as the country met its target for the construction of 1 million homes, with 1.13m built in 2018 as part of efforts to reduce the country's housing backlog. The slow growth in the architectural coating consumption was observed in 2019 followed by a decline in 2020 due to lower new constructions in both residential cand commercial sector owing to the spread of covid-19 in the country and partial lockdown of 50 days across the country.

- The increase in consumption and sales is expected to grow at a significant rate in 2022 and the forecasted period due to the rising population in the country and positive investment in the rapid growing construction sector. According to the world population review, Indonesia currently grows by about 2.73 million people per year.

Indonesia Architectural Coatings Industry Overview

The Indonesia Architectural Coatings Market is fragmented, with the top five companies occupying 17.22%. The major players in this market are AkzoNobel N.V., Asian paints, Jotun, Nippon Paint Holdings Co., Ltd. and TOA Paint Public Company Limited. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Floor Area Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION

- 4.1 Sub End User

- 4.1.1 Commercial

- 4.1.2 Residential

- 4.2 Technology

- 4.2.1 Solventborne

- 4.2.2 Waterborne

- 4.3 Resin

- 4.3.1 Acrylic

- 4.3.2 Alkyd

- 4.3.3 Epoxy

- 4.3.4 Polyester

- 4.3.5 Polyurethane

- 4.3.6 Other Resin Types

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles

- 5.4.1 AkzoNobel N.V.

- 5.4.2 Asian paints

- 5.4.3 Avian Brands

- 5.4.4 DAI NIPPON TORYO CO.,LTD.

- 5.4.5 Guangdong Maydos building materials limited company

- 5.4.6 Jotun

- 5.4.7 Kansai Paint Co.,Ltd.

- 5.4.8 Mowilex

- 5.4.9 Nippon Paint Holdings Co., Ltd.

- 5.4.10 PT Propan Raya

- 5.4.11 SKK(S) Pte. Ltd

- 5.4.12 TOA Paint Public Company Limited.

6 KEY STRATEGIC QUESTIONS FOR ARCHITECTURAL COATINGS CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219