|

市场调查报告书

商品编码

1683805

绿色氢能 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Green Hydrogen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

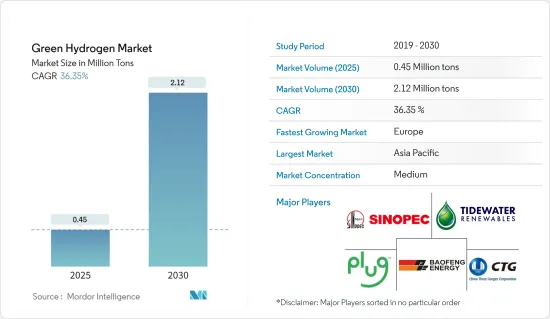

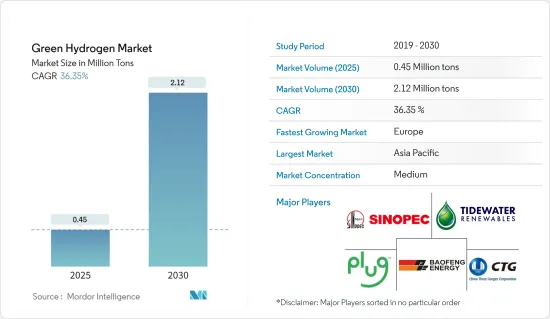

2025年绿氢市场规模预估为45万吨,预估2030年将达212万吨,预测期间(2025-2030年)复合年增长率为36.35%。

由于生产停顿和供应链中断,COVID-19 疫情对绿氢产业的整体成长产生了中等影响。然而,疫情过后,交通运输领域对绿氢的需求增加,推动了该产业的成长。

从中期来看,化学工业对绿氢的需求以及对碳排放日益增长的环境问题预计将推动对绿氢的需求。

另一方面,绿色氢能的高投资成本、有限的技术和基础设施以及高能源损失可能会阻碍该行业的整体成长。

鼓励使用绿氢的有利法规和政策预计将为市场提供新的成长机会。

预计亚太地区将主导市场,其中欧洲在预测期内将实现最高的年增长率。

绿氢市场趋势

电力和其他终端用户工业领域预计将主导市场

- 氢是一种用途广泛的能源载体,有可能在能源系统脱碳方面发挥关键作用。

- 风能和太阳能发电场产生的可再生能源以压缩气体的形式储存。氢能能源储存系统由将电能转化为绿色氢气的电解槽、将氢气以压缩气体形式储存的储存设施和将绿色氢气转化为电能的燃料电池组成。

- 世界各主要国家都在加大氢储存能力建设,主要针对寻求脱碳的发电产业。

- 这种推动作用透过补贴和奖励等各种措施得到体现。例如,美国政府已在 2023 年向 16 个计划拨款约 4,800 万美元,专注于推动清洁氢技术,特别是燃料电池和储能技术。

- 世界主要经济体均致力于开发创新解决方案,加速采用氢能综合绿色发电解决方案,以满足气候变迁目标。印度新可再生能源部于2023年9月宣布了一项重大倡议,宣布实施先导计画,利用绿氢储存全天候发电100兆瓦电力。

- 此外,2024 年 4 月,Satluj Jal Vidyut Nigam (SJVN) 宣布在喜马偕尔邦 Jhakri 启动印度首个多用途绿色氢先导计画Nathpa Jhakri 水电站 (NJHPS),这是一个基于 20 Nm3/hr电解槽和电池运作的先导计画kW 燃料计画和电池容量。

- 同样,中国在2023年7月取得了突破,在甘肃省合作市建造了12MW/2MWh绿色氢能能源储存设施。

- 许多市场公司正在开发创新解决方案,将绿氢融入发电设施。例如,西门子能源和西门子歌美飒计画在未来五年内共投资约 1.2 亿欧元,将离岸风力发电机开发为直接生产绿色氢气的单一同步系统,并计画在 2025/2026 年进行全面的海上示范。

- 绿色氢能的日益普及,加上建筑和电力行业的积极脱碳努力,为所研究的市场描绘了一幅光明的前景,预计未来几年将出现强劲增长。

- 此外,绿氢(H2)等低碳燃料将成为 2050 年实现温室气体(GHG)净零排放的全球能源系统的关键组成部分。

- 根据国际可再生能源机构(IRNA)报告,全球新建氢发电工程的数量正在逐年变化。例如,2022 年有 5 个计划,但 2023 年只有 2 个项目。

- 因此,上述因素预计将推动电力和其他终端用户能源产业对绿氢的消费。

亚太地区可望主导市场

- 预计亚太地区将主导市场。中国是该地区国内生产毛额最高的国家,与印度一道,是世界上成长最快的经济体之一。

- 2022年3月,中国公布了首个长期氢能规划,涵盖2021年至2035年。此战略蓝图强调分阶段实施,优先透过技术进步和增强製造能力来发展国内氢能产业。值得注意的是,中国的目标是到 2025 年每年利用可再生能源生产 10 万至 20 万吨氢气,更广泛的目标是到 2035 年将可再生氢能纳入经济的主流,并加强中国的绿色能源转型。此外,该计画倡导多样化的技术路径,在未来15年内推动再生能源来源的多元化组合。

- 中国钢铁製造商处于向绿氢能转型的前沿,旨在取代高炉操作等过程中的石化燃料。值得注意的是,大型钢铁製造商宝武已开始在广东省湛江市建造一座以绿氢为燃料的电弧炉。

- 钢铁、水泥和化肥等行业以其高碳排放而闻名,并面临越来越大的脱碳压力。随着国家绿色氢能计画的雄心勃勃的目标(到 2030 年减少 1000 亿印度卢比的石化燃料进口量并减少每年约 5000 万吨的二氧化碳排放)以及印度的共同努力,绿色氢能成为这一转型中的一线希望。

- 同样,印度国家电力公司 (NTPC) 也迈出了重要一步,将从 2023 年 1 月起在其位于印度古吉拉突邦拉特卡瓦斯镇的 PNG 网路中混合高达 8% 的绿色氢气。

- 东京非但没有落后,反而在公共土地上开发绿色氢能设施方面取得了进展。东京都政府已宣布计划在 2024 财年之前开始建造三台机组,并计划在当年年终前让其中一台运作。但仍有待政府提供更多细节。

- 2024 年 1 月,SK Scottplant 与 Bloom Energy 合作推出了一项开创性的绿氢倡议。我们与韩国南方电力公司和地方政府合作,旨在引进大规模氢能发电。 SK Ecoplant 将利用 Bloom 的尖端固体氧化物电解槽(SOEC) 技术在韩国济州岛生产绿色氢气作为运输燃料。预计该专案将于 2025 年底投产,将采用 1.8 兆瓦的电解槽技术。

- 因此,上述因素预计将推动亚太地区的绿氢消费。

绿氢产业概况

全球绿氢市场已部分整合。市场的主要企业包括(不分先后顺序)中国石油化学集团公司、宁夏宝丰能源集团、普拉格能源公司、中国长江三峡集团公司(CTG)和Tidewater Renewables Ltd.。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 发挥化学工业的潜力

- 对碳排放的环境担忧日益加剧

- 市场限制

- 绿氢投资成本高

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 技术简介

第五章 市场区隔

- 最终用户产业

- 精製

- 化学

- 钢

- 运输

- 电力和其他终端用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Air Products and Chemicals Inc.

- Air Liquide

- BP PLC

- China Petroleum & Chemical Corporation

- China Three Gorges Corporation

- Engie

- Fortescue Future Industries

- Green Hydrogen International Corp.

- Iberdrola SA

- Intercontinental Energy

- LHYFE

- Linde PLC

- Ningxia Baofeng Energy Group Co. Ltd

- Plug Power Inc.

- Reliance Industries Limited

- Tidewater Renewables Ltd

- Uniper SE

- Yara

第七章 市场机会与未来趋势

- 有利法规政策推动绿氢应用

The Green Hydrogen Market size is estimated at 0.45 million tons in 2025, and is expected to reach 2.12 million tons by 2030, at a CAGR of 36.35% during the forecast period (2025-2030).

The COVID-19 pandemic moderately impacted the overall growth of the green hydrogen industry, owing to a halt in production and disruption in the supply chain. However, after the pandemic, the demand for green hydrogen increased in the transportation segment, which, in turn, has propelled the industry's growth.

Over the medium term, the demand for green hydrogen in the chemical industry and growing environmental concerns regarding carbon emissions are expected to drive the demand for green hydrogen.

On the flip side, the high investment cost of green hydrogen, limited access to technology and infrastructure, and high energy losses will likely hinder the industry's overall growth.

Favorable policies and regulations promoting the usage of green hydrogen are projected to offer new growth opportunities to the market.

Asia-Pacific is expected to dominate the market, and Europe will likely witness the highest annual growth rate during the forecast period.

Green Hydrogen Market Trends

The Power and Other End-user Industries Segment is Expected to Dominate the Market

- Hydrogen is a very versatile energy carrier that has the potential to play a significant role in decarbonizing the energy system.

- Renewable energy produced via wind or solar farms is stored as compressed gas. The hydrogen energy storage system consists of an electrolyzer to convert electricity to green hydrogen, a storage facility to store hydrogen as a compressed gas, and a fuel cell to convert green hydrogen to electricity.

- Leading economies worldwide are ramping up their hydrogen storage capacities, primarily targeting the power generation sector for decarbonization.

- This push is evident through various initiatives, such as grants and incentives. For example, in 2023, the US government allocated nearly USD 48 million across 16 projects, focusing on advancing clean hydrogen technologies, notably fuel cells and storage.

- Major economies around the globe are foraging into the field of developing innovative solutions to improve the adoption of integrated green hydrogen-based power generation solutions to meet climate goals. In a significant move, in September 2023, India's Ministry of New & Renewable Energy unveiled plans for a pilot project to generate 100 MW of round-the-clock power using green hydrogen storage.

- Moreover, in April 2024, Satluj Jal Vidyut Nigam (SJVN) announced the commissioning of India's first multi-purpose green hydrogen pilot project, a 20 Nm3/hr electrolyzer and 25 kW fuel cell capacity-based green hydrogen pilot project, Nathpa Jhakri Hydro Power Station (NJHPS) in Himachal's Jhakri.

- Similarly, China made strides in July 2023, inaugurating a 12 MW/2 MWh green hydrogen-based energy storage facility in Gannanzhou Cooperation City, Gansu Province.

- Numerous market players are developing innovative solutions to integrate green hydrogen into power generation facilities. For instance, Siemens Energy and Siemens Gamesa target a total investment of around EUR 120 million in the coming five years to develop an offshore wind turbine as a single synchronized system to directly produce green hydrogen, with a full-scale offshore demonstration expected by 2025/2026.

- The rising adoption of green hydrogen, coupled with aggressive decarbonization efforts in the building and power sectors, paints a promising picture for the market under study, projecting robust growth in the coming years.

- Additionally, low-carbon fuels, like green hydrogen (H2), will be a key component of the global energy system, which aims to achieve net zero greenhouse gas (GHG) emissions by 2050.

- According to the report of the International Renewable Energy Agency (IRNA), the number of new power-to-hydrogen projects worldwide has changed yearly. For instance, in 2022, there were five projects, and in 2023, there were only two.

- Therefore, the aforementioned factors are projected to boost the consumption of green hydrogen in the power and other end-user energy industries.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the market. China has the largest GDP in the region, and China and India are among the fastest-emerging economies in the world.

- In March 2022, China revealed its first long-term hydrogen plan from 2021 to 2035. This strategic roadmap emphasizes a phased approach, prioritizing the growth of the domestic hydrogen industry through technological advancements and enhanced manufacturing capabilities. Notably, the plan targets producing 100,000 to 200,000 tons of hydrogen annually from renewable sources by 2025, with a broader goal of mainstreaming renewable hydrogen in the economy to bolster China's green energy transition by 2035. Additionally, the plan advocates for a diverse technology pathway, promoting a varied mix of renewable sources over the next 15 years.

- Chinese steelmakers spearhead the shift toward green hydrogen, aiming to replace fossil fuels in processes like Blast Furnace operations. Notably, Baowu, a major player, initiated the construction of a green hydrogen-fueled electric arc furnace in Zhanjiang, Guangdong.

- Industries like steel, cement, and fertilizers, known for their high carbon footprint, face mounting pressure for decarbonization. However, with India's concerted efforts and the ambitious targets set by the National Green Hydrogen Mission, which aims to slash INR 1 lakh crore worth of fossil fuel imports and nearly 50 million metric tons (MMT) of CO2 emissions annually by 2030, green hydrogen emerges as a beacon of hope in their transition.

- Similarly, NTPC Limited took a significant step starting in January 2023, blending up to 8% green hydrogen into the PNG Network at its Kawas Township in Surat, Gujarat, India.

- Tokyo is making strides in developing its green hydrogen facilities on publicly owned land rather than falling behind. The metropolitan government announced intentions to begin constructing three units by the fiscal year 2024, aiming to have one operational by the end of that year. However, further details from the government are eagerly anticipated.

- In January 2024, SK Ecoplant partnered with Bloom Energy for a groundbreaking green hydrogen initiative. Teaming up with Korea Southern Power and local authorities, they aim to introduce hydrogen power on a significant scale. SK Ecoplant will leverage Bloom's cutting-edge solid oxide electrolyzer (SOEC) technology to produce green hydrogen as a transport fuel on Jeju Island, South Korea. The upcoming presentation, scheduled to commence in late 2025, will involve the implementation of 1.8 megawatts of electrolyzer technology.

- Hence, the above-mentioned factors are expected to boost the consumption of green hydrogen in Asia-Pacific.

Green Hydrogen Industry Overview

The global green hydrogen market is partially consolidated. Some of the major players in the market include China Petroleum & Chemical Corporation, Ningxia Baofeng Energy Group Co. LTD, Plug Power Inc., China Three Gorges Corporation (CTG), and Tidewater Renewables Ltd (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Realizing the Potential in the Chemical Industry

- 4.1.2 Growing Environmental Concerns Regarding Carbon Emissions

- 4.2 Market Restraints

- 4.2.1 High Investment Cost of Green Hydrogen

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End-user Industry

- 5.1.1 Refining

- 5.1.2 Chemicals

- 5.1.3 Iron and Steel

- 5.1.4 Transportation

- 5.1.5 Power and Other End-user Industries

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 Rest of the World

- 5.2.4.1 South America

- 5.2.4.2 Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Products and Chemicals Inc.

- 6.4.2 Air Liquide

- 6.4.3 BP PLC

- 6.4.4 China Petroleum & Chemical Corporation

- 6.4.5 China Three Gorges Corporation

- 6.4.6 Engie

- 6.4.7 Fortescue Future Industries

- 6.4.8 Green Hydrogen International Corp.

- 6.4.9 Iberdrola SA

- 6.4.10 Intercontinental Energy

- 6.4.11 LHYFE

- 6.4.12 Linde PLC

- 6.4.13 Ningxia Baofeng Energy Group Co. Ltd

- 6.4.14 Plug Power Inc.

- 6.4.15 Reliance Industries Limited

- 6.4.16 Tidewater Renewables Ltd

- 6.4.17 Uniper SE

- 6.4.18 Yara

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Favorable Policies and Regulations Promoting the Usage of Green Hydrogen