|

市场调查报告书

商品编码

1683809

电力电子电容器 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Capacitor For Power Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

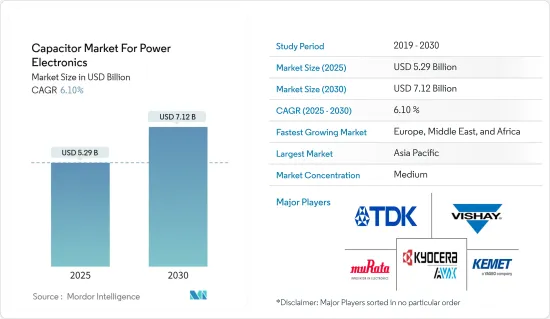

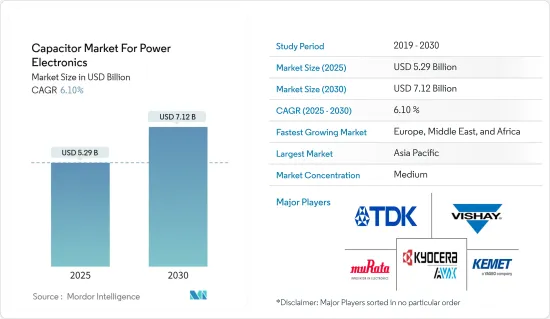

电力电子电容器市场预计将从 2025 年的 52.9 亿美元成长到 2030 年的 71.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.1%。

电容器经常用于电路中,阻止直流电 (DC) 并允许交流电通过。

主要亮点

- 2022年,电容器成本将占总电源转换器成本的约10%。薄膜电容器是最昂贵的电容器,常用于高功率应用。因此,随着系统功率等级的提高,电源转换器中电容器的成本也会增加,需要更多的电容器。

- 除了日常使用的大量商用和公共电动车,包括巴士、火车、路面电车以及工业卡车和设备外,电动车也贡献了巨大的市场需求。此外,随着油价上涨,人们寻求更环保的个人交通途径,混合动力汽车也开始出现。直流链路电力电容器只是电气系统和组件所有重大变化的一个例子,这些变化使得生产种类繁多的电动车成为可能。

- 电动车中使用电容器来平滑直流总线电压的变化并阻止涟波电流返回电源。此外,电容器用于保护IGBT等半导体,而不是实际的闸流体。

- 到预测期结束时,电动车使用的电力电子电容器的市场占有率预计将从 29% 增加到 44%。因此,许多电容器公司都在竞相发展并关注汽车行业的当前和未来需求。

- 最常见的马达是感应马达,因为它可靠、经济且耐用。工业和采矿业中使用的大多数设备主要由三相交流感应马达驱动。这些马达消耗了全世界全部电力的 70-80%。当没有负载时,感应马达的功率因数相对较低。从零负载到满载,情况会变得更好。功率因数校正可在起动器、配电盘或配电盘处实施,透过在相关马达电路中并联添加电容器来实现。

电容器市场趋势

超级电容/EDLC 市场将实现大幅成长

- 由于能源危机和环境破坏,清洁和可再生能源储存技术正在开发中。电双层电容器 (EDLC),也称为超级电容,以紧凑的外形提供极高的电容。由于不存在化学过程所产生的磨损,电能可以以两个导电板之间的电场形式储存,从而比电池多经历数十万次充电和放电循环。因此,它在电动装置、UPS、主动滤波器、牵引和汽车工业中的应用正在扩大,并且正在藉鉴参考资料以更深入地了解它的特性。

- 由于其出色的储能能力,超级电容被广泛应用于各种应用,包括固态硬碟、 LED灯、电动装置、UPS、牵引和电动车。超级电容是上海公车的唯一电源,每三站利用再生煞车能量进行一到两分钟的充电。中国向世界证明了这项技术的广泛应用。然而,超级电容和电池的组合对于公车来说是一项更好的技术。

- 根据国际能源总署预测,2022年中国将註册5.4万辆电动公车,欧洲将註册5,000辆。随着油价上涨以防止空气污染,这一趋势正在逐步增加。预计预测期内电动车的日益普及将推动电力电子电容器市场的成长。

- 超级电容用于无线电调谐器、行动电话、笔记型电脑记忆体和其他电子设备。当需要短时间突波时使用它,例如在 LED 闪光灯装置中。

亚太地区占较大市场占有率

- 亚太地区是电力电子电容器最重要的市场之一。电动车越来越受欢迎,中国被认为是采用电动车最多的国家之一。中国的「十三五」规划推动混合动力汽车汽车和电动车等环保型交通解决方案的发展,预计将加速中国交通运输业的发展。

- 由于数十家竞争对手的新车型吸引了新买家并鼓励车主转换用电动车,中国电动车将在 2022 年实现全国普及率 20% 的目标,远超政府对 2025 年的预测。

- 随着政府对扩大印度电网的兴趣日益浓厚,电力电子电容器预计将受益匪浅。为了鼓励使用 e-2W,FAME-II 计划下的需求激励已从 10,000 印度卢比(119.67 美元)/千瓦时增加到 15,000 印度卢比(179.51 美元)/千瓦时,上限也从车辆成本的 20% 提高到 40%。此外,FAME-India计划第二阶段已于2022年3月31日后再延长两年。该战略旨在提供更经济、更环保的交通运输,增强国家燃料安全,并帮助印度汽车产业引领全球製造业。

- 该地区的市场投资正在增加。例如,2024 年 2 月,Keltron 与印度太空研究组织合作,在坎努尔建立了一座最先进的超级电容製造厂。此举代表能源储存技术的重大进步。该设施投资4.2亿印度卢比,不仅拥有无与伦比的能源储存能力,还将使印度走在尖端电容器技术的前沿。

电容器产业概况

电力电子电容器市场分散且竞争激烈。主要参与者包括 TDK 公司、Vishay Intertechnology Inc.、村田製造公司、AVX 公司(京瓷集团旗下一家公司)和 Kemet 公司(国巨旗下一家公司)。为了在竞争激烈的市场中保持地位,参与者不断创新新产品并实施各种其他业务发展策略。

- Vishay BC 元件 172 RLX 系列由 Vishay Intertechnology Inc. 于 2023 年 4 月开发,是低电阻汽车级小型电解电容器的全新产品系列。它们有 14 种外壳尺寸,从 10mm x 12mm 到 18mm x 40mm 不等,工作温度高达 +105°C。汽车、通讯、工业、音讯视讯和电子资料处理 (EDP) 应用的开关电源、DC/DC 转换器、马达驱动器和控制单元可受益于 Vishay BC 元件 172 RLX 系列非固体电解极化电解电容器的平滑、滤波和缓衝功能。

- 2022 年 12 月:TDK 公司提出了一种适用于直流链路应用、能够在极高开关频率下工作的模组化电容器的构想:ModCap HF。新开发的B25647A*系列六种电力电容器的额定电压为900至1600伏,电容量范围为640至1850伏特。最大允许热点温度为90°C,额定电流范围依类型从160A到210A。 ModCap HF 特别适合快速开关基于 SiC 的逆变器,因为它具有仅为 8nH 的超低 ESL 值和平坦的 ESR 与频率特性,有助于最大限度地减少高频下的损耗。功率半导体具有极低的自感,因此在电流关闭时不会发生电压过衝。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 多个行业对感应马达的需求日益增加

- 电动车创新系统的需求不断增加

- 市场限制

- 电气元件漏电

第六章 市场细分

- 类型

- 陶瓷製品

- 钽

- 电解电容器

- 纸塑膜电容器

- 超级电容/EDLC

- 地区

- 美洲

- 欧洲、中东和非洲

- 亚洲(日本和韩国除外)

- 日本和韩国

- 澳洲和纽西兰

第七章 竞争格局

- 公司简介

- TDK Corporation

- Vishay Intertechnology Inc.

- Murata Manufacturing Co. Ltd

- AVX Corporation(Kyocera Group)

- Kemet Corporation(Yageo Company)

- Cornell Dubilier Electronics Inc.

- Eaton Corporation PLC

- Hongfa Technology Co.

- NIPPON CHEMI-CON CORPORATION

- Yageo Corporation

第八章投资分析

第九章:市场的未来

The Capacitor Market For Power Electronics Industry is expected to grow from USD 5.29 billion in 2025 to USD 7.12 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

In electrical circuits, capacitors are frequently employed to block direct current (DC) while allowing alternating current to flow.

Key Highlights

- In 2022, the cost of the capacitor made up around 10% of the entire cost of the power converter. Film capacitors are the costliest form of capacitors and are frequently employed for high power levels. Consequently, as more capacitors are required due to the system's increasing power level, the cost of capacitors in a power converter rises.

- Electric automobiles contribute to significant market demand, in addition to the numerous commercial and public electric vehicles, such as buses, trains, trams, and industrial trucks and equipment, that are used daily. Besides, hybrid cars are now on the roads as people search for more environment-friendly forms of personal transportation in response to the skyrocketing price of oil. The DC link power capacitor is only one example of how the electrical systems and parts that have made it possible to build such a wide range of electric cars have all undergone significant change.

- Capacitors are used in electric cars to smooth out changes in DC bus voltage and stop ripple currents from returning to the power source. Additionally, capacitors are utilized for safeguarding semiconductors like IGBTs rather than the original thyristors.

- It is expected that by the end of the forecast period, the market share of capacitors for power electronics used in EVs will rise from 29% to 44%. As a result, many capacitor businesses are eager to grow and concentrate on the present and future requirements of the automobile sector.

- The most common electrical motors are induction motors because of their dependability, affordability, and durability. Most pieces of equipment used in industrial and mining applications use three-phase AC induction motors as their main power source. These motors use 70-80% of all the power used worldwide. Induction motors have relatively low power factors when there is no load. It becomes better at going from zero load to full load. Power factor correction can be implemented at the starter, switchboard, or distribution panel and is accomplished by adding capacitors in parallel with the related motor circuits.

Capacitor Market Trends

Supercapacitor/EDLC Segment to Register Significant Growth

- Clean and renewable energy storage technologies have been developed due to the energy crisis and environmental damage. The Electrical Double Layer Capacitor (EDLC), often known as a supercapacitor, offers a very high capacitance in a compact form. Because it does not undergo the wear and tear associated with the chemical process, it may store electric energy as an electric field between two conducting plates and perform hundreds of thousands more charge-discharge cycles than batteries. Because of this and its growing application in electric drives, UPS, active filters, traction, and automotive industries have drawn interest to learn more about their peculiarities.

- The exceptional storage capacity of supercapacitors has led to their widespread usage in various applications, including SSDs, LED lamps, electric drives, UPS, traction, and electric cars. Supercapacitors are the sole power source for buses in Shanghai, and they are recharged every third stop in one to two minutes using regenerative braking energy. China has shown the rest of the world that this technology can be used extensively. However, the technology that combines a supercapacitor and battery is more favorable for buses.

- According to IEA, in 2022, 54 thousand electric bus registrations were completed in China and five thousand in Europe. This trend is gradually increasing as oil prices are hiking to prevent air pollution. This growing adoption of EVs will boost the growth of the market for capacitors in power electronics during the forecast period.

- Supercapacitors are utilized in radio tuners, mobile phones, laptop memory, and other electronic equipment. They are used in situations like LED flash units when a brief power surge is necessary.

Asia-Pacific to Hold a Significant Market Share

- The Asia-Pacific region is one of the most important markets for capacitors in power electronics applications. The popularity of EVs is growing, and China is regarded as one of the most dominant adopters of electric vehicles. The country's 13th Five-Year Plan promotes the development of green transportation solutions, such as hybrid and electric cars, for advancements in the country's transportation sector.

- China's electric cars are reached the 20% nationwide penetration goal in 2022, well ahead of the Chinese government's 2025 forecast, due to new models by dozens of competitors attracting new buyers and encouraging owners to switch to electric vehicles.

- Capacitors in power electronics applications are expected to benefit significantly from the government's growing interest in expanding electric distribution networks throughout India. To encourage the use of e-2W, the demand incentive under the FAME-II plan was raised from INR 10,000 (USD 119.67)/KWh to INR 15,000 (USD 179.51)/KWh with a ceiling increase from 20% to 40% of vehicle cost. Additionally, after March 31, 2022, phase II of the FAME-India Scheme was extended for an additional two years. This strategy was developed to provide more economical, environment-friendly transportation, strengthen national fuel security, and help India's car sector take the lead in global manufacturing.

- The region is witnessing an increase in market investments. For instance, in February 2024, Keltron, partnered with the Indian Space Research Organisation, has inaugurated a state-of-the-art supercapacitor manufacturing plant in Kannur. This move signifies a major advancement in energy storage technology. The facility, backed by a INR 42 crore investment, not only boasts exceptional energy storage capabilities but also propels India to the forefront of cutting-edge capacitor technology.

Capacitor Industry Overview

The capacitors market for power electronics is fragmented and highly competitive, as several international and domestic players are operating in the market. Some key players include TDK Corporation, Vishay Intertechnology Inc., Murata Manufacturing Co. Ltd, AVX Corporation (Kyocera Group), and Kemet Corporation (Yageo Company), among others. To maintain their position in a highly competitive market, the players are continuously innovating new products and undertaking various other business development strategies.

- April 2023: The Vishay BC components 172 RLX series, developed by Vishay Intertechnology Inc., is a new line of low-impedance automotive-grade miniature aluminum electrolytic capacitors. It features 14 case sizes with dimensions ranging from 10mm by 12mm to 18mm by 40mm, and it can operate at temperatures up to +105 °C. The switch mode power supplies, DC/DC converters, motor drives, and control units for automotive, telecommunications, industrial, audio-video, and electronic data processing (EDP) applications can benefit from the smoothing, filtering, and buffering capabilities of the Vishay BC components 172 RLX series of polarised aluminum electrolytic capacitors with non-solid electrolyte.

- December 2022: TDK Corporation offers ModCap HF, a modular capacitor idea that can operate at extremely high switching frequencies for DC link applications. The six newly created power capacitors in the B25647A* series are rated for voltages between 900 and 1600 volts and have capacitance ranges between 640 and 1850 volts. The highest allowable hot spot temperature is 90 °C, and the rated currents range from 160 A to 210 A depending on the kind. ModCap HF is especially well suited for fast-switching SiC-based inverters because of its ultra-low ESL value of just 8 nH and flat ESR vs. Freq evolution that allows minimizing losses even at high frequency. The power semiconductors don't experience voltage overshooting when the current is turned off due to the extremely low self-inductance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for Induction Motors Across Several Industries

- 5.1.2 Increasing Demand for Innovative Systems in Electric Vehicles

- 5.2 Market Restraints

- 5.2.1 Instances of Current Leakage in Electrical Components

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Ceramic

- 6.1.2 Tantalum

- 6.1.3 Aluminium Electrolytic Capacitors

- 6.1.4 Paper and Plastic Film Capacitor

- 6.1.5 Supercapacitors/EDLC

- 6.2 Geography

- 6.2.1 Americas

- 6.2.2 Europe, Middle East and Africa

- 6.2.3 Asia (excluding Japan and Korea)

- 6.2.4 Japan and South Korea

- 6.2.5 Australia and New Zealand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TDK Corporation

- 7.1.2 Vishay Intertechnology Inc.

- 7.1.3 Murata Manufacturing Co. Ltd

- 7.1.4 AVX Corporation (Kyocera Group)

- 7.1.5 Kemet Corporation (Yageo Company)

- 7.1.6 Cornell Dubilier Electronics Inc.

- 7.1.7 Eaton Corporation PLC

- 7.1.8 Hongfa Technology Co.

- 7.1.9 NIPPON CHEMI-CON CORPORATION

- 7.1.10 Yageo Corporation