|

市场调查报告书

商品编码

1683820

美国证据管理:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)US Evidence Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

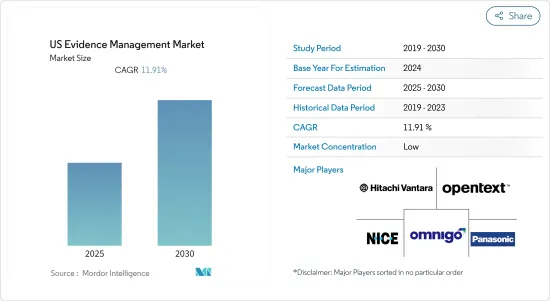

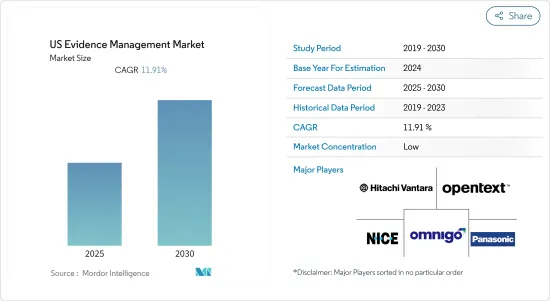

预计预测期内美国证据管理市场将以 11.91% 的复合年增长率成长。

证据的数量不再是可以用电子表格来管理的。相反,证据会被转移到中央储存库,在那里进行排序,并设置警报以进行证据管理。

主要亮点

- 由于每天都会收集、处理、储存和报告大量的数位证据资料,因此可能会出现案件积压和资料遗失、被误用或冗余的情况。数位证据管理系统是一种现代、高效且安全的刑事调查选择。

- 此外,数位证据大大提高了美国公民的安全性,并从根本上改变了刑事调查。刑事调查人员经常使用数位证据。随着相机、智慧型手机、平板电脑和笔记型电脑的普遍使用,以及电子邮件、讯息、照片、社交媒体贴文和其他数位内容的丰富,数位证据变得越来越丰富,从而推动了市场的发展。

- 全球范围内犯罪率的上升导致了证据管理行业的发展。刑事调查中对高效率、安全证据处理的需求日益增长,推动了对先进证据管理系统的需求。

- 证据控制包括确保证据的真实性不会被改变、以保护其完整性的方式储存证据、以及以不会被窜改的方式处理证据。处理与事件相关的证据需要储存、分类和管理资讯。

美国证据管理市场的趋势

预计云端基础部署将强劲成长

- 在证据管理产业中,云端领域是指使用云端运算技术来储存、管理和存取数位证据。由于比内部部署解决方案具有多种优势,近年来该市场在该国越来越受到关注。

- 云端基础的证据管理解决方案可以与执法和法律部门系统整合。整合随身摄影机、CCTV系统、法医学分析工具和案件管理系统,可实现顺畅的资料交换和互通性,进而提高业务效率。

- 例如,2022 年 12 月,联邦风险与授权管理计画 (FedRAMP) 联合授权委员会 (JAB) 授予 Axon Enterprise Inc.云端基础的软体即服务 (SaaS) 解决方案高影响力称号。这项变更将允许 Axon 的政府客户储存由联邦民事机构管理的最敏感的非机密资料。利用 Axon云端基础的 SaaS 解决方案可以实现数位证据管理、情境察觉和记录管理工作流程。

- 2022 年 3 月,全球云端原生视讯安全和分析供应商 Ava Security Limited 被摩托罗拉系统公司收购。 Ava Security 提供扩充性、安全且适应性强的云端解决方案,为组织提供即时洞察和进阶分析,以优化营运并识别异常和威胁。该平台提供企业级视讯安全解决方案,同时最大限度地减少安全基础设施的实体占用空间。

- 总体而言,考虑到技术进步、与数位取证工具的整合、扩充性和成本效益等因素,随着越来越多的组织认识到云端基础的解决方案在更有效地管理和处理资料方面所提供的众多优势,该国证据管理市场云端运算部分预计将进一步增长。

服务业可望占据主要市场占有率

- 证据管理服务供应商提供各种服务,包括研究和咨询、系统整合、支援和维护以及培训和教育。这些服务提供专业知识来追踪问题根源、加强证据流程并协助调查人员进行结构化调查。证据支持服务包括线上支援和培训,主要透过电话和网路会议,以协助制定新的政策和程序。

- 同时,我们的证据培训服务有助于培养该领域所需的一系列技能。该服务主要涉及培训和运作用户的员工。本次培训旨在解答使用者可能遇到的任何问题并提供系统概述。

- 各种公司在培训完成后都会提供服务,并且只要您维持年度维护支援合同,就会为您的组织提供支援并提供持续的培训。例如,Amped Software 培训课程提供 Amped Software 产品的实务经验,并深入了解使用者在处理法医影片和数位多媒体证据时面临的问题。这些课程由世界各地的讲师亲自或线上授课,以来自多个组织的使用者小组形式授课,或为个别组织提供私人课程。

- 证据咨询服务是透过持续的对话、培训和现场评估来确定证据管理方法的优点和缺点,从而改善业务健康状况。这些咨询服务是我们设计转型蓝图的全面证据管理解决方案 (TEMS) 解决方案组合的关键。

- 市场正在见证主要企业的产品发布和技术创新,这是他们改善业务、接触客户和扩大影响力以满足各种应用需求的策略的重要组成部分。例如,2022 年 5 月,Tracker Products 与证据管理研究所 (EMI) 合作,提供证据管理领域最全面的产品和服务集合。 3600 全面证据管理解决方案 (TEMS) 是多个活动部件的集合,它们共同协作以满足证据管理社区的需求。

- 西雅图警方估计,2022 年的犯罪案件比 2021 年增加了 1,834 起,增幅为 4%。虽然犯罪率正在下降,但 2021 年报告的犯罪案件创下了历史新高。去年,暴力犯罪和财产犯罪总合总合49,577 起。由于犯罪数量庞大,美国执法机构需要证据管理系统来收集案件证据。随着犯罪率的上升,证据追踪软体可用于管理必须储存、组织和分析的大量数位记录。

- 基于证据的管理咨询可能有助于提高服务业组织的绩效。透过资料和研究,顾问可以帮助组织确定提高生产力、效率和客户服务的领域。

- 因此,由于美国犯罪率上升以及政府机构和执法机构的支持增加,预计整个预测期内市场将呈指数级增长。

美国证据管理产业概况

美国证据管理市场比较分散,拥有数十年商业经验的本土公司和跨国公司都在争取市场占有率。该市场的退出门槛相对较低,新参与企业很容易进入,现有企业在利润较低时也容易退出。主要参与者包括 NICE Ltd、Omnigo Software LLC(Quetel Corporation)、Open Text Corporation、Hitachi Vantara LLC(日立有限公司)和Panasonic Corporation。市场参与者正在采取合作和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2022 年 10 月-摩托罗拉系统公司宣布推出新的公共技术,以行动优先的方式支援警察情报收集。其中包括首个针对 Apple CarPlay 的公共应用程序,用于改变现场业务,并将来自紧急应变无人机和机器人的影像整合到 CommandCentral Aware 中。来自行动现场系统的资料无缝流入 CommandCentral 平台,集中记录和证据以供分析、调查和事件准备。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

- 价值链分析

第五章 市场动态

- 市场驱动因素

- 全球犯罪率上升推动市场扩张

- 市场限制

- 储存的资料可能被窜改,影响资料安全

第六章 市场细分

- 按部署

- 本地

- 云

- 按组件

- 硬体

- 车载摄影机

- 车载行车记录仪

- 城市相机

- 公共运输视频

- 软体

- 服务(咨询、培训、支援)

- 硬体

第七章 竞争格局

- 公司简介

- Nice Ltd

- Omnigo Software LLC(Quetel Corporation)

- Open Text Corporation

- Hitachi Vantara LLC(Hitachi Ltd)

- Panasonic Corporation

- Motorola Solutions Inc.

- Oracle Corporation

- Caseguard

- Safe Fleet

- Porter Lee Corporation

- Genetec Inc.

- IBM Corporation

- Fileonq

- Input-ace(Axon Enterprise Inc.)

- Amped Srl

第八章投资分析

第九章:市场的未来

The US Evidence Management Market is expected to register a CAGR of 11.91% during the forecast period.

Large volumes of evidence are no longer supported on spreadsheets. Instead, evidence is moved to a centralized repository, where an order of custody is maintained, and alerts are set up for evidence management.

Key Highlights

- There may be significant case backlogs and data loss, misuse, or redundancy because of the enormous volumes of digital evidence data gathered, processed, stored, and reported daily. Digital evidence management systems are modern, efficient, and secure options for criminal investigations.

- Additionally, digital evidence has considerably improved citizen safety in the United States and fundamentally altered criminal investigations. Investigators in crimes regularly use digital evidence. Due to the common use of cameras, smartphones, tablets, and laptops, and the massive amounts of email, messages, photographs, social media posts, and other digital content, there is now an abundance of digital evidence, which is, in turn, driving the market.

- The global rise in crime has led to the growth of the evidence management industry. The rising requirement for efficient and safe evidence processing in criminal investigations has driven the growing need for advanced evidence management systems.

- Evidence management entails ensuring that the authenticity of the evidence is not altered, storing it in a way that protects the integrity of the evidence, and processing it in such a way that there is no question about evidence tampering. Handling the evidence connected to an event entails storing, categorizing, and maintaining the information so that it is readily available and may be relied upon to show the details of an event as and when required.

US Evidence Management Market Trends

Cloud Based Deployment Expected to Grow Significantly

- In the evidence management industry, the cloud segment refers to using cloud computing technologies for storing, managing, and accessing digital evidence. Because of its multiple advantages over on-premise solutions, this market has gained traction in the country in recent years.

- Cloud-based evidence management solutions may be integrated with law enforcement and legal department systems. Integrating body-worn cameras, CCTV systems, forensic analysis tools, and case management systems enables smooth data interchange and interoperability, resulting in increased operational efficiency.

- For instance, in December 2022, the Federal Risk and Authorization Management Programme (FedRAMP) Joint Authorization Board (JAB) granted Axon Enterprise Inc. high impact designation for their cloud-based Software as a Service (SaaS) solutions. With this change, Axon's government customers may keep the most confidential, unclassified data managed by federal civilian agencies. Workflows for digital evidence management, situational awareness, and records management are possible with Axon's cloud-based SaaS solutions.

- In March 2022, Ava Security Limited, a global provider of cloud-native video security and analytics, was acquired by Motorola Solutions. The scalable, secure, and adaptable cloud solution from Ava Security offers organizations real-time insight and advanced analytics to optimize operations and identify anomalies and threats. The platform provides organizations an enterprise-grade video security solution while minimizing their security infrastructure's physical footprint.

- Overall, taking into account factors such as technological advancements, integration with digital forensics tools, scalability, cost-effectiveness, and others, the cloud segment in the country's evidence management market is expected to grow further as more organizations recognize the numerous advantages of cloud-based solutions in more effectively managing and processing data.

Services Component Segment Expected to Hold Significant Market Share

- The evidence management service providers render various services such as investigation and consulting, system integration, support and maintenance, and training and education. These services assist investigators in performing structured investigations providing expertise to track the source of a problem and enhance the evidence process. The evidence support services mainly include telephone and online support training via telephone and web-conference, and many others, thereby aiding with developing new policies and procedures.

- On the other hand, evidence training services helps the user in developing the various skills one need in this market sector. The service mainly trains the user's staff to get them up and running. This training is designed to help answer any questions the user may have and give them an overview of the system.

- Various companies offer the service even after the training is complete, supporting them and offering ongoing training to their organization for as long as they maintain their yearly maintenance and support contract. For instance, Amped Software training courses provide hands-on experience with Amped Software products and insight into the problems users confront while processing forensic video and digital multimedia evidence. The courses are taught by instructors worldwide, in person or live online, in groups with users from multiple organizations, or in private organization-specific sessions.

- The evidence consulting services are a series of ongoing conversations, training, and on-premise assessments that determine the strengths and weaknesses of your evidence management practices to improve the health of your operations. These consultations are key in the total evidence management solution (TEMS) assortment of solutions as they design a change roadmap.

- The market is witnessing product launches and innovations by key players as a crucial part of its strategy to improve business and their presence to reach customers and meet their requirements for various applications. For instance, in May 2022, Tracker Products and the Evidence Management Institute (EMI) joined forces to offer the most comprehensive collection of products and services available in the evidence management world. The 3600 total evidence management solution (TEMS) is an assemblage of moving parts working together to serve the needs of the evidence management community.

- The Seattle Police Department estimates that overall crime increased in 2022 compared to 2021 by 1,834, or 4%. Despite decreasing percentages, reported crime reached an all-time high in 2021. A total of 49,577 violent and property offenses were reported last year, exceeding those totals. Law enforcement agencies in the US require an evidence management system for collecting evidence from incidents due to the huge number of crimes. Evidence-tracking software may be used to manage the enormous number of digital recordings that must be stored, organized, and analyzed as crime rises.

- Evidence-based management consulting may help organizations in the service sector improve their performance. With the help of data and research, consultants can help organizations to identify areas to improve their productivity, efficiency, and customer service.

- Therefore, with the increased crime rate and the rise in support from government entities and law enforcement agencies in the United States, the market is expected to grow exponentially throughout the forecast period.

US Evidence Management Industry Overview

The US evidence management market is fragmented, with local and multinational firms having decades of business expertise and businesses competing for market share. The market has relatively low exit barriers, which encourage new enterprises to participate and established firms to withdraw when profits are low. The major players are NICE Ltd, Omnigo Software LLC (Quetel Corporation), Open Text Corporation, Hitachi Vantara LLC (Hitachi Ltd), and Panasonic Corporation. Players in the market are adopting strategies, such as partnerships and acquisitions, to enhance their product offerings and gain sustainable competitive advantage.

- October 2022 - Motorola Solutions announced the launch of new public safety technology advancements that support a mobile-first approach to preparing officers with the information. These include a first-of-its-kind public safety application for Apple CarPlay to transform field operations and the integration of video footage from emergency response drones and robots into CommandCentral Aware. Data from mobile field-based systems flows seamlessly into the CommandCentral platform, where records and evidence are centralized for analysis, investigations, and case preparation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

- 4.4 Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Crime Rates Globally Lead to Market Expansion

- 5.2 Market Restraints

- 5.2.1 Data Stored can be Tampered, Affecting the Security of the Data

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Component

- 6.2.1 Hardware

- 6.2.1.1 Body-worn Camera

- 6.2.1.2 Vehicle Dash Camera

- 6.2.1.3 Citywide Camera

- 6.2.1.4 Public Transit Video

- 6.2.2 Software

- 6.2.3 Services (Consulting, Training, and Support)

- 6.2.1 Hardware

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nice Ltd

- 7.1.2 Omnigo Software LLC (Quetel Corporation)

- 7.1.3 Open Text Corporation

- 7.1.4 Hitachi Vantara LLC (Hitachi Ltd)

- 7.1.5 Panasonic Corporation

- 7.1.6 Motorola Solutions Inc.

- 7.1.7 Oracle Corporation

- 7.1.8 Caseguard

- 7.1.9 Safe Fleet

- 7.1.10 Porter Lee Corporation

- 7.1.11 Genetec Inc.

- 7.1.12 IBM Corporation

- 7.1.13 Fileonq

- 7.1.14 Input-ace (Axon Enterprise Inc.)

- 7.1.15 Amped Srl