|

市场调查报告书

商品编码

1683824

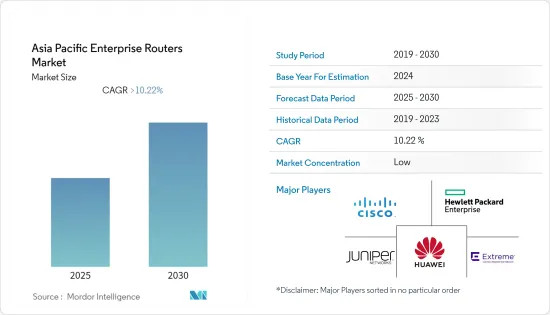

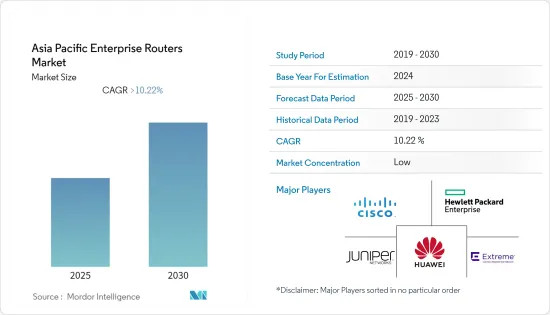

亚太企业路由器:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia Pacific Enterprise Routers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预测期内,亚太地区企业路由器市场预计将以超过 10.22% 的复合年增长率成长

主要亮点

- 随着越来越多的员工在线上和远端工作,企业路由器在实现安全可靠的企业网路远端存取方面变得越来越重要。具有 VPN 功能并支援可靠远端存取通讯协定的路由器可让远端工作人员无缝连接、存取公司资源并高效沟通。根据CNNIC统计,预计2022年12月中国远距工作者数将增加至5.4亿。

- 根据GSMA统计,截至2022年3月底,亚太地区14个市场的33家行动通讯业者已推出了商用5G服务,其中7个国家的14通讯业者也提供5G固定无线接取(FWA)解决方案。 5G 目前已在包括韩国在内的早期采用地区广泛应用,在韩国,5G 约占行动网路连线的五分之二。疫情后的经济復苏、5G智慧型手机销量的成长、网路覆盖范围的扩大以及整体行销倡议都有助于推动这一成长势头。

- 影响企业路由器销售的另一个关键因素是数位转型。随着数位转型计划的推进,新的网路需求不断涌现,而新冠疫情更是加速了这一发展。这迫使IT主管改进系统和路由器,以提高效能并支援变得越来越重要的各种等级的安全性。

- 由于频宽密集型应用程式、云端服务和物联网设备的日益普及,亚太地区的频宽需求显着增加。企业路由器必须满足这一日益增长的需求,以确保无缝连接和最佳网路效能。然而,老一路由器难以满足频宽需求,导致效率低和资料传输速度变慢。这迫使企业频繁升级路由器,增加成本并阻碍市场成长。

亚太企业路由器市场趋势

IT 和通讯将经历显着成长

- 亚太地区IT和电讯业正在大力投资发展其网路基础设施。政府、企业和服务供应商一直致力于扩展其网路以满足日益增长的连接需求。这种扩展导致了更大、更复杂的网路的部署,从而需要企业路由器来管理和优化流量。

- 云端处理和资料中心的采用是企业路由器市场的主要驱动力。在亚太地区,云端服务供应商和企业越来越多地利用云端基础架构在资料中心託管应用程式和服务。这一趋势导致云端、资料中心和最终用户设备之间的资料流量激增,需要企业路由器等强大、扩充性的网路解决方案来有效管理资料流。

- 根据OpenSignal显示,2023年,新加坡在亚太地区5G影片使用者体验评级中名列第一,得分为78.2分(满分100分)。此外,新加坡在5G游戏使用者体验方面也以94.1分(满分100分)的惊人成绩位居榜首。

- 边缘运算导致企业路由器的需求增加,因为需要可靠、安全、高效能的网路基础设施来支援不断扩展的边缘部署并处理网路边缘不断增加的资料流量。

- 由于 5G 网路需要先进的基础设施来适应高速连接和增加的资料流量,因此对通讯基础设施的不断增加的投资正在支持市场的成长。因此,对相容 5G 的先进规格的企业路由器的需求日益增长。

中国可望占主要市场占有率

- 中国的资讯科技基础设施正在大幅扩张,对企业路由器和其他网路设备的需求不断增加。有线和无线路由器在建立和维护中国商业网路连接方面都发挥着至关重要的作用。

- 此外,旨在为服务不足和农村地区开发和提供路由器解决方案的几项官民合作关係预计将推动该地区的产业成长。中国政府制定的「互联网+」策略也促进了网路设备市场特别是宽频市场的发展。

- 中国政府也大力投资互联互通和数位计划。随着越来越多的政府机构、部门和组织需要可靠、安全的网路接入,对无线企业路由器的需求预计会增加。

- 国务院在中国「十四五」数位经济发展目标中指出,数位经济将成为继农业和工业之后整个国家的重要经济支柱。该国的目标是到2025年全面发展数位经济,其中数位经济关键领域的增加值预计将占GDP的10%。

- 根据GSMA预测,2022年5G连线比例预计将达到36%,到2030年将达到约88%。此外,预计2022年行动网路用户将达到11.7亿,到2030年将成长到13.3亿。

- 行动网路已经高度密集,但 6GHz 有可能增加现有站点的永续5G 容量,并实现经济高效的部署。此外,以合理的条款和价格及时提供6GHz频谱将有助于实现经济高效的网路部署,缩小宽频存取差距,促进数位包容。这将促进该国的市场成长。

亚太地区企业路由器市场概况

所研究的亚太企业路由器市场竞争激烈,预计在研究市场的预测期内竞争将会加剧。决定这种力量的主要因素是透过技术创新、市场渗透、退出障碍、竞争策略的强度和企业集中度来获得永续的竞争优势。少数几家大公司主导着该产业,包括Juniper Networks、Cisco和惠普企业。这些公司在性能、功能和成本方面展开竞争。还有一些较小的公司提供企业路由器。

- 2023 年 3 月-华为与 Telkomsel 宣布已签署谅解备忘录,合作进行包含「未来电信指南」的联合技术探索。两家公司将加强在数位基础设施方面的合作,探索数位业务成长的新可能性,为印尼消费者和企业提供最佳的数位体验和先进的服务。

- 2023 年 2 月-思科在 Catalyst 8500 系列中加入 100G服务边际。 C8500-20X6C 配备了高度扩充性的功能集,适用于路由和 SD-WAN 部署。此单一平台非常适合多租户边缘/中心、主机託管多重云端网关、SD-WAN 远端存取聚合、多区域结构 (MRF) 边界路由器、私有 5G-IoT 端点的 IPsec 闸道和多重云端服务边缘等功能。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 高速连线的需求不断增加,以加快资料处理和资料传输

- 越来越多采用先进技术

- 成本快速下降

- 市场限制

- 保质期缩短导致投资报酬率降低

- 关键使用案例

- 资料速率和连接埠速度的技术进步

第六章 市场细分

- 按连线类型

- 有线

- 无线的

- 依港口类型

- 固定连接埠

- 模组化的

- 按类型

- 核心路由器

- 多业务服务边际

- 存取路由器

- 按行业

- BFSI

- 资讯科技和电信

- 卫生保健

- 零售

- 製造业

- 其他行业

- 按国家

- 中国

- 印度

- 越南

- 泰国

- 印尼

- 台湾

第七章 竞争格局

- 公司简介

- CISCO Systems Inc.

- Huawei Technologies Co. Ltd

- Hewlett Packard Enterprise

- Juniper Networks Inc.

- Extreme Networks Inc.

- D-link Corporation

- Dell Technologies Inc.

- Nokia Corporation

- ZTE Corporation

- Arista Network

- List of Major Vendors By Country

- China

- India

- Vietnam

- Thailand

- Indonesia

- Taiwan

第八章投资分析

第九章:市场的未来

The Asia Pacific Enterprise Routers Market is expected to register a CAGR of greater than 10.22% during the forecast period.

Key Highlights

- Enterprise routers are becoming increasingly important in delivering safe and dependable remote access to business networks as more employees work online or in distant locations. Routers with VPN abilities and support for reliable remote access protocols enable remote employees to connect seamlessly, allowing them to access company resources and communicate efficiently. According to CNNIC, the number of remote workers in China increased to 540 million in December 2022.

- According to GSMA, by the end of March 2022, 33 mobile carriers had begun offering commercial 5G services throughout 14 markets in the Asia-Pacific, comprising 14 operators across seven nations that also provide 5G fixed wireless access (FWA) solutions. In early adopter regions, including South Korea, where 5G currently makes up around two out of every five mobile network connections, 5G has become widely adopted. The economic recovery following the pandemic, increased 5G smartphone sales, network coverage extensions, and general marketing initiatives have all helped to increase momentum.

- Another significant factor influencing enterprise router sales is digital transformation. New network needs are growing as digital transformation projects gain traction, a development that the COVID-19 pandemic hastened. This puts pressure on IT executives to improve their systems and routers to enhance performance and support various security levels that are becoming more crucial.

- The demand for bandwidth in the Asia-Pacific is increasing significantly due to the rising adoption of bandwidth-intensive applications, cloud services, and IoT devices. Enterprise routers must keep up with this escalating demand to ensure seamless connectivity and optimal network performance. However, older-generation routers may struggle to cope with the bandwidth requirements, resulting in reduced efficiency and slower data transmission. This compels enterprises to upgrade their routers more frequently, adding to the cost and challenging the market's growth.

Asia Pacific Enterprise Routers Market Trends

IT and Telecommunication to Witness Major Growth

- Asia-Pacific's IT and Telecom industry has witnessed considerable investment in network infrastructure development. Governments, businesses, and service providers have focused on expanding their networks to meet the increasing demand for connectivity. This expansion led to the deployment of larger and more complex networks, requiring enterprise routers to manage and optimize the traffic flow.

- Adopting cloud computing and data centers are the main drivers in the enterprise router market. In Asia-Pacific, cloud service providers and enterprises increasingly leverage cloud infrastructure and host their applications and services in data centers. This trend has led to a surge in data traffic between cloud, data centers, and end-user devices, requiring robust and scalable networking solutions like enterprise routers to manage data flow effectively.

- According to OpenSignal, In 2023, Singapore led the Asia-Pacific region with the highest 5G video user experience rating, scoring 78.2 out of 100. Additionally, the nation achieved the top spot for 5G games user experience, boasting an impressive 94.1 out of 100.

- Edge computing leads to an increased demand for enterprise routers due to the need for reliable, secure, and high-performance networking infrastructure to support the expanding edge deployments and handle the increased data traffic at the network edge.

- The growing investment in telecom infrastructure supports the market growth, as 5G networks require advanced infrastructure to handle high-speed connectivity and increased data traffic. As a result, the market is growing because of the need for 5G-enabled advanced specification enterprise routers.

China is Expected to Hold Significant Market Share

- The infrastructure of China's information technology infrastructure has been expanding significantly, creating a demand for networking equipment such as enterprise routers. Both wired and wireless routers play a crucial role in establishing and maintaining network connectivity for businesses in China.

- Additionally, several public-private partnerships aiming at developing and offering router solutions to underserved and rural areas are anticipated to augment the growth of the regional industry. The "Internet Plus" strategy, which the Chinese government created, has also helped the market develop network equipment, especially broadband.

- The Chinese government is also making significant investments in connectivity and digital infrastructure projects. The need for wireless enterprise routers is projected to expand as more government agencies, departments, and organizations need reliable and secure access to the Internet.

- The State Council's goal for the growth of the digital economy during the 14th Five-Year Goal era in China clearly stated that the digital economy, after agriculture and industry, is the major economic pillar of the entire country. The goal of the country was to have a fully developed digital economy by 2025, with the main sectors of the digital economy's added value estimated to contribute 10% of GDP.

- As per GSMA, the percentage of 5G connections in 2022 was 36%, which is expected to reach around 88% in 2030. Additionally, there were 1.17 billion mobile internet users in 2022, which is expected to rise to 1.33 billion by 2030.

- Mobile networks are already highly densified, but 6 GHz may enable the growth of sustainable 5G capacity on existing sites to allow cost-effective deployments. Also, the timely availability of 6 GHz, at reasonable conditions and price, will drive cost-efficient network deployment, help reduce the broadband usage gap and support digital inclusion. This will augment the market's growth in the country.

Asia Pacific Enterprise Routers Market Overview

The intensity of competition in the Asia-Pacific enterprise routers market studied is anticipated to be high and is expected to increase over the forecast period in the market studied. Major factors governing this force are sustainable competitive advantage through innovation, levels of market penetration, barriers to exit, the power of competitive strategy, and the firm concentration ratio. Several large firms dominate the industry, such as Juniper Networks Inc., Cisco Systems Inc., and Hewlett Packard Enterprise. These businesses compete on performance, features, and cost. There are also several small firms that provide Enterprise Routers.

- March 2023 - Huawei and Telkomsel announced that they had signed a Memorandum of Understanding (MOU) on collaboration in joint technologies exploration by embracing "GUIDE to Future Telco." By enhancing their collaboration on digital infrastructure and exploring the possibility of brand-new digital business growth, the two parties will work to offer consumers and enterprises in Indonesia the greatest digital experiences and advanced services.

- February 2023 - Cisco added a 100G service edge to the Catalyst 8500 series. The C8500-20X6C includes feature sets that are highly scalable for the installation of routing and SD-WAN. The most suitable platforms for multi-tenant edge/hubs, colocation-hosted multi-cloud gateways, SD-WAN remote access aggregation, border routers in multi-region fabrics (MRF), IPsec gateways for private 5G-IoT endpoints, multi-cloud services edges, and other functions are available on this one.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for High-speed Connectivity for Faster Data Processing and Transfer

- 5.1.2 Rising Adoption of Advanced Technology

- 5.1.3 Rapidly Declining Cost

- 5.2 Market Restraints

- 5.2.1 Decreasing Shelf Life Leading to Lower RoI

- 5.3 Key Use Cases

- 5.4 Evolution of Technology in Terms of Data Rate and Ports Speed

6 MARKET SEGMENTATION

- 6.1 By Type of Connectivity

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By Type of Port

- 6.2.1 Fixed Port

- 6.2.2 Modular

- 6.3 By Type

- 6.3.1 Core Routers

- 6.3.2 Multi-services Edge

- 6.3.3 Access Router

- 6.4 By End-user Vertical

- 6.4.1 BFSI

- 6.4.2 IT & Telecom

- 6.4.3 Healthcare

- 6.4.4 Retail

- 6.4.5 Manifacturing

- 6.4.6 Other End-user Verticals

- 6.5 By Country

- 6.5.1 China

- 6.5.2 India

- 6.5.3 Vietnam

- 6.5.4 Thailand

- 6.5.5 Indonesia

- 6.5.6 Taiwan

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CISCO Systems Inc.

- 7.1.2 Huawei Technologies Co. Ltd

- 7.1.3 Hewlett Packard Enterprise

- 7.1.4 Juniper Networks Inc.

- 7.1.5 Extreme Networks Inc.

- 7.1.6 D-link Corporation

- 7.1.7 Dell Technologies Inc.

- 7.1.8 Nokia Corporation

- 7.1.9 ZTE Corporation

- 7.1.10 Arista Network

- 7.2 List of Major Vendors By Country

- 7.2.1 China

- 7.2.2 India

- 7.2.3 Vietnam

- 7.2.4 Thailand

- 7.2.5 Indonesia

- 7.2.6 Taiwan