|

市场调查报告书

商品编码

1683854

西班牙医药物流:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Spain Pharmaceutical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

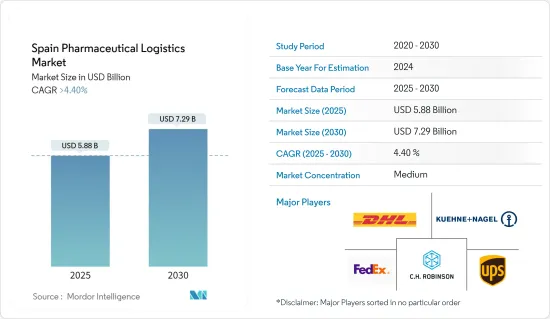

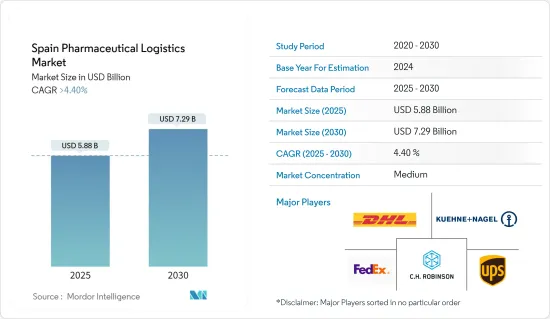

西班牙医药物流市场规模预计在 2025 年为 58.8 亿美元,预计到 2030 年将达到 72.9 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 4.4%。

2024年,西班牙将在「医药成长潜力」方面领先世界,而巴塞隆纳将成为欧洲第二大生物技术投资地点。

随着越来越多的国际生物科技新兴企业和公司将重点关注巴塞隆纳及其大都会区,加泰隆尼亚首都正在巩固其作为生物科技中心的地位。报告称,到2024年,西班牙在「医药成长潜力」方面将位居世界第6、欧洲第3。

西班牙蓬勃发展的製药业将提振该国的医药物流市场,为温度敏感型和一般医药产品的运输和储存带来丰厚的机会。

西班牙有103家生产人用药品的工厂,其中11家专门生技药品。加上46家活性成分工厂和24家兽药工厂,总合达173家工厂,分布在122个业务集团。这些工厂总合僱用了 183,000 名员工(包括直接、间接和诱发就业),生产产品价值 160 亿欧元(167.9 亿美元)(75% 用于出口),并且在竞争力和环境永续性方面处于领先地位。

2023年,处方药将主导西班牙医药市场,占销售额的近70%。其次是非处方药,占12.4%,营养产品约占3%。当年,西班牙拥有约 22,261 家药局,相当于每 2,130 名居民就有一家药局。

2023年,西班牙医药进口额将达到约220亿美元,较2022年的240亿美元略为下降。值得注意的是,在分析期间内,进口额增加了4.2倍以上。

西班牙医药产业的强劲成长可能为全国温度敏感型和一般医药产品的运输和储存创造重大机会,从而支持西班牙医药物流市场的发展。

对高效物流解决方案的需求日益增长,推动了对基础设施、技术和服务的投资,以确保药品安全及时地送达。因此,西班牙医药物流市场预计将实现显着成长,并巩固其作为全球医药供应链关键组成部分的地位。

西班牙医药物流市场趋势

扩大仓储市场

在西班牙医药物流市场中,仓库在提高供应链效率和可靠性方面发挥着至关重要的作用。

位于战略位置的仓库充当配送中心,确保药品的快速运输。最佳放置可减少运输时间,使製药公司能够为医疗保健提供者、药房和患者提供更快的服务。这种及时性至关重要,尤其是对于紧急药品和医疗紧急情况而言。

从医院到诊所,医疗保健机构都依赖仓库来满足其药品需求。这些仓库确保货物的准确和完整,有助于维持医疗保健系统的平稳运作。

製药业涵盖频谱广泛,从常见的非处方药到专门的昂贵药品。仓库熟练地管理这种多样性,提供单独的储存条件,例如为疫苗和其他温度敏感物品提供冷藏空间。

仓库为您提供了应对市场变化所需的灵活性,包括需求波动、新产品发布和不断变化的分销策略。在一个快速响应市场变化至关重要的行业中,这种适应性至关重要。

新仓库由该公司与 VGP 集团合作开发,VGP 集团是一家领先的泛欧公司,专门从事最先进的物流园区建设,预计于 2023 年第一季开始营运。

2023 年 1 月,UPS 子公司 Bomi Group 投资 1,800 万欧元(1,934 万美元)在马德里开设了一个新的仓储和配送中心。该物流中心占地 27,578平方公尺,符合 GMP 和 GDP 标准,可容纳 60,000 个托盘,是欧洲最大的医药仓库之一,并创造了 150 个技术职位。

在生技药品、专科药物和个人化医疗进步的推动下,欧洲80%的药品现在需要温控运输,马德里设施可以满足这项需求。

我们提供各种温控储存选项(-30°C、+2+8°C、+15+25°C),并配备最先进的自动拣货系统,其错误率低于 0.02%。该设施按照 BREEAM 标准建造,非常注重永续运作。

西班牙医药物流市场仓储和储存能力的增加反映了对高效可靠的供应链解决方案日益增长的需求。随着製药业随着新产品创新和市场动态而不断发展,仓储的角色变得越来越重要。

增强的仓储能力将确保製药公司能够满足医疗保健提供者和患者日益增长的需求,最终有助于西班牙医疗保健体系的全面改善。

学名药市场的扩张

西班牙政府放宽了某些监管规定,促进了欧洲学名药的快速成长。

学名药的生产成本相对于品牌药较低,吸引了製造商投资该行业。此外,物流公司正在推出新服务,以确保用户获得有关其订单的最新资讯并提供其他附加价值服务。

西班牙是欧洲学名药普及率最高的国家之一,得到了医疗机构和病患的大力支持。西班牙对生物相似药的重视体现在其接受英Infliximab和Rituximab等生物製药的生物相似药,这些药物对于治疗类风湿性关节炎和某些癌症等疾病至关重要。

主要企业有Khan Pharma和Shinhwa Biotech。 KernPharma 的生物相似药 Remsima(Infliximab)无缝整合到治疗通讯协定中,为患者提供了更经济的选择。

西班牙的学名药市场充满活力,由 Laboratorios Normon 和 Teva Pharmaceuticals 领衔。 Laboratorios Normon 拥有多元化的产品组合,涵盖从心血管到肿瘤学等广泛的治疗领域。同时,梯瓦製药公司正在扩大其学名药产品,帮助西班牙患者以可负担的价格获得药品。

西班牙药品和医疗设备管理局 (AEMPS)监督这些药品的监管和核准,并维持严格的安全性和有效性基准。随着这种情况的发展,生物相似药和学名药将在加强西班牙医疗保健系统和改善患者治疗效果方面发挥至关重要的作用。

2024年5月,全球製药公司Hikma Pharmaceuticals PLC(Hikma)宣布成立HIKMA ESPANA, SLU(Hikma Spain)。这项战略倡议标誌着 Hikma 首次进军西班牙利润丰厚的非专利注射剂市场,该市场价值约 8.6 亿美元。迄今为止,Hikma 已获得 36 种产品的核准,并在西班牙成功上市了 25 种产品,涉及循环系统、肿瘤、中枢神经系统和抗感染疾病等各个治疗领域。

学名药在西班牙越来越受欢迎,对医药物流市场产生了重大影响。随着对这些高性价比药品的需求不断增加,物流供应商正在提高其有效管理分销的能力。

其中包括采用先进的追踪系统、优化供应链和提供全面的附加价值服务。因此,学名药市场的成长不仅正在改变製药业,而且还推动物流业的创新和效率,确保患者能够及时可靠地获得基本药物。

西班牙医药物流流动产业概况

西班牙医药物流产业竞争激烈、充满活力,但在国家经济中扮演更重要的角色仍有相当大的空间。市场现有主要参与者包括 DHL Supply Chain、FedEx、Kuehne + Nagel International AG、联合包裹服务公司和 C.H.罗宾逊。这些公司正在将自动化、人工智慧、机器学习(AI 和 ML)、区块链和运输管理系统等下一代物流解决方案技术融入其服务中,以提高供应链生产力、降低成本并避免错误。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 当前市场状况

- 市场驱动因素

- 药品销售成长推动市场

- 人口成长推动市场

- 市场限制

- 确保药品安全

- 劳动力短缺

- 市场机会

- 增加冷藏仓库

- 产业供应链/价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 政府的市场措施和监管

- 市场技术趋势

- 深入了解西班牙第三方物流市场

- 地缘政治与疫情将如何影响市场

第五章 市场区隔

- 按服务

- 运输

- 路

- 铁路

- 航空

- 海上运输

- 仓库存放

- 附加价值服务

- 运输

- 温度管理

- 温控/低温运输

- 非温控/非低温运输

- 按产品

- 学名药

- 品牌药物

- 按应用

- 生物製药

- 化学品和製药

第六章 竞争格局

- 市场集中度概览

- 公司简介

- DHL

- FedEx

- Kuehne+Nagel International AG

- United Parcel Service

- CH Robinson

- CEVA Logistics

- DB Schenker

- Movianto

- Agility Logistics

- Eurotranspharma

- CSP*

- 其他公司

第七章 市场机会与未来趋势

第 8 章 附录

- 宏观经济指标(GDP分布,依活动划分)

- 经济统计 - 运输及仓储业对经济的贡献

The Spain Pharmaceutical Logistics Market size is estimated at USD 5.88 billion in 2025, and is expected to reach USD 7.29 billion by 2030, at a CAGR of greater than 4.4% during the forecast period (2025-2030).

Spain is set to lead the world in 'pharma growth potential' in 2024, with Barcelona emerging as Europe's second-best hub for biotech investment.

With a growing number of international biotech startups and companies eyeing Barcelona and its metropolitan area, the Catalan capital is solidifying its position as a biotech stronghold. Reports indicate that by 2024, Spain will rank sixth globally and third in Europe for 'pharma growth potential.'

The booming pharmaceutical industry in Spain is poised to bolster the country's pharmaceutical logistics market, paving the way for lucrative opportunities in transporting and storing both temperature-sensitive and general pharmaceutical products.

Spain boasts 103 factories dedicated to producing medicines for human use, with 11 specializing in biologics. When factoring in 46 facilities for active ingredients and 24 for veterinary use, the total rises to 173 factories, spread across 122 distinct business groups. Collectively, they generate 183,000 jobs (encompassing direct, indirect, and induced employment), produce goods worth EUR 16 billion (USD 16.79 billion) (with 75% earmarked for export), and lead in both competitiveness and environmental sustainability.

In 2023, prescription medications dominated Spain's pharmaceutical market, accounting for nearly 70% of the revenue. Over-the-counter medications followed at 12.4%, while nutritional products made up about 3%. That year, Spain boasted approximately 22,261 pharmacies, translating to one pharmacy for every 2,130 residents.

In 2023, Spain's pharmaceutical imports were valued at around USD 22 billion, a slight dip from the USD 24 billion in 2022. Notably, over the analyzed period, imports surged by more than 4.2 times.

This robust growth of the pharmaceutical industry in Spain will support the advancement of the Spanish pharmaceutical logistics market by creating tremendous opportunities for the transport and storage of temperature-sensitive and general pharmaceutical products in the country.

The increasing demand for efficient logistics solutions will drive investments in infrastructure, technology, and services, ensuring the safe and timely delivery of pharmaceutical products. Consequently, the Spanish pharmaceutical logistics market is expected to experience significant growth, solidifying its position as a critical component of the global pharmaceutical supply chain.

Spain Pharmaceutical Logistics Market Trends

Expansion in Warehousing and Storage Market

In Spain's pharmaceutical logistics market, warehouses are pivotal, enhancing the supply chain's efficiency and reliability.

Strategically positioned, warehouses act as distribution hubs, ensuring the swift transportation of pharmaceuticals. Their optimal placement reduces transit times, allowing pharmaceutical companies to promptly serve healthcare providers, pharmacies, and patients. This timeliness is vital, especially for urgent medications and medical emergencies.

Healthcare entities, from hospitals to clinics, depend on warehouses for their pharmaceutical needs. These warehouses guarantee accurate and complete shipments, bolstering the healthcare system's smooth operation.

The pharmaceutical sector encompasses a broad spectrum, from common over-the-counter drugs to specialized, high-value medications. Warehouses adeptly manage this variety, offering tailored storage conditions, such as refrigerated spaces for vaccines and other temperature-sensitive items.

Warehouses offer the necessary flexibility to navigate market shifts, be it demand fluctuations, new product launches, or evolving distribution strategies. Such adaptability is vital in an industry where swift responses to market changes are paramount.

In collaboration with the VGP Group, a top pan-European firm specializing in cutting-edge logistics parks, a new warehouse is set to commence operations in the first quarter of 2023.

In January 2023, Bomi Group, a subsidiary of UPS, inaugurated its new storage and distribution hub in Madrid, backed by an EUR 18-million (USD 19.34 million)investment. Spanning 27,578m2, this GMP and GDP-compliant logistics center boasts a capacity for 60,000 pallets, positioning it among Europe's largest pharmaceutical warehouses and generating 150 skilled jobs.

With 80% of pharmaceutical products in Europe now needing temperature-controlled transport due to advancements in biologics, specialty drugs, and personalized medicine, the Madrid facility is equipped to cater to this demand.

It offers diverse temperature-controlled storage options (-30 °C, +2+8 °C, +15+25 °C) and features a cutting-edge automated order-picking system, boasting an impressive error rate of under 0.02%. Built to BREEAM standards, the facility emphasizes sustainable operations.

The increase in warehousing and storage capacity in Spain's pharmaceutical logistics market reflects the growing demand for efficient and reliable supply chain solutions. As the pharmaceutical industry continues to evolve with new product innovations and market dynamics, the role of warehouses becomes increasingly critical.

Enhanced warehousing capabilities ensure that pharmaceutical companies can meet the rising needs of healthcare providers and patients, ultimately contributing to the overall improvement of the healthcare system in Spain.

Increasing in Generic Drugs market

The Spanish government is relaxing certain regulations, contributing to the surge of generic drugs in Europe.

Low production costs of generic drugs, compared to branded counterparts, are luring manufacturers to invest in the industry. Additionally, logistics companies are rolling out new services, ensuring users stay updated on their orders, complemented by other value-added offerings.

Spain boasts one of the highest rates of generic drug penetration in Europe, underscoring robust backing from both healthcare providers and patients. A testament to Spain's dedication to biosimilars is its embrace of biosimilar versions of biologic drugs, such as infliximab and rituximab, pivotal in treating ailments like rheumatoid arthritis and specific cancers.

Leading this charge are companies like Kern Pharma and Cinfa Biotech. Kern Pharma's biosimilar, Remsima (infliximab), has seamlessly integrated into treatment protocols, offering patients a more economical choice.

Spain's generic drug landscape is vibrant, with Laboratorios Normon and Teva Pharmaceuticals at the helm. Laboratorios Normon boasts a diverse portfolio, catering to therapeutic areas from cardiovascular health to oncology. Meanwhile, Teva Pharmaceuticals is broadening its generic drug offerings, ensuring Spanish patients have access to affordable medications.

The Spanish Agency of Medicines and Medical Devices (AEMPS) oversees the regulation and approval of these drugs, upholding rigorous safety and efficacy benchmarks. As the landscape shifts, both biosimilars and generics are poised to play pivotal roles in bolstering Spain's healthcare system and enhancing patient outcomes.

In May 2024, Hikma Pharmaceuticals PLC (Hikma), a global pharmaceutical entity, proudly unveiled HIKMA ESPANA, S.L.U. (Hikma Spain). This strategic move marks Hikma's inaugural foray into Spain's lucrative generic injectable market, valued at around USD 860 million. With 36 product approvals under its belt, Hikma has successfully launched 25 products across diverse therapeutic domains in Spain, including cardiovascular, oncology, central nervous system, and anti-infectives.

The increasing penetration of generic drugs in Spain is significantly impacting the pharmaceutical logistics market. As demand for these cost-effective medications rises, logistics providers are enhancing their capabilities to manage the distribution efficiently.

This includes adopting advanced tracking systems, optimizing supply chains, and offering comprehensive value-added services. Consequently, the growth of the generic drugs market is not only transforming the pharmaceutical landscape but also driving innovation and efficiency within the logistics sector, ensuring that patients receive timely and reliable access to essential medications.

Spain Pharmaceutical Logistics Industry Overview

Spain's pharmaceutical Logistics industry is competitive and dynamic, but it still has a considerable margin to achieve a more relevant role in the national economy. A few existing major players in the market include DHL Supply Chain, FedEx, Kuehne + Nagel International AG, United Parcel Service, and CH Robinson. These companies are implementing next-generation logistics solution technologies into their services, such as automation, artificial intelligence, machine learning (AI and ML), blockchain, transportation management systems, and others, to increase supply chain productivity, reduce costs, and avoid errors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Drivers

- 4.2.1 Increase In Pharmaceutical Sales Is Driving The Market

- 4.2.2 Rise In Population Is Driving The Market

- 4.3 Marrket Restraints

- 4.3.1 Ensure The Safety Of Medications

- 4.3.2 Labor Shortage

- 4.4 Market Opportunities

- 4.4.1 Increase in Cold Storage Warehouses

- 4.5 Industry Supply Chain/Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Government Initiatives and Regulations in the Market

- 4.8 Technological Trends in the Market

- 4.9 Insights Into The 3PL Market in Spain

- 4.10 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Services

- 5.1.1 Transportation

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Sea

- 5.1.2 Storage and Warehousing

- 5.1.3 Value Added Services

- 5.1.1 Transportation

- 5.2 By Temperature Control

- 5.2.1 Temperature Controlled/Cold Chain

- 5.2.2 Non-Temperature Controlled/Non-Cold Chain

- 5.3 By Product

- 5.3.1 Generic Drugs

- 5.3.2 Branded Drugs

- 5.4 By Application

- 5.4.1 Biopharma

- 5.4.2 Chemical Pharma

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL

- 6.2.2 FedEx

- 6.2.3 Kuehne+Nagel International AG

- 6.2.4 United Parcel Service

- 6.2.5 C.H. Robinson

- 6.2.6 CEVA Logistics

- 6.2.7 DB Schenker

- 6.2.8 Movianto

- 6.2.9 Agility Logistics

- 6.2.10 Eurotranspharma

- 6.2.11 CSP*

- 6.3 Other Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy