|

市场调查报告书

商品编码

1683858

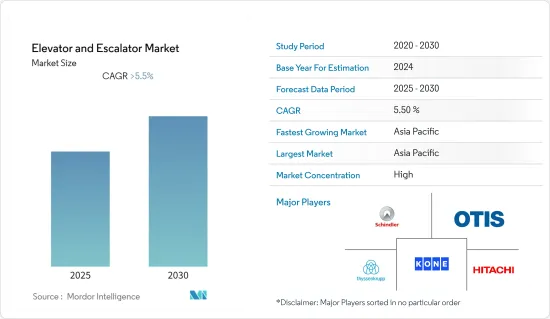

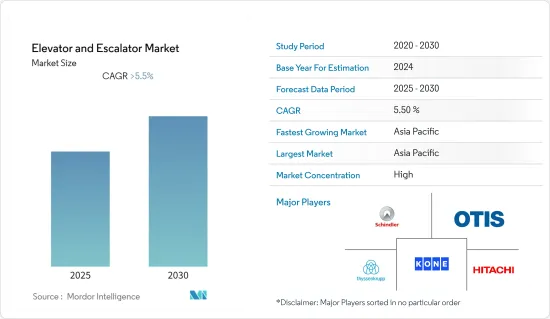

电梯和自动扶梯-市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Elevator and Escalator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预测期内,电梯和自动扶梯市场预计将以超过 5.5% 的复合年增长率成长

主要亮点

- 从长远来看,预计在预测期内,对机场、住宅、高层建筑和其他高层建筑等大型基础设施计划的大量投资等因素将推动市场发展。

- 另一方面,售后维护熟练人力的短缺可能会在预测期内阻碍市场成长。

- 然而,预计在预测期内,电梯和自动扶梯技术在降低能耗和排放的技术进步将为市场提供有利的成长机会。

- 由于住宅、商业和公共基础设施计划投资的增加,以及该地区政府的支持政策,预计亚太地区将成为预测期内成长最快的市场。

电梯和自动扶梯市场趋势

公共基础建设计划投资增加推动市场

- 在全球范围内,增加对基础设施计划的投资以满足不断增长的人口和提高生活水准预计将成为预测期内市场成长的最重要驱动力之一。

- 持续的都市化趋势导致世界各地城市快速发展。随着城市垂直扩张,高层建筑越来越多,对电梯和自动扶梯等高效垂直运输解决方案的需求变得至关重要,以确保楼层之间的无缝移动。这些交通系统对于解决交通拥堵和优化空间利用至关重要。

- 世界各国政府都优先发展强大的公共基础设施,以支持经济成长并满足不断增长的人口的需求。正在进行的投资包括交通枢纽、购物中心、机场和火车站等一系列计划。因此,这些大型物流和商业中心对电梯和自动扶梯的需求正在稳步增长。这些移动解决方案是促进人员和货物流动的重要组成部分。

- 随着全球对温室气体排放的担忧日益加剧,对永续基础设施的需求也日益增加。为了在2030年实现永续目标,到2050年实现净零排放,我们必须将大量资金用于永续和有韧性的基础设施建设。根据经济合作暨发展组织(OECD)估计,到2050年,每年需要约6.9兆美元投资基础设施,以实现发展目标并创造低碳、气候适应型的未来。

- 根据全球基础设施中心预测,到2023年,所需投资将出现巨大缺口,达到数兆美元。随着人们对排放的担忧日益加剧以及对开发新的永续基础设施的投资不断增加,预计预测期内对电梯和自动扶梯的需求将快速增长。

- 因此,预计对新的永续基础设施的投资将在预测期内推动市场成长。

亚太地区将成为成长最快的市场

- 亚太地区正经历快速的都市化、人口成长和基础设施建设的增加,导致对电梯和自动扶梯的需求激增。随着农村人口迁移到都市区寻求更好的经济机会和更高的生活水准,亚太地区正在经历显着的都市化。都市区集中导致高层建筑和商业空间的建设,增加了对垂直交通解决方案的需求。

- 亚太地区的一些国家正在大力投资基础建设,以促进经济成长和应对城市化挑战。各国政府正在实施雄心勃勃的大型企划,例如新机场、铁路网络和智慧城市,这些项目不可避免地需要垂直交通解决方案。

- 尤其是中国、印度和日本正在进行大规模的基础设施投资。随着大规模都市化建设和高层建筑的建设,中国已成为全球最大的电梯和自动扶梯市场。印度快速的都市化和基础设施计划也导致对电梯和自动扶梯的巨大需求,尤其是在大城市。

- 在印度,2023-24 年预算中基础设施资本投资支出将增加 33%,达到 10,0000 亿印度卢比(1,220 亿美元),占 GDP 的 3.3%。 2023-24 年联邦预算为铁路拨款创纪录地达到 2.4 兆卢比(290 亿美元),比 2013-14 年增加了 9 倍。

- 据介绍,国家基础设施计画(NIP)计划数量从6835个扩大到9142个,涵盖34子部门。目前,「一带一路」倡议下正在推进的计划有2,476个,预计投资额达1.9兆美元。正在开发的计划近一半集中在交通运输领域,其中道路和桥樑子子部门有 3,906 个。

- 印度铁路公司预计 24 财年的交通收入将达到 2,646 亿印度卢比(约 321.7 亿美元)。

- 2022 年 12 月,印度机场管理局 (AAI) 和其他机场开发商为未来五年机场产业的资本支出设定了目标,约 98,000 亿印度卢比(118 亿美元)。这项投资将用于扩建和改造现有航站楼、建造新航站楼和加强跑道等开发活动。

- 因此,由于快速的都市化和如此大规模的基础设施投资,特别是在中国和印度,预计亚太地区将成为预测期内市场成长最快的地区。

电梯和自动扶梯产业概况

电梯和自动扶梯市场正在整合。市场的主要企业(不分先后顺序)包括迅达集团、奥的斯全球公司、蒂森克虏伯股份公司、通力公司和日立有限公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2028 年市场规模与需求预测

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 加大公共基础建设计划投资

- 对环保产品的需求不断增加,导致绿色标籤产品的采用率不断提高

- 限制因素

- 缺乏售后维修的熟练劳工

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 按类型

- 电梯

- 电扶梯

- 电动平面步道

- 按服务

- 新安装

- 维护和修理

- 现代化

- 按最终用户

- 住宅

- 商业的

- 大规模

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 亚太地区

- 中国

- 印度

- 韩国

- 日本

- 其他亚太地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- Companies Profiles

- Schindler Group

- Otis Worldwide Corporation

- ThyssenKrupp AG

- Kone Oyj

- Hitachi Limited

- Hyundai Limited

- Fujitec Co. Limited

- Toshiba Corporation

- Mitsubishi Electric Corporation

第七章 市场潜力与未来趋势

- 降低电梯和自动扶梯能耗和排放的技术进步

简介目录

Product Code: 50001268

The Elevator and Escalator Market is expected to register a CAGR of greater than 5.5% during the forecast period.

Key Highlights

- Over the long term, factors such as massive investments in large infrastructure projects such as airports, residential communities, skyscrapers, and other superstructures are expected to drive the market during the forecast period.

- On the other hand, the lack of a proficient workforce for post-sales maintenance will likely impede the market's growth during the forecast period.

- Nevertheless, technological advancements in reducing energy consumption and emissions in elevator and escalator technology are expected to create lucrative growth opportunities for the market during the forecast period.

- Asia-Pacific is the fastest-growing market during the forecast period due to the increasing investments in residential, commercial, and public infrastructure projects, coupled with supportive government policies across the region.

Elevator and Escalator Market Trends

Rising Investments in Public Infrastructure Projects to Drive the Market

- Globally, rising investments in infrastructure projects to cater to the demands of growing populations and living standards are expected to be one of the most significant drivers for market growth during the forecast period.

- The ongoing trend of urbanization is leading to the rapid growth of cities worldwide. As cities expand vertically with more high-rise buildings, the demand for efficient vertical transportation solutions, such as elevators and escalators, becomes crucial to ensure seamless floor mobility. These transportation systems are pivotal in addressing congestion and optimizing space utilization.

- Governments worldwide prioritize developing robust public infrastructure to support economic growth and cater to the needs of a growing population. Investments are being made in various projects, including transportation hubs, commercial complexes, airports, and railway stations. As a result, the demand for elevators and escalators in these large-scale logistical and commercial hubs is steadily rising, as these mobility solutions are essential components facilitating the easy movement of people and goods.

- As concerns about greenhouse emissions have intensified globally, the demand for sustainable infrastructure has grown. To reach the sustainable development goals by 2030 and achieve net zero emissions by 2050, substantial funding must be directed toward sustainable and resilient infrastructure. According to the Organisation for Economic Co-operation and Development (OECD), an estimated USD 6.9 trillion annually is required until 2050 to invest in infrastructure, enabling the fulfillment of development objectives and the creation of a low-carbon, climate-resilient future.

- According to the Global Infrastructure Hub, as of 2023, a considerable gap exists in required investments, amounting to trillions of dollars. As concerns about emissions grow and investments are made in developing new sustainable infrastructure, this is expected to create a rapid demand for elevators and escalators during the forecast period.

- Hence, investments in new sustainable infrastructure are expected to drive the growth of the market during the forecast period.

Asia-Pacific to be the Fastest-growing Market Segment

- The Asia-Pacific region is witnessing rapid urbanization, population growth, and increased infrastructural development, leading to a surge in the demand for elevators and escalators. The Asia-Pacific region has been experiencing significant urbanization as rural populations migrate to cities for better economic opportunities and improved living standards. The concentration of populations in urban centers has resulted in the construction of high-rise buildings and commercial spaces, thereby amplifying the need for vertical transportation solutions.

- Several countries in the Asia-Pacific region are investing heavily in infrastructural development to boost economic growth and address urban challenges. Governments are undertaking ambitious mega projects, such as new airports, railway networks, and smart cities, which invariably require vertical transportation solutions.

- China, India, and Japan, particularly, are witnessing substantial infrastructural investments. China has been the largest market for elevators and escalators globally, owing to its massive urbanization initiatives and high-rise building constructions. India's rapid urbanization and infrastructure projects have also led to significant demand for elevators and escalators, especially in metropolitan cities.

- In India, during Budget 2023-24, the capital investment outlay for infrastructure is increasing by 33%, reaching INR 10 lakh crore (USD 122 billion), accounting for 3.3% of GDP. The Union Budget 2023-24 has allocated a record-breaking capital outlay of INR 2.40 lakh crore (USD 29 billion) for the Railways, representing a ninefold increase compared to the outlay in 2013-14.

- According to news reports, the National Infrastructure Pipeline (NIP) project count has expanded from 6,835 to 9,142, encompassing 34 sub-sectors. Within the initiative, 2,476 projects are currently in development, with an estimated investment of USD 1.9 trillion. Nearly half of the under-development projects are concentrated in the transportation sector, while 3,906 are in the roads and bridges sub-sector.

- For FY24, the Indian Railways anticipates achieving a total revenue from traffic amounting to INR 2,64,600 crore (USD 32.17 billion).

- In December 2022, the Airport Authority of India (AAI) and other Airport Developers set a target capital outlay of approximately INR 98,000 crore (USD 11.8 billion) for the airport sector over the next five years. This investment will be utilized to expand and modify existing terminals, construct new terminals, and strengthen runways, among other development activities.

- Hence, due to the rapid rise in urbanization and such significant infrastructure investments, especially in China and India, the Asia-Pacific region is expected to be the fastest-growing region in the market during the forecast period.

Elevator and Escalator Industry Overview

The elevators and escalators market is consolidated. Some of the major players in the market (in no particular order) include Schindler Group, Otis Worldwide Corporation, ThyssenKrupp AG, Kone Oyj, and Hitachi Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Investments in Public Infrastructure Projects

- 4.5.1.2 Growing Demand for Environmental Friendly Products to Increase the Adoption of Green Labeled Products

- 4.5.2 Restraints

- 4.5.2.1 Lack of a Proficient Workforce for Post-Sales Maintenance

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 By Type

- 5.1.1 Elevators

- 5.1.2 Escalators

- 5.1.3 Moving Walkways

- 5.2 By Service

- 5.2.1 New Installation

- 5.2.2 Maintenance and Repair

- 5.2.3 Modernization

- 5.3 By End-user

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Large-scale

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Asia-Pacific

- 5.4.2.1 China

- 5.4.2.2 India

- 5.4.2.3 South Korea

- 5.4.2.4 Japan

- 5.4.2.5 Rest of Asia-Pacific

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 Middle-East and Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 South Africa

- 5.4.4.4 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Chile

- 5.4.5.4 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 Schindler Group

- 6.3.2 Otis Worldwide Corporation

- 6.3.3 ThyssenKrupp AG

- 6.3.4 Kone Oyj

- 6.3.5 Hitachi Limited

- 6.3.6 Hyundai Limited

- 6.3.7 Fujitec Co. Limited

- 6.3.8 Toshiba Corporation

- 6.3.9 Mitsubishi Electric Corporation

7 MARKET OPPORTUNITIES and FUTURE TRENDS

- 7.1 Technological Advancements in Reducing Energy Consumption and Emissions in Elevator and Escalator Technology

02-2729-4219

+886-2-2729-4219