|

市场调查报告书

商品编码

1683903

北美快递包裹 (CEP):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)North America Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

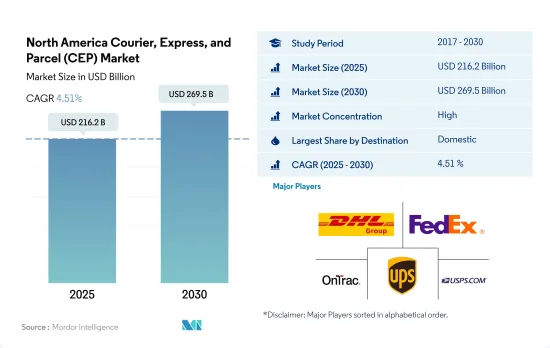

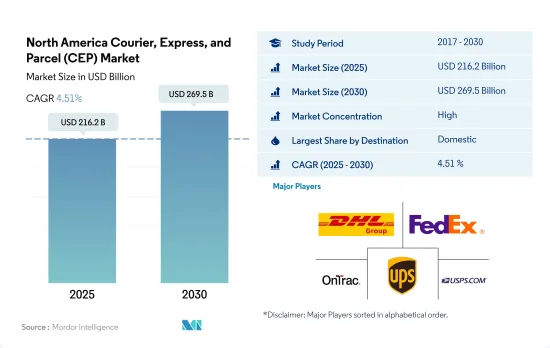

北美快递包裹 (CEP) 市场规模预计在 2025 年将达到 2,162 亿美元,预计到 2030 年将达到 2,695 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.51%。

电子商务销售额的增加和贸易的扩大将影响宅配市场的需求

- 电子商务的成长和全球疫情推动了北美宅配市场的发展。随着宅配数量的增加,许多公司开始在该国进行收购。在美国,UPS Inc.于2023年10月从PayPal Holdings Inc.收购了退货管理软体Happy Returns。此次收购增强了UPS在快速成长的线上退货领域的地位。该公司在全美 12,000 多个投递点提供无需包装箱和标籤的退货服务。

- 在墨西哥,2019年有11%的农村人口进行了网上购物,约相当于140万人。 2019年,进行过网上购物的网路用户比例增加了约58%,显示该国电子商务正在加速成长。由于需求增加和积极的成长模式,墨西哥 CEP 产量在 2023 年有所增加。随着宅配和小包裹服务的持续成长,这一趋势预计将进一步增加线上购物的采用,预计到 2040 年墨西哥 95% 的购物将透过网路进行。

基础设施投资、机器人送货车的采用以及自动化仓库推动区域市场

- 随着小包裹需求的不断增加,许多公司正在该地区进行併购。例如,2023 年 10 月,UPS Inc. 收购了主要企业的逆向物流公司 Happy Returns,让商家和消费者更轻鬆、更快捷地退回小包裹。此外,2021 年,Estafeta 投资 9,750 万美元用于改善其实体和数位基础设施,包括在墨西哥城建立一个专门用于电子商务的新枢纽。 2023年,联邦快递宣布合併在加拿大的联邦快递和地面业务,以简化其小包裹递送业务。

- 2024年,牙买加电子商务市场预计将创造6.962亿美元的收益。预计到 2029 年,这一数字将以每年 9.28% 的速度成长,并激增至 10.85 亿美元。这一增长是由互联网普及率的提高、智慧型手机使用率的提高以及人们对网路购物的偏好日益增长所推动的。预计到2029年,用户数将成长至710.2万,渗透率将从2024年的19.1%上升至2029年的25.8%,反映出消费行为向数位平台的重大转变。

北美快递包裹 (CEP) 市场趋势

美国是该地区GDP的最大贡献者,这得益于加强港口和供应链的基础设施计画。

- 高效可靠的交通系统对经济至关重要。透过国家贸易走廊基金,加拿大政府投资改善供应链、减少贸易壁垒和促进业务成长,以创造未来的经济机会。 2024年5月,交通部长宣布该基金将向19个数位基础设施计划提供高达5,120万美元的资金。加拿大政府正在利用创新技术加强供应链,以便为加拿大人提供更快、更便宜的送货服务。该计划将促进与全国各地相关人员在数计划上的合作,以有效解决运输瓶颈、脆弱性和港口拥堵问题。

- 在美国,由于基础设施的发展和电子商务的兴起,运输和仓储行业的就业预计将增长。根据美国劳工统计局 (BLS) 的数据,预计 2022 年至 2032 年期间该行业的年增长率为 0.8%,从而在此期间增加近 57 万个就业机会。预计宅配和信差产业以及仓储和储存业将为该产业预计的就业成长贡献约 80%。

中东地区紧张局势加剧影响原油供应,导致该地区原油价格大幅上涨。

- 到 2024 年 10 月,即总统大选之前,预计美国汽油价格将在三年多来首次跌至每加仑 3 美元以下。燃料价格下跌主要由于需求放缓和原油价格下跌,为因成本上涨而遭受通膨打击的消费者带来了缓解。这种发展可能会增强包括副总统卡马拉·哈里斯在内的民主党人的支持,因为他们将对共和党对油价飙升的批评作出回应。截至 2024 年 9 月,普通汽油平均价格为每加仑 3.25 美元,比上月下降 19 美分,比去年同期下降 58 美分。

- 预计2024年加拿大油砂工厂的年度维护将照常进行。但工会领导人警告称,由于两个新的行业计划,亚伯达将在 2025 年的转折季节出现劳动力短缺。亚伯达的生产商每年都会僱用数千名技术纯熟劳工,负责油砂升级工厂、火力发电发电工程和炼油厂的关键维护。加拿大是世界第四大石油生产国,每天生产的 490 万桶原油中约有三分之二来自亚伯达北部的油砂。最早在 2025 年,燃料短缺就可能导致燃料价格上涨。

北美快递包裹 (CEP) 产业概况

北美快递包裹 (CEP) 市场相当集中,市场主要企业(按字母顺序排列):DHL 集团、FedEx、Ontrack、美国联合包裹服务公司 (UPS) 和 USPS。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的 GDP 分布

- 经济活动带来的 GDP 成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业生产毛额

- 出口趋势

- 进口趋势

- 燃油价格

- 物流绩效

- 基础设施

- 法律规范

- 加拿大

- 墨西哥

- 美国

- 价值链与通路分析

第五章 市场区隔

- 目的地

- 国内的

- 国际的

- 送货速度

- 表达

- 非快递

- 模型

- 企业对企业 (B2B)

- 企业对消费者 (B2C)

- 消费者对消费者(C2C)

- 运输重量

- 重型货物

- 轻型货物

- 中等重量货物

- 运输方式

- 航空邮件

- 路

- 其他的

- 最终用户

- 电子商务

- 金融服务(BFSI)

- 卫生保健

- 製造业

- 一级产业

- 批发零售(线下)

- 其他的

- 国家名称

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介

- Aramex

- DHL Group

- Dropoff Inc.

- DTDC Express Limited

- Fastfrate Inc.

- Fedex

- International Distributions Services(including GLS)

- JB Hunt Transport, Inc.

- OnTrac

- Spee-Dee Delivery Service, Inc.

- TFI International Inc.

- United Parcel Service of America, Inc.(UPS)

- USPS

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 技术进步

- 资讯来源和进一步阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001571

The North America Courier, Express, and Parcel (CEP) Market size is estimated at 216.2 billion USD in 2025, and is expected to reach 269.5 billion USD by 2030, growing at a CAGR of 4.51% during the forecast period (2025-2030).

Rising e-commerce market sales along with growing trade influencing the demand for parcel delivery market

- E-commerce growth and the global pandemic fueled the parcel shipping market in the North American region, as consumers were more inclined toward ordering online compared to purchasing from physical stores. With rising volumes, many companies are undertaking acquisitions in the country. In the United States, in October 2023, UPS Inc. acquired Happy Returns, a returns management software company, from PayPal Holdings Inc. The deal enhances UPS' presence in the rapidly growing online returns sector. The company will provide box and label-free return options at over 12,000 drop-off locations across the US.

- In Mexico, 11% of the population in rural areas made online purchases in 2019, which equated to almost 1.4 million people. The percentage of internet users who made purchases online increased from 2018 to 2019 by about 58%, an indication of the accelerated growth of e-commerce in the country. With the increasing demand and positive growth pattern, the Mexican CEP volume increased in 2023. With consistent growth related to courier and parcel services, the trend is anticipated to increase further the adoption of online purchases, wherein by 2040, 95% of purchases are estimated to be made online in Mexico.

Infrastructure investments, adoption of robotic delivery cars, automated warehousing driving regional market

- With rising parcel demand, many companies are undertaking mergers and acquisitions across the region. For instance, in October 2023, UPS Inc. acquired Happy Returns, a leading reverse logistics company, to enable easy and quick returns of parcels for merchants and consumers. Also, in 2021, Estafeta invested USD 97.5 million in improving its physical and digital infrastructure, including the construction of a new hub in Mexico City focused entirely on e-commerce. In 2023, FedEx announced the merger of FedEx Express and Ground operations in Canada to streamline parcel delivery operations.

- In 2024, Jamaica's e-commerce market is set to generate a revenues of USD 696.20 million. With an annual growth rate of 9.28%, projections indicate a surge to USD 1,085.00 million by 2029. This growth is driven by increasing internet penetration, rising smartphone usage, and a growing preference for online shopping. User numbers are anticipated to climb to 710.2k by 2029, with penetration rates rising from 19.1% in 2024 to 25.8% in 2029, reflecting a significant shift in consumer behavior towards digital platforms.

North America Courier, Express, and Parcel (CEP) Market Trends

The US dominates with maximum regional GDP contribution, fueled by an infrastructure program that boosts ports and supply chains

- An efficient and reliable transportation system is crucial for the economy. Through the National Trade Corridors Fund, the Government of Canada invests in improving supply chains, reducing trade barriers, and fostering business growth for future economic opportunities. In May 2024, the Minister of Transport announced up to USD 51.2 million for 19 digital infrastructure projects under this fund. The Canadian government aims to enhance supply chains with innovative technologies to expedite and reduce costs for Canadians. This initiative will drive collaboration with stakeholders nationwide on digital projects to address transportation bottlenecks, vulnerabilities, and port congestion effectively.

- In United States, infrastructure development and the rise of e-commerce are anticipated to boost employment in the transportation and storage sector. According to the Bureau of Labor Statistics (BLS), this sector is projected to grow at a rate of 0.8% annually from 2022 to 2032, resulting in the addition of nearly 570,000 jobs during that timeframe. The couriers and messengers industry, along with warehousing and storage, are expected to contribute significantly to about 80% of the sector's projected job growth.

Rising tensions in the Middle East are expected to affect crude oil supplies and lead to sudden price hikes in the region

- By October 2024, just ahead of the presidential election, gasoline prices in the US were projected to dip below USD 3 a gallon for the first time in over 3 years. This decline in fuel prices, primarily driven by waning demand and decreasing oil prices, offered a reprieve to consumers who had been grappling with elevated costs contributing to inflation. Such a development could have bolstered Vice President Kamala Harris and other Democrats in addressing Republican critiques regarding soaring gas prices. As of September 2024, regular gas averaged USD 3.25 a gallon, marking a 19-cent drop from the previous month and a 58-cent YoY decrease.

- Annual maintenance on Canada's oil sands plants in 2024 is expected to proceed normally. However, trade union officials warn of a labor shortage in Alberta's 2025 turnaround season due to two new industrial projects. Alberta producers annually hire thousands of skilled workers for essential maintenance on oil sands upgraders, thermal projects, and refineries. As the world's fourth-largest oil producer, Canada gets about two-thirds of its 4.9 million barrels per day of crude from the northern Alberta oil sands. This shortage might raise fuel prices in 2025.

North America Courier, Express, and Parcel (CEP) Industry Overview

The North America Courier, Express, and Parcel (CEP) Market is fairly consolidated, with the major five players in this market being DHL Group, Fedex, OnTrac, United Parcel Service of America, Inc. (UPS) and USPS (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Canada

- 4.12.2 Mexico

- 4.12.3 United States

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

- 5.7 Country

- 5.7.1 Canada

- 5.7.2 Mexico

- 5.7.3 United States

- 5.7.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aramex

- 6.4.2 DHL Group

- 6.4.3 Dropoff Inc.

- 6.4.4 DTDC Express Limited

- 6.4.5 Fastfrate Inc.

- 6.4.6 Fedex

- 6.4.7 International Distributions Services (including GLS)

- 6.4.8 J.B. Hunt Transport, Inc.

- 6.4.9 OnTrac

- 6.4.10 Spee-Dee Delivery Service, Inc.

- 6.4.11 TFI International Inc.

- 6.4.12 United Parcel Service of America, Inc. (UPS)

- 6.4.13 USPS

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219