|

市场调查报告书

商品编码

1683923

欧洲国内宅配市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Domestic Courier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

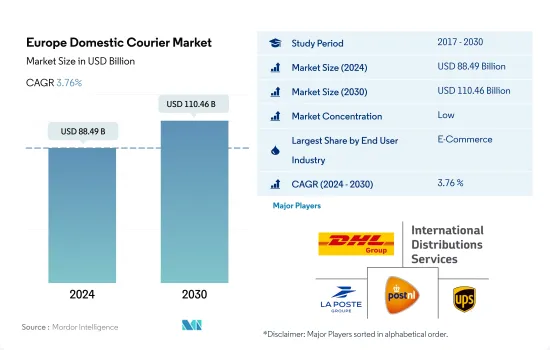

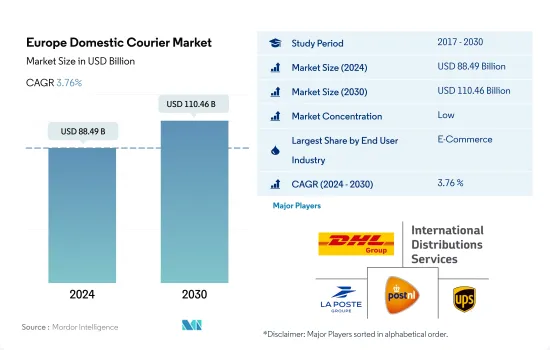

预计 2024 年欧洲国内宅配市场规模为 884.9 亿美元,到 2030 年将达到 1,104.6 亿美元,预测期内(2024-2030 年)的复合年增长率为 3.76%。

电子商务公司正在扩大在欧洲的网络,以便更好地服务客户。

- 由于消费者希望他们的订单能够快速、方便地送达,国内宅配服务在电子商务产业中变得越来越重要。过去几年,疫情导致购物行为发生了巨大变化,购物过程转向网路购物。此外,电子商务公司正在扩大其在欧洲的网络,以便更好地服务客户。例如,西班牙零售商 DIA 已将其配送服务扩展到从赫罗纳到韦尔瓦的西班牙沿海每个城镇,吸引了超过 500 万新客户。

- 2022年,葡萄牙、土耳其和波兰的销售额增幅位居欧洲首位,分别为13.3%、10.2%和10.1%。 2021年,零售支出在所有欧洲国家的私人消费中占比很大,一般在30%至50%之间。在欧洲,德国市场是销售额最大、最重要的零售市场。继德国之后,欧洲最大的经济体是法国、英国和义大利,它们是国内宅配服务的主要需求国。

- 由于医疗用品需求增加、医疗费用上涨以及对更快、更有效率的送货服务的需求等多种因素,预计未来几年该地区的医疗保健产品宅配服务将会成长。此外,预计欧洲五个国家(德国、英国、法国、义大利和西班牙)的零售总额将从 2023 年起成长至疫情前的水平,从而推动市场成长。因此,预计欧洲国内宅配市场在预测期内将实现正成长。

义大利国内宅配需求推动 CEP 成长,销售额成长 22%,达到 116 亿美元

- 2022年圣诞节期间,德国宅配公司运送了7.25亿件小包裹。 B2C小包裹运输是最大的细分市场,共有 3.95 亿个小包裹递送给私人收件人。平均每天递送包裹 1450 万件,其中尖峰时段每天递送 2000 万件小包裹,住宅地址递送包裹 800 万件。由于电子商务的成长,德国市场对国内 CEP 的需求预计将增加,预计 2023 年至 2027 年电子商务的成长速度为 9.36%。

- 预计电子商务产业将成为法国宅配市场的主要成长动力。 2022年,法国国内宅配市场规模约830亿美元,预计2027年将达1,520亿美元。电子商务需求的不断增长将导致小包裹递送量大幅增加,仅法国国家邮政服务公司法国邮政集团在2022年就递送了26亿件小包裹。法国CEP市场的其他主要企业也做出了重大贡献,包括DHL全球货运法国公司、通用物流系统法国公司和联合包裹服务法国公司。

- 在义大利,国内航运需求在推动CEP航运方面发挥重要作用。 CEP营收也大幅成长,从2020年的96亿美元成长22%至2021年的116亿美元。人均小包裹递送数量也从2020年的21件增加到2021年的24件,增加了17%。这意味着每个家庭平均会收到55个小包裹。

欧洲国内宅配市场趋势

欧盟拨款57.6亿美元用于135个交通计划以促进经济復苏

- 在欧洲,由于贸易和旅行的成长,运输和仓储产业的 GDP 将在 2021 年成长 10.48%。约有 135 个交通基础建设计划获选获得 2022 年欧盟补贴,总额达 60 亿美元。运输和仓储行业在支持各行各业的业务方面发挥着至关重要的作用,其中德国领先法国和英国。从全球来看,德国是第三大商品出口国和进口国。德国联邦政府宣布将增加对交通基础设施的投资,2022年将为联邦公路拨款超过120亿欧元(128亿美元),为水道拨款约17亿欧元(18.1亿美元),彰显其改善交通网络的决心。

- 德国政府打算在铁路方面的投资大于公路方面的投资。 2022年,德国铁路、联邦政府和地方政府将在铁路基础建设计划上投资约136亿欧元(145.1亿美元)。下萨克森州、汉堡州、不来梅州、梅克伦堡-前波美拉尼亚和石勒苏益格-荷尔斯泰因州正在与德国铁路公司合作,投资到 2030 年对其铁路网络进行现代化改造。

- 2022年,欧盟核准为约135个交通基础建设计划提供54亿欧元的津贴。这些计划旨在支持欧盟成员国在大洪水后的经济恢復,加强交通网络,促进永续交通,提高安全并创造就业机会。所有支持的计划都是连接欧盟成员国的跨欧洲交通网络的一部分,符合欧盟到2030年完成TEN-T核心网络、到2050年完成综合网络的目标。

自2023年2月以来,俄罗斯的进口禁令导致来自中东、亚洲和北美的柴油进口量增加。

- 2022年第一季,欧元区19个国家中大多数国家的汽油价格上涨至每公升2欧元(2.13美元)以上。价格上涨的主要原因是俄罗斯与乌克兰衝突导致的供应问题,而俄罗斯则供应了欧盟超过四分之一的石油需求。 2021 年,欧元区每公升汽油的平均价格为 1.30 欧元(1.38 美元),但 2022 年初每公升汽油的平均价格约为 1.55 欧元(1.65 美元)。

- 俄罗斯是欧洲最大的柴油供应国。 2023年,欧洲柴油价格下跌。自2023年2月欧盟实施禁止从俄罗斯进口石油产品禁令以来,俄罗斯对欧洲的柴油出口量平均为2.4万桶/天,比2022年俄罗斯对欧洲的63万桶/天下降了96%。从2月到5月,中东对欧洲的柴油出口成长了51%(16万桶/天),亚洲成长了97%(14.7万桶/天),北美成长了65%(4.7万桶/天)。

- 丹麦的汽油价格最高,而芬兰的柴油价格最高。奥地利的汽油最便宜,西班牙的柴油最便宜。 2022 年英国燃油价格创下历史新高,7 月汽油平均价格达到每公升 245.55 美元,柴油平均价格达到每公升 251.79 美元。到 2023 年为止,英国汽油的平均价格已超过每公升 150披索(1.88.02 美元),柴油价格上涨至每公升 152.41披索(191.04 美元)。 2023 年 1 月,西班牙的燃料价格比英国汽油每公升低约 20 美分,柴油每公升低约 40 美分。

欧洲国内宅配产业概况

欧洲国内宅配市场较为分散,前五大公司占36.18%的市占率。该市场的主要企业有:DHL集团、国际配送服务公司(包括GLS)、法国邮政集团、荷兰邮政和美国联合包裹服务公司(UPS)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的GDP分布

- 经济活动带来的 GDP 成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业生产毛额

- 出口趋势

- 进口趋势

- 燃油价格

- 物流绩效

- 基础设施

- 法律规范

- 中欧和东欧(CEE)

- 法国

- 德国

- 义大利

- 荷兰

- 北欧的

- 俄罗斯

- 西班牙

- 瑞士

- 英国

- 价值炼和通路分析

第五章 市场区隔

- 送货速度

- 表达

- 非快递

- 运输重量

- 重型货物

- 轻型货物

- 中等重量货物

- 最终用户产业

- 电子商务

- 金融服务(BFSI)

- 卫生保健

- 製造业

- 一级产业

- 批发零售(线下)

- 其他的

- 模型

- 企业对企业(B2B)

- 企业对消费者(B2C)

- 消费者对消费者(C2C)

- 国家

- 阿尔巴尼亚

- 保加利亚

- 克罗埃西亚

- 捷克共和国

- 丹麦

- 爱沙尼亚

- 芬兰

- 法国

- 德国

- 匈牙利

- 冰岛

- 义大利

- 拉脱维亚

- 立陶宛

- 荷兰

- 挪威

- 波兰

- 罗马尼亚

- 俄罗斯

- 日本与斯洛伐克关係

- 斯洛维尼亚

- 西班牙

- 瑞典

- 瑞士

- 英国

- 欧洲其他地区

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- DHL Group

- FedEx

- GEODIS

- International Distributions Services(including GLS)

- La Poste Group

- Logista

- Otto GmbH & Co. KG

- Post NL

- Poste Italiane

- United Parcel Service of America, Inc.(UPS)

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 技术进步

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001613

The Europe Domestic Courier Market size is estimated at 88.49 billion USD in 2024, and is expected to reach 110.46 billion USD by 2030, growing at a CAGR of 3.76% during the forecast period (2024-2030).

E-commerce companies are expanding their networks in Europe to provide better services to customers

- Domestic courier services are becoming increasingly important in the e-commerce industry as consumers expect their orders to arrive quickly and conveniently. The pandemic brought a drastic change in shopping behavior over the past years, shifting the shopping process toward online shopping. Moreover, e-commerce companies are expanding their networks in Europe to provide better services to customers. For instance, the Spanish retailer DIA is expanding its delivery services to all towns along the Spanish coastline, from Girona to Huelva, reaching more than 5 million new customers.

- In 2022, Portugal, Turkey, and Poland had the highest rise in sales in terms of volume in Europe at 13.3%, 10.2%, and 10.1%, respectively. In 2021, retail spending constituted a large proportion of private consumption in all European countries, i.e., typically between 30% and 50%. The German market in Europe was the largest and most important retail market in terms of turnover. After Germany, the largest economies in Europe were France, the United Kingdom, and Italy, the major demand generators for domestic courier services.

- Courier services for healthcare products are expected to grow in the coming years in the region due to several factors, including the increasing demand for medical supplies, rising healthcare spending, and the need for faster and more efficient delivery services. Also, From 2023 onward, it is expected that the total retail sales in Europe-5 countries (Germany, the United Kingdom, France, Italy, and Spain) will grow at pre-pandemic levels and drive the growth of the market. As a result, the European domestic courier market is expected to grow positively during the forecast period.

Italy's domestic delivery demand fuels CEP growth, revenue hits USD 11.6 billion with 22% increase

- Germany's parcel service providers moved a volume of 725 million parcels during the Christmas period in 2022. B2C parcel shipments were the largest segment, with 395 million parcels delivered to private recipients. On average, deliveries included 20 million shipments per day during peak times and 14.5 million parcels daily, including 8 million to private residences. The demand for domestic CEP in the German market is expected to increase due to the projected growth of e-commerce at a rate of 9.36% from 2023 to 2027.

- The e-commerce segment is expected to be the primary driver of growth in the French domestic courier market. In 2022, the French domestic courier market was valued at approximately USD 83 billion, and it is projected to reach USD 152 billion by 2027. The increased demand in e-commerce has led to significant parcel deliveries, with France's national postal service, La Poste Group, alone delivering 2.6 billion parcels in 2022. Other significant players in the French CEP market, such as DHL Global Forwarding France SAS, General Logistics Systems France SA, and United Parcel Services France SAS, also make substantial contributions.

- Domestic delivery demand plays a major role in driving CEP deliveries in Italy. Revenue from CEP also experienced a significant increase, rising by 22% to USD 11.6 billion in 2021 from USD 9.6 billion in 2020. The number of parcels delivered per person also grew, rising from 21 in 2020 to 24 in 2021, representing a 17% increase. This resulted in households receiving 55 parcels on average.

Europe Domestic Courier Market Trends

European Union allocated USD 5.76 billion to 135 transportation projects to boost economic recovery

- In Europe, the GDP of the transport and storage sector rise by 10.48% in 2021 due to rise in trade and travel. In 2022, around 135 transport infrastructure projects were selected for EU grants totaling USD 6 billion.The transportation and warehouse sector plays a crucial role in supporting operations across various industries, with Germany leading as the dominant player, surpassing France and the United Kingdom. Globally, Germany ranks third in both imports and exports of goods. The German federal government expressed its intention to increase investments in transportation infrastructure, allocating over EUR 12 billion (USD 12.80 billion) for federal highways and around EUR 1.7 billion (USD 1.81 billion) for waterways in 2022, thereby demonstrating its commitment to improving transportation networks.

- The German government intends to invest more in rail than roads. In 2022, Deutsche Bahn, the federal government, and the local and regional governments invested roughly EUR 13.6 billion (USD 14.51 billion) in rail infrastructure projects. Lower Saxony, Hamburg, Bremen, Mecklenburg-Western Pomerania, and Schleswig-Holstein are partnering with DB to invest in modernizing their rail network by 2030.

- In 2022, the European Union approved EUR 5.4 billion through grants for approximately 135 transport infrastructural projects. These projects aim to aid post-pandemic economic recovery in the EU Member States, enhance transport links, promote sustainable transportation, boost safety, and create job opportunities. All supported projects are part of the Trans-European Transport Network, which connects EU Member States and aligns with the European Union's goal of completing the TEN-T core network by 2030 and the comprehensive network by 2050.

Since February 2023, diesel imports from the Middle East, Asia, and North America have increased due to the ban on imports from Russia

- Gasoline prices surpassed EUR 2 (USD 2.13) per liter in most of the 19 eurozone countries in Q1 2022. The main reason behind the increased prices was supply issues due to the conflict between Russia and Ukraine, as Russia supplied more than a quarter of the EU's petroleum needs. In 2021, the average price for a liter of gasoline in the eurozone was EUR 1.30 (USD 1.38); at the start of 2022, the price was about EUR 1.55 (USD 1.65) per liter.

- Russia has been Europe's largest supplier of diesel. In 2023, diesel prices declined in Europe. Since February 2023, when the European Union implemented the ban on petroleum product imports from Russia, diesel exports from Russia to Europe have averaged 24,000 barrels per day (b/d), down by 96% from the 630,000 b/d Russia sent to Europe in 2022. From February through May, diesel exports to Europe increased by 51% (160,000 b/d) from the Middle East, by 97% (147,000 b/d) from Asia, and by 65% (47,000 b/d) from North America.

- Denmark is the most expensive country for petrol, and Finland is the most expensive for diesel. Austria has the cheapest petrol, and Spain is the cheapest for diesel. Fuel prices in the United Kingdom reached record highs in 2022, with the average price of petrol hitting USD 245.55 per liter and diesel reaching USD 251.79 per liter in July. The average cost of petrol at UK forecourts has risen to break 150 p a liter (USD 1.88.02) since the start of 2023, and diesel has risen to 152.41p a liter (USD 191.04). Spanish fuel prices were lower than in the United Kingdom by about 20 cents per liter for petrol and 40 cents per liter for diesel in January 2023.

Europe Domestic Courier Industry Overview

The Europe Domestic Courier Market is fragmented, with the top five companies occupying 36.18%. The major players in this market are DHL Group, International Distributions Services (including GLS), La Poste Group, Post NL and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Central and Eastern Europe (CEE)

- 4.12.2 France

- 4.12.3 Germany

- 4.12.4 Italy

- 4.12.5 Netherlands

- 4.12.6 Nordics

- 4.12.7 Russia

- 4.12.8 Spain

- 4.12.9 Switzerland

- 4.12.10 United Kingdom

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Speed Of Delivery

- 5.1.1 Express

- 5.1.2 Non-Express

- 5.2 Shipment Weight

- 5.2.1 Heavy Weight Shipments

- 5.2.2 Light Weight Shipments

- 5.2.3 Medium Weight Shipments

- 5.3 End User Industry

- 5.3.1 E-Commerce

- 5.3.2 Financial Services (BFSI)

- 5.3.3 Healthcare

- 5.3.4 Manufacturing

- 5.3.5 Primary Industry

- 5.3.6 Wholesale and Retail Trade (Offline)

- 5.3.7 Others

- 5.4 Model

- 5.4.1 Business-to-Business (B2B)

- 5.4.2 Business-to-Consumer (B2C)

- 5.4.3 Consumer-to-Consumer (C2C)

- 5.5 Country

- 5.5.1 Albania

- 5.5.2 Bulgaria

- 5.5.3 Croatia

- 5.5.4 Czech Republic

- 5.5.5 Denmark

- 5.5.6 Estonia

- 5.5.7 Finland

- 5.5.8 France

- 5.5.9 Germany

- 5.5.10 Hungary

- 5.5.11 Iceland

- 5.5.12 Italy

- 5.5.13 Latvia

- 5.5.14 Lithuania

- 5.5.15 Netherlands

- 5.5.16 Norway

- 5.5.17 Poland

- 5.5.18 Romania

- 5.5.19 Russia

- 5.5.20 Slovak Republic

- 5.5.21 Slovenia

- 5.5.22 Spain

- 5.5.23 Sweden

- 5.5.24 Switzerland

- 5.5.25 United Kingdom

- 5.5.26 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 DHL Group

- 6.4.2 FedEx

- 6.4.3 GEODIS

- 6.4.4 International Distributions Services (including GLS)

- 6.4.5 La Poste Group

- 6.4.6 Logista

- 6.4.7 Otto GmbH & Co. KG

- 6.4.8 Post NL

- 6.4.9 Poste Italiane

- 6.4.10 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219