|

市场调查报告书

商品编码

1683928

南美快递、快递、包裹 (CEP):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)South America Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

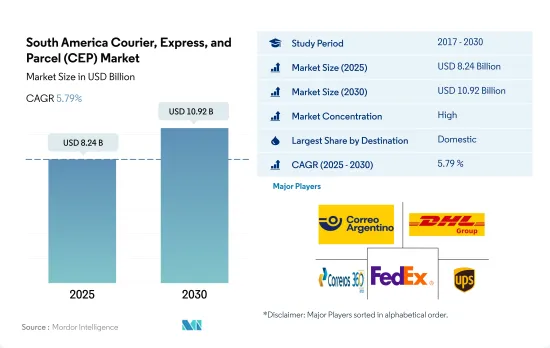

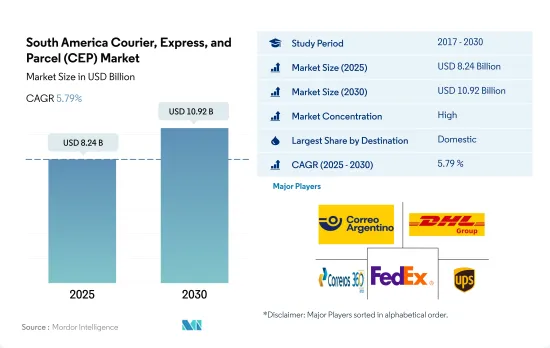

南美快递包裹 (CEP) 市场规模预计在 2025 年为 82.4 亿美元,预计到 2030 年将达到 109.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.79%。

市场领先的 B2C 电子商务领域

- 快递包裹市场的主要需求驱动因素之一是 B2C 电子商务。儘管B2C电子商务在拉丁美洲起步缓慢,但目前该地区多个国家的普及率已超过50%。预计 2021 年巴西的电子商务总销售额最高,其次是墨西哥、哥伦比亚和阿根廷。总部位于阿根廷的线上市场MercadoLibre主导拉丁美洲的B2C电子商务市场,在阿根廷、墨西哥和智利等多个国家都名列前茅,并在2022年占据了阿根廷电子商务市场的三分之二以上。 2022年,Mercado Libre的电子商务销售额将超过120亿美元。预计到 2027 年电子商务规模将达到 1,343 亿美元,CEP 市场将经历显着成长。

- 电子商务的成长预计将极大地促进该地区的 CEP 市场。受该地区国内和跨境电子商务成长的推动,到 2023 年,电子商务用户渗透率预计将达到 56.5%。预计2027年用户数将达2.581亿,2027年用户渗透率将达61.4%。

小包裹配送中心的扩张、低成本空运服务等因素推动了当地市场的需求

- 该地区的 CEP 市场主要受到电子商务小包裹主导量的激增以及製造业和 BFSI 行业等其他终端用户的需求的推动。巴西、智利、阿根廷等国家构成了该地区的CEP市场。在巴西,Magazine Luiza、Casabahia和Americanas占据巴西前100家网路商店销售额的36.5%,推动了2022年国内CEP需求。在阿根廷,Mercado Libre拥有约2,700万线上消费者。到 2025 年,买方渗透率预计将达到 62% 左右,这将对预测期内的国内 CEP 需求产生重大影响。

- 宅配和小包裹递送市场的主要需求驱动因素之一是B2C电子商务。拉丁美洲B2C电子商务起步缓慢,目前在多个地区的渗透率已超过50%。 2021年,巴西的电子商务销售额将位居第一,其次是墨西哥、哥伦比亚和阿根廷。总部位于阿根廷的线上市场MercadoLibre在阿根廷、墨西哥和智利等多个国家都名列前茅,在拉丁美洲的B2C电子商务领域占据主导地位,占2022年阿根廷电子商务领域的三分之二以上。

南美洲快递包裹 (CEP) 市场趋势

南美国家正大力投资基础建设,以改善交通运输部门。

- 2024年6月,阿根廷联邦政府将914个基础建设计划移交给省级当局,为各省带来了严峻的财政挑战。儘管各州希望重新开放公共服务,但它们的主要收入来源——联邦政府的拨款却大幅削减。 2024 年 6 月,联邦对各州的税收转移 (CFI) 与去年同期相比下降了 20%,2024 年六个月中有五个月出现两位数的下降。 6 月其他联邦政府转移支付(RON)也下降了 24.1%。

- 2023年,巴西政府已拨款25.9亿美元用于基础建设物流,包括高速公路、铁路、港口和机场。其中,约 24.2 亿美元用于公路建设,铁路建设获得的拨款较少,为 3,025 万美元。展望未来,政府计划在 2024 年 6 月之前启动一项重大国家倡议,旨在透过公共和私营部门的联合融资来增加对货运铁路计划的投资。基于这个雄心勃勃的愿景,政府计划向这些铁路计划注资 40 亿美元。

俄乌战争对全球油价的影响,导致该地区油价大幅上涨。

- 2024年3月,受季节性波动和经济放缓征兆影响,巴西柴油需求下降。巴西石油公司决定降低柴油价格,并强制将生质柴油混合率从 12% 提高到 14%,进一步导致了传统化石柴油需求的下降。国内市场也受到全球油价波动和政府稳定油价努力的影响。儘管巴西库存有 320 万桶俄罗斯轻质原油过剩,但巴西仍维持了俄罗斯原油的出口,而不是完全停止出口。

- 智利计划在 2030 年开始大规模生产永续航空燃料 (SAF),并计划到 2050 年用从石油、生物和城市废弃物中提取的生质燃料满足其一半的航空燃料需求。预计到 2040 年,空中交通量将翻一番,智利将 SAF 视为其脱碳策略的关键要素。此外,SAF 可以与传统喷射机燃料混合,无需对引擎进行任何改造即可减少高达 80% 的排放气体。预计SAF将为智利贡献一半以上的碳排放目标,并在该国实现净零目标中发挥关键作用。

南美快递包裹 (CEP) 产业概况

南美洲快递包裹(CEP)市场相当集中,市场主要企业(按字母顺序排列):阿根廷邮政、DHL集团、巴西邮政电报公司、联邦快递和美国联合包裹服务公司(UPS)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的 GDP 分布

- 经济活动带来的 GDP 成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业生产毛额

- 出口趋势

- 进口趋势

- 燃油价格

- 物流绩效

- 基础设施

- 法律规范

- 阿根廷

- 巴西

- 智利

- 价值链与通路分析

第五章 市场区隔

- 目的地

- 国内的

- 国际的

- 送货速度

- 表达

- 非快递

- 模型

- 企业对企业 (B2B)

- 企业对消费者 (B2C)

- 消费者对消费者(C2C)

- 运输重量

- 重型货物

- 轻型货物

- 中等重量货物

- 运输方式

- 航空邮件

- 路

- 其他的

- 最终用户

- 电子商务

- 金融服务(BFSI)

- 卫生保健

- 製造业

- 一级产业

- 批发零售(线下)

- 其他的

- 国家名称

- 阿根廷

- 巴西

- 智利

- 南美洲其他地区

第六章 竞争格局

- 重大策略倡议

- 市场占有率分析

- 业务状况

- 公司简介

- Aramex

- Chilexpress

- Correo Argentino

- Correos de Chile

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Empresa Brasileira de Correios e Telegrafos

- FedEx

- La Poste Group

- United Parcel Service of America, Inc.(UPS)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 技术进步

- 资讯来源和进一步阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001618

The South America Courier, Express, and Parcel (CEP) Market size is estimated at 8.24 billion USD in 2025, and is expected to reach 10.92 billion USD by 2030, growing at a CAGR of 5.79% during the forecast period (2025-2030).

B2C e-commerce segment leading the market

- One of the major demand generators for the courier, express, and parcel market is B2C e-commerce. Although B2C e-commerce in Latin America had a slow start, it has a penetration rate of over 50% in multiple countries in the region. Brazil was estimated to rank the highest in total e-commerce sales in 2021, followed by Mexico, Colombia, and Argentina. MercadoLibre, an online marketplace headquartered in Argentina, dominates the B2C e-commerce market In Latin America by being the top seller in several countries, including Argentina, Mexico, and Chile and account for more than two-thirds of Argentina's e-commerce market in 2022. In the 2022, Mercado Libre reached retail e-commerce sales worth over USD 12 billion. With e-commerce projected to touch USD 134.3 billion by 2027, CEP market is expected to grow significantly.

- E-commerce growth is expected to significantly boost the CEP market in the region. The e-commerce user penetration is projected to touch 56.5% in 2023 owing to rising domestic and cross-border e-commerce in the region. It is further expected to have a 258.10 million users by 2027, accounting for 61.4% user penetration by 2027.

Expansion of parcel distribution centres, low-cost air cargo service, among drivers of regional market demand

- The CEP market in the region is driven mainly by a surge in e-commerce-led parcel shipments along with demand from other end users such as manufacturing, BFSI sector among others. Brazil, Chile, Argentina, along with other countries, comprise the CEP market in the region. In Brazil, Magazine Luiza, Casabahia, and Americanas accounted for 36.5% of Brazil's top 100 online stores' revenue, which drove domestic CEP demand in 2022. In Argentina, Mercado Libre has almost 27 million online consumers. By 2025, buyer penetration is expected to touch approximately 62%, significantly impacting domestic CEP demand during the forecast period.

- One of the major demand generators for the courier express and parcel market is B2C e-commerce. Although B2C e-commerce in Latin America had a slow start, it has a penetration rate of over 50% in multiple regional countries. Brazil ranked the highest in e-commerce sales in 2021, followed by Mexico, Colombia, and Argentina. MercadoLibre, an online marketplace headquartered in Argentina, dominated the B2C e-commerce segment in Latin America by being the top seller in several countries, including Argentina, Mexico, and Chile, and accounted for more than two-thirds of Argentina's e-commerce segment in 2022.

South America Courier, Express, and Parcel (CEP) Market Trends

South American countries are investing heavily in infrastructure development to improve the transportation sector

- In June 2024, Argentina's federal government transferred 914 infrastructure projects to provincial authorities, creating a tough financial challenge for the provinces. Despite wanting to resume public works, provinces have faced deep cuts to federal transfers, their main source of income. Federal tax transfers (CFI) to provinces dropped 20% YoY in June 2024 and have decreased by double digits in five out of the six months of 2024. Other federal transfers (RON) also fell 24.1% in June.

- In 2023, the Brazilian government allocated USD 2.59 billion to infrastructure logistics, encompassing highways, railways, ports, and airports. A significant portion, approximately USD 2.42 billion, was funneled into highways, while railways received a modest allocation of USD 30.25 million. Looking ahead, by June 2024, the government is set to launch a major national initiative aimed at amplifying investments in freight rail projects, leveraging a blend of public and private sector funding. With an ambitious vision, the government plans to inject a substantial USD 4 billion into these rail projects.

Crude oil prices in the region rose significantly owing to the impact of the Russia-Ukraine War on global crude oil

- In March 2024, seasonal fluctuations and signs of an economic slowdown led to a decline in Diesel demand in Brazil. Petrobras' decision to reduce Diesel prices, coupled with the mandated increase in biodiesel blending from 12% to 14%, further fueled this drop in demand for conventional fossil Diesel. The domestic market was also swayed by global fluctuations in crude oil prices and government efforts to stabilize them. Even with an excess of 3.2 million barrels of Russian Diesel on hand, Brazil maintained its shipments without a complete halt.

- By 2030, Chile plans to launch large-scale production of sustainable aviation fuel (SAF) and aims for these biofuel sources derived from oils, fats, and both biological and municipal waste to satisfy half of its aviation fuel needs by 2050. With projections of air traffic doubling by 2040, Chile views SAF as a pivotal element in its decarbonization strategy. Moreover, SAF can be blended with traditional jet fuel to reduce emissions by up to 80% without engine modifications. It is expected to contribute over half of Chile's targeted carbon emissions reductions, playing a key role in the country's net-zero goals.

South America Courier, Express, and Parcel (CEP) Industry Overview

The South America Courier, Express, and Parcel (CEP) Market is fairly consolidated, with the major five players in this market being Correo Argentino, DHL Group, Empresa Brasileira de Correios e Telegrafos, FedEx and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Argentina

- 4.12.2 Brazil

- 4.12.3 Chile

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

- 5.7 Country

- 5.7.1 Argentina

- 5.7.2 Brazil

- 5.7.3 Chile

- 5.7.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aramex

- 6.4.2 Chilexpress

- 6.4.3 Correo Argentino

- 6.4.4 Correos de Chile

- 6.4.5 DHL Group

- 6.4.6 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.7 Empresa Brasileira de Correios e Telegrafos

- 6.4.8 FedEx

- 6.4.9 La Poste Group

- 6.4.10 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219