|

市场调查报告书

商品编码

1683939

欧洲LED照明:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

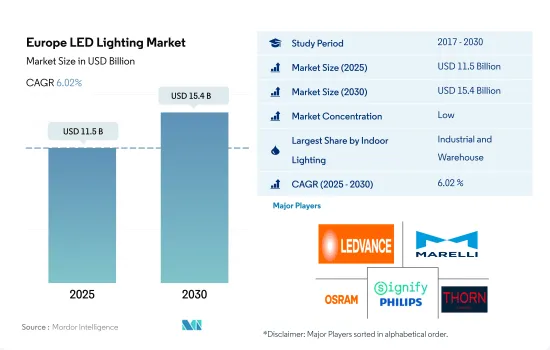

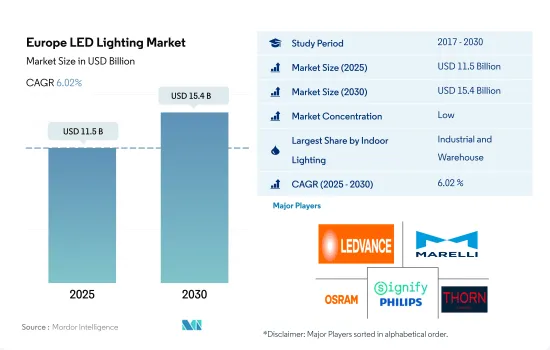

预计2025年欧洲LED照明市场规模为115亿美元,到2030年将达到154亿美元,预测期间(2025-2030年)的复合年增长率为6.02%。

工业和住宅领域的发展不断加快,推动市场成长

- 以金额为准,截至2023年,工业和仓库照明将占较大份额,其次是商业、住宅和农业照明。法国、俄罗斯和波兰占据仓库建设的大部分。新冠疫情危机加速了法国恢復工业能至疫情前水准的努力。 2022年12月,法国工业生产成长1.1%,11月成长2%。波兰拥有近440万平方公尺的空间。到 2022 年中期,波兰将建造近 450 万平方公尺的仓库和工业空间。

- 在商业设施中,医院、学校和机场占据了大部分市场。在受访的42个国家中,可支配所得差异很大。列支敦士登、瑞士和卢森堡的可支配收入最高,因此人们更容易负担学校或大学的学费。

- 截至 2023 年,住宅领域将占最大份额。在强劲需求的支撑下,义大利住宅市场保持稳定。 2021 年第四季住宅房地产交易量年增 14.1%,达到 263,795 套。所有地区的销售额均强劲成长。自 2022 年 1 月上次封锁结束以来,儘管许多企业正处于过渡期,但办公室入住率仍呈上升趋势。截至 2022 年第三季度,办公大楼领域的平均折扣为 26%,低于 31% 的整体平均值。 年终整体空置率为7.2%,与2021年终相比大致稳定(+10bp)。整体而言,办公室和住宅的吸收率正在上升,导致LED需求大幅增加。

仓库和体育场建设的增加以及各国政府的资助正在推动市场

- 2023 年,其他欧洲国家将占据大部分市场占有率。欧盟各地的开发活动持续保持中等水平,2022 年将有超过 2,000 万平方公尺的现代化仓库和工业空间进入市场。波兰在仓库建设开发领域处于领先地位。在欧洲,波兰以约 440 万平方公尺的面积领先。捷克共和国的供应量也创历史新高,超过 110 万平方公尺。到 2022 年中期,波兰将建造近 450 万平方公尺的仓库和工业空间。

- 体育场馆的持续发展和维修正在推动 LED 照明的使用。例如,西班牙的瓦伦西亚是第二大投资者,斥资3亿欧元,计划于2022年建造诺梅斯塔利亚球场。塞尔维亚足球联合会(FSS)在欧洲足球协会联盟(UEFA)的支持下,已投资超过2000万欧元,用于2023年对全国多个体育场馆进行现代化改造。这些发展反映了该国对LED照明日益增长的需求。

- 2023年,法国将占据较大的金额份额,而德国将占据最高的销售份额。巴黎市已与电力公司 EDF 和工程公司 Eiffage 的一家子公司签订了一份价值 7.04 亿欧元的合同,用于对其街道照明和配电线路进行现代化改造。德国联邦政府正在采取措施,实现2050年使国家实现气候中和的目标。政府希望透过为新住宅和多用户住宅提供额外资金来实现这一目标,津贴最高可达投资价值的20%。这些努力有望促进LED照明市场的成长。

欧洲 LED 照明市场趋势

住宅和非住宅用途的增加可能推动 LED 照明的成长

- 2022年,欧洲人口为7.435亿。欧盟成员国共有超过1.31亿栋建筑物。欧盟有1.19亿栋住宅和1200万栋非住宅。 2022年,住宅需求依然强劲,鼓励该地区住宅建设,并使当地LED市场受益。

- 预计家庭数量将从 2020 年的 1.96 亿增加到 2021 年的 1.974 亿。在欧盟,2021 年 49.4% 的家庭有一个孩子,其次是 38.6% 有两个孩子,12% 有三个或三个以上孩子。 2020年,约70%的欧盟公民拥有自己的住房。 2019年,欧洲平均每人拥有1.6个房间。随着人口和家庭数量的增加,家庭和商业空间中 LED 的使用可能会增加。

- 截至2019年,欧盟道路上共有2.427亿辆汽车,比与前一年同期比较增长1.8%,其中包括2800万多辆货车。目前,法国是持有数量最多的国家,共拥有 600 万辆,其次是义大利(420 万辆)、西班牙(380 万辆)和德国(280 万辆)。欧盟道路上有 620 万辆中型和重型商用车。儘管近期註册量增加,但欧盟所有车辆中只有 4.6% 采用替代能源。混合动力电动车占欧盟道路上所有车辆的 0.8%,而电池电动车和插电式混合动力车仅占 0.2%。汽车销量的成长可能会对该地区的 LED 销售产生积极影响。

可支配收入增加和政府奖励有望推动 LED 的普及

- 2022年,欧盟共有1.98亿个居住,平均每个家庭有2.2人。该地区人口在2020年为7.462亿,到2023年将下降到7.422亿。欧盟的房屋自有率从2021年的69.90%下降到2022年的69.10%。这些案例表明,儘管家庭数量略有下降,但住宅开发计划的数量却比平常少。因此,预计 LED 渗透率将呈正增长,但与以前相比,住宅领域的成长率较低。

- 在欧洲,大多数国家的可支配收入都很高,这又增加了个人的消费能力,尤其是在购买新住宅空间的消费能力。 2022年英国的人均所得达到3,3,138美元,法国达到2,5,337.7美元。

- 在欧洲,政府正在提供奖励计划来促进 LED 的普及。英国政府公布了节能照明的新提案。根据该提案,LED 等耗能较低的照明设备将取代老式卤素灯泡。此类努力可为家庭节省 2,000 英镑(2,525.96 美元)至 3,000 英镑(3,788.98 美元):欧洲户外住宅 2021 年 1 月,德国启动了「联邦高效建筑资助」计画。任何在德国拥有或考虑购买房产的人都可以申请这笔资金。该能源效率计划还包括照明节能建筑。 2017年6月,法国政府宣布了一项能源效率证书计划,允许家庭根据其收入获得最高可达LED灯泡价格100%的补贴。预计预测期内此类案例将推动该地区对 LED 照明的需求。

欧洲LED照明产业概况

欧洲LED照明市场较为分散,前五大企业占比为36.91%。该市场的主要企业有:LEDVANCE GmbH(MLS)、Marelli Holdings、OSRAM GmbH.、Signify(飞利浦)和Thorn Lighting Ltd.(Zumtobel Group)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 汽车产量

- 人口

- 人均收入

- 汽车贷款利率

- 充电站数量

- 持有汽车数量

- LED进口总量

- 照明耗电量

- #家庭数量

- 道路网络

- LED渗透率

- #体育场数量

- 园艺区

- 法律规范

- 室内照明

- 法国

- 德国

- 英国

- 户外照明

- 法国

- 德国

- 英国

- 汽车照明

- 法国

- 德国

- 西班牙

- 英国

- 室内照明

- 价值链与通路分析

第五章 市场区隔

- 室内照明

- 农业照明

- 商业照明

- 办公室

- 零售

- 其他的

- 工业/仓库

- 住宅照明

- 户外照明

- 公共设施

- 路

- 其他的

- 汽车实用照明

- 日间行车灯 (DRL)

- 方向指示器

- 头灯

- 倒车灯

- 红绿灯

- 尾灯

- 其他的

- 汽车照明

- 二轮车

- 商用车

- 搭乘用车

- 国家

- 法国

- 德国

- 英国

- 欧洲其他地区

第六章竞争格局

- 主要策略趋势

- 市场占有率分析

- 商业状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- Dialight PLC

- HELLA GmbH & Co. KGaA

- KOITO MANUFACTURING CO., LTD.

- LEDVANCE GmbH(MLS Co Ltd)

- Marelli Holdings Co., Ltd.

- OSRAM GmbH.

- Panasonic Holdings Corporation

- Signify(Philips)

- Thorn Lighting Ltd.(Zumtobel Group)

- Valeo

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001637

The Europe LED Lighting Market size is estimated at 11.5 billion USD in 2025, and is expected to reach 15.4 billion USD by 2030, growing at a CAGR of 6.02% during the forecast period (2025-2030).

Increasing development in the industrial and residential sectors drives market growth

- In terms of value, as of 2023, industrial and warehouse had a major share, followed by commercial, residential, and agricultural lighting. France, Russia, and Poland had the majority of warehouse constructions. The COVID-19 crisis accelerated France's efforts to return industrial production capacities to the pre-pandemic levels. French industrial production increased by 1.1% over one month in December 2022, after +2% in November 2022. Poland has close to 4.4 million sq. m of space. By the middle of 2022, almost 4.5 million sq. m of warehouse and industrial space was under construction in Poland.

- In commercial, hospitals, schools, and airports comprise the majority of the share. The disposable net income among the 42 countries surveyed varies significantly. Liechtenstein, Switzerland, and Luxembourg have the highest disposable net income by a wide margin, which means more affordability for schools and college studies.

- In terms of volume, as of 2023, the residential sector had a major share. Italy's housing market remains stable, supported by strong demand. In Q4 2021, residential property transactions increased by 14.1% to 263,795 units compared to a year earlier. All regions saw a strong sales increase during the period. Despite many businesses remaining in transition, office usage rates continued on an upward trend from the end of the last lockdown in January 2022. As of Q3 2022, the office sector traded at an average discount of 26%, which was below the 31% overall average. The overall vacancy rate stood at 7.2% at the end of 2022, almost stable compared to the end of 2021 (+10bp). Overall, there is a positive trend toward a higher office and residential absorption rate, leading to a major increase in the demand for LEDs.

Increasing warehouse and stadium construction along with government funds in their countries drives the market

- The Rest of Europe comprised the majority of the market share in 2023. Development activities across the European Union continued at a par level, with more than 20 million sq m of modern warehouse and industrial space entering the market in 2022. Poland leads in the construction segment with its warehouse construction development. In Europe, Poland was at the top, with nearly 4.4 million sq m of space. The Czech Republic also reported high supply levels with over 1.1 million sq m. By the middle of 2022, almost 4.5 million sq m of warehouse and industrial space was under construction in Poland.

- Continued development and renovation of stadiums are encouraging the use of LED lighting. For example, Spain's Valencia was the second-largest investor, with EUR 300 million, to build the Nou Mestalla stadium in 2022. The Serbian Football Federation (FSS) invested over EUR 20 million in modernizing several stadiums in the country in 2023 with the support of the Union of European Football Associations (UEFA). These developments reflect the growing demand for LED lighting in the country.

- France occupied the major value share, and Germany had the highest volume share in 2023. The City of Paris awarded a EUR 704 million contract to subsidiaries of the utility EDF and engineering firm Eiffage to modernize streetlights and energy distribution lines. The German federal government is taking steps to meet its goal of becoming climate-neutral by 2050. The government hopes to achieve this by providing extra funding for newly built houses and apartment buildings and granting up to 20% of the investment. Such initiatives are expected to promote the growth of the LED lighting market.

Europe LED Lighting Market Trends

Increasing residential housing and non-residential buildings may drive the growth of LED lights

- In 2022, Europe had 743.5 million people. The Member States of the European Union contain over 131 million structures. The European Union has 119 million residential buildings and 12 million non-residential buildings. In 2022, the demand for housing remained high, encouraging the building of new homes in the region, thus benefitting the local LED market.

- There were 197.4 million households in 2021 as opposed to 196.0 million in 2020. In the EU, 49.4% of households had a single child in 2021, followed by 38.6% with two children and 12% with three or more. About 70% of EU citizens were homeowners in 2020. In 2019, European homes had 1.6 rooms per person on average. The use of LEDs in homes and business spaces may increase as the population and the number of households rise.

- As of 2019, there were 242.7 million cars on the road in the European Union, an increase of 1.8% from the previous year, and more than 28 million vans on the road. France has by far the largest fleet of vans, with six million vehicles, followed by Italy (4.2 million), Spain (3.8 million), and Germany (2.8 million). EU roadways have 6.2 million medium and heavy commercial vehicles. Even though registrations have gone up recently, only 4.6% of all EU vehicles are alternatively powered. Hybrid electric vehicles make up 0.8% of all vehicles on EU roads, while battery-electric and plug-in hybrid vehicles each account for only 0.2% of the total. The increase in automotive vehicle sales may positively impact LED sales in the region.

Increasing disposable income and government incentives may lead to more LED penetration

- In 2022, 198 million households resided in the EU, with 2.2 members per household on average. The region's population was 746.2 million in 2020, which reduced to 742.2 million by 2023. Homeownership rates in the EU declined by 69.10% in 2022 from 69.90% in 2021. Such instances suggest that housing development projects are less than in previous years despite a slight decline in the number of households. Thus, LED penetration is expected to grow positively but less in the residential segment compared to previous years.

- In Europe, disposable income is high for most countries, resulting in rising spending power of individuals, especially on new residential spaces. The United Kingdom's per capita income reached USD 33,138 in 2022, while that of France reached USD 25,337.7.

- In Europe, the governments provide incentive programs to create more LED penetration. The UK government announced the launch of a new energy-efficient lighting proposal. Under this, lighting, such as low energy-use LEDs, would replace old halogen bulbs. Such initiatives could save households between GBP 2,000 (USD 2,525.96) and GBP 3,000 ( USD 3,788.98) over: Europe outdoor households. The "Federal Funding for Efficient Buildings" program was launched in January 2021 in Germany. Anyone who owns a property in Germany or who is looking to buy property in the country can apply for the funding. The energy efficiency program also includes lighting energy efficiency buildings. In June 2017, the French government announced the Energy Savings Certificate scheme, which allows people to get subsidies that can cover up to 100% of the price of LED bulbs based on the householder's income. Such instances are expected to boost the demand for LED lighting in the region during the forecast period.

Europe LED Lighting Industry Overview

The Europe LED Lighting Market is fragmented, with the top five companies occupying 36.91%. The major players in this market are LEDVANCE GmbH (MLS Co Ltd), Marelli Holdings Co., Ltd., OSRAM GmbH., Signify (Philips) and Thorn Lighting Ltd. (Zumtobel Group) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 Lighting Electricity Consumption

- 4.9 # Of Households

- 4.10 Road Networks

- 4.11 Led Penetration

- 4.12 # Of Stadiums

- 4.13 Horticulture Area

- 4.14 Regulatory Framework

- 4.14.1 Indoor Lighting

- 4.14.1.1 France

- 4.14.1.2 Germany

- 4.14.1.3 United Kingdom

- 4.14.2 Outdoor Lighting

- 4.14.2.1 France

- 4.14.2.2 Germany

- 4.14.2.3 United Kingdom

- 4.14.3 Automotive Lighting

- 4.14.3.1 France

- 4.14.3.2 Germany

- 4.14.3.3 Spain

- 4.14.3.4 United Kingdom

- 4.14.1 Indoor Lighting

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Outdoor Lighting

- 5.2.1 Public Places

- 5.2.2 Streets and Roadways

- 5.2.3 Others

- 5.3 Automotive Utility Lighting

- 5.3.1 Daytime Running Lights (DRL)

- 5.3.2 Directional Signal Lights

- 5.3.3 Headlights

- 5.3.4 Reverse Light

- 5.3.5 Stop Light

- 5.3.6 Tail Light

- 5.3.7 Others

- 5.4 Automotive Vehicle Lighting

- 5.4.1 2 Wheelers

- 5.4.2 Commercial Vehicles

- 5.4.3 Passenger Cars

- 5.5 Country

- 5.5.1 France

- 5.5.2 Germany

- 5.5.3 United Kingdom

- 5.5.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Dialight PLC

- 6.4.2 HELLA GmbH & Co. KGaA

- 6.4.3 KOITO MANUFACTURING CO., LTD.

- 6.4.4 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.5 Marelli Holdings Co., Ltd.

- 6.4.6 OSRAM GmbH.

- 6.4.7 Panasonic Holdings Corporation

- 6.4.8 Signify (Philips)

- 6.4.9 Thorn Lighting Ltd. (Zumtobel Group)

- 6.4.10 Valeo

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219