|

市场调查报告书

商品编码

1683975

美国割草机市场:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)US Lawn Mowers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

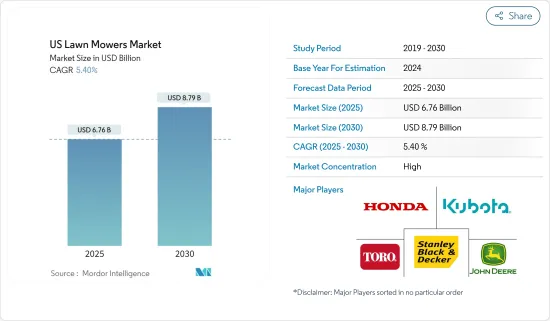

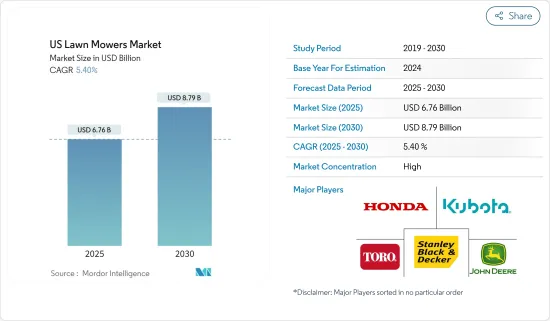

预计 2025 年美国割草机市场规模将达到 67.6 亿美元,预计到 2030 年将达到 87.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.4%。

由于景观维护的重要性日益增加、人们对绿色屋顶的认识不断提高以及行业技术创新不断增加,美国割草机市场预计将加速成长。郊区草坪、高尔夫球场、运动场和公共公园对景观美化服务的需求不断增加,推动了美国割草机市场的发展。从长远来看,绿地和屋顶的不断增加预计将推动市场成长。作为维护环境的努力的一部分,政府也重视扩大和保护绿地。例如,根据美国人口普查局的数据,政府计划投资1.7812兆美元用于包括公园在内的商业和住宅建设活动。因此,此类措施可能会在未来几年支持对割草机的需求。此外,市场参与者正专注于推出技术先进的产品。例如,2022 年 7 月,Toro 公司推出了一款新型机器人割草机(名称尚未确定),其定位系统使用摄影机而非雷射雷达。这意味着使用者不需要使用周边电线,割草机可以轻鬆侦测到障碍物。

美国割草机市场的趋势

汽油割草机需求旺盛

汽油割草机是家庭和商务用的理想选择。它具有出色的动力和高级的尖端性能,可以在大面积草坪上以推式或自走式使用。此外,该相机采用坚固的专业级组件製造,包括耐腐蚀底盘和铝,确保低维护和维修成本。此外,预计未来几年政府措施将推动汽油割草机市场的发展。例如,2022 年 7 月,国家公园管理局透过户外休閒遗产伙伴关係(ORLP)津贴计画向当地社区发放了 1.92 亿美元。这使得城市社区能够创造新的户外休閒空间,振兴现有的公园,并让经济弱势群体接触户外。

商业/政府部门是最大的最终用户

随着高尔夫球场、运动场、学校和公共等商业空间维护需求的不断增长,美国商务用割草机市场正在扩大。该国拥有大量的高尔夫球场和运动场,这有助于推动商务用割草机市场的成长。例如,根据美国国家高尔夫基金会的研究,到2022年,美国总合16,000个高尔夫球场。 2022年,超过三分之一的5岁及以上美国人口将打高尔夫球(在球场内或场外)、在电视或网上观看高尔夫球比赛、阅读高尔夫球书籍或收听与高尔夫球相关的播客。例如,根据美国高尔夫球基金会的数据,2022年打高尔夫球的总人数为1.19亿,比前一年增加12%。全国高尔夫球手数量的增加将促进商务用割草机的使用。此外,政府也致力于透过投资改善公共公园来扩大加州的户外空间。 2022 年,地方和州领导人拨款约 1,500 万美元用于扩建户外设施。预计未来几年此类户外设施在该国的扩张将增加商务用割草机的使用。

美国割草机产业概况

美国割草机市场整合且竞争激烈。企业之间的竞争主要体现在产品品质和促销方面,并专注于采取策略性措施来抢占更大的市场占有率。公司正大力投资新产品开发、合作和收购,希望扩大市场占有率并加强研发活动。市场的主要企业包括 Deere &Co.、Stanley Black & Decker、The Toro Company、Kubota Corporation 和 American Honda Motor Co. Inc.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 维护景观的需求

- 绿地和屋顶花园的普及

- 市场限制

- 园林绿化劳动力短缺

- 割草机维护成本高

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 产品类型

- 手动的

- 电的

- 汽油驱动

- 机器人

- 其他产品类型

- 最终用户

- 住宅

- 商业/政府

第六章竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Ariensco

- Deere & Company

- American Honda Motor Co. Inc.

- Husqvarna Group

- Kubota Corporation

- Makita Corporation

- Stanley Black & Decker

- Yamabiko Corporation

- The Toro Company

- Stihl Group

第七章 市场机会与未来趋势

The US Lawn Mowers Market size is estimated at USD 6.76 billion in 2025, and is expected to reach USD 8.79 billion by 2030, at a CAGR of 5.4% during the forecast period (2025-2030).

The United States lawn mowers market is anticipated to grow faster, owing to the growing prominence of landscaping maintenance, rising awareness about green roofs, and expanding technological innovations in the industry. Increasing demand for landscaping services in suburban lawns, golf courses, sports fields, and public parks drive the US lawn mower market. Over the long term, increasing adoption of green spaces and roofs is anticipated to drive market growth. Besides, the government emphasizes expanding and preserving green spaces as part of environmental sustainability. For instance, according to the US Census Bureau, the government planned to invest USD 1,781.2 billion for commercial and residential construction activities, including parks. Hence, such initiatives are likely to support the demand for lawnmowers in the coming years. Moreover, market players have been concentrating on introducing technologically advanced products. For instance, in July 2022, the Toro Company launched a new league of robotic lawn mowers (unnamed) that uses cameras instead of LiDAR for their positioning system, which means the user does not need to use a periphery wire, and the mower can detect obstacles easily.

United States Lawn Mowers Market Trends

Petrol Land Mowers are in High Demand

Petrol lawnmowers are ideal for home or professional use. They are push-powered or self-propelled for large lawn areas due to their superior power and high-grade cutting-edge performance. They are built using rigid, professional-grade components, such as corrosion-resistant chassis and aluminum, and require low maintenance and servicing costs. Moreover, initiatives by the government are anticipated to drive the petrol lawnmower market in the coming years. For instance, in July 2022, the National Park Service distributed USD 192 million to local communities through the Outdoor Recreation Legacy Partnership (ORLP) grant program. This enabled urban communities to create new outdoor recreation spaces, reinvigorate existing parks, and form connections between people and the outdoors in economically underserved areas.

Commercial/Government Sector is the Largest End User

The market for commercial lawnmowers in the United States is expanding with the growing demand for the maintenance of commercial spaces such as golf courses, sports fields, schools, and public parks. The large number of golf courses and sports fields in the country are fueling the commercial lawnmower market growth. For instance, according to a survey by the National Golf Foundation, in 2022, there were a total of 16,000 golf courses in the United States. More than one-third of the US population over the age of 5 played golf (on-course or off-course), followed golf on television or online, read about the game, or listened to a golf-related podcast in 2022. For instance, according to the National Golf Foundation, there were a total of 119 million people who played golf in 2022, 12% up from the previous year. This increase in the number of golf players in the country fuels commercial lawnmower use. Furthermore, the government is focusing on expanding outdoor spaces in California by investing in public park improvements. In 2022, local and state leaders granted nearly USD 15 million to expand outdoor facilities. This expansion of outdoor facilities in the country is expected to increase the use of commercial lawnmowers in the coming years.

United States Lawn Mowers Industry Overview

The United States Lawn Mowers market is consolidated and competitive. Companies compete based on product quality and promotion and focus on strategic moves to hold larger market shares. Companies are investing heavily in developing new products and collaborating with and acquiring other companies, which is expected to increase their market shares and strengthen their R&D activities. Some of the key players in the market are Deere & Co., Stanley Black & Decker, The Toro Company, Kubota Corporation, and American Honda Motor Co. Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand For Landscaping Maintenance

- 4.2.2 Adoption of Green Spaces and Green Roofs

- 4.3 Market Restraints

- 4.3.1 Shortage of Labor In Landscaping

- 4.3.2 High Maintenance Cost of Lawn Mowers

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Manual

- 5.1.2 Electric

- 5.1.3 Petrol

- 5.1.4 Robotics

- 5.1.5 Other Product Types

- 5.2 End User

- 5.2.1 Residential

- 5.2.2 Commercial/Government

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Ariensco

- 6.3.2 Deere & Company

- 6.3.3 American Honda Motor Co. Inc.

- 6.3.4 Husqvarna Group

- 6.3.5 Kubota Corporation

- 6.3.6 Makita Corporation

- 6.3.7 Stanley Black & Decker

- 6.3.8 Yamabiko Corporation

- 6.3.9 The Toro Company

- 6.3.10 Stihl Group