|

市场调查报告书

商品编码

1683979

亚太除草剂:市场占有率分析、产业趋势和成长预测(2025-2030)Asia Pacific Herbicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

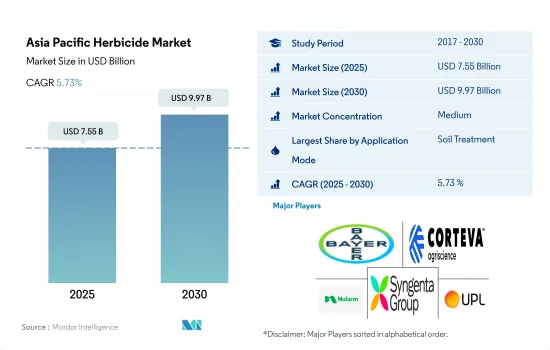

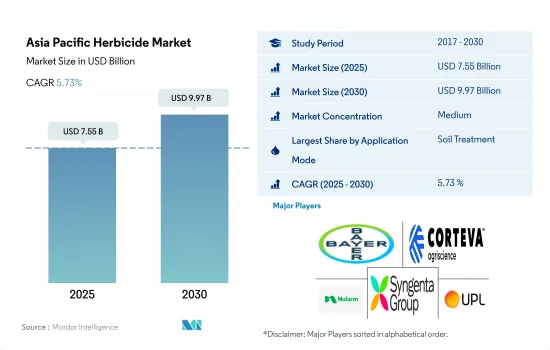

亚太除草剂市场规模预计在 2025 年为 75.5 亿美元,预计到 2030 年将达到 99.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.73%。

杂草侵染和随之而来的农作物产量下降正在推动市场

- 亚太地区作物种类繁多,既有水稻、小麦、玉米、大豆等主粮作物,也有棉花、甘蔗、水果、作物等经济作物,这些作物都面临多种杂草的威胁。 2022年,土壤治疗方法占亚太除草剂市场的最大份额,为46.8%,市场规模达30亿美元。土壤处理包括将除草剂直接施用于土壤,是一种有效的除草方法。此方法可在种植前或作物出苗后使用,针对土壤中存在的杂草种子、幼苗或已成熟的杂草。

- 2022 年,叶面喷布除草剂占 32.6% 的市场占有率,价值 21 亿美元。这种方法对于阔叶杂草、莎草、禾本科植物甚至水生杂草都非常有效。将除草剂直接施用于这些杂草的叶子上,可以达到最大程度的吸收和控制。叶面喷布的灵活性使得农民能够在杂草活跃生长阶段针对性地除草,以获得最佳效果。

- 2022 年,化学喷洒占除草剂施用方式的 18.9%,价值 12 亿美元。这种增长是由于微灌溉系统的普及以及除草剂在农田中均匀施用和分布的便利。

- 熏蒸可以提供有效的、有针对性的杂草控制,特别是在其他方法效果较差的封闭环境中。它可以到达难以控制的杂草的种子、根系和繁殖体。

- 由于每种技术的优势和独特性,预计预测期内每种技术的市场都会成长。

全部区域水稻等主粮作物的除草剂使用量正在增加

- 亚太地区除草剂市场在过去一段时间内稳步成长,预计到 2022 年该地区将占据全球除草剂市场的大部分份额。丁草胺、敌稗、Pretilachlor、2,4-D、双草醚钠和氰氟草酯是该地区常用的一些除草剂。

- 水稻是亚洲最重要的作物,占全球水稻产量和消费量的90%。除草剂主要用于谷物和谷类,因为亚太地区是稻米等主食谷物的最大出口区和生产区。 2022 年,谷物和谷类产品的以金额为准占比为 56.6%。

- 该地区的许多国家都采用了综合杂草管理措施,包括使用所有可用的相容控制策略来最大限度地减少产量损失。新引进的杂草需要立即根除,以免蔓延到其他地区,但可以使用除草剂来控制。在菲律宾的新怡诗夏省和伊洛伊洛省,透过结合栽培管理并适当使用除草剂,产量分别提高了约10%至15%。

- 然而,杂草群体中除草剂抗性的出现带来了重大挑战,因为它限制了有效杂草管理的除草剂选择。同时,日本等各国政府正在投资研究倡议,以发现新的杂草及其相应的除草剂。这些政策鼓励农民采取作物保护措施,旨在促进这一领域的成长。预计该部分在预测期内(2023-2029 年)的复合年增长率将达到 6.1%。

亚太地区除草剂市场趋势

水稻等主要作物杂草滋生日益严重,需要有效的除草措施,导致每公顷除草剂消费量增加

- 在亚太地区,每公顷除草剂的使用量与前期相比大幅增加。这是由于农业中杂草的普遍存在,杂草成为各种疾病的传播媒介,导致该地区真菌感染疾病增加,作物损失增加。日本每公顷除草剂的消费量在历史时期内显着增加,估计比亚太其他地区高出约 7%。该国每公顷除草剂使用量的增加是由于多种因素造成的,包括农业人口老化、劳动力短缺和农田面积增加。因此,水稻和大豆等主要作物的杂草管理已从人工除草转变为使用除草剂。

- 缅甸每公顷除草剂消费量位居该地区第二,2022年每公顷消耗量为2200克,高于2017年的1600克。这一增长很大程度上得益于采用适当的杂草管理技术来控制杂草,提高水稻等主要作物的农业产量。旱季因杂草造成的水稻平均产量损失约65%,雨季则约34%。该国农民严重依赖除草剂产品来控制主要作物的杂草,导致每公顷除草剂的消费量增加。

- 在亚太地区,除中国外,所有国家由于主要作物杂草侵染增加,每公顷除草剂使用量与去年同期相比均增加。但中国实施农药零成长政策,所以采用其他除草方法。

气候变迁对作物带来压力,进而促进杂草生长,推动市场发展。

- 甲草胺是一种选择性系统性除草剂,可透过抑制光合作用用于控制玉米、甘蔗、马铃薯和番茄等主要作物中的阔叶杂草。 2022 年的价格为每吨 16,600 美元。

- Atrazine是一种广泛用于控制玉米和水稻作物中的阔叶杂草和禾本科杂草(如稗草、苋菜属和苋菜)的除草剂。 2022 年,该除草剂的价值为 13,800 美元。

- Paraquat是克无踪的有效成分,用来控制杂草和草类。它也用于在收穫前干燥棉花等作物。 2022年Paraquat的价格为每吨4,600美元。中国是Paraquat的主要出口国,其80%以上的Paraquat产量出口到世界各国。

- 二甲戊灵是一种选择性出苗前除草剂,2022 年的价格为每吨 3,300 美元。可广谱防治马铃薯、烟草、高粱、水稻和甘蔗作物中的一年生杂草和阔叶杂草。同样,常见的系统性除草剂2,4-二氯苯氧乙酸(2,4-D) 的 2022 年价格评估为每吨 2,300 美元。它用于控制草皮、草坪、田地、果树和蔬菜作物中的阔叶杂草。

- Glyphosate是频谱广谱系统性除草剂和作物干燥剂,2022 年的价格为每吨 1,100 美元。Glyphosate主要用于控制禾本科、莎草科和阔叶杂草。

- 气候变迁将损害和给植物带来压力,对植物健康产生负面影响,因为它们无法在极端压力条件下生存,并且会加剧杂草的生长。这将进一步导致对除草剂的需求增加,从而推高有效成分的价格。

亚太除草剂产业概览

亚太地区除草剂市场适度整合,前五大公司占50.02%的市占率。市场的主要企业是:拜耳股份公司、科迪华农业科技、Nufarm Ltd、先正达集团和UPL Limited。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 活性成分价格分析

- 法律规范

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 缅甸

- 巴基斯坦

- 菲律宾

- 泰国

- 越南

- 价值链与通路分析

第五章 市场区隔

- 执行模式

- 化学喷涂

- 叶面喷布

- 熏蒸

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 缅甸

- 巴基斯坦

- 菲律宾

- 泰国

- 越南

- 其他亚太地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Jiangsu Yangnong Chemical Co. Ltd

- Nufarm Ltd

- Rainbow Agro

- Syngenta Group

- UPL Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001681

The Asia Pacific Herbicide Market size is estimated at 7.55 billion USD in 2025, and is expected to reach 9.97 billion USD by 2030, growing at a CAGR of 5.73% during the forecast period (2025-2030).

The market is being driven by increasing weed infestation and associated yield losses in crops

- The Asia-Pacific region is home to a diverse range of crops, encompassing staple food crops like rice, wheat, corn, and soybeans, as well as cash crops such as cotton, sugarcane, fruits, and vegetables, which face challenges from several weed species. In 2022, the soil treatment method accounted for the largest share of 46.8% in the Asia-Pacific herbicide market, representing a value of USD 3.0 billion. Soil treatment involves the direct application of herbicides to the soil, serving as an effective means of weed control. This method can be utilized either before planting or after crop emergence, targeting weed seeds, seedlings, or established weeds present in the soil.

- In 2022, foliar application of herbicides held a market share of 32.6% and was valued at USD 2.1 billion. This method is highly effective in targeting broadleaf weeds, sedges, grasses, and even aquatic weeds. By directly applying herbicides to the foliage of these weeds, maximum absorption and control can be achieved. The flexibility of foliar application allows farmers to target weeds during their active growth stages for optimal results.

- In 2022, chemigation accounted for 18.9% of herbicide application methods, valued at USD 1.2 billion. This growth is attributed to the increasing adoption of micro-irrigation systems and the ease of herbicide application, ensuring uniform distribution throughout the cropland.

- Fumigation can provide effective and targeted weed control, especially in enclosed environments where other methods may be less effective. It can reach weed seeds, root systems, and weed propagules that are difficult to control through other means.

- Owing to the advantages and specificity of each method, the market for each method is anticipated to grow during the forecast period.

The use of herbicides for major crops like rice is growing across the region

- The herbicide market in Asia-Pacific witnessed steady growth during the historical period, with the region occupying a significant share of the global herbicide market in 2022. Butachlor, propanil, pretilachlor, 2,4-D, bispyribac-sodium, and cyhalofop-butyl are the commonly used herbicides in the region.

- Rice is by far the most important crop in Asia; the region accounts for 90% of the world's production and consumption of rice. Herbicides are mostly used for grains and cereals in the Asia-Pacific as the region is the largest exporter and producer of staple grains such as rice. The grains & cereals segment occupied a share of 56.6% by value in 2022.

- Many countries in the region have adopted the Integrated weed Management method that entails the use of all available compatible control tactics to minimize yield losses. Newly introduced weeds that would require immediate eradication before they spread to other areas can be controlled with the use of herbicides. It was observed that combining cultural management practices and judicious herbicide usage resulted in higher yields of about 10% to 15% in the Nueva Ecija and Iloilo provinces of the Philippines, respectively.

- However, the occurrence of herbicide resistance in weed populations presents a big challenge as it limits herbicide choices for effective weed management. At the same time, governments of various countries like Japan are investing in research initiatives to discover new weeds and their subsequent herbicides. Such policies are encouraging farmers to adopt crop protection practices that aim to contribute to the growth of the segment. The segment is expected to record a CAGR of 6.1% during the forecast period (2023-2029).

Asia Pacific Herbicide Market Trends

Increased weed infestations in major crops like rice need efficient weed control, boosting the per hectare herbicide consumption

- In the Asia-Pacific region, the use of herbicides per hectare significantly increased over the historical period. This is due to the prevalence of weeds in agriculture, which are acting as vectors for a variety of diseases, resulting in an increase in fungal infections and crop loss in the region. Japan experienced a significant rise in herbicide consumption per hectare over the historical period, which was estimated to be approximately 7% higher than the rest of the Asia-Pacific region. The increasing use of herbicides per hectare in the country is attributed to a combination of factors, including the aging of farmers, a lack of labor, and an increase in agricultural land. This resulted in a shift from manual weeding to the use of herbicides for weed management in major crops such as rice and soybeans.

- Myanmar ranks second in the region in terms of herbicide consumption per hectare, with 2,200 grams of herbicide per hectare consumed in 2022, an increase over the 1,600 grams consumed in 2017. This increase is largely attributed to the implementation of appropriate weed management techniques to control weeds and enhance agricultural production in key crops such as rice. The average yield losses in rice crops due to weeds are approximately 65% and 34% in the dry and wet seasons, respectively. Farmers in the country are majorly reliant on herbicide products to control weeds in major crops, which has led to increased consumption of herbicides per hectare.

- Overall, in the Asia-Pacific region, herbicide use per hectare increased Y-o-Y in all countries except China, as weed infestations increased in the major crops. However, China is using other weed control methods as it implements zero growth policies in pesticides.

Climate change causing stress to crop plants, thus leading to increased weed growth driving the market

- Metribuzin is a selective and systemic herbicide used to control broadleaf weeds in major crops like corn, sugarcane, potatoes, and tomatoes by inhibiting photosynthesis. In 2022, it was priced at USD 16.6 thousand per metric ton.

- Atrazine is an herbicide widely used for the control of broadleaf and grassy weeds like Echinocloa, Elusine spp., and Amaranthus viridis in maize and rice crops. The herbicide was valued at a price of USD 13.8 thousand in 2022.

- Paraquat is the active ingredient in Gramoxone, which is used to control weeds and grasses. It is also used for the desiccation of crops, like cotton, prior to harvest. Paraquat was valued at a price of USD 4.6 thousand per metric ton in 2022. China is a major paraquat export country, and over 80% of its paraquat output is exported to countries worldwide.

- Pendimethalin is a selective pre-emergence herbicide valued at USD 3.3 thousand per metric ton in 2022. It offers broad-spectrum control of annual grasses and broadleaf weeds in potato, tobacco, sorghum, rice, and sugarcane crops. Similarly, 2,4-dichlorophenoxyacetic acid (2,4-D) is a common systemic herbicide that was valued at a price of USD 2.3 thousand per metric ton in 2022. It is used in the control of broadleaf weeds in turf, lawn, field, fruit, and vegetable crops.

- Glyphosate is an organophosphorus broad-spectrum systemic herbicide and crop desiccant, priced at USD 1.1 thousand per metric ton in 2022. Glyphosate is mainly used to control weeds like grasses, sedges, and broadleaves.

- Climate change can cause damage and stress to plants and be detrimental to plant health as they cannot survive in extreme stress conditions, leading to increased weed growth. This further leads to an increase in herbicide demand, thereby boosting the prices of active ingredients.

Asia Pacific Herbicide Industry Overview

The Asia Pacific Herbicide Market is moderately consolidated, with the top five companies occupying 50.02%. The major players in this market are Bayer AG, Corteva Agriscience, Nufarm Ltd, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Australia

- 4.3.2 China

- 4.3.3 India

- 4.3.4 Indonesia

- 4.3.5 Japan

- 4.3.6 Myanmar

- 4.3.7 Pakistan

- 4.3.8 Philippines

- 4.3.9 Thailand

- 4.3.10 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Myanmar

- 5.3.7 Pakistan

- 5.3.8 Philippines

- 5.3.9 Thailand

- 5.3.10 Vietnam

- 5.3.11 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Jiangsu Yangnong Chemical Co. Ltd

- 6.4.7 Nufarm Ltd

- 6.4.8 Rainbow Agro

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219