|

市场调查报告书

商品编码

1684002

南美除草剂:市场占有率分析、产业趋势和成长预测(2025-2030)South America Herbicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

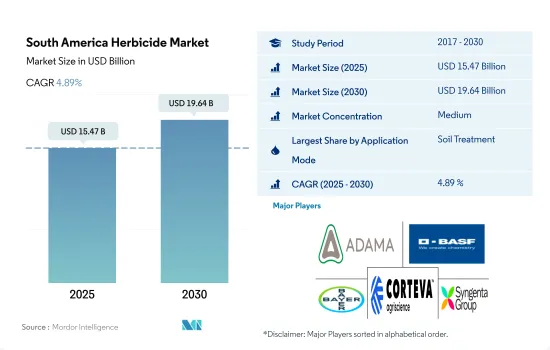

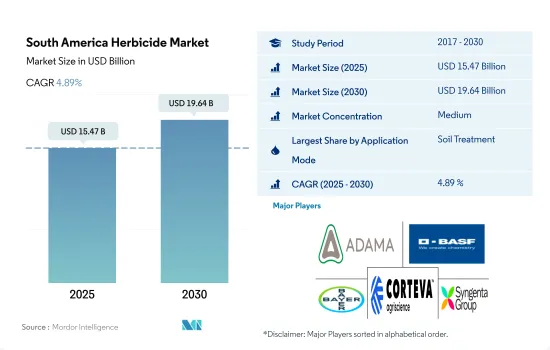

南美除草剂市场规模预计在 2025 年达到 154.7 亿美元,预计到 2030 年将达到 196.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.89%。

对农产品的需求不断增加以及对有效杂草管理的关注正在加强市场的成长。

- 化学灌溉将占2022年市场价值的19.7%,在灌溉基础设施发达的地区广泛应用。预计未来几年滴灌系统的普及将推动市场成长。

- 叶面喷布预计将占据第二大市场份额,预测期内(2023-2029 年)的复合年增长率为 5.1%。除草剂直接施用于植物的叶子上,被植物吸收并转移到整个植物体内,抑制不必要的植被。这是农业中常见的做法,可以有针对性地有效控制杂草,同时最大限度地减少除草剂的使用。

- 预计2023年至2029年间,熏蒸消毒的支出将增加7,830万美元。这种方法使用气态除草剂来控制土壤或温室等封闭空间内的害虫和杂草。此方法通常用于处理大面积区域,并且对土壤传播的害虫特别有效。

- 预计预测期内(2023-2029 年)土壤处理领域的复合年增长率将达到 5.4%。该方法涉及将除草剂直接施用于土壤,以在种植前控制杂草或解决持续存在的杂草问题。土壤处理有助于为作物的生长和生长创造良好的环境。

- 预测期内(2023-2029年),南美除草剂市场预计将成长 50.4 亿美元。南美洲对除草剂的需求是由这些施用方法推动的,这些方法可以有效控制杂草生长并最大限度地提高作物产量。耕作方式、作物类型、杂草压力和害虫管理策略的变化正在推动对除草剂产品的需求。

提高对杂草控制效益和产量影响的认识推动成长

- 2022年,南美洲将占全球除草剂市场总量的35.5%。南美洲除草剂市场在阿根廷、巴西、智利和南美洲其他地区等各个地区都在经历成长。这些国家是主要的农业生产国,拥有大片农田,使用除草剂对于控制杂草数量和确保最佳作物产量至关重要。

- 巴西占了53.6%的市场份额,预计在此期间的复合年增长率为5.2%。该国的农民越来越意识到控制杂草的好处以及杂草对作物产量的影响。杂草造成的作物损失增加可能导致除草剂的使用率提高。

- 2022年,阿根廷占据南美除草剂市场的35.1%,与其他国家相比,其复合年增长率最快,为5.6%。随着对食品和农产品的需求增加,阿根廷农民可能会扩大耕地面积并加强作物生产,从而增加对除草剂的需求。

- 杂草对某些除草剂的抗药性可能会对农民造成重大挑战。因此,农民可能会转向更新的除草剂配方和作用方式,从而增加对这些替代品的需求。由于这些因素,预计在此期间除草剂消费量将增加191,900吨。

- 预计南美除草剂市场在预测期内(2023-2029 年)的复合年增长率将达到 5.2%。农作物损失的增加、保护农作物的需要、对杂草控制的认识的不断提高以及对农产品的需求的不断增长正在推动市场的成长。

南美洲除草剂市场趋势

阿根廷的土壤条件有益杂草生长,是南美洲除草剂消费量最大的国家

- 杂草是人们不想要的、不良的植物,它们会干扰土地和水资源的利用,并对作物产量不利影响。杂草造成的作物产量损失取决于几个因素,包括杂草出现的时间、杂草的种类和作物的种类。如果不加以控制,杂草将导致 100% 的产量损失。除草剂是用于操纵或控制有害杂草的化学物质。除草剂是一种有效且易于操作的控制杂草的工具,与机械方法相比,它可以更有效率地实现产量,同时消耗更少的能量。

- 2022 年,阿根廷以 7.4 公斤/公顷的除草剂消费量位居南美洲榜首。阿根廷的土壤种类繁多,从潘帕斯草原的肥沃土壤到干旱地区的沙质土壤和壤土。不同的杂草种类适应特定的土壤条件,因此在全国各地繁衍生息。最重要的杂草是稗草、豚草、约翰草、指草、牛筋草、稗草和黑麦草。

- 2022 年巴西的除草剂消费量排名第二,为 5.3 公斤/公顷。巴西主要为热带气候,全年大部分时间气温较高。高温促进了多种杂草的萌发、生长和繁殖,为杂草的生长创造了有利条件。鸭跖草、Conyza spp.、Cyperus spp.、鬼针草和高粱是巴西发现的主要杂草。

- 南美洲,尤其是巴西和阿根廷,拥有大片可耕地,这推动了对除草剂的需求。清理土地用于大规模作物种植加剧了对有效杂草控制的需求,从而增加了对除草剂的需求。

各种除草剂的控制效果以及对其他国家进口的依赖可能会提高该地区Atrazine除草剂的价格。

- Atrazine是一种三嗪类除草剂,广泛用于防治多种作物中的阔叶杂草和禾本科杂草。 2022年南美洲Atrazine的价格为13,810美元。Atrazine作为除草剂的作用机转是抑制植物的光合作用过程。它专门针对叶绿体中的光系统 II (PSII) 蛋白复合物,抑制植物在光合作用过程中将光能转化为化学能的能力。这会导致有毒化合物的积聚,最终杀死目标杂草。

- Paraquat是一种广泛使用的除草剂,属于Bipyridylium化合物类。它主要在农业和非农业环境中控制多种阔叶杂草和草类杂草。由于Paraquat具有快速起效和非选择性的特性,它通常被用作种植前或出苗前的除草剂,以在作物出现之前控制杂草。它对多种作物有效,包括棉花、玉米、大豆、甘蔗和许多其他作物。 2022 年Paraquat在南美的售价为 4,600 美元。

- Glyphosate是一种广泛使用的除草剂,属于有机膦酸酯类。作为一种非选择性系统性除草剂,它能有效控制多种作物中的多种杂草。 2022年南美洲Glyphosate的价格为1,100美元。Glyphosate的有效性、广谱性和相对较低的价格使其成为该地区农民常用的作物Glyphosate。然而,由于担心潜在的健康和环境影响,其使用一直存在争议。

南美洲除草剂产业概况

南美洲除草剂市场适度整合,前五大公司占48.24%的市占率。该市场的主要企业有:ADAMA Agricultural Solutions Ltd、 BASF SE、Bayer AG、Corteva Agriscience 和 Syngenta Group。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 活性成分价格分析

- 法律规范

- 阿根廷

- 巴西

- 智利

- 价值炼和通路分析

第五章市场区隔

- 执行模式

- 化学灌溉

- 叶面喷布

- 熏蒸

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 阿根廷

- 巴西

- 智利

- 南美洲其他地区

第六章竞争格局

- 重大策略倡议

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd

- American Vanguard Corporation

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Rainbow Agro

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001704

The South America Herbicide Market size is estimated at 15.47 billion USD in 2025, and is expected to reach 19.64 billion USD by 2030, growing at a CAGR of 4.89% during the forecast period (2025-2030).

The rising demand for agricultural products and a focus on managing weed effectively are strengthening the market's growth

- Chemigation accounted for 19.7% of market value in 2022. It is a popular choice in areas with well-developed irrigation infrastructure. The rising adoption of drip irrigation systems is expected to fuel the market's growth in the coming years.

- Foliar holds the second major share and is expected to record a CAGR of 5.1% during the forecast period (2023-2029). Herbicides are applied directly to the leaves of plants, where they are absorbed and translocated throughout the plant to control unwanted vegetation. It is common practice in agriculture, allowing for targeted and efficient weed control while minimizing herbicide usage.

- The fumigation method is anticipated to witness a growth of USD 78.3 million between 2023 and 2029. This method involves using gaseous herbicides to control pests and weeds in soil or enclosed spaces, such as greenhouses. It is commonly used to treat large areas and is especially effective against soil-borne pests.

- The soil treatment segment is expected to record a CAGR of 5.4% during the forecast period (2023-2029). This method involves applying herbicide directly to the soil to control weeds before planting or managing persistent weed issues. Soil treatment can help create a favorable environment for crop establishment and growth.

- The South American herbicide market is expected to grow by a value of USD 5.04 billion during the forecast period (2023-2029). The demand for herbicides in South America is influenced by the adoption of these application methods to control weed growth effectively and maximize crop yield. Changing agricultural practices, crop types, weed pressure, and pest management strategies are driving the demand for herbicide products.

The growth was driven by rising awareness about the benefits of weed control and its impact on yield

- South America accounted for 35.5% of the total global herbicide market in 2022. The herbicide market in South America is experiencing growth in various regions, including Argentina, Brazil, Chile, and the Rest of South America. These countries are major agricultural producers with vast expanses of farmland; therefore, the use of herbicides becomes crucial to manage weed populations and ensure optimal crop yields.

- Brazil held a major share of 53.6% in the market and is expected to register a CAGR of 5.2% during the period. Farmers in the country are becoming increasingly aware of the benefits of weed control and the impact of weeds on crop yields. Rising crop losses due to weeds may lead to higher adoption of herbicides.

- In 2022, Argentina held a 35.1% share of the South American herbicide market, registering a CAGR of 5.6%, which was the fastest compared to other countries. With the rising demand for food and agricultural products, farmers in Argentina may expand their cultivation areas and intensify crop production, leading to a greater need for herbicides to control weeds.

- Weed resistance to certain herbicides can be a significant challenge for farmers. As a result, they may switch to newer herbicide formulations or modes of action, driving demand for these alternatives. Due to these factors, the consumption of herbicide is expected to increase by 191.9 thousand metric ton during the period.

- The South American herbicide market is projected to record a CAGR of 5.2% during the forecast period (2023-2029). The rising crop losses, the need to protect crops, and increasing awareness of weed control, coupled with rising demand for agriculture products, are driving the growth of the market.

South America Herbicide Market Trends

Argentina dominated South America in the consumption of herbicides due to the favorable soil conditions for weed infestation

- Weeds are unwanted and undesirable plants that interfere with the utilization of land and water resources and thus adversely affect crop yields. Yield losses in crops due to weeds depend on several factors, such as weed emergence time, type of weeds, and crop type. Weeds can result in 100% yield loss if left uncontrolled. Herbicides are chemicals used to manipulate or control undesirable weeds. Herbicides are effective and operative tools to control weeds, allowing yields to be achieved efficiently with less energy than mechanical practices.

- Argentina dominated South America in consumption of herbicides at a rate of 7.4 kg/ha in 2022. Argentina has diverse soil types, ranging from fertile soils in the Pampas region to sandy and loamy soils in the arid areas. Different weed species are adapted to specific soil conditions, allowing them to thrive and spread in different areas of the country. Fleabane, pigweed, johnsongrass, fingergrass, goosegrass, barnyard grass, and ryegrass are considered the most important weeds.

- Brazil has the second-highest herbicide consumption rate of 5.3 kg/ha in 2022. Brazil has a predominantly tropical climate, with warm temperatures throughout the year in most regions. High temperatures provide favorable conditions for weed growth, as they accelerate the germination, growth, and reproduction of many weed species. Commelina benghalensis, Conyza spp., Cyperus spp., Bidens pilosa, and Sorghum halepense are some of the major weed species found in Brazil.

- South America has vast areas of arable land, particularly in countries like Brazil and Argentina, which drives the demand for herbicides. The clearing of land for cultivating large-scale crops contributes to the need for effective weed control, thereby increasing the demand for herbicides.

effectiveness in controlling various herbicides and dependency on imports from other countries may raise the price of Atrazine herbicides in the region.

- Atrazine is a herbicide belonging to the chemical class of triazines and is widely used to control broadleaf and grassy weeds in various crops. The price of atrazine in South America was USD 13.81 thousand in 2022. Atrazine's mode of action as a herbicide involves inhibiting the photosynthesis process in plants. It specifically targets the photosystem II (PSII) protein complex in chloroplasts, disrupting the plants' ability to convert light energy into chemical energy during photosynthesis. This leads to the accumulation of toxic byproducts and, ultimately, the death of the targeted weeds.

- Paraquat is a widely used herbicide belonging to the chemical class of bipyridylium compounds. It primarily controls various broadleaf and grassy weeds in agricultural and non-agricultural settings. Due to its rapid action and non-selective nature, paraquat is commonly used as a pre-plant or pre-emergence herbicide to control weeds before crops emerge. It is effective in a wide range of crops, including cotton, corn, soybeans, sugarcane, and various other crops. Paraquat was priced at USD 4.6 thousand in South America in 2022.

- Glyphosate is a widely used herbicide belonging to the chemical class of organophosphonates. It is a non-selective systemic herbicide, meaning it can effectively control a broad range of weeds in various crops. The price of glyphosate in South America was USD 1.1 thousand in 2022. Glyphosate's effectiveness, broad-spectrum activity, and relatively low cost have made it a popular choice for weed control for farmers in the region. However, its use has been controversial due to concerns about potential health and environmental impacts.

South America Herbicide Industry Overview

The South America Herbicide Market is moderately consolidated, with the top five companies occupying 48.24%. The major players in this market are ADAMA Agricultural Solutions Ltd, BASF SE, Bayer AG, Corteva Agriscience and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.3.3 Chile

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Chile

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 American Vanguard Corporation

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 FMC Corporation

- 6.4.7 Rainbow Agro

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219