|

市场调查报告书

商品编码

1684004

美国草坪和观赏植物保护:市场占有率分析、行业趋势、统计数据和成长预测(2025-2030 年)US Turf and Ornamental Protection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

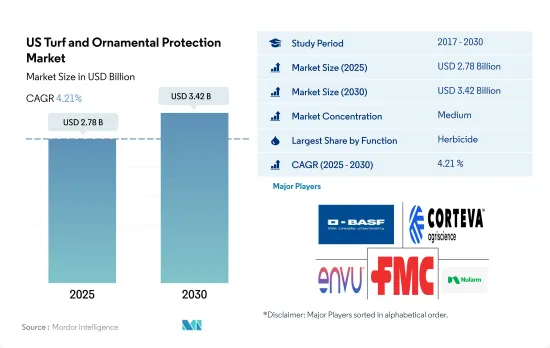

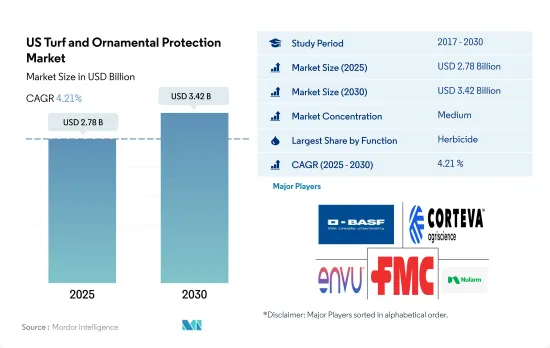

美国草坪和观赏植物保护市场规模预计在 2025 年为 27.8 亿美元,预计到 2030 年将达到 34.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.21%。

花卉种植者的增加推动了作物保护化学品的使用

- 2022 年,草坪和观赏植物领域占美国作物保护化学品市场总量的 13.1%。该领域包括公园、花园、运动场和景观美化等广泛的空间。在这些地区,经常会遇到影响美观和整体健康的害虫问题。

- 2021年,美国有9,558名花卉种植者,分布在17个州。在这 17 个州中,生产商数量比前一年增加了 8%。最大的类别是床上用品和花园植物,年销售额为 23 亿美元。随着种植面积和种植者数量的不断增长,农药的使用量也不断增加。

- 2022 年,除草剂占据市场主导地位,占有 53.3% 的份额。这是由于杂草蔓延所造成的。草坪和观赏作物常受到各种杂草的侵害,包括马唐草、芒草、稗草和狗尾草。因此,除草剂的使用有所增加,以应对这些挑战并保持作物的健康和外观。

- 杀虫剂占2022年市场占有率的37.5%。北方和南方的蠼螋、纸蜂、象鼻虫、象鼻虫、日本甲虫、东方甲虫、欧洲蠼螋、棕色隐士和其他草地蝽是影响草坪和观赏田的常见害虫。

- 受真菌疾病、昆虫和杂草问题日益严重的推动,预测期内,草坪和观赏植物作物保护市场预计将以 4.5% 的复合年增长率增长。

美国草坪与观赏植物保护市场趋势

草坪和观赏作物在各种用途的应用日益增多,以及这些作物种植面积的扩张可能会推动市场的发展。

- 新烟碱类杀虫剂最常用于草坪护理,以控制甜菜夜蛾。在美国,草坪和观赏作物约占新烟碱类杀虫剂使用量的 4%。对维护良好的草坪和观赏景观(包括公园、高尔夫球场、花园和公共场所)的需求不断增加,导致杀虫剂的使用增加,以控制害虫并保持理想的外观。

- 美国对鲜花的需求不断增长,推动了2017年至2022年期间草坪和观赏植物的种植面积增加649,800公顷。种植面积的增加和品质要求的满足导致同期农药消费量的增加。

- 住宅、园艺师和物业经理越来越意识到病虫害管理对于维护景观价值和吸引力的重要性,增加了杀虫剂产品的采用。高尔夫球场、运动场和公共公园通常需要进行病虫害管理来维持其质量,这导致草坪行业的农药消耗量增加。

- 此外,影响草坪和观赏用地的害虫压力不断增加,包括杂草、昆虫和疾病,可能会导致未来几年农药消费量增加,以实现有效控制。随着都市区的扩大,对害虫管理解决方案的需求可能会增加,因为更多的绿地集中,为害虫的繁殖创造了有利条件。

- 气候变迁可能会影响害虫族群,从而可能推动未来几年农药的消费。

它能有效控制多种害虫,包括蚜虫、介壳虫、斑甲虫、棉红铃虫、早期斑螟和毛虫,而且由于该国供应有限,导致其价格上涨。

- 2022年Cypermethrin的价格为每吨21,200美元。它广泛用于草坪和观赏植物,因为它能有效控制多种害虫,包括蚜虫、介壳虫、斑点甲虫、粉红球虫、早期叶斑病和毛虫。由于其有效性,它受到那些想要保护作物免受害虫侵害并确保丰收的农民的欢迎。

- Atrazine是一种系统性除草剂,属于氯化三嗪类,用于一年生禾本科植物和阔叶杂草的出苗前防治。含有Atrazine的农药製剂已被批准用于玉米、甜玉米、高粱、甘蔗、小麦、澳洲坚果和核准等作物,以及各种草坪和观赏作物,包括运动草坪、高尔夫球场草坪以及商业和住宅草坪。 2022 年Atrazine的价格为每吨 13,800 美元。

- Malathion用于控制多种害虫,包括蚜虫、跳甲和几种珍贵观赏作物中的其他吸汁害虫。美国常见的、经常用Malathion处理的作物包括菊花、常绿植物、玫瑰、山茶花和杜鹃花。 2022 年Malathion的价格为每吨 12,600 美元。

- 代森锰锌是一种频谱接触性杀菌剂,在美国被批准用于室外和温室作物。它可以控制多种真菌疾病,包括叶銹病、秆銹病、条銹病、灰霉病、叶斑病和尾孢病。它可用作马铃薯、玉米、高粱、番茄和谷物等作物的种子处理剂。 2022 年的市场价值将达到每吨 7,800 美元。

美国草坪和观赏植物保护产业概况

美国草坪和观赏植物保护市场适度整合,前五大公司占46.20%的市场。该市场的主要企业有: BASF SE、Corteva Agriscience、Environmental Science US LLC (Envu)、FMC Corporation 和 Nufarm Ltd(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 活性成分价格分析

- 法律规范

- 美国

- 价值炼和通路分析

第五章市场区隔

- 功能

- 杀菌剂

- 除草剂

- 杀虫剂

- 杀软体动物剂

- 杀线虫剂

- 执行模式

- 化学处理

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

第六章竞争格局

- 重大策略倡议

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- American Vanguard Corporation

- BASF SE

- Corteva Agriscience

- Environmental Science US LLC(Envu)

- FMC Corporation

- Gowan Company

- Mitsui & Co. Ltd(Certis Belchim)

- Nufarm Ltd

- Syngenta Group

- UPL Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The US Turf and Ornamental Protection Market size is estimated at 2.78 billion USD in 2025, and is expected to reach 3.42 billion USD by 2030, growing at a CAGR of 4.21% during the forecast period (2025-2030).

An increase in the number of floriculture producers drives the usage of crop protection chemicals

- The turf and ornamental segment accounted for 13.1% of the total US crop protection chemicals market in 2022. This segment encompasses a wide range of spaces, including parks, gardens, sports fields, and landscaping. These areas commonly encounter difficulties related to pests that can impact their aesthetic appeal and overall health.

- In 2021, 9,558 floriculture producers spread across 17 states in the United States. Within those 17 states, the number of producers witnessed an 8% rise from the previous year. The highest sales were recorded in annual bedding and garden plants, amounting to USD 2.3 billion. As cultivation and the number of producers continue to grow, there is a corresponding increase in the use of pesticides.

- In 2022, herbicides dominated the market with a majority share of 53.3%. This is due to the prevalence of weed infestation. Turf and ornamental crops are commonly affected by various weeds, including crabgrass, goosegrass, barnyardgrass, and foxtail. As a result, the use of herbicides has increased to combat these challenges and maintain the health and appearance of the crops.

- Insecticides accounted for 37.5% of the market share in 2022. Northern and southern masked chafers, Asiatic Garden beetles, weevils, billbugs, Japanese beetles, oriental beetles, European chafers, cutworms, and other chinch bugs are common insect pests affecting the turf and ornamental sector.

- The crop protection chemicals market in the turf and ornamental sector is projected to grow during the forecast period with an estimated CAGR of 4.5%, driven by the increasing problems with fungal disease, insects, and weeds.

US Turf and Ornamental Protection Market Trends

Growing adoption of turf & ornamental crops in various applications, extending cultivation area under these crops may drive the market

- Neonicotinoids are the most commonly used in turf care as a preventive material for the control of white grubs. Turf and ornamental crops comprise about 4% of neonicotinoid usage in the United States. There is a rising demand for well-maintained turf and ornamental landscapes, such as in parks, golf courses, gardens, and public spaces, leading to higher pesticide usage to control pests and maintain the desired appearance.

- The area under the turf and ornamental increased by 649.8 thousand hectares between 2017 and 2022 due to the rising demand for flowers in the United States. The increase in cultivation area and meeting the quality requirements led to the increase in the consumption of pesticides during the same period.

- Homeowners, landscapers, and property managers are more aware of the importance of pest management to maintain the value and appeal of their landscapes, leading to higher adoption of pesticide products. Golf courses, sports fields, and public parks often require pest management to maintain their quality, contributing to the consumption of pesticides in the turf segment.

- Additionally, an increase in pest pressures affecting turfs and ornamental areas, such as weeds, insects, or diseases, could lead to an increase in the consumption of pesticides for effective control during the coming years. As urban areas expand, green spaces become more concentrated, creating conducive environments for pests to thrive, which could lead to a higher demand for pest management solutions.

- Changing climate patterns can influence pest populations, which may drive the consumption of pesticides in the coming years.

Effectiveness in controlling various insects such as aphids, beetles, spotted ball worms, pink ball worms, early spot borers, hairy caterpillars, and limited availability in the country is increasing the price of it

- In 2022, cypermethrin was priced at USD 21.2 thousand per metric ton. It has been widely adopted in turf & ornamental crops for its effectiveness in controlling various types of insects, including aphids, beetles, spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars. Its effectiveness has made it popular for farmers seeking to protect their crops from pests and ensure a successful harvest.

- Atrazine, a systemic herbicide belonging to the chlorinated triazine group, is utilized for targeted control of annual grasses and broadleaf weeds before their emergence. Pesticide formulations containing atrazine are approved for application on various turf & ornamental such as sports turf, golf course turf, and commercial and residential lawns, in addition to agricultural applications like corn, sweet corn, sorghum, sugarcane, wheat, macadamia nuts, and guava. Atrazine was priced at USD 13.8 thousand per metric ton in 2022.

- Malathion is used to control a wide range of pests, including aphids, fleas, and other sucking pests on several valuable ornamental crops. Crops extensively grown in the United States and frequently use malathion are chrysanthemums, evergreens, roses, camellias, and azaleas. Malathion was priced at USD 12.6 thousand per metric ton in 2022.

- Mancozeb is a broad-spectrum contact fungicide labeled for outdoor and greenhouse crops in the United States. It protects against a wide spectrum of fungal diseases, including leaf, stem, stripe rusts, botrytis blight, leaf spot, and Cercospora blight. It serves as a seed treatment for crops such as potatoes, corn, sorghum, tomatoes, and cereal grains. In 2022, its market value reached USD 7.8 thousand per metric ton.

US Turf and Ornamental Protection Industry Overview

The US Turf and Ornamental Protection Market is moderately consolidated, with the top five companies occupying 46.20%. The major players in this market are BASF SE, Corteva Agriscience, Environmental Science US LLC (Envu), FMC Corporation and Nufarm Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 American Vanguard Corporation

- 6.4.2 BASF SE

- 6.4.3 Corteva Agriscience

- 6.4.4 Environmental Science US LLC (Envu)

- 6.4.5 FMC Corporation

- 6.4.6 Gowan Company

- 6.4.7 Mitsui & Co. Ltd (Certis Belchim)

- 6.4.8 Nufarm Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms