|

市场调查报告书

商品编码

1684037

航太与国防 MLCC-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Aerospace and Defence MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

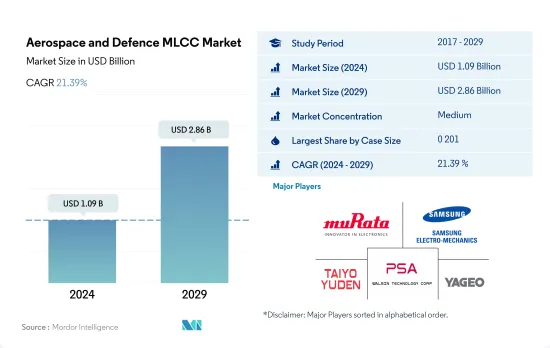

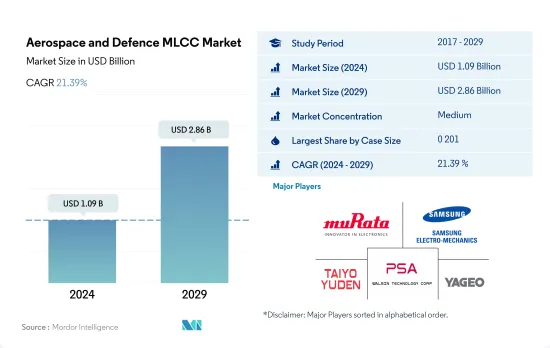

预计 2024 年航太和国防 MLCC 市场规模为 10.9 亿美元,到 2029 年将达到 28.6 亿美元,预测期内(2024-2029 年)的复合年增长率为 21.39%。

优化航空电子MLCC选择增强航太和国防系统

- 随着人工智慧、物联网和 5G通讯等先进航空电子技术的日益普及,航太和国防工业正在迅速转型。这些趋势推动了对具有更高电容、更低 ESR 和更高可靠性的 MLCC 的需求,以支援飞机上的先进电子系统。外壳尺寸为 0201 和 0402 的 MLCC 常用于航空电子设备中的小型、轻量电子电路。它们外形规格小、电容高,非常适合用于无人机和其他小型飞机上的飞行控制系统、导航系统和通讯设备等小型设备。航空电子设备朝着更小、更轻的方向发展,推动了对外壳尺寸 0.201 和 0.402 MLCC 的需求。

- 外壳尺寸为 0603 和 1005 的 MLCC 在小尺寸和电容之间实现了平衡,使其成为各种航空电子应用中的多功能组件。它们通常用于有人驾驶和无人驾驶飞机的驾驶座显示器、感测器系统和配电网路。现代飞机越来越多地采用先进的航空电子系统,推动了对外壳尺寸 0 603 和 1 005 MLCC 的需求。

- 外壳尺寸为 1210 的 MLCC 具有更高的电容值,适用于航空电子电源管理、能源储存和滤波应用。这些大型 MLCC 通常用于关键航空电子系统,例如雷达系统、卫星通讯和先进的航空电子控制单元。对更强大、更复杂的航空电子技术的需求不断增长,推动了对外壳尺寸 1 210 和其他 MLCC 的需求。无人机和微型飞行器的需求日益增长,MLCC在确保电子元件稳定高效运作方面发挥关键作用。

国防费用增加和地缘政治动态推动全球航太和国防 MLCC 市场成长

- 全球航太和国防 MLCC 市场正在经历强劲成长。以中国和印度为首的亚太地区预计 2022 年销售额将达到 3.6203 亿美元,到 2028 年将迅速成长至 10.6 亿美元,2023 年至 2028 年复合年增长率将达到 20.37%。印度 2023-24 年预算为 594 亿印度卢比,印度强调了 MLCC 在增强其国防能力,尤其是无人机 (UAV) 方面发挥的重要作用。

- 欧洲国防费用大幅增加,2021年达1.1605亿美元,较2020年成长3%。 2022年受俄乌衝突影响,欧洲加强国防能力,国防费用激增14%,达3,450亿美元。 MLCC 在此背景下发挥着至关重要的作用,确保了军用飞机和国防系统的信号完整性,为该部门到 2028 年实现 3.3116 亿美元的预期收益目标做出了贡献。

- 北美是全球军费开支最大的地区,在国防方面投入巨资,2022年累积支出达9,120亿美元。其中,美国航太和国防部门为经济贡献了3,910亿美元,而MLCC在确保军用飞机和电子战防御系统可靠运作方面发挥着至关重要的作用。

- 包括中东、非洲和南美洲在内的世界其他地区正在努力应对地缘政治挑战、恐怖主义威胁和不断增加的国防开支。在全部区域,航太和国防 MLCC 市场反映了经济动态、地缘政治影响和国防优先事项的融合,MLCC 成为确保航太和国防系统可靠性和效率的关键组件。

全球航太与国防MLCC市场趋势

对改善监控解决方案的需求不断增长,推动着市场

- 航太和国防 (A&D) 领域对 MLCC 的需求正在增长,尤其是在军用飞机和无人机的电子战防御系统等应用方面。这些产业需要利用具有特定功能的组件的可靠电力电子系统。 MLCC 对于满足这些需求至关重要,因为它们具有高可靠性、高品质因数的最佳性能、有效的 EMI 抑制、降噪、线路滤波、储能能力、高频噪声去耦和电压调节能力。 MLCC 对于确保无人机和其他航太和国防电力电子系统的可靠运作至关重要。

- 无人机产量录得14%的大幅成长,从2021年的384.7万台增加到2022年的444.8万台。这一成长推动了MLCC需求的大幅成长,尤其是对于无人机,以及高压电源应用。 MLCC在无人机中发挥重要作用,作为电源旁路电容器、DC-DC转换器的输入/输出滤波器、平滑电容器以及数位电路和LCD模组中的必备组件。 A&D 公司越来越认识到 MLCC 在满足特定要求和提高系统效能方面的价值和重要性。

- MLCC 的小型化和功能增强等进步正在推动需求的成长。这导致了功能更强大的自动驾驶系统的开发和即时无人机应用的扩展,透过 MLCC 的紧凑整合变得更加容易,而且功能没有任何损害。 MLCC 的改进功能(例如高可靠性和快速反应时间)正在刺激其在即时无人机应用中的应用。

不断加剧的地缘政治紧张局势以及替换老旧军用飞机的现代化计画正在推动军事开支。

- MLCC 是国防电子产品中必不可少的组件,提供重要的能源储存和讯号过滤功能。 MLCC的需求直接受到国防费用波动的影响,开支增加会推动需求增加,尤其是在飞弹系统和国防通讯设备等领域。然而,由于产业将重点转向医疗技术,新冠疫情期间国防开支的减少对 MLCC 市场产生了负面影响。随着国防费用趋于稳定,国防电子产品对MLCC的需求预计将恢復。

- 随着全球重点转向医疗技术和实验室测试设备,COVID-19 疫情对国防电子产品产生了重大影响。这减少了对高可靠性国防电子产品的需求,并需要努力稳定高压国防市场。疫情也对许多国防垂直平台产生了不利影响,凸显了在意外中断面前适应性和復原力的重要性。

- 2012年至2016年,由于政府采取紧缩措施,国防市场陷入停滞。然而,2017年至2019年间出现了显着的转变,航空太空电子学等某些狭窄的终端市场领域实现了显着成长。然而,2020 年疫情打乱了这一成长轨迹,导致国防电子产品需求下降 11%。美国主导的变动导致2022年之前的国防开支受到限制。儘管如此,预计2023年将为小型精密欧洲国防电子市场带来新的商机,并专注于飞弹和飞弹防御系统。

航太与国防MLCC产业概况

航太和国防 MLCC 市场适度整合,前五大公司占 44.17% 的市场。市场的主要企业有:村田製作所、三星电机、太阳诱电、华新科技和国巨集团(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 无人机生产

- 全球无人机产量

- 军费开支

- 全球军费开支

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆类型

- 载人飞机

- 无人机

- 錶壳尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他的

- 电压

- 600V~1100V

- 小于600V

- 1100V以上

- 电容

- 10μF至100μF

- 小于10μF

- 100μF 以上

- 介电类型

- 1级

- 2级

- 地区

- 亚太地区

- 欧洲

- 北美洲

- 世界其他地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Yageo Corporation

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001979

The Aerospace and Defence MLCC Market size is estimated at 1.09 billion USD in 2024, and is expected to reach 2.86 billion USD by 2029, growing at a CAGR of 21.39% during the forecast period (2024-2029).

Optimized avionic MLCC selection enhances aerospace and defense systems

- The aerospace and defense industries are witnessing a rapid transformation with the increasing adoption of advanced avionics technologies, including AI, IoT, and 5G communications. These trends drive the need for MLCCs with higher capacitance, lower ESR, and improved reliability to support cutting-edge electronic systems in aircraft. Case sizes 0 201 and 0 402 MLCCs are popular for compact and lightweight electronic circuits in avionics. Their small form factor and high capacitance make them ideal for miniaturized devices, such as flight control systems, navigation systems, and communication equipment in UAVs and other small aircraft. The trend toward miniaturization and weight reduction in avionics drives the demand for case sizes 0 201 and 0 402 MLCCs.

- Case sizes 0 603 and 1 005 MLCCs balance compactness and capacitance, making them versatile components in various avionic applications. They are commonly used in cockpit displays, sensor systems, and power distribution networks in manned and unmanned aerial vehicles. The increasing adoption of advanced avionics systems in modern aircraft enhances the demand for case sizes 0 603 and 1 005 MLCCs.

- Case size 1 210 MLCCs offer higher capacitance values and are well-suited for power management, energy storage, and filtering applications in avionics. These larger-sized MLCCs are commonly utilized in critical avionic systems like radar systems, satellite communications, and advanced avionics control units. The evolving need for more powerful and sophisticated avionic technologies contributes to the demand for case sizes 1 210 and other MLCCs. The demand for UAVs and MAVs is growing, and MLCCs play a vital role in ensuring stable and efficient electronic components for successful operation.

The global aerospace and defense MLCC market thrives amid rising defense expenditures and geopolitical dynamics

- The aerospace and defense MLCC market experiences robust growth globally. In Asia-Pacific, led by China and India, the segment generated USD 362.03 million in 2022, with a projected surge to USD 1.06 billion by 2028, showcasing a robust CAGR of 20.37% from 2023 to 2028. India, with a substantial INR 5.94 lakh crore budget for FY 2023-24, emphasizes MLCCs' pivotal role in advancing defense capabilities, particularly in unmanned aerial vehicles (UAVs).

- Europe witnessed a noteworthy uptick in defense spending, reaching USD 116.05 million by 2021, reflecting a 3% increase from 2020 to 2021. Amid the Russia-Ukraine conflict in 2022, Europe reinforced its defense capabilities, resulting in a 14% surge in defense expenditures to USD 345 billion. MLCCs play a vital role in this context, ensuring signal integrity in military aircraft and defense systems and contributing to the sector's envisioned revenue target of USD 331.16 million by 2028.

- North America, as the dominant force in global military expenditures, invests significantly in defense, with a cumulative expenditure of USD 912 billion in 2022. The aerospace and defense sector, particularly in the United States, contributes USD 391 billion to the economy, with MLCCs playing a pivotal role in ensuring the reliable operation of military aircraft and electronic warfare defense systems.

- The Rest of the World, encompassing the Middle East, Africa, and South America, grapples with geopolitical challenges, terrorism threats, and increased defense spending. Across these regions, the aerospace and defense MLCC market reflects a convergence of economic dynamics, geopolitical influences, and defense priorities, with MLCCs emerging as critical components ensuring the reliability and efficiency of aerospace and defense systems.

Global Aerospace and Defence MLCC Market Trends

Growing demand for improved surveillance solutions is propelling the market

- The demand for MLCCs is rising in the aerospace and defense (A&D) sectors, especially in applications such as military aircraft and electronic warfare defense systems like UAVs. These industries require reliable power electronic systems that utilize components with specific functionalities. MLCCs are crucial in meeting these demands as they offer high reliability, optimal performance with a high-quality factor, effective EMI suppression, noise reduction, line filtering, energy storage capabilities, decoupling of high-frequency noise, and voltage regulation capabilities. MLCCs are critical in ensuring the dependable operation of UAVs and other aerospace and defense power electronic systems.

- The production of UAVs experienced a significant 14% increase from 3.847 million in 2021 to 4.448 million in 2022. This growth has led to a substantial rise in the demand for MLCCs, particularly for UAVs, specifically for high-voltage power supply applications. MLCCs play critical roles in UAVs as power supply bypass capacitors, input/output filters in DC-DC converters, smoothing capacitors, and essential components in digital circuits and LCD modules. A&D companies are increasingly recognizing the value and significance of MLCCs in meeting their specific requirements and enhancing the performance of their systems.

- Advancements in MLCCs, including smaller sizes and enhanced capabilities, have increased demand. This has led to the development of more capable autopilot systems and the expansion of real-time UAV applications facilitated by the compact integration of MLCCs without compromising functionality. Improved capabilities of MLCCs, such as high reliability and fast response times, have fueled the adoption of real-time UAV applications.

Growing geopolitical tensions and the modernization plans to replace aging military aircraft are propelling military spending

- MLCCs are vital components in defense electronics, providing crucial energy storage and signal filtering capabilities. The demand for MLCCs is directly influenced by fluctuations in defense spending, with increased spending driving higher demand, particularly in areas such as missile systems and defense communication equipment. However, the decline in defense spending during the COVID-19 pandemic negatively affected the MLCC market as the industry shifted focus to medical technology. As defense spending stabilizes, the demand for MLCCs in defense electronics is expected to rebound.

- The COVID-19 pandemic had significant implications for defense electronics as global priorities shifted toward medical technology and laboratory test equipment. This led to a decline in demand for high-reliability defense electronics, requiring efforts to stabilize the high-voltage defense markets. The pandemic also adversely affected many defense vertical platforms, highlighting the importance of adaptability and resilience in the face of unexpected disruptions.

- Between 2012 and 2016, government-imposed sequestering resulted in a stagnant defense market. However, a notable turnaround occurred from 2017 to 2019, with remarkable growth in specific narrow end-market areas such as aircraft and space electronics. However, the pandemic disrupted this growth trajectory in 2020, causing an 11% decline in defense electronics demand. The shift in the US leadership restrained defense spending through 2022. Nonetheless, 2023 was expected to bring new opportunities in the small and precise European markets for defense electronics, focused on missiles and missile defense systems.

Aerospace and Defence MLCC Industry Overview

The Aerospace and Defence MLCC Market is moderately consolidated, with the top five companies occupying 44.17%. The major players in this market are Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd, Walsin Technology Corporation and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Aerial Vehicle Production

- 4.1.1 Global Unmanned Aerial Vehicles Production

- 4.2 Military Spending

- 4.2.1 Global Military Spending

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Manned Aerial Vehicle

- 5.1.2 Unmanned Aerial Vehicle

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 600V to 1100V

- 5.3.2 Less than 600V

- 5.3.3 More than 1100V

- 5.4 Capacitance

- 5.4.1 10 μF to 100 μF

- 5.4.2 Less than 10 μF

- 5.4.3 More than 100 μF

- 5.5 Dielectric Type

- 5.5.1 Class 1

- 5.5.2 Class 2

- 5.6 Region

- 5.6.1 Asia-Pacific

- 5.6.2 Europe

- 5.6.3 North America

- 5.6.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219