|

市场调查报告书

商品编码

1684040

消费性电子用 MLCC:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Consumer Electronics MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

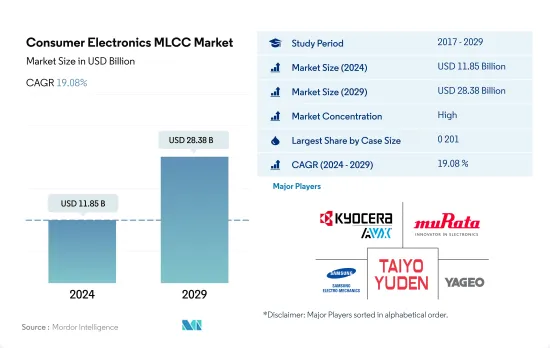

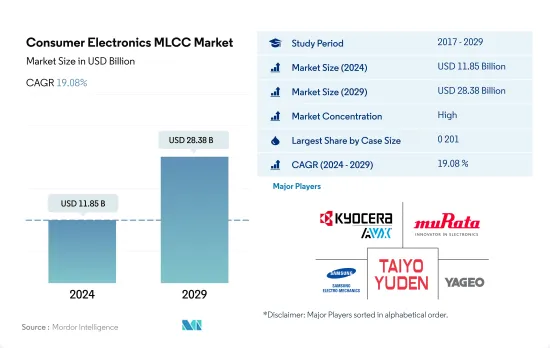

消费性电子 MLCC 市场规模预计在 2024 年为 118.5 亿美元,预计到 2029 年将达到 283.8 亿美元,预测期内(2024-2029 年)的复合年增长率为 19.08%。

外壳尺寸决定消费性电子产品的 MLCC 市场

- 在全球消费性电子MLCC市场中,0 201、0 402、0 603、1 005和1 210等各种外形尺寸在确保整体设备的最佳性能方面发挥着至关重要的作用。预计 0-201 尺寸外壳部分的销售额在 2022 年将达到 26.3 亿美元,这与高阶智慧型手机小型化的趋势完全一致。该领域的成长前景看好,2023-2028 年的复合年增长率为 19.07%,目标是到 2028 年实现 75.7 亿美元的收入。外壳尺寸为 0 201 的 MLCC 是电容器製造中必不可少的微型组件,尤其是对于采用 4G 和 5G 技术的设备。

- 高阶智慧型手机以高解析度显示器、先进摄影机和 5G 连接等先进功能而闻名,依靠 0 201 MLCC 进行电源管理、杂讯抑制和讯号品质。虽然近年来高阶智慧型手机的产量有所波动,但灵活的供应链至关重要,尤其是对于 0201 MLCC 等关键零件而言。消费性电子 MLCC 市场 0402 部分经历强劲成长,反映了个人电脑、笔记型电脑和 Android 智慧型手机市场动态。 [3]

- 0 603 类别在个人电脑、笔记型电脑和智慧型手机中的电压调节、滤波和讯号调节功能中起着至关重要的作用。适中的电容和尺寸使其适用于各种电子应用。该领域也与苹果的 iOS 设备相吻合,后者以寿命长和品质优良而闻名。其他部分涵盖的外壳尺寸包括 0 805、1 812、2 220、1 206、2 225 等。多功能电容器对于维持个人电脑、笔记型电脑和智慧型手机的系统稳定性以及提高设备效能至关重要。

亚太地区是成长最快的市场,复合年增长率为 16.09%

- 全球消费性电子MLCC市场分为四个主要区域:亚太地区、北美、欧洲和亚太其他地区。每个地区在塑造产业动态和成长前景方面都发挥关键作用。亚太地区是全球最大、成长最快的消费性电子产品市场,近年来经历了显着的成长。可支配收入增加、都市化快速发展和技术进步等因素正在推动对消费性电子产品的需求。中国、印度、日本和韩国等国家为该地区的市场扩张做出了重大贡献。预计该地区在 2022 年至 2029 年期间的复合年增长率将达到惊人的 18.50%,显示其具有持续扩张的潜力。

- 北美是一个成熟且成熟的消费性电子产品市场,具有普及率高、消费需求旺盛的特性。该地区的市场价值稳步增长,从 2017 年的 3.6209 亿美元增长到 2029 年的 24.7 亿美元。

- 欧洲是全球消费性电子产品领域的另一个重要参与者,其特点是拥有大量主要製造商和品牌。该地区的消费者倾向于选择高品质、可靠的电子产品。此外,由于环境问题影响购买决策,人们对节能和永续产品的兴趣日益浓厚。

- 世界其他地区包括各种新兴市场,为消费性电子产品提供了巨大的未开发潜力。拉丁美洲、中东、非洲国家正逐步成为全球市场的主要企业。随着这些地区经济的发展和消费者收入的提高,对电子设备的需求显着增加。

消费性电子学领域全球 MLCC 市场趋势

由于个人可支配收入的增加,市场预计还会扩大。

- MLCC 因具有高电容值和高动作温度能力而适合用于空调应用。它还可以提高您的空调系统的效率和可靠性。由于全球气温和湿度上升,以及空调作为实用产品而非奢侈品的接受度不断提高,预计未来几年空调产业将大幅成长。变频空调、空调净化技术等技术先进的空调也有望对空调市场产生正面影响。

- 空调(AC) 出货量从 2021 年的 1.012 亿台成长 3.46% 至 2022 年的 1.047 亿台。住宅和商业领域对空调的需求增加可归因于气候变迁和全球气温上升的影响。生活水准的提高和可支配收入的增加使得个人和家庭越来越能负担得起空调。

- 各个地区的都市化和人口增长也因对舒适度和改善室内空气品质的需求而推动了对空调的需求。科技的进步带来了节能、环保空调的出现,满足了有环保意识的消费者的偏好。都市化导致高层建筑建设的增加。这些建筑需要空调来提供可接受的生活和工作条件,从而增加了对空调的需求。此外,政府鼓励使用节能空调系统的措施也促进了市场的成长。

消费性电子产品用MLCC产业概况

消费性电子MLCC市场格局较为集中,前五大厂商合计占65.31%的市占率。市场的主要企业有:京瓷AVX元件株式会社(京瓷株式会社)、村田製作所、三星电机、太阳诱电和国巨株式会社(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 消费性电子产品销售

- 空调销售

- 桌上型电脑销售

- 游戏机销售

- HDD 和 SSD 销售

- 笔记型电脑销售

- 印表机销售

- 冰箱销售

- 智慧型手机销量

- 智慧型手錶

- 平板电脑销量

- 电视销售

- 法律规范

- 价值链与通路分析

第五章 市场区隔

- 设备类型

- 空调

- 桌上型电脑

- 游戏机

- HDD 和 SSD

- 笔记型电脑

- 印表机

- 冰箱

- 智慧型手机

- 智慧型手錶

- 药片

- 电视机

- 其他的

- 錶壳尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他的

- 电压

- 10V~30V

- 30V 或更高

- 小于10V

- 电容

- 10μF 至 100μF

- 小于10μF

- 100μF 以上

- 介电类型

- 1 类

- 2 级

- 地区

- 亚太地区

- 欧洲

- 北美洲

- 世界其他地区

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The Consumer Electronics MLCC Market size is estimated at 11.85 billion USD in 2024, and is expected to reach 28.38 billion USD by 2029, growing at a CAGR of 19.08% during the forecast period (2024-2029).

Case sizes are shaping the consumer electronics MLCC market

- In the global consumer electronics MLCC market, various case sizes, including 0 201, 0 402, 0 603, 1 005, and 1 210, play pivotal roles in ensuring optimal performance across devices. The 0 201 case size segment had revenue of USD 2.63 billion in 2022, which aligned perfectly with the trend of miniaturization in premium smartphones. The segment's growth prospects are promising, with a targeted revenue of USD 7.57 billion by 2028, registering a CAGR of 19.07% during 2023-2028. MLCC with case size 0 201 are compact components vital for capacitor manufacturing, especially in devices incorporating 4G and 5G technologies.

- Premium smartphones, known for their advanced features, including high-resolution displays, advanced cameras, and 5G connectivity, rely on 0 201 MLCCs for power management, noise suppression, and signal quality. Despite fluctuations in premium smartphone production in recent years, adaptable supply chains are essential, particularly for crucial components like 0 201 MLCCs. The 0 402 segment in the consumer electronics MLCC market experienced significant growth, reflecting changing dynamics in the PC, laptop, and Android smartphone markets. [3]

- The 0 603 category plays a crucial role in voltage regulation, filtering, and signal conditioning functions within PCs, laptops, and smartphones. Its moderate capacitance and size make it suitable for various electronic applications. This segment also aligns with Apple's iOS devices, known for their extended lifespans and premium quality. The others segment, encompassing case sizes such as 0 805, 1 812, 2 220, 1 206, and 2 225, and versatile capacitors are essential in maintaining system stability and enhancing device performance across PCs, laptops, and smartphones.

Asia-Pacific is the fastest-growing market with a CAGR of 16.09%

- The global consumer electronics MLCC market is segmented into four key regions: Asia-Pacific, North America, Europe, and the Rest of the World. Each region plays a significant role in shaping the industry's dynamics and growth prospects. Asia-Pacific is the largest and fastest-growing consumer electronics market, witnessing substantial growth in recent years. Factors such as rising disposable incomes, rapid urbanization, and technological advancements have fueled the demand for consumer electronics products. Countries like China, India, Japan, and South Korea are major contributors to the region's market expansion. The region's CAGR from 2022 to 2029 was recorded at an impressive 18.50%, showcasing the potential for sustained expansion.

- North America is a mature and well-established consumer electronics market characterized by high adoption rates and strong consumer demand. The region witnessed a steady increase in market value, starting at USD 362.09 million in 2017 and reaching USD 2.47 billion in 2029.

- Europe is another prominent player in the global consumer electronics landscape, featuring a robust presence of leading manufacturers and brands. The region's consumers show a preference for high-quality, reliable electronic devices. Moreover, there is a growing interest in energy-efficient and sustainable products, as environmental concerns influence purchasing decisions.

- The Rest of the World encompasses various emerging markets with significant untapped potential for consumer electronics. Countries in Latin America, the Middle East, and Africa are gradually becoming key players in the global market. As economies in these regions develop and consumer incomes rise, the demand for electronic devices is witnessing a notable increase.

Global Consumer Electronics MLCC Market Trends

The increasing disposable incomes of individuals are expected to encourage the uptake of the market

- MLCCs are suited for use in air conditioner applications because of their high capacitance values and high operating temperature capabilities. They can also lead to improving the AC system's efficiency and dependability. The AC industry is expected to grow significantly in the coming years due to the increasing global temperature and humidity levels and the growing acceptance of AC as a utility rather than a luxury product. Technologically advanced air conditioners such as AC with inverters and AC purification technologies are also expected to impact the air conditioner market positively.

- The air conditioner (AC) shipments increased by 3.46% from 101.20 million units in 2021 to 104.70 million units in 2022. The increasing demand for air conditioners in the residential and commercial sectors can be attributed to the impact of climate change and rising global temperatures. Improved living standards and higher disposable incomes have made air conditioners more affordable for individuals and families.

- Urbanization and population growth in various regions have also fueled the demand for air conditioners, driven by the need for improved comfort and indoor air quality. Technological advancements have resulted in the availability of energy-efficient and eco-friendly air conditioning options, catering to the preferences of environmentally conscious consumers. Urbanization has led to the construction of more high-rise buildings. As these buildings require air conditioning to provide acceptable living and working environments, this has increased demand for air conditioners. Additionally, government initiatives to encourage the usage of energy-efficient AC systems are contributing to the market's growth.

Consumer Electronics MLCC Industry Overview

The Consumer Electronics MLCC Market is fairly consolidated, with the top five companies occupying 65.31%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumer Electronics Sales

- 4.1.1 Air Conditioner Sales

- 4.1.2 Desktop PC's Sales

- 4.1.3 Gaming Console Sales

- 4.1.4 HDDs and SSDs Sales

- 4.1.5 Laptops Sales

- 4.1.6 Printers Sales

- 4.1.7 Refrigerator Sales

- 4.1.8 Smartphones Sales

- 4.1.9 Smartwatches Sales

- 4.1.10 Tablets Sales

- 4.1.11 Television Sales

- 4.2 Regulatory Framework

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Device Type

- 5.1.1 Air Conditioner

- 5.1.2 Desktop PCs

- 5.1.3 Gaming Console

- 5.1.4 HDDs and SSDs

- 5.1.5 Laptops

- 5.1.6 Printers

- 5.1.7 Refrigerator

- 5.1.8 Smartphones

- 5.1.9 Smartwatches

- 5.1.10 Tablets

- 5.1.11 Television

- 5.1.12 Others

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 10V to 30V

- 5.3.2 Above 30V

- 5.3.3 Less than 10V

- 5.4 Capacitance

- 5.4.1 10 μF to 100 μF

- 5.4.2 Less than 10 μF

- 5.4.3 More than 100 μF

- 5.5 Dielectric Type

- 5.5.1 Class 1

- 5.5.2 Class 2

- 5.6 Region

- 5.6.1 Asia-Pacific

- 5.6.2 Europe

- 5.6.3 North America

- 5.6.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms