|

市场调查报告书

商品编码

1684063

环氧地板树脂:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Epoxy Flooring Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

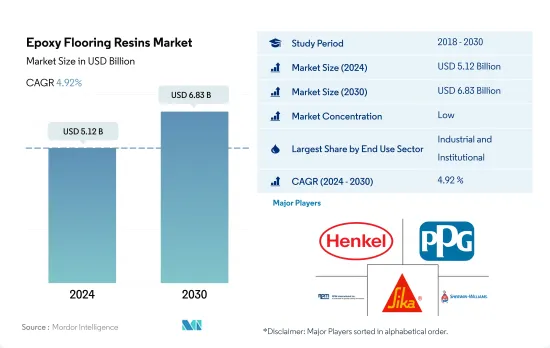

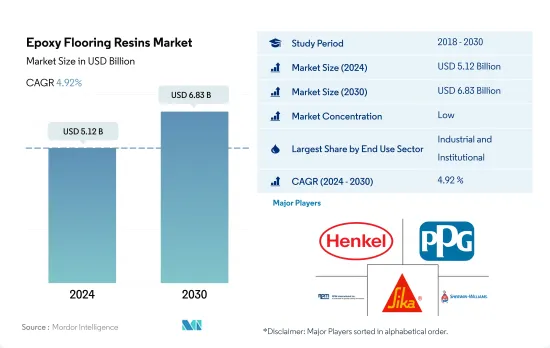

环氧地板树脂市场规模预计在 2024 年为 51.2 亿美元,预计到 2030 年将达到 68.3 亿美元,预测期内(2024-2030 年)的复合年增长率为 4.92%。

购物中心、中心和办公室的需求不断增长可能会推动环氧地板树脂的需求

- 受工业、机构和商业建筑领域需求成长的推动,2022 年全球环氧地板树脂消费量成长 2.67%。到 2023 年,环氧地板树脂预计将占据全球地坪树脂市场的 52%。

- 环氧地坪树脂的消费主要集中在工业和机构部门,2022 年占比高达 92.04%。预计 2023 年全球工业占地面积将成长 3.09%,主要原因是仓储空间的扩张。值得注意的是,与 2022 年上半年相比,2023 年上半年印度工业和仓储产业的吸收量成长了 7%,达到 2,240 万平方英尺。工业建筑投资不断增加,预计到 2026 年美国将在新工业建筑上花费 475.9 亿美元,这将推动地板材料树脂的需求。因此,预计到 2030 年,该产业的地板材料树脂消费量将比 2023 年激增 17.5 亿美元。

- 预计商业领域将成为地板材料树脂成长最快的消费领域,预测期内复合年增长率将达到 7.22%。预计到 2030 年,全球商业领域新增占地面积将达到 93.4 亿平方英尺,主要受购物中心、办公空间和其他商业建筑需求的推动。例如,预计到 2026 年,印度七大城市的甲级办公室市场将扩大至约 10 亿平方英尺,到 2030 年将进一步扩大至 12 亿平方英尺。因此,全球商业领域环氧地板树脂的消费量预计将从 2023 年的 2.43 亿美元增加到 2030 年的 3.97 亿美元。

零售空间的成长预计将推动环氧地板树脂的需求

- 2022 年全球地板材料树脂市场成长约 2.67%,超过 2021 年的数据。其中亚太地区和欧洲成为主要地区,分别占36.24%和32.12%。预计2023年全球环氧地板树脂市场将成长4.34%,超过前一年的成长率。

- 到 2023 年,亚太地区将巩固其作为地板材料树脂主要消费国的地位,预计将占全球市场的 36.15%。需求激增的原因是该地区建设活动的活性化,以及工业、医疗保健和零售等领域的投资。例如,印尼计划在 2025 年竣工六个购物中心计划,总面积为 292,000平方公尺。鑑于这一势头,预计到 2030 年亚太地区环氧地坪树脂市场将比 2023 年的水平大幅增长 40.21%。

- 预计亚太地区将引领消费,并在预测期内实现 5.62% 的最高复合年增长率。这种增长是由环氧地板树脂需求的激增所推动的,尤其是在工业、机构和商业领域。尤其是该地区的工业和机构占地面积预计将在2023年至2024年间扩大1.49亿平方英尺。在印度,预计2023年至2025年间将在德里国家首都辖区、班加罗尔和海德拉巴等主要城市开设近60家购物中心,总合零售面积达2,325万平方英尺。这些趋势显示该地区的地板材料树脂市场呈现强劲发展势头,预计将从 2023 年的 17.6 亿美元增长到 2030 年的 25.8 亿美元。

全球环氧地坪地板材料市场趋势

亚太地区大型办公大楼建设计划的激增将增加全球商业建筑的占地面积。

- 预计2022年全球商业建筑占地面积将与前一年同期比较去年小幅成长0.15%。欧洲表现突出,增幅达 12.70%,这得益于欧洲大力推行节能办公大楼,以实现 2030 年二氧化碳排放目标。随着员工重返办公室,欧洲公司正在重新签订租约,刺激 2022 年新办公大楼建设面积达到 450 万平方英尺。预计这一势头将在 2023 年持续下去,全球成长率预计为 4.26%。

- 新冠疫情造成劳动力和材料短缺,导致商业建筑计划取消和延迟。然而,随着停工缓解和建设活动恢復,2021 年全球新增商业占地面积飙升 11.11%,其中亚太地区以 20.98% 的成长率领先。

- 展望未来,全球新增商业占地面积的复合年增长率将达到4.56%。预计亚太地区的复合年增长率将达到 5.16%,超过其他地区。这一成长背后的驱动力是中国、印度、韩国和日本商业设施建设计划的活性化。尤其北京、上海、香港、台北等中国主要城市的甲级办公室建设正在加速。此外,印度计划于 2023 年至 2025 年间在七大城市开设约 60 家购物中心,总面积约 2,325 万平方英尺。总合到 2030 年,亚太地区的这些措施将比 2022 年增加 15.6 亿平方英尺的新零售占地面积。

预计南美洲的住宅将出现最快的成长,这得益于政府加大对经济适用住宅计画的投资,这将推动全球住宅产业的发展。

- 2022年,全球新建住宅占地面积与2021年相比减少了约2.89亿平方英尺。这是由于土地稀缺、劳动力短缺以及建筑材料价格不可持续的高企造成的住宅危机。这场危机对亚太地区造成了严重影响,2022 年新占地面积与 2021 年相比下降了 5.39%。不过,2023 年的前景更加光明,预计全球新建占地面积将比 2022 年增长 3.31%,这要归功于政府投资,这些投资可以为 2030 年之前 30 亿人建造新的经济适用住宅提供资金。

- 新冠疫情造成经济放缓,导致大量住宅建设计划取消或延后,2020年全球新建占地面积较2019年下降4.79%。随着2021年限制措施的解除,住宅计划被压抑的需求得到释放,2021年全球新建占地面积较2020年增长11.22%,其中欧洲增幅最高,为18.28%,其次是南美洲,2021年较2020年增长17.36%。

- 预测期内,全球住宅新占地面积预计复合年增长率为 3.81%,其中南美洲的复合年增长率最快,为 4.05%。巴西政府宣布将于 2023 年实施「Minha Casa Minha Vida」等计画和倡议,并进行多项监管改革,计画投资 19.8 亿美元为低收入家庭提供经济适用住宅。

环氧地坪地板材料产业概况

地板材料树脂市场分散,前五大公司占据32.44%的市场。该市场的主要企业有:汉高股份公司、PPG工业公司、RPM国际公司、西卡股份公司和宣伟公司(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用途趋势

- 商业

- 工业/设施

- 基础设施

- 住宅

- 重大基础设施计划(目前和已宣布)

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 最终用途部门

- 商业

- 工业/设施

- 基础设施

- 住宅

- 地区

- 亚太地区

- 按国家

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 韩国

- 泰国

- 越南

- 其他亚太地区

- 欧洲

- 按国家

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲国家

- 中东和非洲

- 按国家

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 北美洲

- 按国家

- 加拿大

- 墨西哥

- 美国

- 南美洲

- 按国家

- 阿根廷

- 巴西

- 南美洲其他地区

- 亚太地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Akzo Nobel NV

- Henkel AG & Co. KGaA

- Kansai Paint Co.,Ltd.

- KCC Corporation

- MBCC Group

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50002016

The Epoxy Flooring Resins Market size is estimated at 5.12 billion USD in 2024, and is expected to reach 6.83 billion USD by 2030, growing at a CAGR of 4.92% during the forecast period (2024-2030).

The rising demand for shopping malls & centers and offices is likely to drive the demand for epoxy flooring resins

- The global consumption value of epoxy flooring resins witnessed a 2.67% growth in 2022, driven by rising demand from the industrial & institutional and commercial construction sectors. In 2023, epoxy flooring resins are projected to capture 52% of the global flooring resins market.

- The industrial & institutional sector dominated the consumption of epoxy flooring resins, accounting for a significant 92.04% share in 2022. Globally, the new industrial floor area was expected to grow by 3.09% in 2023, primarily fueled by expanding warehousing spaces. Notably, the Indian industrial and warehousing sector saw a 7% rise in absorption, totaling 22.4 million sq. ft in H1 2023 compared to H1 2022. Heightened investments in industrial construction, like the projected USD 47.59 billion spending on new industrial buildings in the United States by 2026, are expected to bolster the demand for epoxy flooring resins. Consequently, the sector's consumption of epoxy flooring resins globally is projected to surge by USD 1.75 billion by 2030 compared to 2023.

- The commercial sector is projected to be the fastest-growing consumer of epoxy flooring resins, with a notable CAGR of 7.22% during the forecast period. The global new floor construction in the commercial sector is projected to reach 9.34 billion sq. ft by 2030, primarily driven by the surging demand for shopping malls, office spaces, and other commercial establishments. For instance, India's Grade A office market in the top seven cities is anticipated to expand to approximately 1 billion sq. ft by 2026, further scaling up to 1.2 billion sq. ft by 2030. Consequently, the global consumption of epoxy flooring resins in the commercial sector is estimated to increase from USD 243 million in 2023 to USD 397 million in 2030.

The rise in retail spaces is expected to drive the demand for epoxy flooring resins

- The global epoxy flooring resins market witnessed a growth of approximately 2.67% in 2022, surpassing the figures of 2021. Notably, Asia-Pacific and Europe emerged as the leading regions, capturing shares of 36.24% and 32.12%, respectively. The global epoxy flooring resins market was projected to expand by 4.34% in 2023, building on the growth of the previous year.

- In 2023, Asia-Pacific solidified its position as the dominant consumer of epoxy flooring resins, accounting for an estimated 36.15% of the global market. This surge in demand can be attributed to the region's escalating construction activities, driven by investments in sectors like industrial, healthcare, and retail. For instance, Indonesia is set to witness the completion of six shopping mall projects, collectively spanning 292 thousand sq. m, by 2025. Given this momentum, the epoxy flooring resins market in Asia-Pacific is poised to grow by a significant 40.21% by 2030 compared to its 2023 levels.

- Asia-Pacific is leading in consumption and is also projected to exhibit the highest CAGR of 5.62% during the forecast period. This growth is likely to be fueled by the region's surging demand for epoxy flooring resins, particularly in the industrial, institutional, and commercial sectors. Notably, the industrial and institutional floor area in the region is set to expand by 149 million sq. ft from 2023 to 2024. In India, major cities like Delhi NCR, Bangalore, and Hyderabad are expected to witness the opening of nearly 60 shopping malls, boasting a combined retail space of 23.25 million sq. ft, between 2023 and 2025. These trends indicate a robust trajectory for the region's epoxy flooring resins market, with projections pointing toward a value of USD 2.58 billion by 2030, up from USD 1.76 billion in 2023.

Global Epoxy Flooring Resins Market Trends

Asia-Pacific's surge in large-scale office building projects is set to elevate the global floor area dedicated to commercial construction

- In 2022, the global new floor area for commercial construction witnessed a modest growth of 0.15% from the previous year. Europe stood out with a significant surge of 12.70%, driven by a push for high-energy-efficient office buildings to align with its 2030 carbon emission targets. As employees returned to offices, European companies, resuming lease decisions, spurred the construction of 4.5 million square feet of new office space in 2022. This momentum is poised to persist in 2023, with a projected global growth rate of 4.26%.

- The COVID-19 pandemic caused labor and material shortages, leading to cancellations and delays in commercial construction projects. However, as lockdowns eased and construction activities resumed, the global new floor area for commercial construction surged by 11.11% in 2021, with Asia-Pacific taking the lead with a growth rate of 20.98%.

- Looking ahead, the global new floor area for commercial construction is set to achieve a CAGR of 4.56%. Asia-Pacific is anticipated to outpace other regions, with a projected CAGR of 5.16%. This growth is fueled by a flurry of commercial construction projects in China, India, South Korea, and Japan. Notably, major Chinese cities like Beijing, Shanghai, Hong Kong, and Taipei are gearing up for an uptick in Grade A office space construction. Additionally, India is set to witness the opening of approximately 60 shopping malls, spanning 23.25 million square feet, in its top seven cities between 2023 and 2025. Collectively, these endeavors across Asia-Pacific are expected to add a staggering 1.56 billion square feet to the new floor area for commercial construction by 2030, compared to 2022.

South America's estimated fastest growth in residential constructions due to increasing government investments in schemes for affordable housing to boost the global residential sector

- In 2022, the global new floor area for residential construction declined by around 289 million square feet compared to 2021. This can be attributed to the housing crisis generated due to the shortage of land, labor, and unsustainably high construction materials prices. This crisis severely impacted Asia-Pacific, where the new floor area declined 5.39% in 2022 compared to 2021. However, a more positive outlook is expected in 2023 as the global new floor area is predicted to grow by 3.31% compared to 2022, owing to government investments that can finance the construction of new affordable homes capable of accommodating 3 billion people by 2030.

- The COVID-19 pandemic caused an economic slowdown, due to which many residential construction projects got canceled or delayed, and the global new floor area declined by 4.79% in 2020 compared to 2019. As the restrictions were lifted in 2021 and pent-up demand for housing projects was released, new floor area grew 11.22% compared to 2020, with Europe having the highest growth of 18.28%, followed by South America, which rose 17.36% in 2021 compared to 2020.

- The global new floor area for residential construction is expected to register a CAGR of 3.81% during the forecast period, with South America predicted to develop at the fastest CAGR of 4.05%. Schemes and initiatives like the Minha Casa Minha Vida in Brazil announced in 2023 with a few regulatory changes, for which the government plans an investment of USD 1.98 billion to provide affordable housing units for low-income families, and the FOGAES in Chile also publicized in 2023, with an initial investment of USD 50 million, are aimed at providing mortgage loans to families for affordable housing and will encourage the construction of new residential units.

Epoxy Flooring Resins Industry Overview

The Epoxy Flooring Resins Market is fragmented, with the top five companies occupying 32.44%. The major players in this market are Henkel AG & Co. KGaA, PPG Industries, Inc., RPM International Inc., Sika AG and The Sherwin-Williams Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End Use Sector Trends

- 4.1.1 Commercial

- 4.1.2 Industrial and Institutional

- 4.1.3 Infrastructure

- 4.1.4 Residential

- 4.2 Major Infrastructure Projects (current And Announced)

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size, forecasts up to 2030 and analysis of growth prospects.)

- 5.1 End Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 Region

- 5.2.1 Asia-Pacific

- 5.2.1.1 By Country

- 5.2.1.1.1 Australia

- 5.2.1.1.2 China

- 5.2.1.1.3 India

- 5.2.1.1.4 Indonesia

- 5.2.1.1.5 Japan

- 5.2.1.1.6 Malaysia

- 5.2.1.1.7 South Korea

- 5.2.1.1.8 Thailand

- 5.2.1.1.9 Vietnam

- 5.2.1.1.10 Rest of Asia-Pacific

- 5.2.2 Europe

- 5.2.2.1 By Country

- 5.2.2.1.1 France

- 5.2.2.1.2 Germany

- 5.2.2.1.3 Italy

- 5.2.2.1.4 Russia

- 5.2.2.1.5 Spain

- 5.2.2.1.6 United Kingdom

- 5.2.2.1.7 Rest of Europe

- 5.2.3 Middle East and Africa

- 5.2.3.1 By Country

- 5.2.3.1.1 Saudi Arabia

- 5.2.3.1.2 United Arab Emirates

- 5.2.3.1.3 Rest of Middle East and Africa

- 5.2.4 North America

- 5.2.4.1 By Country

- 5.2.4.1.1 Canada

- 5.2.4.1.2 Mexico

- 5.2.4.1.3 United States

- 5.2.5 South America

- 5.2.5.1 By Country

- 5.2.5.1.1 Argentina

- 5.2.5.1.2 Brazil

- 5.2.5.1.3 Rest of South America

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Henkel AG & Co. KGaA

- 6.4.3 Kansai Paint Co.,Ltd.

- 6.4.4 KCC Corporation

- 6.4.5 MBCC Group

- 6.4.6 Nippon Paint Holdings Co., Ltd.

- 6.4.7 PPG Industries, Inc.

- 6.4.8 RPM International Inc.

- 6.4.9 Sika AG

- 6.4.10 The Sherwin-Williams Company

7 KEY STRATEGIC QUESTIONS FOR CONCRETE, MORTARS AND CONSTRUCTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219