|

市场调查报告书

商品编码

1684078

印尼防水解决方案:市场占有率分析、行业趋势和成长预测(2025-2030 年)Indonesia Waterproofing Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

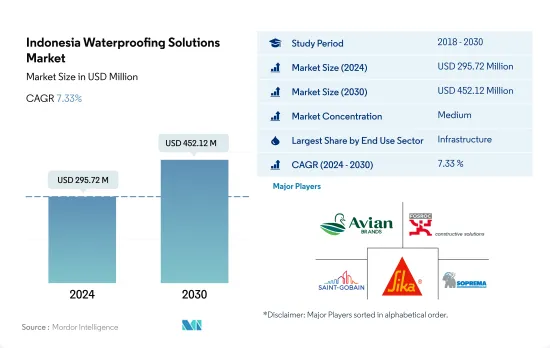

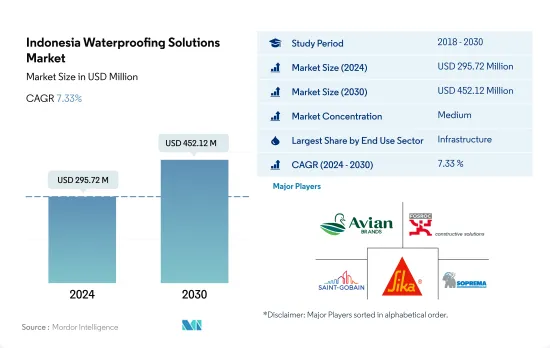

印尼防水解决方案市场规模预计在 2024 年为 2.9572 亿美元,预计到 2030 年将达到 4.5212 亿美元,预测期内(2024-2030 年)的复合年增长率为 7.33%。

住宅需求的增加可能会推动对防水解决方案的需求

- 2022年,受基础设施、住宅和商业建筑领域需求成长的推动,印尼防水解决方案的消费以金额为准成长了3.89%。到2023年,印尼的防水解决方案市场预计将占亚太市场的约2.13%。

- 基础设施终端用途领域是防水解决方案的最大消费者,2022 年占 27.49%。预计 2023 年基础设施支出将达到 582.7 亿美元。随着支出的增加,印尼对绿色基础设施(尤其是能源和交通领域的绿色基础设施)的关注带来了巨大的投资机会。到2030年,该国预计将需要3,228亿美元用于气候智慧型基础建设,其中能源和交通运输占75%,即2,450亿美元。因此,预计从 2023 年到 2030 年,该产业对防水解决方案的需求将成长 3,493 万美元。

- 预计印尼住宅领域将成为成长最快的消费支出领域,预测期内复合年增长率为 8.27%。 2023年,该国新建住宅占地面积将达7.78亿平方英尺。印尼政府(GOI)的目标是到2025年建造100万套住宅。由于住宅计划激增,该领域对防水解决方案的需求预计将从2023年的6,368万美元增加到2030年的1.11亿美元。

印尼防水解决方案市场趋势

预计到2028年,印尼商业房地产市场规模将达到1.39兆美元,可能会推动商业领域的需求。

- 2022年,印尼新建商业占地面积与前一年同期比较%。这一下降是由于新冠疫情期间建筑活动下降后恢復正常所致。疫情爆发前,印尼商业建筑的年能耗强度就已呈现下降趋势,年平均下降率为2.64%。然而,2023年将出现復苏,新的商业占地面积将成长5.7%,这得益于对新的办公室、仓库和零售空间需求激增的外国直接投资(FDI)。

- 在新冠疫情期间,印尼 2020 年和 2021 年新增商业占地面积大幅增加,达到约 960 万平方英尺。政府致力于振兴经济,并采取了诸如放宽私人和公共计划建筑相关隔离措施等措施。这使得员工可以返回工作现场,企业也可以继续运作。值得注意的是,印尼2020年完工建筑量预计将达到约1.32兆印尼盾,2021年将增加至1.42兆印尼盾。

- 预计到 2030 年,印尼的新商业占地面积将比 2023 年强劲成长约 58.72%。这一增长是由于对购物中心、办公室和其他商业空间的需求不断增长。零售房地产领域已成为该国特别有吸引力的行业。例如,商业房地产市场预计到2028年将达到1.39兆美元。印尼新的商业占地面积预计将保持稳定成长,预测期内复合年增长率为6.82%。

住宅需求的增加可能会推动住宅产业的成长

- 2022 年,印尼的新住宅占地面积与 2021 年相比成长了 7.10%。这一增长是由人口增长、富裕和都市化所推动的。预计到 2022 年,政府主导的住宅支持将达到印尼币,根据住宅融资流动性便利计划,到 2023 年将增至印尼币。该倡议旨在建造至少 22 万套住宅。住宅建筑业将经历显着成长。预计到 2023 年,这一数字与前一年同期比较增加至约 5,600 万平方英尺。

- 2020年,印尼新建住宅占地面积较2019年成长7.06%。这是政府的一项策略性倡议,旨在优先发展建筑业,以缓解景气衰退并支持收入减少的家庭。因此,包括隔离在内的建设活动限制已大大放宽。然而,2021年趋势逆转,住宅开工占地面积下降约12.54%。这主要是由于建筑业的外国直接投资(FDI)下降。 2021年建筑业外国直接投资与前一年同期比较减51%。

- 预测期内,印尼的新住宅占地面积预计将以 6.08% 的复合年增长率增长。这一增长归功于该国日益加快的都市化,这得益于政府倡议以及国内外投资的推动。这些因素直接或间接地加剧了该国日益增长的住宅需求,并最终促进了住宅建设。为了满足不断增长的需求,预计到 2030 年每年将需要 82 万至 100 万套住宅。

印尼防水解决方案产业概况

印尼防水解决方案市场正在慢慢整合,前五大公司占据45.62%的市场。该市场的主要企业有:Avian Brands、Fosroc, Inc.、Saint-Gobain、Sika AG 和 Soprema(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用途趋势

- 商业

- 工业/设施

- 基础设施

- 住宅

- 重大基础设施计划(目前和已宣布)

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 最终用途部门

- 商业

- 工业/设施

- 基础设施

- 住宅

- 子产品

- 化学产品

- 依技术

- 环氧型

- 聚氨酯

- 水性

- 其他技术

- 膜

- 依技术

- 冷液

- 全黏性片材

- 热液体

- 鬆铺布

- 化学产品

第六章竞争格局

- 重大策略倡议

- 市场占有率分析

- 商业状况

- 公司简介

- Ardex Group

- Avian Brands

- Fosroc, Inc.

- MAPEI SpA

- Normet

- PT. ASPAL POLIMER EMULSINDO

- PT. Selaras Cipta Global

- Saint-Gobain

- Sika AG

- Soprema

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50002031

The Indonesia Waterproofing Solutions Market size is estimated at 295.72 million USD in 2024, and is expected to reach 452.12 million USD by 2030, growing at a CAGR of 7.33% during the forecast period (2024-2030).

Rising demand for housing units is likely to drive the demand for waterproofing solutions

- In 2022, the consumption of waterproofing solutions in Indonesia saw a 3.89% growth in terms of value, driven by rising demand from the infrastructure, residential, and commercial construction sectors. By 2023, the Indonesian waterproofing solutions market was expected to make up approximately 2.13% of the broader Asia-Pacific market.

- The infrastructure end-use sector stands as the largest consumer of waterproofing solutions, accounting for 27.49% in 2022. Infrastructure spending was anticipated to amount to a value of USD 58.27 billion in 2023. Owing to the growing spending, Indonesia's focus on green infrastructure, especially in energy and transportation, presents a significant investment opportunity. By 2030, the country is projected to require USD 322.8 billion for climate-compatible infrastructure, with energy and transport accounting for 75% at USD 245 billion. Consequently, the sector's demand for waterproofing solutions is projected to rise by USD 34.93 million from 2023 to 2030.

- Indonesia's residential sector is poised to be the fastest-growing consumer, with a CAGR of 8.27% during the forecast period. The country's new residential floor area was set to hit 778 million sq. ft in 2023. The Government of Indonesia (GOI) aims to construct 1 million housing units by 2025, as the nation's housing needs are estimated to reach 30 million units. This surge in housing projects is expected to drive the sector's demand for waterproofing solutions to USD 111 million by 2030, up from USD 63.68 million in 2023.

Indonesia Waterproofing Solutions Market Trends

Indonesian commercial real estate market volume is projected to reach USD 1.39 trillion by 2028 and is likely to augment the demand for commercial sector

- In 2022, Indonesia witnessed a 9.7% decline in the volume of new commercial floor area compared to the previous year. This drop was a result of a return to normalcy following a decline in building activities during the COVID-19 pandemic. Even before the pandemic, commercial buildings in Indonesia were already showing a downward trend in annual energy intensity, accounting for a rate of 2.64% per year. However, in 2023, the country saw a rebound, registering a 5.7% increase in the volume of new commercial floor area, driven by a surge in foreign direct investment (FDI) necessitating new offices, warehouses, and retail spaces.

- Amidst the COVID-19 pandemic, in 2020 and 2021, Indonesia witnessed a significant surge in the volume of new commercial floor area, accounting for approximately 9.6 million square feet. The government's focus on revitalizing the economy led to measures such as easing construction-related quarantines, both in private and public projects. This allowed employees to resume work on-site and companies to continue their operations. Notably, the value of completed constructions in Indonesia stood at around IDR 1.32 quadrillion in 2020 and rose to IDR 1.42 quadrillion in 2021.

- The volume of new commercial floor area in Indonesia is projected to witness a robust growth of around 58.72% by 2030 compared to 2023. This surge is driven by a rising demand for shopping malls, offices, and other commercial spaces. The retail real estate segment is emerging as a particularly captivating sector in the country. For instance, the volume of the commercial real estate market is anticipated to reach USD 1.39 trillion by 2028. The commercial new floor area in Indonesia is expected to maintain steady growth, registering a CAGR of 6.82% during the forecast period.

Increase in demand for housing units is likely to augment the residential sector's growth

- In 2022, Indonesia witnessed a 7.10% volume growth in residential new floor area compared to 2021. This surge can be attributed to increased population, wealth, and urbanization. The government-led housing aid reached IDR 29 trillion in 2022, which was projected to increase to IDR 32 trillion in 2023 under the Housing Financing Liquidity Facility scheme. This initiative aims to construct at least 220 thousand houses. The residential construction sector is poised to witness a significant growth rate. It was estimated to increase to approximately 56 million square feet in 2023 compared to the preceding year.

- In 2020, the volume of residential new floor areas in Indonesia grew by 7.06% compared to 2019. This was a strategic move by the government, prioritizing construction to mitigate the economic downturn and support households grappling with reduced incomes. Consequently, restrictions on construction activities, including quarantines, were significantly eased. However, in 2021, the trend reversed, with a decline of about 12.54% in residential new floor area, primarily attributed to a dip in foreign direct investment (FDI) in the construction sector. FDI for construction plummeted by 51% in 2021 compared to the previous year.

- The residential new floor area in Indonesia is projected to witness a CAGR of 6.08% in volume during the forecast period. This growth stems from the country's increasing urbanization, bolstered by government initiatives and foreign and domestic investments. These factors, directly and indirectly, underscore the mounting housing needs in the nation, ultimately driving residential building construction. Projections indicate that to meet the escalating demand, the country would require between 820,000 and 1 million housing units annually by 2030.

Indonesia Waterproofing Solutions Industry Overview

The Indonesia Waterproofing Solutions Market is moderately consolidated, with the top five companies occupying 45.62%. The major players in this market are Avian Brands, Fosroc, Inc., Saint-Gobain, Sika AG and Soprema (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End Use Sector Trends

- 4.1.1 Commercial

- 4.1.2 Industrial and Institutional

- 4.1.3 Infrastructure

- 4.1.4 Residential

- 4.2 Major Infrastructure Projects (current And Announced)

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size, forecasts up to 2030 and analysis of growth prospects.)

- 5.1 End Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 Sub Product

- 5.2.1 Chemicals

- 5.2.1.1 By Technology

- 5.2.1.1.1 Epoxy-based

- 5.2.1.1.2 Polyurethane-based

- 5.2.1.1.3 Water-based

- 5.2.1.1.4 Other Technologies

- 5.2.2 Membranes

- 5.2.2.1 By Technology

- 5.2.2.1.1 Cold Liquid Applied

- 5.2.2.1.2 Fully Adhered Sheet

- 5.2.2.1.3 Hot Liquid Applied

- 5.2.2.1.4 Loose Laid Sheet

- 5.2.1 Chemicals

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ardex Group

- 6.4.2 Avian Brands

- 6.4.3 Fosroc, Inc.

- 6.4.4 MAPEI S.p.A.

- 6.4.5 Normet

- 6.4.6 PT. ASPAL POLIMER EMULSINDO

- 6.4.7 PT. Selaras Cipta Global

- 6.4.8 Saint-Gobain

- 6.4.9 Sika AG

- 6.4.10 Soprema

7 KEY STRATEGIC QUESTIONS FOR CONCRETE, MORTARS AND CONSTRUCTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219