|

市场调查报告书

商品编码

1685672

水溶性聚合物:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Water-soluble Polymer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

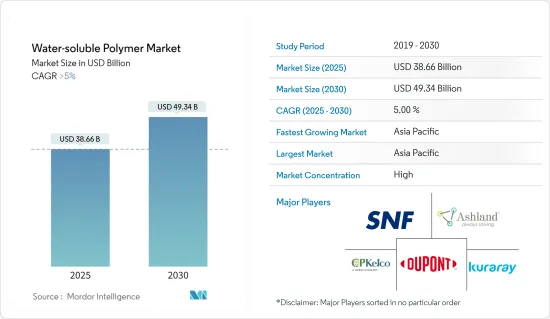

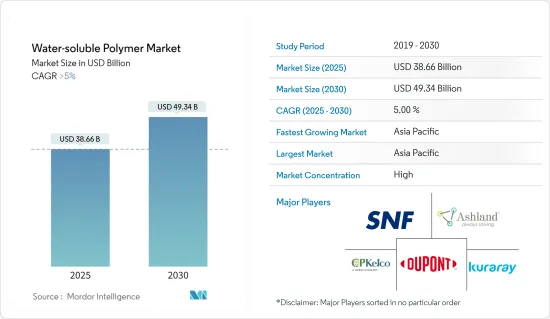

预计 2025 年水溶性聚合物市场规模为 386.6 亿美元,到 2030 年将达到 493.4 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 5%。

COVID-19 疫情对水溶性聚合物市场产生了负面影响。工业活动放缓、供应链中断以及消费行为的变化影响了这些产业对水溶性聚合物的需求。许多使用水溶性聚合物的行业,包括水处理、纺织、个人护理和食品加工,在疫情期间都遭遇停工或暂停。但随着经济状况改善和计划恢復,上述产业用于聚合物的需求增加。

推动市场成长的因素是北美页岩气产业的成长和全球水处理产业对水溶性聚合物的需求不断增加。

然而,预测期内原物料价格的波动预计将阻碍水溶性聚合物市场的成长。

预测期内,生物基丙烯酰胺的需求不断增长以及水溶性聚合物在製药行业的广泛应用预计将为製造商提供各种机会。

亚太地区在全球水溶性聚合物市场中占据主导地位,预计在预测期内将保持最高的复合年增长率。

水溶性聚合物市场趋势

预计预测期内水处理产业将占据市场主导地位

- 有关水质和环境保护的严格规定正在推动对水处理解决方案的需求。水溶性聚合物在水处理过程中发挥至关重要的作用,它可以去除污水和饮用水源中的有机物、悬浮固体和重金属等污染物,确保符合监管标准。

- 对污水处理厂等市政基础设施以及化学处理设施、纸浆和造纸厂以及纺织製造厂等工业基础设施的投资,正在推动对水处理化学品(包括水溶性聚合物)的需求。这些聚合物用于市政和工业污水处理过程中的各种用途,包括污泥脱水、沉淀和浓缩。

- 达拉斯联邦储备银行公布的资料显示,2023年1月,除美国以外的全球工业生产成长0.67%。

- 德国的水处理市场是欧洲最大的。水处理活动的活性化(主要是在该国北部地区)正在推动对水处理聚合物的需求。据联邦环境与自然保护部称,该国水和废水处理行业每年的收入约为 220 亿欧元(约 233.3 亿美元)。

- 2024年1月,Gradiant旗下的H+E公司在德国订单合同,为一家最大的半导体工厂建造一座水处理厂。计划即将开工,预计2025年完工。

- 根据印度政府水利部发布的报告,2022财年,61.5%的农村人口将透过管道系统在其住所获得安全、充足的饮用水。近年来,印度农村地区能够获得安全饮用水的人口数量已从2016财年的不到40%大幅增加。

- 人们越来越重视永续的水资源管理实践和在水处理过程中使用环保化学品。生物分解性、无毒、水溶性聚合物是环保产业和政府的首选,它们希望减少对环境的影响,同时确保有效的水处理。

- 由于这些因素,预计预测期内水处理行业的成长将推动市场发展。

预计亚太地区将在预测期内占据市场主导地位

- 亚太地区的快速工业化正在推动各行业对水溶性聚合物的需求,包括水处理、食品加工、製药、个人护理和农业。

- 农业是亚太许多国家的重要产业。水溶性聚合物在农业中用于改善土壤状况,防止侵蚀,并提高干旱和半干旱地区的保水性。随着农业现代化和机械化的发展,这些聚合物的需求预计会增加。

- 根据印尼统计局和印尼农业部的数据,印尼棕榈油产量将从2017年的3,494万吨增加到2022年的4,558万吨。

- 根据菲律宾统计局发布的资料,预计2022年菲律宾玉米产量将达826万吨,高于2016年的722万吨。

- 亚太地区建设产业正在蓬勃发展,尤其是中国、印度和东南亚。水溶性聚合物广泛应用于水泥系统、砂浆和水泥浆等建筑材料中,并占据了市场主导地位。

- 根据日本国土交通省发布的报告,日本建筑总投资预计将从2018年的61.83兆元(4,100亿美元)增加到2023年的70.32兆元人民币(4,700亿美元)。

- 由于上述因素,预测期内亚太地区预计将主导水溶性聚合物市场。

水溶性聚合物产业概况

水溶性聚合物市场比较分散。主要参与者(不分先后顺序)包括 SNF Group、Ashland、杜邦、CP Kelco US Inc. 和阿科玛。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 北美页岩气产业的成长

- 亚太地区水处理产业快速成长

- 限制因素

- 原物料价格波动

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 类型

- 聚丙烯酰胺

- 聚乙烯醇

- 瓜尔胶

- 明胶

- 黄原胶

- 聚丙烯酸

- 聚乙二醇

- 其他类型(纤维素醚、果胶、淀粉)

- 最终用户产业

- 水疗

- 饮食

- 个人护理和卫生

- 石油和天然气

- 纸浆和造纸

- 药品

- 其他最终用户产业(农药)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 土耳其

- 俄罗斯

- 北欧的

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 埃及

- 卡达

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Arkema

- Ashland

- BASF SE

- CP Kelco US Inc.

- DuPont

- Gantrade Corporation

- Kemira

- Kuraray Co. Ltd

- Merck KGaA

- Mitsubishi Chemical Corporation

- Nouryon

- Polysciences Inc.

- SNF Group

- Sumitomo Seika Chemicals Co. Ltd

第七章 市场机会与未来趋势

- 生物基丙烯酰胺需求不断成长

- 扩大在製药业的应用

The Water-soluble Polymer Market size is estimated at USD 38.66 billion in 2025, and is expected to reach USD 49.34 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively affected the water-soluble polymer market. Reduced industrial activity, supply chain disruptions, and changes in consumer behavior affected demand for water-soluble polymers in these industries. Many industries utilizing water-soluble polymers, such as water treatment, textiles, personal care, and food processing, experienced slowdowns or temporary shutdowns during the pandemic. However, as economic conditions improved and projects resumed, the demand for polymers used in the abovementioned industries increased.

The factors driving the market's growth are the growing shale gas industry in North America and the rising demand for water-soluble polymers from the global water treatment industry.

However, fluctuations in raw material prices are expected to hamper the growth of the water-soluble polymer market during the forecast period.

The rising demand for bio-based acrylamide and growing applications of water-soluble polymers in the pharmaceutical industry are expected to offer various opportunities for manufacturers during the forecast period.

Asia-Pacific dominated the global water-soluble polymer market, and it is projected to hold the highest CAGR during the forecast period.

Water-soluble Polymer Market Trends

The Water Treatment Industry is Expected to Dominate the Market during the Forecast Period

- Stringent regulations for water quality and environmental protection drive the demand for water treatment solutions. Water-soluble polymers play a crucial role in water treatment processes by aiding in the removal of contaminants, such as organic matter, suspended solids, and heavy metals, from wastewater and drinking water sources to meet regulatory standards.

- Investments in municipal infrastructure, such as sewage treatment plants, and industrial infrastructure, including chemical processing facilities, pulp and paper mills, and textile manufacturing plants, drive the demand for water treatment chemicals, including water-soluble polymers. These polymers are utilized for various purposes, such as sludge dewatering, sedimentation, and thickening, in both municipal and industrial wastewater treatment processes.

- Global industrial production, excluding the United States, increased by 0.67 in January 2023, according to the data published by the Federal Reserve Bank of Dallas.

- The German water treatment market is the largest in Europe. The increasing water treatment activities, primarily in the country's northern region, are boosting the demand for water treatment polymers. According to the Federal Ministry for the Environment and Nature Conservation, the country's water supply and wastewater treatment industries account for about EUR 22 billion ( approximately USD 23.33 billion) annually.

- In January 2024, Gradiant's H+E won a contract in Germany to build a water treatment facility for one of the largest semiconductor fabs. The project is expected to commence soon and be completed in 2025.

- According to the report published by the Ministry of Jal Shakti of the Government of India, 61.5% of the rural population had access to safe and adequate drinking water in their premises through a pipe system during the financial year 2022. In recent years, the number of rural people in India who have access to safe drinking water has increased significantly, from less than 40% in the financial year 2016.

- There is a growing emphasis on sustainable water management practices and the use of eco-friendly chemicals in water treatment processes. Water-soluble polymers that are biodegradable and non-toxic are preferred choices for eco-conscious industries and governments aiming to reduce their environmental footprint while ensuring effective water treatment.

- Due to these factors, the growth in the water treatment industry is anticipated to drive the market over the forecast period.

Asia-Pacific is Expected to Dominate the Market during the Forecast Period

- Asia-Pacific is experiencing rapid industrialization, leading to increased demand for water-soluble polymers across various industries such as water treatment, food processing, pharmaceuticals, personal care, and agriculture.

- Agriculture is a significant industry in many Asia-Pacific countries. Water-soluble polymers are used in agriculture for soil conditioning, erosion control, and improving water retention in arid and semi-arid regions. As agricultural practices modernize and mechanize, the demand for these polymers is expected to rise.

- According to Statistics Indonesia and the Ministry of Agriculture Indonesia, the production volume of palm oil in Indonesia increased from 34.94 million metric tons in 2017 to 45.58 million metric tons in 2022.

- According to the data published by the Philippine Statistics Authority, the production volume of corn in the Philippines reached 8.26 million metric tons in 2022, which increased from 7.22 million metric tons in 2016.

- The Asia-Pacific construction industry is booming, especially in China, India, and Southeast Asia. Water-soluble polymers are extensively used in construction materials such as cementitious systems, mortars, and grouts, contributing to their dominance in the market.

- According to the report released by the Ministry of Land, Infrastructure, Transport and Tourism, the total investment in construction in Japan increased from CNY 61.83 trillion (USD 0.41 trillion) in 2018 to CNY 70.32 trillion (USD 0.47 trillion) in 2023.

- Based on the abovementioned factors, Asia-Pacific is expected to dominate the water-soluble polymer market during the forecast period.

Water-soluble Polymer Industry Overview

The water-soluble polymer market is fragmented in nature. The major players (not in any particular order) include SNF Group, Ashland, DuPont, CP Kelco U.S. Inc., and Arkema.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Shale Gas Industry in North America

- 4.1.2 Surging Water Treatment Industry in Asia-Pacific

- 4.2 Restraints

- 4.2.1 Fluctuating Prices of Raw Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Polyacrylamide

- 5.1.2 Polyvinyl Alcohol

- 5.1.3 Guar Gum

- 5.1.4 Gelatin

- 5.1.5 Xanthan Gum

- 5.1.6 Polyacrylic Acid

- 5.1.7 Polyethylene Glycol

- 5.1.8 Other Types (Cellulose Ethers, Pectin, and Starch)

- 5.2 End-user Industry

- 5.2.1 Water Treatment

- 5.2.2 Food and Beverage

- 5.2.3 Personal Care and Hygiene

- 5.2.4 Oil and Gas

- 5.2.5 Pulp and Paper

- 5.2.6 Pharmaceutical

- 5.2.7 Other End-user Industries (Agrochemicals)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Malaysia

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Ashland

- 6.4.3 BASF SE

- 6.4.4 CP Kelco U.S. Inc.

- 6.4.5 DuPont

- 6.4.6 Gantrade Corporation

- 6.4.7 Kemira

- 6.4.8 Kuraray Co. Ltd

- 6.4.9 Merck KGaA

- 6.4.10 Mitsubishi Chemical Corporation

- 6.4.11 Nouryon

- 6.4.12 Polysciences Inc.

- 6.4.13 SNF Group

- 6.4.14 Sumitomo Seika Chemicals Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Acrylamide

- 7.2 Growing Application in the Pharmaceutical Industry