|

市场调查报告书

商品编码

1685678

异丙苯:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Cumene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

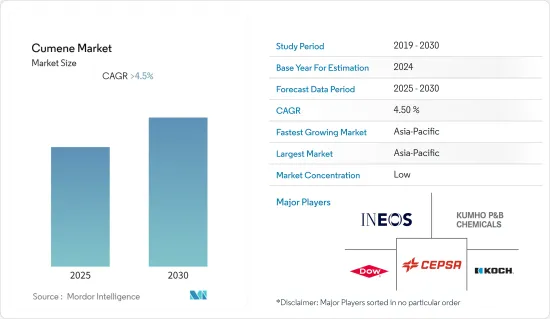

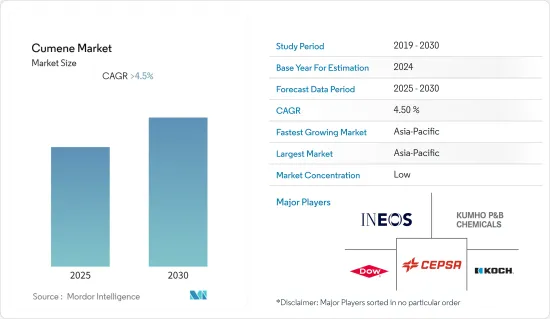

预测期内,异丙苯市场预计将以超过 4.5% 的复合年增长率成长。

2020年突然爆发的新冠疫情导致全球市场对异丙苯的需求下降,进而导致对异丙苯的苯酚和丙酮衍生物的需求下降。由于工业活动停止,苯酚市场部门从 2020 年初到 2021 年中期成长率放缓。 COVID-19对产业、地区以及后续供应链营运的影响导致苯酚产量下降。此外,疫情也影响了异丙苯的主要终端用户产业,如化妆品和个人护理、油漆和搪瓷、高辛烷值航空燃料以及聚合物产业,由于销量减少,导致异丙苯的需求长期疲软。然而,由于建设业等消耗异丙苯及其衍生产品的各种终端用户行业的活动迅速增加,预计市场将在疫情后实现强劲增长。

主要亮点

- 从中期来看,塑胶产业对苯酚的需求增加以及作为溶剂的丙酮的高消耗力是市场成长的主要驱动力。

- 另一方面,长期接触异丙苯及其衍生物的有害影响预计会严重阻碍市场成长。

- 然而,双酚 A (BPA) 的投资和应用不断增加可能很快为全球市场创造有利的成长机会。

- 预计预测期内亚太地区将主导全球市场。预计在预测期内,其复合年增长率也将达到最高。

异丙苯市场趋势

苯酚领域需求不断成长

- 异丙苯的主要用途之一是生产苯酚。异丙苯与分子氧进行液相氧化,生成氢异丙苯过氧化氢,再在催化剂的作用下进一步分解为苯酚和丙酮。

- 苯酚在许多工业中发挥关键作用。酚醛树脂的常见用途包括胶合板、窗玻璃、DVD 和 CD、电脑、体育用品、玻璃纤维船、汽车零件和配件、电路基板和平面电视。

- 汽车工业的成长对于苯酚市场的成长至关重要,这反过来又增加了对异丙苯的需求。过去几年,汽车产业取得了长足的成长。根据OICA的数据,2021年汽车产量为80,145,988辆,较2020年成长3%。

- 苯酚也是胶合板、定向刨花板等木製品中使用的酚醛胶黏剂的主要成分。它也是生产清洁剂、杀虫剂、药物、塑化剂和染料的宝贵中间体。

- 苯酚最大的单一市场是生产由苯酚和丙酮製成的双酚A (BPA)。 BPA 用于生产聚碳酸酯和环氧树脂,并有多种用途。

- 根据经济产业省统计,2021年日本苯酚产量达61.77万吨,2020年为55.169万吨,成长率为11.9%。苯酚产量的增加可能在未来推动异丙苯消费量的增加。

中国主导亚太市场

- 在亚太地区,中国占据区域主导地位。由于在各种化学製程中需求量很大,异丙苯是一种领先的大宗化学品。异丙苯的主要用途是作为苯酚和丙酮生产的中间体。亚太国家化学製造业的扩张和不断增长的终端用户需求为异丙苯的市场提供了积极的动力。

- 少量的异丙苯也可用作油漆、亮漆和搪瓷的稀释剂,以及油漆和其他被覆剂的溶剂。目前,中国占据全球涂料市场的四分之一以上。日本涂料公司 (Nippon Paint) 已开始透过升级其位于中国的新工厂的涂料生产流程来进军这一市场。 2021年中国企业收益价值为3791亿元(545.5亿美元)。

- 2021年5月,PPG宣布完成对中国嘉定油漆涂料工厂1,300万美元的投资。其中包括八条新的粉末涂料生产线和粉末涂料技术中心的扩建,预计将增强 PPG 的研发能力。预计此次扩建将使该工厂的年生产能力增加8,000吨以上。

- 异丙苯也可用作汽油混合物,为喷射机和民航机提供高辛烷值航空燃料。此外,根据中国民航局的数据,中国是国内航空客运最大的市场之一。过去五年来,中国民航机持有稳定成长。

- 根据中国航空运输协会统计,截至2021年6月,中国共有通用航空飞机3066架,其中涡轮螺旋桨、活塞飞机1583架,直升机1049架,喷射机360总合,其他通用航空飞机74架。

异丙苯产业概览

全球异丙苯市场较为分散。主要市场参与者(不分先后顺序)包括 Cepsa、INEOS、Kumho P&B Chemicals Inc.、Dow 和 Koch Industries Inc.

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 塑胶产业对苯酚的需求不断增加

- 增加使用丙酮作为溶剂

- 限制因素

- 长期接触的有害影响

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 原料分析

- 技术简介

- 贸易分析

- 价格趋势

- 监理政策分析

第五章 市场区隔

- 催化剂类型

- 氯化铝催化剂

- 固体磷酸(SPA)催化剂

- 沸石催化剂

- 其他催化剂类型

- 应用

- 苯酚

- 丙酮

- 其他用途(油漆、搪瓷、航空燃料等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Braskem

- Cepsa

- Chang Chun Group

- CITGO Petroleum Corporation

- Domo Chemicals

- Dow

- INEOS

- Koch Industries Inc.

- Kumho P&B Chemicals Inc.

- Prasol Chemicals Pvt. Ltd

- Shell PLC

- SABIC

- Versalis SpA

第七章 市场机会与未来趋势

- 增加对双酚A(BPA)的投资和使用

The Cumene Market is expected to register a CAGR of greater than 4.5% during the forecast period.

The sudden onset of the COVID-19 pandemic in 2020 caused demand for cumene to decline in the global market, leading to low demand for phenol and acetone derivatives of cumene. The phenol market segment witnessed a lower growth rate from early 2020 to mid-2021 owing to the suspension of industrial activities. The production of phenol decreased due to the impact of COVID-19 on the industry, the region, and subsequent supply chain operations. Moreover, the pandemic affected the major end-user industries of cumene, such as cosmetics and personal care, paints and enamels, high-octane aviation fuels, and polymer industries, where declined sales weakened the demand for cumene for a long period. However, the market is projected to grow steadily, owing to a rapid headstart in activities of various end-user industries such as construction and others, which consume cumene and its derivative-based products, post the pandemic retraction.

Key Highlights

- Over the medium term, the increasing demand for phenol from the plastic industry and the large consumption of acetone as a solvent are major factors driving the growth of the market studied.

- On the flip side, harmful effects ehibited by cumene and its derivatives due to extended exposure is anticipated to significantly hinder the market's growth.

- Nevertheless, the rising investments and applications of bisphenol A (BPA) is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific is expected to dominate the global market during the forecast period. Also, it is expected to register the highest CAGR during the forecast period.

Cumene Market Trends

Increasing Demand from Phenol Segment

- One of the major applications of cumene is in the production of phenol. The liquid-phase oxidation of cumene with molecular oxygen forms cumene hydroperoxide, further decomposed with a catalyst into phenol and acetone.

- Phenol plays a major role in many industries. Some common applications of phenol include plywood, window glazing, DVDs and CDs, computers, sports equipment, fiberglass boats, automotive parts and accessories, circuit boards, and flat-panel televisions.

- The growth in the automotive sector is imperative to the growth of the phenol market, which in turn increases the demand for cumene. The automotive industry registered massive growth in the past few years. According to OICA, the total number of vehicles produced in 2021 was 80,145,988, a growth of 3% compared to 2020.

- Phenol is also a major component in phenolic adhesives used in wood products such as plywood and oriented strand board. Also, it is a valuable intermediate in producing detergents, agricultural chemicals, medicines, plasticizers, and dyes.

- The largest single market for phenol is in the production of Bisphenol A (BPA), which is manufactured from phenol and acetone. BPA, in turn, is used in the manufacturing of polycarbonate and epoxy resins which are used in many different sectors, making phenol a major component in end-user sectors thus triggering its production in different regions.

- According to the Ministry of Economy Trade and Industry (METI), the total production volume of phenol in Japan amounted to 617.7 thousand tons in 2021 and registered a growth rate of 11.9% compared to 551.69 thousand tons in 2020. Higher production rates of phenol are likely to drive up the consumption rate of cumene in the future.

China to Dominate the Asia-Pacific Market

- In the Asia-Pacific, China dominates the regional market share. Cumene is a top commodity chemical due to its high demand in various chemical processes. The primary use of cumene is as an intermediate in producing phenol and acetone. The expanding chemical manufacturing sector and growing end-user demand in Asia-Pacific countries support the positive market dynamics of cumene.

- Small amounts of cumene are also used as thinners for paints, lacquers, and enamels and as solvents in paints and other coatings. China accounts for more than one-fourth of the global coatings market presently. Nippon has been tapping into this market by upgrading its coatings production process across its new plants in China. The company's revenue in China was valued at CNY 379.1 billion (USD 54.55 billion) in 2021.

- In May 2021, PPG announced the completion of its USD 13 million investment in its Jiading, China, paint and coatings facility, including eight new powder coating production lines and an expanded powder coatings technology center that is expected to enhance PPG's research and development capabilities. The expansion is likely to increase the plant's capacity by more than 8,000 tons per year.

- Cumene is also used as a gasoline blend for providing high octane aviation fuel, which is being used in the jet and commercial aircrafts. Additionally, according to the Civil Aviation Administration of China (CAAC), China is one of the largest markets for domestic air passengers. The civil aircraft fleet in the country has been increasing steadily for the last five years.

- According to the China Aviation Transportation Association, China had a total of 3,066 general aviation aircraft, including 1,583 turboprops and piston airplanes and 1,049 helicopters as well as 360 business jets and 74 other general aviation aircrafts as of June 2021.

Cumene Industry Overview

The global cumene market is fragmented in nature. The major market players (in no particular order) include Cepsa, INEOS, Kumho P&B Chemicals Inc., Dow, and Koch Industries Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Phenol from the Plastic Industry

- 4.1.2 Increasing Use of Acetone as a Solvent

- 4.2 Restraints

- 4.2.1 Harmful Effects Due to Extended Exposure

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

- 4.6 Technological Snapshot

- 4.7 Trade Analysis

- 4.8 Price Trends

- 4.9 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Catalyst Type

- 5.1.1 Aluminum Chloride Catalyst

- 5.1.2 Solid Phosphoric Acid (SPA) Catalyst

- 5.1.3 Zeolite Catalyst

- 5.1.4 Other Catalyst Types

- 5.2 Application

- 5.2.1 Phenol

- 5.2.2 Acetone

- 5.2.3 Other Applications (Including Paints, Enamels, Aviation Fuels, and Others)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 US

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 UK

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Braskem

- 6.4.2 Cepsa

- 6.4.3 Chang Chun Group

- 6.4.4 CITGO Petroleum Corporation

- 6.4.5 Domo Chemicals

- 6.4.6 Dow

- 6.4.7 INEOS

- 6.4.8 Koch Industries Inc.

- 6.4.9 Kumho P&B Chemicals Inc.

- 6.4.10 Prasol Chemicals Pvt. Ltd

- 6.4.11 Shell PLC

- 6.4.12 SABIC

- 6.4.13 Versalis S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Investments and Applications of Bisphenol A (BPA)