|

市场调查报告书

商品编码

1685682

颜料-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Pigments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

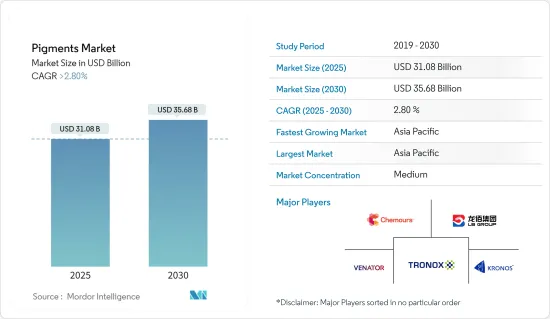

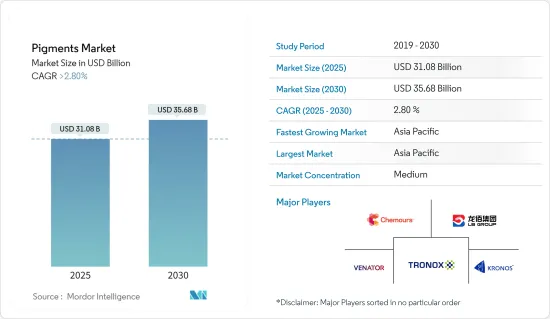

预计 2025 年颜料市场规模为 310.8 亿美元,到 2030 年将达到 356.8 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 2.8%。

主要亮点

- 2020 年,新冠疫情对市场产生了负面影响。全球供应链中断,加上油漆涂料、塑胶和纺织品等多个终端用户产业的需求减少,阻碍了颜料需求。

- 然而,随着消费者在家中度过更多时间并专注于住宅装修计划,市场开始復苏,住宅建筑业也开始復苏。由于人们对清洁和卫生的日益关注,防护涂料和消毒涂料的需求量很大。

- 从中期来看,新兴市场油漆和涂料行业需求的不断增长以及复杂无机颜料在各种应用中的不断扩大的使用是推动市场发展的关键因素。

- 然而,严格的政府法规和对颜料的反倾销税等因素阻碍了市场的成长。此外,环保产品的转变和对 3D 列印材料的需求不断增加等因素也为所研究的市场带来了机会。

- 亚太地区占据全球市场主导地位,其中最大的消费国是中国、印度和日本等国家。

颜料市场趋势

涂料产业需求不断成长

- 颜料是不溶性颗粒材料,负责为油漆和被覆剂提供颜色、不透明度、光泽控制、流变控制、腐蚀抑制和其他特定性能。

- 颜料被认为是油漆和涂料中的重要成分,因为它们可以赋予颜色,也可以作为体积填料帮助降低油漆成本。

- 根据世界油漆和涂料工业协会(WPCIA)的数据,2022 年油漆和涂料行业销售额排名前五的公司分别是剪切机伟、PPG 工业、阿克苏诺贝尔、立邦涂料和 RPM 国际。

- 根据德国联邦统计局的数据,到 2024 年,德国油漆、清漆和类似涂料、印刷油墨和胶粘剂的行业销售额预计将达到约 129.4 亿美元,从而有可能增加油漆和涂料行业使用的颜料的消费量。

- 此外,2022 年 11 月,剪切机司举行了奠基仪式,标誌着其位于北卡罗来纳州斯泰茨维尔的现有製造工厂扩建工程开始动工。此次扩建旨在大幅提高该公司建筑涂料和涂料产品的年生产能力。预计于2024年终完工,从而增加油漆和被覆剂中使用的颜料的需求。

- 预计所有上述因素都将对未来几年的市场成长产生重大影响。

亚太地区占市场主导地位

- 考虑到中国和印度等国家各种应用的巨大需求,亚太地区将主导市场成长。

- 中国占全球涂料市场的四分之一以上。根据中国涂料工业协会统计,近年来,涂料产业成长率达到7%左右。根据欧洲涂料协会统计,中国有近1万家涂料製造商。

- 2022年7月,BASF涂料业务扩大了其位于中国南方广东省江门市涂料基地的汽车修补被覆剂产能。随着扩建工程的完成,BASF汽车修补漆的年产能将提升至3万吨。

- 印度23财年的染料和颜料产量将达到398,000吨,比22财年的产量增加近22%。

- 根据印度工商联合会估计,到 2022 年,印度印刷业的产值将达到约 2,500 亿印度卢比(30 亿美元)。印度对油墨的需求不断增加,带动了多个扩建计划。例如

- 领先的印刷油墨製造商 DIC 株式会社于 2022 年 3 月在古吉拉突邦鲁奇区 Saykha 开设了新的无甲苯工厂 Optima,用于生产液体油墨。工厂用地面积92500平方公尺,第一期可分两班生产TF、KF/NTNK(无甲苯/无酮)液体油墨10000余吨。预计製造设施的扩张将在预测期内推动市场成长。

- 因此,所有这些扩张活动和适当的政府措施预计将促进该地区的建设活动,进一步扩大对油漆和涂料的需求,从而增加对颜料的需求。

颜料产业概况

颜料市场部分整合。主要企业(排名不分先后)包括科慕公司、Venator Materials PLC、Kronos Worldwide Inc.、LB Group 和 Tronox Holdings Plc。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 开发中国家油漆和涂料行业的需求不断增长

- 扩大复合无机颜料(CICP)在各种应用中的使用

- 纺织业需求稳定

- 限制因素

- 严格的政府法规

- 颜料反倾销税

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 产品类型

- 无机

- 二氧化钛

- 氧化锌

- 其他产品种类(碳颜料、干土、群青颜料、镉、铬酸铅等)

- 有机的

- 特殊颜料和其他产品类型(功能性颜料、磁性颜料等)

- 无机

- 应用

- 油漆和涂料

- 纺织品

- 印刷油墨

- 塑胶

- 皮革

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- ALTANA AG

- DIC Corporation

- Heubach Gmbh

- Kronos Worldwide, Inc.

- LANXESS

- LB Group

- Pidilite Industries Ltd.

- Sudarshan Chemical Industries Limited

- The Chemours Company

- Tronox Holdings Plc.

- Venator Materials PLC.

第七章 市场机会与未来趋势

- 转向环保产品

- 3D列印材料需求不断成长

简介目录

Product Code: 46248

The Pigments Market size is estimated at USD 31.08 billion in 2025, and is expected to reach USD 35.68 billion by 2030, at a CAGR of greater than 2.8% during the forecast period (2025-2030).

Key Highlights

- COVID-19 had a negative impact on the market in 2020. The disruption in the worldwide supply chain, combined with lower demand from numerous end-user industries such as paints and coatings, plastics, textiles, and others, hampered pigment demand.

- However, the market recovered as consumers spent more time at home and focused on home remodeling projects, and the residential construction sector recovered. Protective and sanitizing coatings are in high demand due to growing concerns about cleanliness and hygiene.

- In the medium term, the significant factors driving the market studied are rising demand from the paints and coatings industry from developing nations and rising applications of complex inorganic color pigments in various applications.

- On the flip side, factors such as stringent government regulations and anti-dumping duties on pigments are hampering the market growth. Moreover, factors such as shifting focus towards eco-friendly products and rising demand for 3D printing materials are acting as an opportunity for the studied market.

- Asia-Pacific dominated the market worldwide, with the most significant consumption from countries such as China, India, and Japan.

Pigments Market Trends

Increasing Demand from the Paints and Coatings Industry

- Pigments are insoluble particulate materials that are responsible for providing color, opacity, gloss control, rheological control, and certain other properties, such as corrosion inhibition to the paints and coatings.

- Pigments are considered an important constituent in paints and coatings as they impart color and also help in reducing the cost of coatings by acting as a volume filler.

- According to the World Paint and Coatings Industry Association (WPCIA), in the year 2022, with respect to revenue, the top 5 companies in the paints and coatings industry were The Sherwin-Williams Company, PPG Industries, AkzoNobel N.V., Nippon Paint and RPM International.

- According to the Statistisches Bundesamt, the industry revenue of the manufacture of paints, varnishes, and similar coatings, printing ink, and mastics in Germany is projected to reach around USD 12.94 billion by the year 2024, thereby likely to increase the consumption of pigments used in the paints and coatings sector.

- Moreover, in November 2022, The Sherwin-Williams Company held a ceremonial groundbreaking that marked the start of construction of an extension of its existing manufacturing facility in Statesville, North Carolina. This expansion is intended to significantly expand the annual manufacturing capacity for the company's architectural paint and coatings products. It is expected to be finished by the end of 2024, thus increasing the demand for pigments used in paints and coatings.

- All the above factors are expected to impact market growth in the coming years significantly.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the market growth, considering the huge demand from various applications in countries like China, India, and others.

- China accounts for more than one-fourth of the global coatings market. According to the China National Coatings Industry Association, the industry has registered a growth of around 7% in recent years. According to European Coatings, nearly 10,000 coatings manufacturers are located in China.

- In July 2022, BASF Coatings expanded the production capacity of automotive refinish coatings at its coatings site in Jiangmen, Guangdong Province, in South China. With the completion of the expansion, BASF's annual production capacity of automotive refinish coatings increased to 30,000 metric tons.

- India's production volume of dyes and pigments in India in the financial year of 2023 stood at 398,000 metric tons, almost a 22% increase from 2022's production.

- According to the Federation of Indian Chambers of Commerce and Industry, the value of the print industry across India was estimated at around INR 250 billion (USD 3 Billion) in 2022. The demand for ink has been increasing in the country, which has led to several expansion projects. For instance -

- One of the leading manufacturers of printing inks DIC Corporation, in March 2022, inaugurated its new toluene-free plant Optima for liquid ink manufacturing at Saykha in Bharuch district, Gujarat. The plant covers 92,500 sq m, and in phase one, the plant has the capacity to manufacture over 10,000 tons of TF, KF/NTNK (toluene-free/ketone-free) liquid inks in two shifts. Such manufacturing facility expansions are anticipated to boost the market's growth during the forecast period.

- Thus, all such expansion activities and suitable government measures are expected to boost the construction activities in the region, which is further projected to grow the demand for paint and coating, thereby increasing the demand for pigments.

Pigments Industry Overview

The pigment market is partially consolidated in nature. The major companies (not in any particular order) include The Chemours Company, Venator Materials PLC, Kronos Worldwide Inc., LB Group, and Tronox Holdings Plc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand From the Paints and Coatings Industry in Developing Nations

- 4.1.2 Rising Applications of Complex Inorganic Color Pigment (CICP) in Various Applications

- 4.1.3 Consistent Demand from the Textile Industry

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations

- 4.2.2 Anti-Dumping Duty on Pigments

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Inorganic

- 5.1.1.1 Titanium Dioxide

- 5.1.1.2 Zinc Oxide

- 5.1.1.3 Other Product Types (Carbon Pigments, Dry Earth, Ultramarine Pigments, Cadmium, Lead Chromate, and Others)

- 5.1.2 Organic

- 5.1.3 Specialty Pigments and Other Product Types (Functional Pigments, Magnetic Pigments, and Others)

- 5.1.1 Inorganic

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Textiles

- 5.2.3 Printing Inks

- 5.2.4 Plastics

- 5.2.5 Leather

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ALTANA AG

- 6.4.2 DIC Corporation

- 6.4.3 Heubach Gmbh

- 6.4.4 Kronos Worldwide, Inc.

- 6.4.5 LANXESS

- 6.4.6 LB Group

- 6.4.7 Pidilite Industries Ltd.

- 6.4.8 Sudarshan Chemical Industries Limited

- 6.4.9 The Chemours Company

- 6.4.10 Tronox Holdings Plc.

- 6.4.11 Venator Materials PLC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Towards Eco-friendly Products

- 7.2 Rising Demand for 3D Printing Material

02-2729-4219

+886-2-2729-4219