|

市场调查报告书

商品编码

1685685

汽车资讯娱乐系统-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Automotive Infotainment Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

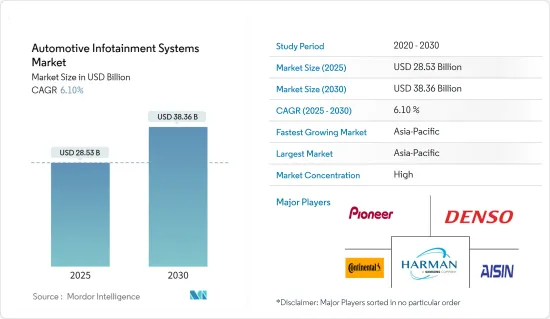

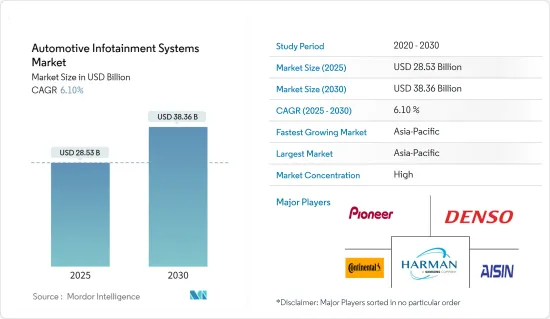

预计2025年汽车资讯娱乐系统市场规模为285.3亿美元,2030年将达到383.6亿美元,预测期间(2025-2030年)的复合年增长率为6.1%。

汽车资讯娱乐系统市场主要受汽车销售和产量成长的推动,因此COVID-19疫情对汽车资讯娱乐系统市场的影响是不可避免的。由于製造工厂不断关闭,2020 年汽车产销量大幅下滑。然而,在2020年上半年,全球汽车产销开始回升,并在2021年维持了这股动能。 2021年全球汽车销售量与2020年相比显着成长。然而,市场从未恢復到2019年的水平,主要原因是全球半导体短缺。疫情过后,各企业携手合作,克服疫情影响,开发新的创新产品。例如

主要亮点

- 2022年9月,瑞萨电子株式会社(Renesas)宣布扩大与越南新创汽车製造商VinFast在电动车技术开发上的合作。两家公司正在资讯娱乐系统方面展开合作,瑞萨电子为 VinFast 的电动 SUV「VF8」和「VF9」提供车载 SoC「R-Car」和类比产品。

汽车製造商正在激烈竞争,争取在预测期内推出的车型中引入先进的资讯娱乐系统。例如,工业、日产汽车公司和雷诺集团已采用Google的 Android 作业系统作为其下一代资讯娱乐系统。此外,由于消费行为的变化以及对行动电话和系统之间无缝连接的需求,对 IVI(车载资讯娱乐)的需求预计会激增。

豪华车销售的成长和客户对车载资讯娱乐系统的偏好是市场的主要驱动力。然而,由于驾驶分心而导致的事故数量增加也可能阻碍市场成长。世界主要汽车製造商在音响单元、显示器单元、导航系统和整合系统等领域与技术OEM进行了广泛的合作。例如

主要亮点

- 2022年10月,丰田与Google云端扩大合作,涵盖丰田和Lexus的下一代音讯多媒体系统以及Google云端基于人工智慧的语音服务。客户将在最新一代丰田音响多媒体和雷克萨斯介面资讯娱乐系统中看到此次合作的首批成果。该系统预计将搭载于 2023 年丰田车型,包括卡罗拉、Tundra、Sequoia、Lexus NX、RX 和电动 RZ。

此外,在商用车中整合导航和车辆控制单元有助于减少紧急回应时间并消除事故风险。此外,一些汽车製造商正在提供低成本的资讯娱乐系统,使产品更实惠。此外,智慧型手机的日益普及和互联网的高度连接也对全球市场的成长产生了重大影响。

预计预测期内亚太市场将以最高速度成长,其次是北美和欧洲。亚太市场的扩张归功于中国、日本和印度等世界最大汽车製造国对汽车资讯娱乐系统的广泛采用。这正在推动整个汽车资讯娱乐系统供应链的技术创新。例如

主要亮点

- 2022年8月,罗姆宣布开发用于资讯娱乐系统和ADAS(高级驾驶辅助系统)中的车载摄影机的BD9S402MUF-C DC/DC转换器IC。

汽车资讯娱乐系统市场趋势

资讯娱乐系统的进步

汽车资讯娱乐系统越来越多地配备智慧型手机功能。在北美和欧洲,超过90%的成年人透过行动电话上网,是所有地区中最高的。随着行动电话使用量的增加,越来越多的汽车配备了智慧型手机以达到相同的目的。

汽车製造商也选择模组化硬体设计。这有助于降低购买资讯娱乐系统的成本。我们开发的技术能够将智慧型手机功能以低成本整合到汽车资讯娱乐系统中。製造商正在努力平衡处理能力和系统竞争力。为了帮助汽车製造商提高联网汽车的效能,数位服务需要产生大量资料。

- 2021年8月,现代汽车选择全球软体技术公司QT作为现代、起亚和Genesis的人机介面(HMI)技术合作伙伴。该技术将使现代汽车能够开发跨车辆资讯娱乐系统的连网汽车作业系统。

- 2021年9月,LG电子在德国慕尼黑举行的IAA Mobility上发表了其汽车资讯娱乐系统。该车的资讯娱乐系统基于 Google Android Automotive 和 Android 10,以优化连接性和便利性。汽车资讯娱乐系统软体将与雷诺伙伴关係开发,并将搭载于 2022 年 2 月推出的雷诺梅甘娜 E-TECH Electric 车款。

汽车资讯娱乐系统正在经历重大的技术变革时期。随着智慧型手机的广泛使用,ADAS 和自动驾驶技术(自动驾驶汽车)的采用正在兴起。车载系统车辆,特别是乘客座椅,对科技越来越熟悉。随着工程师开发创新的汽车资讯娱乐系统,这些功能很可能成为汽车电子系统不可或缺的一部分。

人工智慧和云端服务的采用有望推动汽车资讯娱乐系统的技术进步。大多数公司依赖现有的谷歌和苹果生态系统来建立其资讯娱乐系统。不过,有些公司更愿意为资讯娱乐系统开发自己的作业系统。

中国引领亚太市场

中国在亚太汽车产业中占有最大份额,过去十年来汽车销量最高。随着汽车製造商更加关注新能源汽车(NEV),预计预测期内汽车销售将保持正成长。

从简单的音讯系统到支援导航、Apple CarPlay、Android Auto 和远端资讯处理等多种功能的触控萤幕资讯娱乐系统的转变正在推动该国对资讯娱乐系统的需求。

中国是全球最大的汽车市场之一,2020年乘用车销量超过2,017万辆,预计2021年中国汽车总销量将达到约2,148万辆。然而,中国汽车製造商正在率先开发智慧座舱,而智慧驾驶座正迅速成为现代驾驶体验的重要组成部分。智慧驾驶座将智慧技术与一系列驾驶功能相结合,包括车辆指令的语音辨识、娱乐和导航系统。例如

- 2022年9月,NVIDIA公司宣布开发Drive-Soar,这是一款可整合自动驾驶/ADAS(高级驾驶辅助系统)和汽车资讯娱乐系统的集中式车载电脑。

此外,2021年7月的世界人工智慧大会上透露,中国汽车市场引领智慧驾驶座发展,智慧驾驶座相关专利申请数量超过8.23万件,其次是日本(3.19万件)和美国(1.93万件)。智慧驾驶座正在成为现代驾驶体验的关键技术,其中语音辨识和多功能导航系统是整合到智慧汽车驾驶座的一些关键技术。

汽车资讯娱乐系统产业概况

主要企业罗伯特博世、阿尔派电子、松下公司、哈曼国际和三菱电机公司主导汽车资讯娱乐系统市场。这些公司在全球范围内拥有强大的分销网络,并提供广泛的产品系列。这些公司采用新产品开发、合作、合约和协议等策略来维持其市场地位。

- 2022 年 9 月,梅赛德斯-奔驰股份公司与高通技术公司宣布合作,利用骁龙数位底盘解决方案为未来的宾士汽车带来尖端数位功能。宾士利用高通的驾驶座平台实现直觉、智慧的资讯娱乐系统。这些下一代系统将为车载虚拟助理提供高度直觉的人工智慧体验。

- 2022年6月,梅赛德斯-宾士集团宣布与加州科技公司ZYNC建立合作关係。透过此次合作,ZYNC 将为OEM提供优质的车载数位娱乐平台。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 按安装类型

- 车载资讯娱乐系统

- 后座资讯娱乐系统

- 按车辆类型

- 搭乘用车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 巴西

- 南非

- 其他国家

- 北美洲

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Denso Corporation

- Robert Bosch GmbH

- Continental AG

- Harman International Industries Inc.

- Magnetic Marelli SpA

- Kenwood Corporation

- Alpine Electronics Inc.

- Mitsubishi Electric Corporation

- Visteon Corporation

- Pioneer Corporation

- Aptiv PLC

第七章 市场机会与未来趋势

The Automotive Infotainment Systems Market size is estimated at USD 28.53 billion in 2025, and is expected to reach USD 38.36 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

The impact of the COVID-19 pandemic on the automotive infotainment systems market was inevitable as the market is primarily driven by increasing vehicle sales and production. As there were continuous lockdowns and shutting down of manufacturing units, production and sales of vehicles experienced a slump in 2020. However, in the first half of 2020, global vehicle production and sales started to pick up the pace and continued their growth momentum in 2021. Global vehicle sales witnessed considerable growth in 2021 when compared to 2020. However, the market did not rebound to the levels of the year 2019, primarily due to the global semiconductor shortage. Post-pandemic, players are collaborating and developing new and innovative products to overcome the impact of the pandemic. For instance,

Key Highlights

- In September 2022, Renesas Electronics Corporation (Renesas) announced an expansion of its collaboration with VinFast, a Vietnamese emerging vehicle manufacturer, for the technological development of electric vehicles. Both companies have worked together on infotainment systems, and Renesas provides R-Car, its onboard SoC, and analog products for the VinFast electric SUVs VF8 and VF9.

Automakers are strongly competing to deploy advanced infotainment systems for their upcoming vehicle models during the forecast period. For instance, Mitsubishi Motors Corporation, Nissan Motor Co. Ltd, and Groupe Renault have adopted Google Inc.'s Android OS (operating system) for their next-generation infotainment systems. In addition, demand for IVI (In-Vehicle Infotainment) is expected to witness a steep rise with changing consumer behavior and demand for seamless connectivity of phones with the system.

An increase in luxury vehicle sales and customer preference for in-dash infotainment systems are some of the biggest drivers of the market. However, the rise in the number of accidents due to driver distraction may also hinder the market's growth. The world's leading automobile manufacturers are extensively working with technological OEMs, which work in domains such as audio units, display units, navigation systems, and comprehensive systems. For instance,

Key Highlights

- In October 2022, Toyota and Google Cloud expanded their partnership to include Toyota and Lexus's next-generation audio multimedia systems as well as Google Cloud's AI-based speech services. Customers can see the first fruits of the collaboration in the latest generation Toyota Audio Multimedia and Lexus Interface infotainment systems, which will be available in 2023 models such as the Toyota Corolla, Tundra, and Sequoia, as well as the Lexus NX, RX, and all-electric RZ.

Furthermore, implementing navigation and vehicle control units in commercial vehicles helps reduce the response time during emergencies, thereby eliminating the risk of accidents. Besides this, several automobile manufacturers are also offering low-cost infotainment systems, thereby increasing product affordability. Additionally, the rising adoption of smartphones, along with high internet connectivity, has a significant impact on the market growth on a global level.

The Asia-Pacific market is expected to grow rapidly during the forecast period, followed by North America and Europe. The Asia-Pacific market's expansion can be attributed to the high adoption rate of automotive infotainment systems in countries such as China, Japan, and India, which manufacture the most vehicles globally. This, in turn, is driving technological innovations across the supply chain of the automotive infotainment system. For instance,

Key Highlights

- In August 2022, Rohm Co., Ltd (Rohm) announced the development of the BD9S402MUF-C DC/DC converter IC for infotainment systems and advanced driver assistance system onboard cameras.

Automotive Infotainment Systems Market Trends

Growing Advancements in Infotainment Systems

Smartphone functions are increasingly being integrated into in-vehicle infotainment systems. Over 90% of adults in North America and Europe have access to the internet via their mobile phones, which is one of the highest rates among other regions. As the use of mobile phones has increased, so has the use of smartphones in cars for the same purposes.

Automobile manufacturers are also opting for modular hardware design. This allows them to lower the cost of purchasing infotainment systems. They are developing technologies that allow smartphone functions to be integrated into in-vehicle infotainment systems at a low cost. Manufacturers are working to combine processing power and system competitiveness. For car manufacturers to improve the performance of connected vehicles, digital services generate massive amounts of data.

- In August 2021, Hyundai Motors selected QT, a global software technology company, as its human-machine interface (HMI) technology partner for Hyundai, Kia, and Genesis. This technology would allow Hyundai Motors to develop a connected car operating system across its vehicle infotainment systems.

- In September 2021, LG Electronic unveiled their in-vehicle infotainment system in IAA Mobilityheld in Munich, Germany. The in-vehicle infotainment system was based on Google Android automotive and Android 10 to optimize connectivity and convenience. The in-vehicle infotainment system's software was developed with Renault's partnership, and it is equipped with the Renault Megane E-TECH electric, launched in February 2022.

The automotive infotainment system is undergoing massive technological transformations. With growing smartphone usage, there is an increase in the adoption of ADAS and Autonomous driving technology (self-driving cars). Technologies like Automotive systems vehicles, especially for passenger seating, have become excessively familiar. As engineers develop innovative versions of in-vehicle infotainment systems, these features will become essential contributors to the vehicle's electronic system.

The introduction of AI and cloud services is expected to drive technological advancements in automotive infotainment systems. Most companies rely on the existing Google and Apple ecosystems for their infotainment systems. Although some players prefer to develop their infotainment system OS in-house,

China is Driving the Asia-Pacific Market

China occupied a significant share of the Asia-Pacific automotive industry among Asia-Pacific countries due to its highest vehicle sales over the past decade. The country is anticipated to continue to see positive vehicle sales during the forecast period, owing to the growing focus on new energy vehicles (NEV) among automakers.

The shift from simple audio systems to touchscreen infotainment systems that support multiple features, such as navigation, Apple CarPlay, Android Auto, and telematics, is driving the demand for infotainment systems in the country.

China is one of the world's largest automotive markets, with over 20.17 million passenger cars sold in the country in 2020, and overall car sales in China reached around 21.48 million vehicles in 2021. However, Chinese automakers are pioneering the development of the intelligent cockpit, which is quickly becoming an essential component of the modern driving experience. Intelligent cockpits combine smart technologies with various driving functions, such as voice recognition for vehicle commands and entertainment and navigation systems. For instance,

- In September 2022, NVIDIA Corporation (NVIDIA) announced the development of Drive Soar, a centralized in-vehicle computer capable of integrating autonomous driving/advanced driver assistance systems (ADAS) and in-vehicle infotainment systems.

Further, In July 2021, World artificial intelligence conference, China's automobile market was leading in the development of smart cockpits with more than 82,300 patents application related to intelligent cockpits, followed by Japan and the United States at 31,900 and 19,300, respectively. Intelligent cockpits are becoming a critical technology in the modern driving experience; voice recognition and multiple drive functions navigation systems are some of the prime technologies integrated into intelligent vehicle cockpits.

Automotive Infotainment Systems Industry Overview

Major players such as Robert Bosch, Alpine Electronics, Panasonic Corporation, HARMAN International, and Mitsubishi Electric Corporation dominate the automotive infotainment systems market. These companies have strong distribution networks at a global level and offer an extensive product range. These companies adopt strategies such as new product developments, collaborations, and contracts and agreements to sustain their market positions.

- In September 2022, Mercedes-Benz AG and Qualcomm Technologies, Inc. announced a collaboration to use Snapdragon Digital Chassis solutions to bring the most advanced digital capabilities to future Mercedes-Benz vehicles. Mercedes-Benz is using Qualcomm Cockpit Platforms to power intuitive and intelligent infotainment systems. These next-generation systems will include highly intuitive AI experiences for in-car virtual assistance.

- In June 2022, Mercedes-Benz Group AG announced a collaboration with ZYNC, a California-based technology company. Under this partnership, the latter company will provide a premium in-car digital entertainment platform for the OEM.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD Billion)

- 5.1 By Installation Type

- 5.1.1 In-dash Infotainment

- 5.1.2 Rear-seat Infotainment

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Denso Corporation

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Continental AG

- 6.2.4 Harman International Industries Inc.

- 6.2.5 Magnetic Marelli SpA

- 6.2.6 Kenwood Corporation

- 6.2.7 Alpine Electronics Inc.

- 6.2.8 Mitsubishi Electric Corporation

- 6.2.9 Visteon Corporation

- 6.2.10 Pioneer Corporation

- 6.2.11 Aptiv PLC