|

市场调查报告书

商品编码

1685686

农业中的螯合化合物:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Agricultural Chelates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

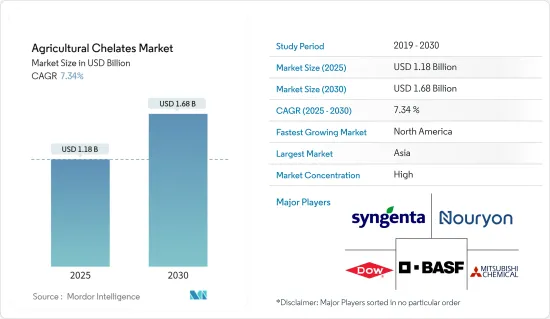

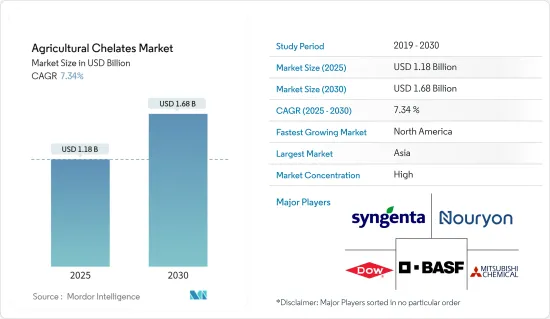

预计 2025 年农业螯合物市场规模为 11.8 亿美元,到 2030 年将达到 16.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.34%。

主要亮点

- 气候变迁、可耕地减少以及世界人口迅速增长引发了人们对粮食安全的担忧。美国农业部(USDA)进行的2022年农业普查显示,美国的农场数量已降至200万个以下。具体来说,2022年美国有190万个农场,比2017年人口普查数据下降了7%。此外,人口普查也强调,到 2022 年,美国农地总面积将减少 2.2%,至 8.8 亿英亩。鑑于这些发展情况,必须透过适当的农业投入来提高生产力。因此,农业中使用螯合剂来提高作物产量以满足世界粮食需求的现象显着增加。螯合剂可增强植物对营养素的吸收,使某些营养素更容易被利用。这可以改善植物的生长和发育,最终提高作物的产量和品质。

- 独立实验室的分析表明,英国数千个土壤样本中,小麦作物缺氮 10%,缺乏磷 25%。螯合是一种保护微量营养素免受溶液和土壤中不良反应影响的机制。透过提高铁、铜、锰和锌等微量营养素的生物利用度,螯合肥料在提高经济作物生产的生产力和盈利方面发挥着至关重要的作用。特别是在 pH 值高于 6.5 和/或微量营养素压力较低的土壤中,螯合肥料与标准微量营养素相比,表现出更高的提高商业性产量的能力。

- 随着永续农业的发展势头强劲以及人们对合成螯合剂对环境影响的认识不断提高,寻找生物分解性替代品的趋势明显。鑑于这种情况,公司正在策略性地定位自己,以满足日益增长的需求并增加其在市场上的占有率。

农业螯合物市场趋势

农业领域对 EDTA 的青睐日益增长

- 乙二胺四乙酸 (EDTA) 已成为农业中的主要合成螯合剂,广泛应用于土壤和叶面营养。如果土壤 pH 值约为 6.0,则 EDTA 作为肥料在户外施用是有效的。这种多功能性确保了EDTA在市场上的主导地位。

- EDTA 螯合物比传统矿物质更受欢迎,因为它们能有效地将铁 (Fe)、锰 (Mn)、铜 (Cu) 和锌 (Zn) 等必需的微量元素从土壤直接转移到植物根部。印度土壤科学研究所强调了普遍存在的微量营养素缺乏的令人担忧的趋势。印度土壤的平均缺锌水准为43.0%、铁为12.1%、铜为5.4%、锰为5.6%、硼为18.3%。令人担忧的是,酸性土壤缺乏锌和磷酸盐,半干旱地区缺乏锌和铁,这表明未来的种植系统面临潜在挑战。锌是一种重要的微量营养素,对于维持植物激素平衡和促进生长至关重要。有机螯合锌源,尤其是 Zn-EDTA(含 12% 的锌),通常被认为优于无机替代品。例如,当将Zn-EDTA螯合物肥料施用于玉米、豆类等作物时,农民只需要使用传统硫酸锌(ZnSO4)的一半。此外,与目前市面上许多其他商业农业螯合物相比,EDTA螯合物具有价格更低、更容易取得的优势。

- 市场主要企业正在展示各种适合农业用途的 EDTA 产品。例如,科迪华 (Corteva) 以 Versenol 和 Crop Max 品牌提供 EDTA 螯合剂,这两种产品在农业产业都很受欢迎。 EDTA除了作为营养物以外,还具有对受到汞、镉、铅等重金属污染的土壤进行解毒的能力,因此其市场正在不断扩大。然而,EDTA 也并非没有挑战。与许多合成药物一样,EDTA 面临高成本、生物分解性有限和潜在交叉污染风险等挑战。这些挑战可能会阻碍该领域的成长轨迹。

亚太地区占市场主导地位

- 在亚太地区,中国、印度、日本和澳洲是农业螯合剂市场需求的主导者。根据澳洲政府统计,碱性土壤覆盖了澳洲约24%的土地面积,尤其是在西部地区,pH值在4到8.5之间。因此,由于微量元素缺乏阻碍了农业生产力,澳洲对螯合剂的需求正在增加。

- 中国是世界上人口最多的国家,同时也拥有最广泛的农业设施。人口迅速增长和粮食需求不断增加迫使中国农民提高作物产量。然而,中国各地普遍存在着石灰性土壤微量营养素缺乏的问题。为了应对这些挑战,中国正在进行一项全面的土壤普查,该普查由总部位于北京的非营利环保组织主导,计划于 2025 年完成。从此次土壤调查中获得的资讯可以凸显土壤的缺陷,并促进螯合剂在中国的销售。

- 微量营养素缺乏影响了包括泰国在内的稻米生产国的生产力。一项独立研究指出关键微量营养素(铁、锰、锌、铜)至关重要,并表明这些营养素的缺乏会导致水稻产量减少 24.12% 至 46.46%。然而,随着 DTPA 的应用,添加这些微量营养素可以显着提高产量。

农业螯合物产业概况

全球农业螯合物市场正在整合,BASF公司、三菱化学、先正达公司、陶氏公司和诺力昂化学控股公司等主要参与者占了相当大的份额。这些公司的巨大市场占有率归功于其高度多样化的产品系列以及在审查期间进行的收购和合作。这些公司也专注于研发和产品创新,以扩大其地理影响力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 对农作物更高产量的需求

- 螯合物在微量营养素毒性的应用。

- 土壤微量营养素缺乏

- 市场限制

- 生物分解性螯合物产品供应不足

- 加强合成螯合剂使用的限制

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 类型

- 合成

- EDTA

- EDDHA

- DTPA

- IDHA

- 其他合成类型

- 有机的

- 硫酸苹果酸

- 胺基酸

- 七葡萄糖酸盐

- 其他有机类型

- 合成

- 应用

- 土壤

- 叶面喷布

- 受精

- 其他用途

- 作物类型

- 粮食

- 豆类和油籽

- 经济作物

- 水果和蔬菜

- 草坪和观赏植物

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 西班牙

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲国家

- 北美洲

第六章竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Nouryon Chemicals Holding BV

- Shandong Iro Chelating Chemical Co. Ltd

- Ava Chemicals Private Limited

- Protex International

- Innospec Inc.

- Syngenta Ag

- Mitsubishi Group(Mitsubishi Chemical Corporation)

- Dow Inc

第七章 市场机会与未来趋势

The Agricultural Chelates Market size is estimated at USD 1.18 billion in 2025, and is expected to reach USD 1.68 billion by 2030, at a CAGR of 7.34% during the forecast period (2025-2030).

Key Highlights

- Concerns over food security are rising due to changing climate conditions, diminishing arable land, and a swiftly expanding global population. The 2022 Census of Agriculture, conducted by the United States Department of Agriculture (USDA), revealed that the number of farms in the United States (U.S.) has dipped below 2 million. Specifically, in 2022, the U.S. counted 1.9 Million farms, marking a 7% decrease from the figures in the 2017 Census. Additionally, the Census highlighted a 2.2% reduction in total U.S. farmland, bringing it down to 880 million acres in 2022. Given these developments, boosting productivity through appropriate agricultural inputs has become imperative. Consequently, there's been a notable surge in the adoption of chelating agents in agriculture, to enhance crop yields to satisfy global food requirements. Chelating agents facilitate plants' uptake of nutrients, making certain nutrients more accessible. This leads to improved plant growth and development, ultimately enhancing crop yield and quality.

- Independent laboratory analyses highlight troubling trends, includes wheat crops in the UK are experiencing a 10% nitrogen deficiency and a 25% phosphorus deficiency, as evidenced by thousands of soil samples. Chelation serves as a protective mechanism, shielding micronutrients from unwanted reactions in both solutions and soil. By boosting the bioavailability of micronutrients like Fe, Cu, Mn, and Zn, chelated fertilizers play a pivotal role in enhancing the productivity and profitability of commercial crop production. Notably, in soils with a pH exceeding 6.5 or those under low-micronutrient stress, chelated fertilizers have demonstrated a superior capacity to boost commercial yields compared to standard micronutrients.

- With the rising momentum of sustainable farming and growing awareness about the environmental repercussions of synthetic chelating agents, there's a marked pivot towards exploring biodegradable alternatives. In light of this, companies are strategically positioning themselves to meet this evolving demand, thereby strengthening their market presence.

Agricultural Chelates Market Trends

Increasing Preference for EDTA in Agriculture

- Ethylenediaminetetraacetic acid (EDTA) has emerged as the premier synthetic chelating agent in agriculture, widely employed for both soil and foliar nutrient applications. At soil pH levels around 6.0, EDTA demonstrates its efficacy in open-field fertigation. This adaptability plays a pivotal role in cementing EDTA's leading market position.

- EDTA chelates are preferred over conventional inorganic sources due to their superior efficiency in transferring essential trace elements such as iron (Fe), manganese (Mn), copper (Cu), and zinc (Zn)-from the soil directly to plant roots. The Indian Institute of Soil Science highlights a concerning trend of micronutrient deficiencies are widespread, with average deficiencies in Indian soils being 43.0% for Zinc, 12.1% for Iron, 5.4% for Copper, 5.6% for Manganese, and 18.3% for Boron. Alarmingly, the combined deficiency of Zn and B in acidic soils, and Zn and Fe in semi-arid regions, signals potential challenges for future cropping systems. Zinc, a crucial micronutrient, is essential for maintaining plant hormone balance and fostering growth. Organic chelated zinc sources, particularly Zn-EDTA (which contains 12% Zn), are frequently regarded as superior to their inorganic alternatives. For instance, when treating crops like corn and beans, the application of Zn-EDTA chelate fertilizer allows farmers to use only half the quantity compared to traditional zinc sulfate (ZnSO4). Additionally, EDTA chelates not only come at a lower price point but also boast greater accessibility than numerous other commercial agricultural chelates available today.

- Prominent players in the market showcase a wide array of EDTA products tailored for agricultural use. Corteva, for instance, offers its EDTA chelating agents under the brand names Versenol and Crop Max, both of which are in high demand within the agricultural community. Beyond its nutrient application, EDTA's ability to detoxify soils contaminated with heavy metals like mercury, cadmium, and lead further fuels its market expansion. However, EDTA isn't without its challenges. Like many synthetic agents, it grapples with issues such as high costs, limited biodegradability, and potential secondary pollution risks. These challenges could hinder the segment's growth trajectory.

Asia-Pacific Dominates the Market

- In the Asia-Pacific region, China, India, Japan, and Australia lead in market demand for agricultural chelates. According to the Australian Government, alkaline soils account for about 24% of Australia's land, particularly in the western regions, where pH levels range from 4 to 8.5. As a result, Australia is experiencing an increasing demand for chelating agents, driven by trace element deficiencies that impede agricultural productivity growth.

- China, home to the world's largest population, also hosts some of the most expansive agricultural facilities. With its population surging and food demand rising, Chinese farmers are under pressure to achieve higher crop yields. Yet, various regions in China grapple with micronutrient deficiencies in their calcareous soils. To address these challenges, China is undertaking a comprehensive soil census, led by a nonprofit environmental organization from Beijing, with an anticipated completion in 2025. Insights from this soil survey are poised to illuminate soil deficiencies, potentially boosting chelate sales in the nation.

- Micronutrient deficiencies are currently undermining productivity in rice-growing nations, notably Thailand. An independent study identified key micronutrients (Fe, Mn, Zn, and Cu) as pivotal, revealing their deficiency could slash rice grain yields by a staggering 24.12%-46.46%. However, with the application of DTPA, these yields can be significantly bolstered through the addition of these micronutrients.

Agricultural Chelates Industry Overview

The global agricultural chelates market is consolidated, with the major players in the market including BASF SE, Mitsubishi Chemical Corporation, Syngenta Ag, Dow Inc, Nouryon Chemicals Holding B.V, etc holding a significant share of the market. The significant market share of these players can be attributed to a highly diversified product portfolio and acquisitions and partnerships during the review period. These players also focus on R&D and product innovations to widen their geographical presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand For Higher Crop Yields

- 4.2.2 Application of Chelates in Micronutrient Intoxication

- 4.2.3 Micronutrient Deficiency In Soil

- 4.3 Market Restraints

- 4.3.1 Poor Product Offering in Biodegradable Chelates

- 4.3.2 Rising Regulation on Use of Synthetic Chelating Agents

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Synthetic

- 5.1.1.1 EDTA

- 5.1.1.2 EDDHA

- 5.1.1.3 DTPA

- 5.1.1.4 IDHA

- 5.1.1.5 Other Synthetic Types

- 5.1.2 Organic

- 5.1.2.1 LingoSulphates

- 5.1.2.2 Aminoacids

- 5.1.2.3 Heptagluconates

- 5.1.2.4 Other Organic Types

- 5.1.1 Synthetic

- 5.2 Application

- 5.2.1 Soil

- 5.2.2 Foliar

- 5.2.3 Fertigation

- 5.2.4 Other Applications

- 5.3 Crop Type

- 5.3.1 Grains and Cereals

- 5.3.2 Pulses and Oilseeds

- 5.3.3 Commercial Crops

- 5.3.4 Fruits and Vegetables

- 5.3.5 Turf and Ornamentals

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Germany

- 5.4.2.5 Russia

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Nouryon Chemicals Holding B.V

- 6.3.2 Shandong Iro Chelating Chemical Co. Ltd

- 6.3.3 Ava Chemicals Private Limited

- 6.3.4 Protex International

- 6.3.5 Innospec Inc.

- 6.3.6 Syngenta Ag

- 6.3.7 Mitsubishi Group (Mitsubishi Chemical Corporation)

- 6.3.8 Dow Inc