|

市场调查报告书

商品编码

1685696

西班牙太阳能-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Spain Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

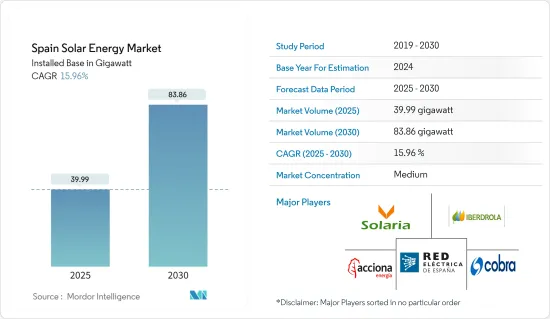

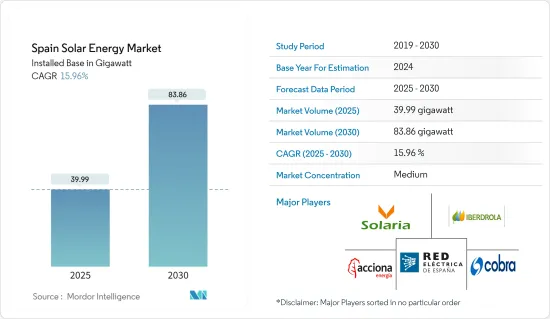

西班牙太阳能市场规模(安装基数)预计将从 2025 年的 39.99 吉瓦扩大到 2030 年的 83.86 吉瓦,预测期内(2025-2030 年)的复合年增长率为 15.96%。

主要亮点

- 从中期来看,政府鼓励可再生能源发电的支持政策和太阳能光电设备成本的下降预计将成为西班牙太阳能发电市场的驱动因素之一。

- 然而,水力发电和风电等替代再生能源来源的日益普及,以及有限的电网基础设施和能源储存系统预计将在预测期内阻碍市场成长。

- 然而,随着《2021-2030年国家能源与气候计画》的出台,政府的目标是到2030年将可再生能源的比例提高到42%。预计这将在未来几年为太阳能电力公司创造商机。

西班牙太阳能市场的趋势

光伏(PV)型占市场主导地位

- 预计太阳能光伏(PV)技术将成为可再生能源中年发电量增加最多的技术,远超过风能和水力发电。过去六年来,太阳能市场变得越来越受欢迎,成本大幅下降。太阳能板的价格也大幅下降,导致太阳能发电系统的安装增加。

- 2023 年 6 月,西班牙生态转型和人口挑战部(MITECO)发布了国家综合能源和气候计画(PNIEC)的修订提案。目标是将温室气体排放在 1990 年的基础上减少 32%,高于先前 23% 的目标。为实现此目标,新能源策略要求在2030年太阳能发电装置容量达到76GW(其中19GW用于自发自用)。

- 根据国际可再生能源机构(IRENA)的数据,太阳能发电正在快速成长,2023年总设备容量将达到约2,871万千瓦,较2022年成长23%。 2022年,包括光伏和光热在内的太阳能光伏发电量约为31TWh。

- 近年来,西班牙对太阳能发电能力的投资激增。例如,2024年2月,Statkraft获得西班牙环境转型部(MITECO)的同意,在西班牙穆尔西亚建造一座228兆瓦的太阳能发电厂。该公司计划在该名为 Faucita Solar 的计划中投资约 1.618 亿美元。该计划是该公司在穆尔西亚地区的首个可再生能源计划,并将成为西班牙最大的太阳能发电厂之一。该工厂预计于 2026 年试运行。

- 同样在 2024 年 1 月,Ethical Power Spain订单了两个位于西班牙马拉加的 Corchia 旗下太阳能发电工程的 EPC 合约。这两个计划的总容量为 9 兆瓦,位于该州彼此相邻。随着大型太阳能发电工程计划在 2030年终达到 31 吉瓦的目标,西班牙太阳能光电市场预计将在预测期内经历显着成长。

- 因此,在政府利好政策的支持下,太阳能发电产业持续发展和产能扩张,预计将在预测期内占据市场主导地位。

政府政策和目标推动市场需求

- 西班牙的可再生能源领域,特别是太阳能,是该国能源政策的重点,为向更清洁、更永续的能源来源转型做出了重大贡献。该国也是欧洲日照时间最长的国家之一。

- 西班牙太阳能成长的驱动力之一是政府的法律规范和支持机制。西班牙实施了上网电价、补贴和竞争性竞标等优惠政策,以吸引投资并促进全国太阳能发电工程的发展。这些政策为国内外投资者提供了稳定、有利的环境。

- 西班牙致力于减少对石化燃料的依赖,并增加可再生能源在其能源结构中的份额。 2023年6月,西班牙将2030年温室排放减量目标从23%上调至32%,主要是因为人们对年终太阳能发电量的预期有所提高。

- 西班牙修订后的再生能源计画预计在2023年至2020年年终安装56吉瓦的大型太阳能发电设施。其次,推广可再生能源符合西班牙对欧盟可再生能源指令的承诺。该指令为欧盟设定了一个具有约束力的目标,即2030年可再生能源在最终能源消耗中所占比例达到42.5%。

- 西班牙生态转型部长表示,政府将于2024年2月开放新的奖励计画征集提案,以支持国内清洁能源技术供应链的发展。该机构推出了计划,第一轮能源转换设备生产补贴预算为12.4亿美元。该计划得到了復苏、转型和復原力计划(PRTR)的资助,预计将支持太阳能发电面板、电池、风力发电机、热泵和电解槽的设备和基本部件的生产。

- 太阳能光电装置的增加有助于扩大西班牙可再生能源的容量。根据国际可再生能源机构(IRENA)的预测,2023年西班牙可再生能源装置容量将达到80,136兆瓦,与前一年同期比较增长9%。

- 因此,考虑到强有力的法律规范和为太阳能发电厂製定的财政奖励,预计西班牙太阳能市场将在预测期内成长。

西班牙太阳能产业概况

西班牙的太阳能市场减少了一半。市场上的主要企业(排名不分先后)包括 Acciona SA、Iberdrola SA、The Red Electrica Group、COBRA Group 和 Solaria Energia y Medio Ambiente SA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 太阳能装置容量及2029年预测

- 可再生能源结构(2023年)

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 市场驱动因素

- 降低安装太阳能发电的成本

- 政府对可再生能源的支持政策

- 市场限制

- 其他能源来源的普及

- 市场驱动因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 按类型

- 光伏(PV)

- 聚光型太阳光电(CSP)

- 依实施类型

- 屋顶

- 地面安装

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Acciona SA

- COBRA Group

- Iberdrola SA

- Solaria Energia y Medio Ambiente SA

- JinkoSolar Holding Co. Ltd

- The Red Electrica Group

- Repsol SA

- Engie SA

- Soltec Energias Renovables SL

- Gransolar Group

- 市场排名分析

第七章 市场机会与未来趋势

- 政府支持政策

简介目录

Product Code: 46389

The Spain Solar Energy Market size in terms of installed base is expected to grow from 39.99 gigawatt in 2025 to 83.86 gigawatt by 2030, at a CAGR of 15.96% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, supportive government policies to promote renewable power generation and the declining cost of solar PV installations are expected to be some of the driving factors of the solar energy market in Spain.

- On the other hand, the increasing adoption of alternate renewable sources such as hydropower and wind and limited grid infrastructure and storage systems are expected to hinder the market's growth during the forecast period.

- Nevertheless, with the introduction of the National Energy and Climate Plan for 2021-2030, the government aims to increase the renewable energy share to 42% by 2030. This is expected to create opportunities for solar power companies over the coming years.

Spain Solar Energy Market Trends

Solar Photovoltaic (PV) Type to Dominate the Market

- Solar photovoltaic (PV) technology is expected to account for renewables' most considerable annual capacity additions, well above wind and hydro as well. The solar PV market reduced costs dramatically in the past six years as it was flooded with equipment. The cost of solar panels also dropped exponentially, leading to increased solar PV system installations.

- In June 2023, Spain's Ministry for the Ecological Transition and Demographic Challenge (MITECO) published a revised draft of the National Integrated Energy and Climate Plan (PNIEC). The target is to reduce greenhouse gas (GHG) emissions by 32% compared to 1990, surpassing the previous goal of 23%. To meet these targets, the new energy strategy outlines a plan to have 76 GW of solar photovoltaic installed capacity by 2030, including 19 GW for self-consumption.

- According to the International Renewable Energy Agency (IRENA), solar power witnessed rapid growth and recorded a total installed capacity of about 28.71 GW in 2023. This represents a 23% increase compared to 2022. In 2022, electricity generation from solar, including PV and thermal solar, stood at about 31 TWh.

- In recent years, Spain has been witnessing a surge in investments to increase the country's solar power capacity. For instance, in February 2024, Statkraft received consent from the Spanish Ministry for the Ecological Transition (MITECO) to build a 228 MW capacity solar farm in Murcia, Spain. The company plans to invest around USD 161.8 million in the project named Fausita Solar. This will be the company's first renewable energy project in Murcia and one of its largest solar farms in Spain. The commissioning of the plant is expected to take place in 2026.

- Similarly, in January 2024, Ethical Power Spain was awarded the EPC contract for two photovoltaic projects in Malaga, Spain, owned by Korkia. The two projects have a total capacity of 9 MW and are located next to each other in the province. With large solar power projects lined up to achieve the aim of 31 GW by the end of 2030, the solar photovoltaic market in Spain is expected to witness significant growth during the forecast period.

- Thus, with such ongoing developments and capacity additions supported by favorable government policies, the solar PV segment is expected to dominate the market during the forecast period.

Supportive Government Policies and Targets Driving the Market Demand

- Spain's renewable energy sector, particularly solar power, has become a focal point of the country's energy policy and a key contributor to its transition toward cleaner and more sustainable energy sources. The country is also among those European countries that obtain the maximum hours of sunshine.

- One of the driving factors behind the growth of solar energy in Spain has been the regulatory framework and support mechanisms provided by the government. Spain implemented favorable policies, including feed-in tariffs, subsidies, and competitive auctions, which have attracted investments and promoted the development of solar projects across the country. These policies have provided a stable and supportive environment for both domestic and international investors.

- Spain is committed to reducing the country's dependence on fossil fuels and increasing its share of renewable energy in the energy mix. In June 2023, Spain raised its targeted 2030 reduction of greenhouse gas emissions to 32%, up from a previous goal of 23%, mainly due to a rise in expectations on how much solar PV can be built out by the end of 2030.

- Spain's revised renewables plans point to a massive 56 GW deployment of solar from 2023 to the end of the decade. Secondly, promoting renewable energy aligns with Spain's commitment to the European Union's Renewable Energy Directive, which sets a binding target for the European Union to achieve a 42.5% share of renewable energy in final energy consumption by 2030.

- According to Spain's minister of ecological transition, the government submitted a new incentive scheme to public consultation in February 2024. It is designed to support the development of a clean energy technology supply chain in the country. The authorities launched the project for the first call for subsidies for energy transition equipment production, with a budget of USD 1.24 billion. Backed by funds from the Plan for Recovery, Transformation, and Resilience (PRTR), the scheme is expected to support the production of equipment and essential components of photovoltaic panels, batteries, wind turbines, heat pumps, and electrolyzers.

- The growth in solar energy installations has contributed to the expansion of Spain's overall renewable energy capacity. According to the International Renewable Energy Agency (IRENA), Spain's renewable energy capacity stood at 80,136 MW in 2023, a rise of 9% from the previous year.

- Therefore, considering the robust regulatory framework and the development of financial incentives for solar plants, the solar energy market in Spain is expected to witness growth during the forecast period.

Spain Solar Energy Industry Overview

The Spanish solar energy market is semi-fragmented. Some of the major players in the market (in no particular order) include Acciona SA, Iberdrola SA, The Red Electrica Group, COBRA Group, and Solaria Energia y Medio Ambiente SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Solar Energy Installed Capacity and Forecast, in GW, till 2029

- 4.3 Renewable Energy Mix, 2023

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Market Drivers

- 4.6.1.1 Declining Cost of Solar PV Installations

- 4.6.1.2 Supportive Government Policies for Renewable Energy

- 4.6.2 Market Restraints

- 4.6.2.1 Penetration of Other Energy Sources

- 4.6.1 Market Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Deployment Type

- 5.2.1 Rooftop

- 5.2.2 Ground-mounted

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Acciona SA

- 6.3.2 COBRA Group

- 6.3.3 Iberdrola SA

- 6.3.4 Solaria Energia y Medio Ambiente SA

- 6.3.5 JinkoSolar Holding Co. Ltd

- 6.3.6 The Red Electrica Group

- 6.3.7 Repsol SA

- 6.3.8 Engie SA

- 6.3.9 Soltec Energias Renovables SL

- 6.3.10 Gransolar Group

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Supportive Government Policies

02-2729-4219

+886-2-2729-4219