|

市场调查报告书

商品编码

1685704

化妆品和香水玻璃瓶包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Cosmetic Perfumery Glass Bottle Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

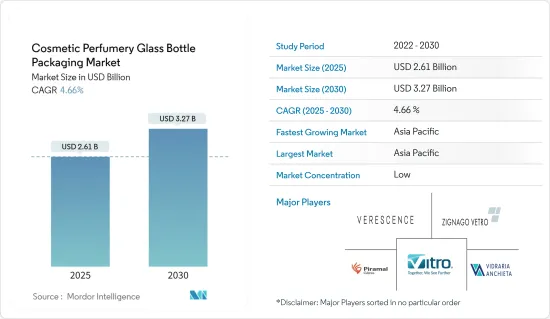

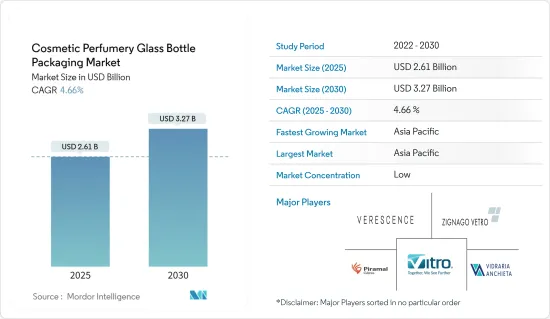

2025 年化妆品香水玻璃瓶包装市场规模预计为 26.1 亿美元,预计到 2030 年将达到 32.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.66%。

从出货量来看,市场预计将从 2025 年的 164 亿台成长到 2030 年的 203.8 亿台,预测期间(2025-2030 年)的复合年增长率为 4.44%。

在所有行业中,化妆品行业拥有最多样化的包装需求,并且对化妆品包装的需求持续增加。化妆品产业参与者正在齐心协力对抗塑胶污染,采用创新的包装策略和先进的配方。

玻璃是一种传统的包装材料,无孔且不渗透。它具有化学惰性,不会随着时间的劣化。玻璃除了具有功能性优势外,还能为产品带来高檔的感觉,让消费者能够看到内容和颜色,从而帮助他们做出购买决定。这种透明度和奢华的感觉是玻璃在化妆品包装中如此广泛使用的主要原因。

随着对永续解决方案的需求不断增长,企业正在积极寻求化妆品包装中传统塑胶的替代品,尤其是热固性材料。由于各种包装法规,此类不可回收材料面临政府限制的风险。

此外,由于 ABS 等材料面临区域监管,企业越来越多地转向永续选择,尤其是玻璃包装。

优质包装显着提高了消费者的满意度,使他们更有可能重复购买或推荐。全球化妆品和香水玻璃包装市场的主要企业正在拓宽视野,推出一系列用于化妆品和香水的优质玻璃包装。这些趋势可能会在未来几年增强对此类包装的需求。

从历史上看,铝和玻璃是化妆品包装的主要材料。然而,原物料成本的上涨使这些选择在经济上不适合大众消费,因此人们更倾向于选择塑胶作为替代品。

化妆品香水玻璃瓶包装市场趋势

香水市场预计将大幅成长

- 由于天然香料的需求相对于合成香料的激增以及奢侈香水的普及度上升,预计香水市场在预测期内将显着增长。这种日益增长的需求正推动各公司投资创新的香水瓶设计。此外,玻璃香水瓶以其优雅的造型和反射特性而闻名,将其定位为高端奢侈品。

- 随着消费者环保意识的增强,他们明显转向使用可最大限度减少废弃物的永续产品。这种转变增加了对填充用玻璃瓶的需求。这些填充用的香水瓶不仅透过减少一次性包装和塑胶废弃物符合环保价值观,而且它们还因玻璃可无限回收且不会劣化,成为最佳选择。

- 可再填充瓶不仅能带来环境效益,也能为消费者和製造商带来经济效益。对消费者来说,这是一项长期投资。每次购买填充用比购买新瓶装更便宜。对于製造商来说,持续购买填充用瓶可以提供可靠的收入来源。

- 中性高檔香水的日益普及也推动了化妆品产业对玻璃瓶的需求。当今的全球消费者已经超越了传统的性别标籤,期望他们的品味和偏好得到认可。消费者情绪的转变也体现在许多全球产品的推出上,从而推动了对玻璃瓶的需求。

预计亚太地区将实现最高成长

- 受国家蓬勃发展的经济和日益富裕的中产阶级的推动,中国包装产业正在蓬勃发展。随着中国化妆品市场的不断增长,对化妆品包装的需求也不断飙升。虽然化妆品和香水包装领域正在努力应对自身的挑战和机会,但中国消费者不断变化的生活方式趋势极大地推动了对玻璃包装的需求。

- 玻璃包装可以作为护肤产品的保护罩,保护它们免受湿气、空气和有害紫外线的伤害。许多护肤品含有敏感成分,因此保持其完整性至关重要。玻璃包装已成为最佳选择,可确保这些产品保持其纯度和效力。

- 此外,消费者被韩国产品吸引的一个主要原因是他们认为韩国产品重视健康和福祉。消费者往往会被包装标籤上突出的天然成分以及实惠的价格和引人注目的设计所吸引。随着对这些好处的认识不断提高,在社群媒体的影响和产品个性的推动下,消费者也变得更愿意投资。

- 随着趋势和消费者偏好的变化,玻璃在化妆品和香水领域的作用也不断发展。行业领导者利用创新的设计和技术,不断突破界限,创造出不仅引人注目,而且还能体现其所提供产品奢华的包装。

化妆品香水玻璃瓶包装市场概况

化妆品香水玻璃瓶包装市场竞争激烈,较为分散,几家主要企业占据领先地位。目前,其中少数主要参与者占了相当大的市场份额。这些参与者利用其突出的地位,积极努力扩大多个国家的基本客群。 Verescence、Vidraria Anchieta、Vitro SAB de CV、Zignago Vetro SpA 和 Piramal Glass Private Limited 等供应商正在利用策略联盟引领包装产业的创新。

- 2024年3月,爱茉莉太平洋集团与韩国资源再生振兴院(KORA)合作,推动玻璃化妆品瓶的回收。这些瓶子通常带有各种涂层,使其难以回收。此项联合活动于 2024 年 4 月 22 日世界地球日在京畿道启动,旨在减少环境破坏。该计划重点关注玻璃化妆品瓶的收集和回收,即使它们来自竞争对手。

- 2024 年 2 月加拿大知名药局 Shoppers Drug Mart 正致力于透过 Quo Beauty 免费回收计画减少塑胶垃圾。透过与 TerraCycle 合作,该商店为顾客提供了回收空的 Quo Beauty 化妆品容器的机会,避免它们进入垃圾掩埋场和焚化炉。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 滴管瓶需求不断增加

- 包装对于产品差异化的重要性日益增加

- 市场限制

- 塑胶包装作为玻璃瓶的替代品日益增多

第六章 市场细分

- 依产品类型

- 香水

- 指甲护理

- 护肤

- 其他产品类型

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 中国

- 韩国

- 印度

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Verescence France

- Vidraria Anchieta

- Vitro SAB De CV

- Zignago Vetro SpA

- Piramal Glass Private Limited(Piramal Group)

- Pragati Glass Pvt Ltd

- Berlin Packaging LLC

- Nekem Packaging

- SGB Packaging Group Inc.

- SKS Bottle & Packaging Inc.

- Stoelzle Oberglas Gmbh(CAG-Holding Gmbh)

- Apackaging Group LLC

- Baralan International SpA

- Bormioli Luigi SpA

- Roetell Group(Jiangsu Rongtai Glass Products Co. Ltd)

- Continental Bottle Company Ltd

- DSM Packaging Sdn Bhd

- Gerresheimer AG

- Heinz-Glas Gmbh & Ko. KGaA

- Lumson SpA

第八章投资分析

第九章:市场的未来

The Cosmetic Perfumery Glass Bottle Packaging Market size is estimated at USD 2.61 billion in 2025, and is expected to reach USD 3.27 billion by 2030, at a CAGR of 4.66% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 16.40 billion units in 2025 to 20.38 billion units by 2030, at a CAGR of 4.44% during the forecast period (2025-2030).

Among all industries, the cosmetic sector boasts the most diverse packaging needs, with a consistent uptick in cosmetic packaging demands. United in their efforts, players in the cosmetics industry are adopting innovative packaging strategies and refined formulations to combat plastic pollution.

Glass, a time-honored packaging material, is both nonporous and impermeable. Its chemically inert nature ensures it does not degrade over time. Beyond its functional benefits, glass enhances the premium allure of products, allowing consumers to view the contents and colors, thus informing their purchase decisions. This transparency and premium feel largely explain glass's prevalent use in cosmetic packaging.

As the demand for sustainable solutions surges, companies are actively seeking alternatives to conventional plastics in cosmetics packaging, notably steering clear of thermoset materials. These non-recyclable materials risk facing government-imposed restrictions due to various packaging regulations.

Moreover, with materials like ABS facing region-specific regulations, companies are increasingly pivoting toward sustainable options, notably glass packaging.

Premium packaging significantly boosts consumer satisfaction, enhancing the chances of repeat purchases and recommendations. Key players in the global cosmetic and perfume glass packaging market are broadening their horizons, introducing a range of luxury glass packaging tailored for cosmetics and perfumes. This trend is poised to bolster the demand for such packaging in the coming years.

Historically, aluminum and glass were the go-to materials for cosmetic packaging. However, rising raw material costs rendered these options less economically viable for mass consumption, paving the way for plastics to emerge as a favored alternative.

Cosmetic Perfumery Glass Bottle Packaging Market Trends

Perfume Segment Expected to Register Significant Growth

- As demand surges for natural fragrances over synthetic ones and luxury perfumes gain traction, the market is poised for significant growth during the forecast period. This rising demand has prompted companies to invest in innovative perfume bottle designs. Furthermore, perfume glass bottles, known for their elegant shapes and reflective quality, are positioned as high-end luxury items.

- As consumers grow increasingly conscious of their environmental footprint, there is a marked shift toward sustainable products that minimize waste. This shift has amplified the demand for refillable glass bottles. These refillable perfume bottles not only align with eco-friendly values by reducing disposable packaging and plastic waste but also stand out as glass, being infinitely recyclable without quality degradation, making it the top choice.

- Beyond environmental benefits, refillable bottles present economic advantages for both consumers and manufacturers. For consumers, it is a savvy long-term investment. Purchasing refills is cheaper than buying a new bottle each time. For manufacturers, the consistent purchase of refills translates to a reliable income stream.

- The rising popularity of unisex luxury perfumes is further fueling the demand for glass bottles in the cosmetic sector. Today's global consumers seek recognition for their preferences and tastes, transcending traditional gender labels. This evolving sentiment is evident in numerous global product launches, amplifying the demand for glass bottles.

Asia-Pacific Expected to Witness Highest Growth

- China's packaging industry is witnessing rapid growth, fueled by the nation's booming economy and an increasingly affluent middle class. As China's cosmetic market grows, the demand for cosmetic packaging has surged in tandem. While the cosmetic and perfume packaging sector grapples with its own set of challenges and opportunities, shifting trends in Chinese consumer lifestyles are notably driving the demand for glass packaging.

- Glass packaging serves as a shield for skincare products, guarding them against moisture, air, and harmful UV rays. Given that many skincare items boast sensitive ingredients, preserving their integrity is paramount. Opting for glass packaging emerges as the optimal choice, ensuring these products maintain their purity and effectiveness.

- Moreover, a significant draw for consumers toward Korean products lies in the perception that these items prioritize health and well-being. Shoppers are often enticed by the natural ingredients highlighted on packaging labels, coupled with the allure of affordable pricing and eye-catching designs. As awareness of these benefits grows, bolstered by social media influence and the distinctiveness of the offerings, consumers are increasingly inclined to invest in them.

- As trends and consumer preferences shift, the role of glass in the cosmetics and perfume sector is continually adapting. Industry frontrunners are pushing boundaries, experimenting with innovative designs and techniques to craft packaging that not only stands out but also mirrors the premium quality of their offerings.

Cosmetic Perfumery Glass Bottle Packaging Market Overview

The cosmetics and perfumery glass bottles market is characterized by intense competition and fragmentation, with several key players at the forefront. A handful of these major players currently command a significant share of the market. Capitalizing on their prominent positions, these players are actively working to broaden their customer base across multiple countries. Market vendors, including Verescence France, Vidraria Anchieta, Vitro SAB de CV, Zignago Vetro SpA, and Piramal Glass Private Limited, are harnessing strategic collaborations to spearhead innovations in the packaging industry.

- March 2024: Amorepacific Group teamed up with the Korea Resource Circulation Service Agency (KORA) to boost the recycling of cosmetic glass bottles. These bottles often have diverse coatings, making recycling a challenge. Their joint effort, which kicked off on Earth Day, April 22, 2024, in Gyeonggi Province, aims to lessen environmental harm. The project will spotlight the collection and recycling of cosmetic glass bottles, even those from rival companies.

- February 2024: Shoppers Drug Mart, a prominent Canadian drugstore, is taking steps to cut down on plastic waste through its Quo Beauty Free Recycling Program. In collaboration with TerraCycle, the retailer is providing customers an opportunity to recycle empty components of Quo Beauty cosmetics, ensuring they do not end up in landfills or incinerators.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Dropper Bottles

- 5.1.2 Increased Emphasis on Packaging for Product Differentiation

- 5.2 Market Restraints

- 5.2.1 Growth of Plastic Packaging as a Substitute for Glass Bottles

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Perfumes

- 6.1.2 Nail Care

- 6.1.3 Skin Care

- 6.1.4 Other Product Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 South Korea

- 6.2.3.3 India

- 6.2.3.4 Japan

- 6.2.3.5 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verescence France

- 7.1.2 Vidraria Anchieta

- 7.1.3 Vitro S.A.B. De C.V.

- 7.1.4 Zignago Vetro SpA

- 7.1.5 Piramal Glass Private Limited (Piramal Group)

- 7.1.6 Pragati Glass Pvt Ltd

- 7.1.7 Berlin Packaging LLC

- 7.1.8 Nekem Packaging

- 7.1.9 SGB Packaging Group Inc.

- 7.1.10 SKS Bottle & Packaging Inc.

- 7.1.11 Stoelzle Oberglas Gmbh (CAG-Holding Gmbh)

- 7.1.12 Apackaging Group LLC

- 7.1.13 Baralan International SpA

- 7.1.14 Bormioli Luigi SpA

- 7.1.15 Roetell Group (Jiangsu Rongtai Glass Products Co. Ltd)

- 7.1.16 Continental Bottle Company Ltd

- 7.1.17 DSM Packaging Sdn Bhd

- 7.1.18 Gerresheimer AG

- 7.1.19 Heinz-Glas Gmbh & Ko. KGaA

- 7.1.20 Lumson SpA