|

市场调查报告书

商品编码

1685713

网路安全-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Cyber Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

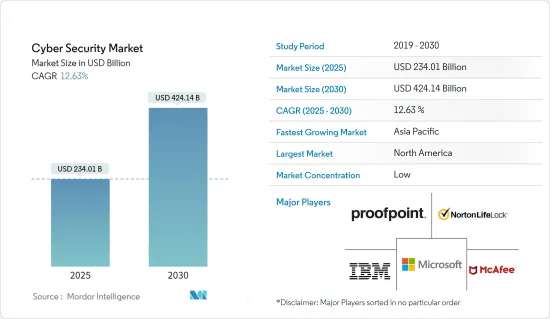

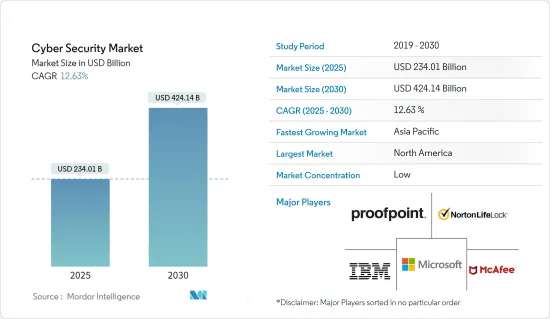

网路安全市场规模预计在 2025 年为 2,340.1 亿美元,预计到 2030 年将达到 4,241.4 亿美元,预测期内(2025-2030 年)的复合年成长率为 12.63%。

电子商务平台的兴起、智慧型装置的广泛使用以及由于部署云端解决方案而导致的网路攻击数量的增加是推动市场成长的因素。随着智慧和物联网设备的使用增加,网路威胁预计还会持续演变。因此,企业有望采用和部署先进的网路安全解决方案来侦测、最小化和减轻网路攻击的风险,从而推动市场成长。

主要亮点

- 网路安全产业不断上升的变革趋势预计将推动市场研究。例如,云端运算的兴起使组织能够比以往更好地扩充性其基础设施。组织还可以在云端环境中扩大或缩小其基础设施。一些组织已将资料中心完全迁移到云端,而其他组织则采用云端处理来增强其内部资料中心。

- 此外,随着人工智慧在所有细分市场的采用,这项技术与机器学习相结合正在彻底改变网路安全。人工智慧在建立自动化安全系统、脸部侦测、自然语言处理和自动化威胁侦测方面发挥关键作用。但它也可能被用来创建智慧恶意软体和攻击,忽略处理资料的最新安全通讯协定。支援人工智慧的威胁侦测系统可以预测新的攻击并立即通知管理员任何资料外洩。网路安全新技术的引入等趋势预计将成为一股推动力。

- 然而,网路安全专业人员短缺的问题仍然存在,影响到各种规模和行业的企业。这种短缺凸显了网路安全工作性质的不断演变。当今的网路安全工作反映了不同专业、组织和行业的多样化需求,需要兼具技术和非技术能力。

- 在 COVID-19 疫情爆发后,全球企业面临越来越多的网路攻击,因此,预计全球对网路安全的投资将会增加。该组织表示,Mirai、Gh0st.Rat 和 Pushdoare 是最常见的殭尸网路。预计网路相关 IT 硬体的投资将集中在加强安全性。预计在整个预测期内,网路安全设备将占全球企业 IT 支出的很大一部分。

网路安全市场趋势

BFSI 产业是最大的最终用户

- 网路安全市场的 BFSI 终端用户产业包括从事银行、金融交易、保险和相关金融服务的机构。这些机构优先采取强力的网路安全措施来保护敏感的财务资料、确保遵守法规并防范网路威胁。该行业包括商业银行、保险公司、非银行金融公司 (NBFC)、投资公司和信用合作社。

- 随着金融机构的业务和服务数位化,强而有力的网路安全措施变得越来越必要。 BFSI 产业是网路犯罪分子的主要目标之一,因为它管理着高价值交易、敏感客户资料和关键金融基础设施。

- 此外,据 SentinelOne 称,近年来针对 BFSI 行业的攻击频率和复杂程度显着增加。就去年报告的资料外洩数量而言,金融机构是受影响第二严重的行业。针对金融服务的勒索软体攻击将从 2022 年的 55% 增加到 2023 年的 64%,几乎是 2021 年报告的 34% 的两倍。

- 在整个产业中,金融服务的数位转型、云端采用以及区块链和人工智慧等先进技术的融合等因素正在推动安全实践的重大变化。金融科技创新的日益普及带来了更大的复杂性,需要灵活的网路安全策略来保护动态、互联环境中的交易和客户资讯。

- Sophos 表示,针对全球金融机构的勒索软体攻击主要由一些关键因素驱动。

- 随着数位科技的采用和线上金融服务的增加,BFSI 领域的网路威胁面不断扩大。行动银行、数付款管道和线上交易的扩张为网路安全带来了新的挑战,需要先进的解决方案来防范诈骗、资料外洩和其他网路风险。

北美占最大市场占有率

- 美国面临着不断演变和复杂的网路威胁情势,由于数位技术和云端运算在终端用户产业的渗透率高于其他国家,美国是全球网路犯罪的中心。作为受攻击最严重的国家,美国公司面临更多的攻击,一旦攻击得逞,损失将更加惨重。

- 近年来,由于组织和个人面临的网路威胁和攻击日益增多,网路安全已成为美国越来越重要的领域。根据身分盗窃资源中心的数据,2023 年美国发生了 3,205 起资料外洩事件,影响了 3.53 亿人。这些违规行为包括破坏、洩漏和暴露,其通用结果是未授权存取敏感资料。

- 在美国,网路攻击变得越来越频繁和复杂,推动了网路安全解决方案的采用。美国的许多行业都受到 HIPPA、GDPR 和 PCI DSS 等法规的约束,不断增加的监管要求正在推动许多组织采用和投资网路安全解决方案。因此,企业正在加大对网路安全的投资。

- 例如,2023年9月,Google Cloud和ONDC的开放商务解决方案被20多家电子商务公司接受。这使得买家、卖家和物流服务供应商能够无缝参与 ONDC 网路。这将允许更多的消费者和卖家,特别是居住在小城市的消费者和卖家,使用 Google Cloud 提供的生成式 AI 工具在网路上进行交易。

- 随着私营和公共部门数位化趋势的不断增强,加拿大网路安全市场也在不断发展。例如,加拿大的能源产业正在经历由云端、人工智慧、物联网和量子运算等技术的数位化能力所推动的变革时期。随着产业的发展,国家对网路安全的需求也不断增加。

- 网路犯罪在加拿大迅速成长,其影响也日益严重。根据通讯安全局(CSE)2023年8月的报告,加拿大共报告了70,878起网路诈骗案件,导致窃盗金额超过3.9亿美元。随着勒索软体攻击和资料外洩等网路威胁的频率和复杂程度不断增加,加拿大组织正在投资网路安全解决方案,以保护自己免受不断演变的威胁。

网路安全产业概览

网路安全市场高度分散,既有全球参与者,也有中小型企业。主要公司包括 IBM Corporation、Nortonlifelock Inc.(Gen Digital Inc.)、Microsoft Corporation、Proofpoint Inc.(Thoma Bravo LP)和 Mcafee LLC。为了增强服务和解决方案并获得永续的竞争优势,市场上的公司正在采取收购和伙伴关係等策略。

- 2024 年 7 月-IBM 和微软加强了网路安全合作,以协助客户简化和更新保全行动,特别是在混合云端身分管理领域。透过将 IBM 咨询网路安全服务与微软强大的安全技术套件结合,此次合作为客户提供了简化保全行动、利用云端功能、保护资料和发展业务所需的工具和专业知识。

- 2024 年 6 月—微软宣布了一项举措计划,以加强为美国农村地区 6000 多万居民提供服务的医院的防御能力。为了补充这一点,微软将与社区大学合作开发网路安全技能计画。此外,微软也透过其 TechSpark 计画积极与当地合作伙伴共同培育技术和网路安全就业机会。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第1章 引言

- 研究假设和市场定义

- 研究范围

第2章调查方法

第3章执行摘要

第4章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 评估新冠疫情对产业的影响及復苏

- 评估宏观经济趋势的影响

第5章市场动态

- 市场促进因素

- 数位转型技术与安全情报的兴起

- 关键基础设施遭受攻击的潜在损害程度以及这些攻击的复杂程度

- 更多采用资料密集方法和决策

- 市场挑战

- 与传统基础设施的复杂整合

- 关键使用案例

- 法规和网路安全标准

- 网路安全培训趋势

- 定价及定价模式分析

第6章市场区隔

- 按服务

- 解决方案

- 应用程式安全

- 云端安全

- 资料安全

- 身分和存取管理

- 基础设施保护

- 综合风险管理

- 网路安全设备

- 其他解决方案

- 服务

- 专业服务

- 託管服务

- 解决方案

- 按部署

- 本地

- 云

- 按最终用户产业

- IT/电信

- 使用案例

- BFSI

- 使用案例

- 零售与电子商务

- 使用案例

- 石油、天然气和能源

- 使用案例

- 製造业

- 使用案例

- 政府和国防

- 使用案例

- 其他最终用户产业

- 使用案例

- IT/电信

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 希腊

- 亚洲

- 中国

- 印度

- 日本

- 澳洲

- 印尼

- 菲律宾

- 马来西亚

- 新加坡

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 北美洲

第7章竞争格局

- 公司简介

- IBM Corporation

- Nortonlifelock Inc.(Gen Digital Inc.)

- Microsoft Corporation

- Proofpoint Inc.(Thoma Bravo LP)

- Mcafee LLC

- Fortinet Inc.

- Check Point Software Technologies Ltd

- Trend Micro Inc.

- Cisco Systems Inc.

- Sophos Ltd

第8章厂商市场占有率分析

第9章 区域供应商排名

第10章投资分析

第11章:投资分析市场的未来

The Cybersecurity Market size is estimated at USD 234.01 billion in 2025, and is expected to reach USD 424.14 billion by 2030, growing at a CAGR of 12.63% during the forecast period (2025-2030).

The rising number of cyber-attacks with the emergence of e-commerce platforms, the proliferation of smart devices, and the deployment of cloud solutions are some factors driving the market's growth. Cyber threats are expected to evolve with the increased use of devices with intelligent and IoT technologies. As such, firms are expected to adopt and deploy progressive cyber security solutions to detect, minimize, and mitigate the risk of cyber-attacks, thereby driving market growth.

Key Highlights

- The upsurging of transformative trends in the cybersecurity industry is expected to drive the market studied. For instance, increased cloud computing has provided organizations with much greater infrastructure scalability than was previously possible. Organizations can also scale their infrastructure up or down with cloud environments. While some organizations have transitioned their data centers entirely to the cloud, others have embraced cloud computing to augment on-premise data centers.

- Moreover, with AI being introduced in all market segments, this technology, integrated with machine learning, has brought considerable changes in cybersecurity. Artificial Intelligence has been critical in building automated security systems, face detection, natural language processing, and automatic threat detection. However, it is also used to create smart malware and attacks to overlook the latest security protocols for handling data. Artificial Intelligence-enabled threat detection systems can predict new attacks and instantly notify admins of any data breach. Trends like the implementation of new technologies in cybersecurity are expected to drive.

- However, a shortage of cybersecurity professionals persists, affecting businesses across the board, irrespective of size or industry. This scarcity highlights the evolving nature of cybersecurity roles, which now demand a blend of technical and non-technical proficiencies, reflecting the diverse needs of different specializations, organizations, and industries.

- After the COVID-19 pandemic, global enterprises have been faced with an increasing number of attacks on their networks, owing to which investments in safeguarding the network are expected to increase worldwide. Organizations are targeted with botnets with Mirai, Gh0st. Rat and Pushdoare are the most common botnets. A prominent share of the investment into IT hardware in terms of network is expected to be focused on enhancing security. Throughout the forecast period, network security equipment is expected to be a significant part of enterprise IT spending worldwide.

Cybersecurity Market Trends

BFSI Industry to be the Largest End User

- The BFSI end-user industry in the cybersecurity market encompasses institutions involved in banking, financial transactions, insurance, and related financial services. These organizations prioritize robust cybersecurity measures to protect sensitive financial data, ensure regulatory compliance, and safeguard against cyber threats. The sector includes commercial banks, insurance companies, non-banking financial companies (NBFCs), investment firms, and credit unions.

- As financial institutions increasingly digitize their operations and services, robust cybersecurity measures are necessary. The BFSI sector is one of the key targets for cybercriminals due to the high-value transactions, sensitive customer data, and critical financial infrastructure it manages.

- Moreover, as per SentinelOne, there has been a substantial surge in the frequency and sophistication of attacks on the BFSI industry in recent years. Financial institutions were the sector with the second highest impact as per the number of reported data breaches last year. Ransomware attacks on financial services have increased to 64% in 2023 from 55% in 2022, almost double the 34% reported in 2021.

- The industry is witnessing a significant shift in security measures, driven by factors such as the digital transformation of financial services, cloud adoption, and integration of advancing technologies, such as blockchain and AI. The increasing prevalence of fintech innovations adds complexity, necessitating agile cybersecurity strategies to secure transactions and customer information in an interconnected and dynamic environment.

- According to Sophos, ransomware attacks on global financial organizations primarily stem from many key factors; 40% are due to exploited vulnerabilities, while 23% result from compromised credentials.

- The augment in the adoption of digital technologies and the rise of online financial services have stretched the attack surface for cyber threats in the BFSI sector. The expansion of mobile banking, digital payment platforms, and online transactions created new challenges for cybersecurity, necessitating advanced solutions to protect against fraud, data breaches, and other cyber risks.

North America Holds Largest Market Share

- The United States faces a continuously evolving and sophisticated cyber threat landscape, and it is at the epicenter of cybercrime globally due to the high penetration of digital technologies and cloud computing in end-user industries compared to other countries. It is the most highly targeted nation, and American businesses face a higher volume of attacks and more costly consequences when an attack is successful.

- Cybersecurity has become an increasingly important area of focus in the United States in recent years, owing to the augmenting number of cyber threats and attacks that organizations and individuals face. As per the Identity Theft Resource Center, in 2023, the United States witnessed 3,205 data compromises, impacting 353 million individuals. These compromises encompassed breaches, leaks, and exposures, culminating in one shared outcome: unauthorized access to sensitive data.

- The increasing frequency and sophistication of cyber-attacks drive the adoption of cybersecurity solutions in the United States. The growing regulatory requirement leads many organizations to adopt and invest in cybersecurity solutions, as many industries in the United States are subject to regulations such as HIPPA, GDPR, and PCI DSS, which require the organization to implement. Due to this, companies are increasing their investments in cybersecurity.

- For instance, in September 2023, the Open Commerce solution from Google Cloud and ONDC was accepted by over 20 e-commerce enterprises. This allows buyers, sellers, and logistical service providers to join the ONDC network seamlessly. With this, there will be an increase in the number of consumers and sellers who can use the generative AI tools offered by Google Cloud to transact on the network, particularly people who reside in smaller cities.

- The cybersecurity market in Canada is evolving with the increasing digitalization trends in different private and public sector sectors. For instance, the Canadian energy sector is entering a period of transformation, which is driven by the digital capabilities of technologies like cloud, AI, IoT, and quantum computing. As the industry evolves, the country's cybersecurity demand is growing.

- Cybercrime is rapidly gaining traction in Canada, and its impact is increasing alarmingly. According to a report published by the Communications Security Establishment (CSE) in August 2023, there were 70,878 reports of cyber fraud in Canada, with over USD 390 million stolen. The rising frequency and sophistication of cyber threats, including ransomware attacks and data breaches, have driven organizations in Canada to invest in cybersecurity solutions to protect against evolving threats.

Cybersecurity Industry Overview

The Cybersecurity market is highly fragmented, owing to global players and small and medium-sized enterprises. Some of the major players are IBM Corporation, Nortonlifelock Inc. (Gen Digital Inc.), Microsoft Corporation, Proofpoint Inc. (Thoma Bravo LP), and Mcafee LLC. In order to enhance their services and solution offerings and gain sustainable competitive advantage, players in the market adopt strategies such as acquisitions and partnerships.

- July 2024 - IBM and Microsoft bolstered their cybersecurity collaboration, aiming to assist clients in streamlining and updating their security operations, especially in the realm of hybrid cloud identity management. The collaboration combined IBM Consulting's cybersecurity services and Microsoft's robust security technology suite, equipped clients with the necessary tools and know-how to streamline their security operations, leverage cloud capabilities, safeguard their data, and fuel business expansion.

- June 2024 - Microsoft Corp. unveiled a cybersecurity initiative to bolster the defenses of hospitals catering to over 60 million residents in rural America. Complementing this, Microsoft collaborates with community colleges to roll out the Cybersecurity Skills Initiative. Furthermore, through its TechSpark program, Microsoft is actively fostering technology and cybersecurity employment opportunities in tandem with local partners.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry within the Industry

- 4.2.5 Threat of Substitute Products and Services

- 4.3 An Assessment of the Impact of and Recovery From COVID-19 on the Industry

- 4.4 An Assessment of the Impact of Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Digital Transformation Technologies and Rise of Security Intelligence

- 5.1.2 High Potential Damages From Attacks On Critical Infrastructure and Increasing Sophistication of Attacks

- 5.1.3 Increase in Adoption of Data-intensive Approaches and Decisions

- 5.2 Market Challenges

- 5.2.1 Integration Complexities With Legacy Infrastructure

- 5.3 Key Use Cases

- 5.4 Regulations and Cybersecurity Standards

- 5.5 Cybersecurity Training Trends

- 5.6 Analysis of Pricing and Pricing Model

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Solutions

- 6.1.1.1 Application Security

- 6.1.1.2 Cloud Security

- 6.1.1.3 Data Security

- 6.1.1.4 Identity and Access Management

- 6.1.1.5 Infrastructure Protection

- 6.1.1.6 Integrated Risk Management

- 6.1.1.7 Network Security Equipment

- 6.1.1.8 Other Solutions

- 6.1.2 Services

- 6.1.2.1 Professional Services

- 6.1.2.2 Managed Services

- 6.1.1 Solutions

- 6.2 By Deployment

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By End-User Industry

- 6.3.1 IT and Telecom

- 6.3.1.1 Use Cases

- 6.3.2 BFSI

- 6.3.2.1 Use Cases

- 6.3.3 Retail and E-Commerce

- 6.3.3.1 Use Cases

- 6.3.4 Oil Gas and Energy

- 6.3.4.1 Use Cases

- 6.3.5 Manufacturing

- 6.3.5.1 Use Cases

- 6.3.6 Government and Defense

- 6.3.6.1 Use Cases

- 6.3.7 Other End-user Industries

- 6.3.7.1 Use Cases

- 6.3.1 IT and Telecom

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Greece

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia

- 6.4.3.5 Indonesia

- 6.4.3.6 Philippines

- 6.4.3.7 Malaysia

- 6.4.3.8 Singapore

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.5 Middle East and Africa

- 6.4.5.1 Saudi Arabia

- 6.4.5.2 United Arab Emirates

- 6.4.5.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Nortonlifelock Inc. (Gen Digital Inc.)

- 7.1.3 Microsoft Corporation

- 7.1.4 Proofpoint Inc. (Thoma Bravo LP)

- 7.1.5 Mcafee LLC

- 7.1.6 Fortinet Inc.

- 7.1.7 Check Point Software Technologies Ltd

- 7.1.8 Trend Micro Inc.

- 7.1.9 Cisco Systems Inc.

- 7.1.10 Sophos Ltd