|

市场调查报告书

商品编码

1685724

聚氨酯:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)Polyurethane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

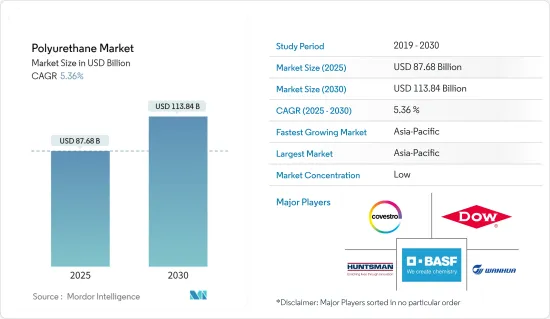

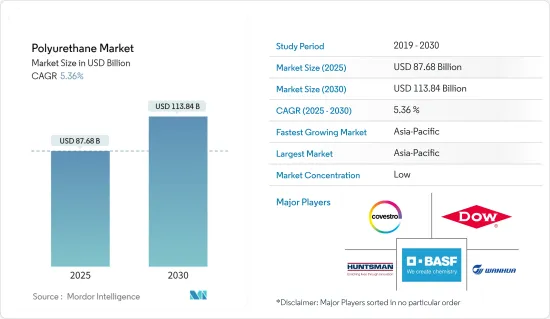

聚氨酯市场规模预计在 2025 年为 876.8 亿美元,预计到 2030 年将达到 1138.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.36%。

COVID-19 严重影响了各行业的市场成长。为控制疫情而导致的计划停工和放缓、生产停顿、旅行限制和劳动力短缺导致聚氨酯市场的成长放缓。然而,受家具、鞋类和汽车等各种终端用途消费增加的推动,2021 年已显着復苏。

主要亮点

- 汽车产业对轻质高性能复合材料的需求不断增加,床上用品、地毯和缓衝产业的需求不断增加,以及建筑业的需求不断增加是推动研究市场成长的主要因素。

- 然而,预计在预测期内,日益增长的环境问题将抑制目标产业的成长。

- 然而,对生物基聚氨酯的需求不断增长可能为全球市场提供有利的成长机会。

- 预计亚太地区将主导市场,并在预测期内实现最高的复合年增长率。

聚氨酯市场趋势

建筑和建设产业的需求不断增长

- 聚氨酯因其优异的强度重量比、绝缘性能、多功能性和耐用性而被广泛应用于建筑应用。聚氨酯组件因其价格低廉和舒适性而被世界各地的住宅所采用。

- 建设产业是硬质聚氨酯泡沫和喷涂聚氨酯泡沫的最大消费者。硬质聚氨酯泡沫隔热材料具有许多优点,包括能源效率、多功能性、高性能、热性能和机械性能以及环保性能。

- 硬质聚氨酯泡棉用于隔热板、墙壁和屋顶隔热材料以及作为门窗周围的缝隙填充材。硬质泡棉黏合剂用于门窗安装和预製住宅。

- 预计全球整体建筑量将成长 85%,其中中国、美国和印度将领先,占全球成长的 57%。随着全球最大建筑市场的成长放缓,预计到2030年,中国在全球建筑市场的市场占有率将略有增加。

- 根据国际贸易组织的统计,中国是全球最大的建筑市场,拥有全球最高的都市化。根据中国国家统计局的资料,2022年,全国建筑业总产值超过31兆元(约4.31兆美元),比前十年增长近100%。

- 根据美国人口普查局的数据,2022年美国私人建筑支出为14,342亿美元,比2021年的12,795亿美元增加11.7%(+-1.0%)。 2022年住宅建筑支出为8,991亿美元,比2021年的7,937亿美元增加13.3%(+2.1%),非住宅建筑支出为5,301亿美元,比2021年的4,858亿美元(1.0%)下降9.1%(+2.1%)。 2023 年 10 月发放的建筑许可数量约为 148.7 万份,而 2022 年 10 月为 155.5 万份。

- 此外,欧盟復苏基金的投资推动欧洲建筑业在2022年成长2.5%。儘管大多数欧盟建设公司面临价格压力,但预计景气将在2022年初恢復,并达到新冠疫情之前的水平。此外,随着新冠疫情危机的消退,建商不愿投资新的公司大楼和维修现有房产,非住宅建筑预计将加快步伐,从而支持整体建筑市场的成长。 2021年主要建设计划为非住宅项目(办公大楼、医院、饭店、学校及工业建筑),占31.3%。

- 中东地区的一些主要商业建设项目是由政府计划推动的,例如沙乌地阿拉伯2030愿景和阿布达比2030经济愿景。 Qiddiya、Al-Ula的Sharaan度假村、法赫德国王医疗城扩建、Al Widyan和阿卜杜拉·本·阿卜杜勒阿齐兹国王医疗综合体是沙乌地阿拉伯的一些建设计划,这些项目将对市场成长产生积极影响。

- 由于上述因素,预测期内建设产业对聚氨酯的需求预计将蓬勃发展。

亚太地区占市场主导地位

- 亚太地区占据全球聚氨酯市场的大部分份额。由于中国和印度的汽车产量增加、建设活动增加以及都市化加快,聚氨酯的使用量正在增加。

- 根据国际贸易组织的统计,中国是全球最大的建筑市场,拥有全球最高的都市化。根据美国建筑师协会(AIA)上海分会的资料,到2025年,中国预计将建成一个相当于10个纽约规模的城市。

- 聚氨酯在汽车中有着广泛的应用。除了使汽车座椅更舒适的发泡聚苯乙烯外,聚氨酯还用于保险桿、被称为「车顶」的内部天花板部分、车身、车门、扰流板、车窗等。中国是最大的汽车生产国。由于人们对环境问题的日益关注,该国的汽车产业正在经历重大的产品变革,专注于创造既能确保燃油效率又能最大限度减少排放气体的产品。

- 根据国际汽车工业组织(OICA)的数据,中国是最大的汽车生产国,预计2022年汽车产量将达到27,026,155辆,比2021年增长3%。印度汽车产业经历了巨大的成长,2022年汽车产量为5,456,857辆,比2021年成长24%。

- 聚氨酯泡棉经常被用作舒适、实用的衬垫傢俱产品的核心,从办公椅到床。亚太地区占全球家具产量的一半以上。最大的家俱生产国是中国。根据中国国家统计局的数据,2023年10月中国家具零售额将达到约137亿元人民币(约18.7亿美元),低于2023年9月的138亿元人民币(约18.8亿美元)。

- 由于这些因素,预计亚太地区的聚氨酯市场在预测期内将稳定成长。

聚氨酯产业概况

聚氨酯市场较为分散。市场上的主要企业(不分先后顺序)包括亨斯迈国际有限责任公司、万华化学、科思创股份公司、BASF股份公司和陶氏化学。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 汽车产业对轻质、高性能复合材料的需求不断增加

- 建筑和建设产业的需求增加

- 床上用品、地毯和垫子行业的需求增加

- 限制因素

- 日益增长的环境问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 类型

- 硬质泡沫

- 柔软泡沫

- 被覆剂、黏合剂、密封剂、弹性体(CASE)

- 热塑性聚氨酯

- 其他类型

- 最终用户产业

- 家具

- 建筑与施工

- 电子产品

- 车

- 鞋类

- 包装

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- BASF SE

- BCI Holding SA

- Carpenter Co.

- Covestro AG

- DIC Corporation

- Dow

- Huntsman International LLC

- INOAC Corporation

- Kuwait Polyurethane Industries WLL

- LANXESS

- Mitsui Chemicals Inc.

- Rogers Corporation

- Sheela Foam Limited

- Tosoh Corporation

- Wanhua

第七章 市场机会与未来趋势

- 生物基聚氨酯的需求不断成长

The Polyurethane Market size is estimated at USD 87.68 billion in 2025, and is expected to reach USD 113.84 billion by 2030, at a CAGR of 5.36% during the forecast period (2025-2030).

COVID-19 severely impacted market growth in various sectors. Stoppage or slowdown of projects, production halts, movement restrictions, and labor shortages to contain the outbreak have led to a decline in the growth of the polyurethane market. However, it recovered significantly in 2021 due to rising consumption from various end-use applications, such as furniture, footwear, and automotive.

Key Highlights

- The increasing demand for lightweight and high-performance composites from the automotive industry, rising demand from the bedding, carpet, and cushioning industries, and increasing demand from the building and construction industry are major factors driving the growth of the market studied.

- However, growing environmental concerns are anticipated to restrain the growth of the target industry during the forecast period.

- Nevertheless, the increasing demand for bio-based polyurethane may create lucrative growth opportunities for the global market.

- Asia-Pacific is expected to dominate the market and is likely to witness the highest CAGR during the forecast period.

Polyurethane Market Trends

Increasing Demand from the Building and Construction Industry

- Polyurethane is widely used in construction applications due to its excellent strength-to-weight ratio, insulation properties, versatility, and durability. Polyurethane components are found in homes across the world due to their affordability and the comfort they provide.

- The building and construction industry is the largest consumer of rigid and sprayed polyurethane foam. Rigid polyurethane foam insulation has many benefits, including energy efficiency, versatility, high performance, thermal/mechanical performance, and environment-friendly nature.

- Rigid polyurethane foams are used as insulated panels, wall and roof insulation, and gap fillers for the space around doors and windows. Rigid foam adhesives are used in window and door installations and manufactured housing.

- The volume of construction work is expected to grow by 85% globally, with China, the United States, and India leading the way, accounting for 57% of global growth. China's global construction market share is expected to increase marginally as growth in the world's largest construction market slows until 2030.

- According to the International Trade Organization, China is the world's largest construction market and has the highest rate of global urbanization. According to data from the National Bureau of Statistics of China, in 2022, the construction industry in the country generated an output of over CNY 31 trillion (~USD 4.31 trillion), representing an increase of almost 100% from the previous decade.

- According to the United States Census Bureau, in the United States, the value of private construction in 2022 stood at USD 1,434.2 billion, 11.7% (+- 1.0%) higher than the USD 1,279.5 billion in 2021. Residential construction spending in 2022 was USD 899.1 billion, up by 13.3% (+-2.1%) from USD 793.7 billion in 2021, while non-residential construction spending accounted for USD 530.1 billion, down by 9.1% (+-2.1%) from USD 485.8 billion in 2021 (1.0%). The total number of building permits in October 2023 was around 1,487,000 units compared to 1,555,000 units in October 2022.

- Furthermore, Europe's construction sector grew by 2.5% in 2022 because of the investments from the EU Recovery Fund. Business confidence picked up in early 2022, despite price pressures at most EU construction firms, and is expected to reach pre-COVID-19 levels. Moreover, as the COVID-19 crisis abates and builders become less reluctant to invest in new corporate buildings and renovate existing properties, non-residential construction is expected to pick up the pace, thus supporting overall growth in the construction market. The major construction projects in 2021 were non-residential (offices, hospitals, hotels, schools, and industrial buildings), accounting for 31.3%.

- Several primary commercial construction operations in the Middle East are driven by government projects, such as Saudi Arabia Vision 2030 and Abu Dhabi Economic Vision 2030. Qiddiya, Sharaan Resort at Al-Ula, King Fahad Medical City Expansion, Al Widyan, and King Abdullah Bin Abdulaziz Medical Complexes are examples of construction projects in Saudi Arabia with a favorable impact on the market growth.

- According to the above-mentioned factors, the demand for polyurethane from the building and construction industry is expected to flourish during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific holds the major market share in the global polyurethane market. Polyurethane usage is increasing, with growing automobile production, construction activities, and rapid urbanization in China and India.

- According to the International Trade Organization, China is the largest construction market in the world and has the highest rate of global urbanization. According to data from the American Institute of Architects (AIA) Shanghai, by 2025, China is expected to construct a city equivalent to 10 in New York since the 1990s.

- Polyurethane is widely used in automobiles. In addition to the foam that makes car seats comfortable, polyurethane is used in bumpers, interior "headline" ceiling sections, the car body, doors, spoilers, and windows. China is the largest producer of automobiles. Due to the growing environmental concerns, the country's automotive sector is aiming for large-scale product evolution, focusing on manufacturing products to ensure fuel economy while minimizing emissions.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), China was the largest producer of motor vehicles, with a production of 27,020,615 units of vehicles in 2022, registering a 3% growth compared to 2021. The Indian automobile sector saw immense growth, with a production of 54,56,857 units of vehicles in 2022, a 24% increase from 2021.

- Polyurethane foams are frequently used as the core of comfortable and functional upholstered furniture, with products ranging from office chairs to beds. Asia-Pacific accounted for more than half of global furniture production. China is the largest producer of furniture. According to the National Bureau of Statistics of China, in October 2023, the retail sales of furniture in China amounted to approximately CNY 13.7 billion (~USD 1.87 billion) compared to CNY 13.8 billion (~USD 1.88 billion) in September 2023.

- Due to all such factors, the Asian-Pacific polyurethane market is expected to witness steady growth during the forecast period.

Polyurethane Industry Overview

The polyurethane market is fragmented in nature. Some major players (not in any particular order) in the market include Huntsman International LLC, Wanhua, Covestro AG, BASF SE, and DOW.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Lightweight and High-performance Composites from the Automotive Industry

- 4.1.2 Increasing Demand from the Building and Construction Industry

- 4.1.3 Increasing Demand from the Bedding, Carpet, and Cushioning Industries

- 4.2 Restraints

- 4.2.1 Growing Environmental Concerns

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Rigid Foam

- 5.1.2 Flexible Foam

- 5.1.3 Coatings, Adhesives, Sealants, and Elastomers (CASE)

- 5.1.4 Thermoplastic Polyurethane

- 5.1.5 Other Types

- 5.2 End-user Industry

- 5.2.1 Furniture

- 5.2.2 Building and Construction

- 5.2.3 Electronics and Appliances

- 5.2.4 Automotive

- 5.2.5 Footwear

- 5.2.6 Packaging

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 BCI Holding SA

- 6.4.3 Carpenter Co.

- 6.4.4 Covestro AG

- 6.4.5 DIC Corporation

- 6.4.6 Dow

- 6.4.7 Huntsman International LLC

- 6.4.8 INOAC Corporation

- 6.4.9 Kuwait Polyurethane Industries WLL

- 6.4.10 LANXESS

- 6.4.11 Mitsui Chemicals Inc.

- 6.4.12 Rogers Corporation

- 6.4.13 Sheela Foam Limited

- 6.4.14 Tosoh Corporation

- 6.4.15 Wanhua

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Polyurethane