|

市场调查报告书

商品编码

1685732

生物基聚氨酯:市场占有率分析、产业趋势与成长预测(2025-2030)Bio-based Polyurethane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

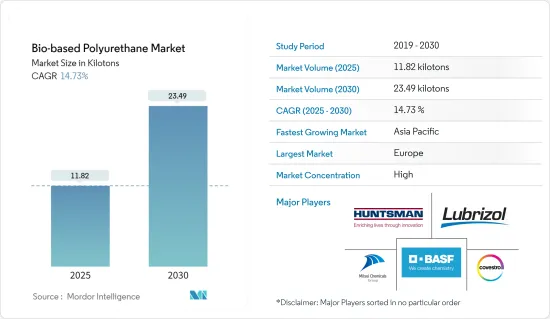

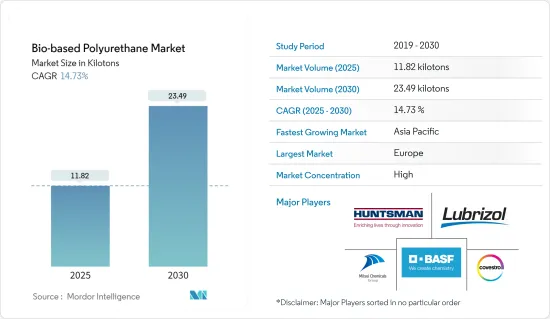

预计 2025 年生物基聚氨酯市场规模为 11.82 千吨,2030 年将达到 23.49 千吨,预测期间(2025-2030 年)的复合年增长率为 14.73%。

主要亮点

- 市场受到了 COVID-19 疫情的不利影响。疫情期间,建设产业受到较大影响,影响了被调查市场的需求。不过,预计未来几年市场将维持成长轨迹。目前,市场已从疫情中恢復,并呈现显着的成长率。

- 从中期来看,新兴国家建设产业需求的增加以及电子製造业需求的增加是推动市场发展的关键因素。

- 然而,生物基材料的高成本预计会阻碍市场成长。

- 不过,预计预测期内中东和非洲的工业成长将会良好。

- 亚太地区预计将成为全球成长最快的市场,其中消费量最高的国家是中国和印度。

生物基聚氨酯市场趋势

运输业需求增加

- 生物基聚氨酯的主要应用是运输业,包括汽车、铁路和航太。此外,汽车产业还消耗生物基聚氨酯泡棉、涂料、黏合剂和密封剂。具体来说,生物基聚氨酯泡棉用于座椅系统(头枕、车顶内衬、扶手、座垫等)和内装零件。

- 根据国际汽车製造商协会(OCIA)预测,2022年全球汽车产量将达8,502万辆,产能较2021年成长6%。到2022年,中国、美国、德国将成为全球三大汽车和商用车生产国。

- 作为最大的汽车生产地区,亚太地区在2022年也录得7%的成长率,产量从2021年的4,676万辆成长至2022年的5,002万辆。同样,美洲和非洲在2022年的成长率分别为10%和13%。

- 在铁路产业,生物基聚氨酯具有潜在的应用,因为它可以在未来几年内在很大程度上取代传统的聚氨酯产品。在铁路领域,生物基泡棉可用于座椅缓衝和隔热应用。

- 印度铁路作为全球第三大单一所有权铁路企业,可望透过政府的智慧实现扩张。印度品牌股权基金会预计,2018 年至 2022 年间,印度铁路(34 个基础设施子部门之一)的投资金额将达到 1,240 亿美元。

- 此外,在航太工业中,生物基聚氨酯泡棉和涂料有潜力取代传统的聚氨酯材料。根据波音公司预测,2022年至2041年间,全球航太服务业的价值将超过3.6兆美元,其中美国和加拿大约占30%,欧洲紧追在后,占23.5%。

- 因此,预计预测期内运输业的需求将增加对生物基聚氨酯的需求。

亚太地区可望成为成长最快的市场

- 亚太地区是最大的生物基聚氨酯生产地。

- 生物基聚氨酯用于建筑领域。它越来越多地被用于门窗型材、管道和排水沟、水泥、地板材料、玻璃、密封剂和黏合剂、隔热材料、建筑板和屋顶。

- 中国正经历建筑业的繁荣。该国拥有该地区乃至全球最大的建筑市场,占全球建筑投资的20%。中国政府估计,2022 年新增基础设施债券年度限额将为 3.85 兆元(5,400 亿美元),高于 2021 年的 3.65 兆元(5,200 亿美元)。

- 生物聚氨酯可以取代汽车应用中的聚丙烯,例如保险桿和保险桿扰流板、墙板、车顶/行李箱扰流板、户定板、车身面板、主机、控制台、暖通空调系统 (HVAC)、电池盖、空气管道、压力容器和防溅板。

- 根据国际汽车製造商协会(OICA)的数据显示,2021年中国汽车产量约为2,612万辆,而2022年约为2,702万辆,成长率约为3%。

- 除了电绝缘、抗衝击和黏合性能外,生物基聚氨酯还广泛应用于行动电话、行动装置、电脑和电视等电气和电子应用。

- 同样在印度,电子产品市场的需求正在不断成长,市场规模正在快速成长。印度电子和资讯技术部发布了印度电子製造业愿景文件第二卷,预计印度电子製造业规模将从 2020-21 年的 750 亿美元增长至 2025-26 年的 3000 亿美元。印度和中国电子和家用电器市场的成长可能会进一步推动亚太地区的市场成长。

- 上述因素可能在预测期内增加对生物基聚氨酯的需求。

生物基聚氨酯产业概况

生物基聚氨酯市场正在整合。研究涉及的市场主要参与者包括BASF公司、科思创公司、亨斯迈国际有限公司、三井化学公司、路博润公司等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 新兴国家建筑业的需求不断增加。

- 电子产品製造商的需求不断成长

- 其他驱动因素

- 限制因素

- 生物基材料成本高

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 应用

- 表格

- 被覆剂

- 黏合剂和密封剂

- 其他用途(聚氨酯黏合剂、聚氨酯分散体)

- 最终用户产业

- 运输

- 鞋类和纺织品

- 建筑学

- 包装

- 家具和床上用品

- 电子产品

- 其他终端用户产业(生物医药、化肥业)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

- 世界其他地区

- 巴西

- 沙乌地阿拉伯

- 南非

- 其他国家

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Arkema

- BASF SE

- Covestro AG

- Huntsman International LLC

- Miracll Chemicals Co. Ltd

- Mitsui Chemicals Inc.

- Stahl Holdings BV

- Toray Industries Inc.

- Teijin Limited

- The Lubrizol Corporation

- Woodbridge

第七章 市场机会与未来趋势

- 中东和非洲的产业成长

- 生物基建筑材料的开发

简介目录

Product Code: 46725

The Bio-based Polyurethane Market size is estimated at 11.82 kilotons in 2025, and is expected to reach 23.49 kilotons by 2030, at a CAGR of 14.73% during the forecast period (2025-2030).

Key Highlights

- The market was negatively affected by the COVID-19 pandemic. The construction industry was significantly impacted during the pandemic, which affected the demand in the market studied. However, the market is excepted to retain its growth trajectory in the coming years. Currently, the market has recovered from the pandemic and is growing at a significant rate.

- Over the mid-term, the key factors driving the market studied are the increasing demand from the construction industry in developing countries and the increasing demand from electronic appliance manufacturing.

- However, the high cost of bio-based materials is expected to hinder the growth of the market studied.

- Nevertheless, industrial growth in the Middle East and Africa is expected to act as an opportunity during the forecast period.

- The Asia-Pacific region is expected to be the fastest-growing market across the world, with the largest consumption from countries such as China and India.

Bio-based Polyurethane Market Trends

Increasing Demand from the Transportation Industry

- Bio-based polyurethane finds its key applications in the transportation industry, including the automotive, railway, and aerospace industries. Moreover, the automotive industry consumes bio-based PU foams, coatings, adhesives, and sealants. Specifically, bio-based PU foams are used in seating systems (headrests, headliners, armrests, seat cushioning, and others) and interior parts.

- According to Organisation Internationale des Constructeurs d'Automobiles (OCIA), global automotive production reached 85.02 million units in 2022. The production capacity increased by 6% compared to 2021. In 2022, China, the United States, and Germany were the top three manufacturers of cars and commercial vehicles.

- Asia-Pacific, the largest automotive production region, also witnessed a growth rate of 7% in 2022. The production increased from 46.76 million in 2021 to 50.02 million in 2022, respectively. Similarly, America and Africa witnessed 10% and 13% growth rates, respectively, in 2022.

- In the railway industry, bio-based PU has potential applications, as it can replace conventional PU products by a significant amount in the coming years. In railways, bio-based foams can be used in seat cushioning and thermal insulation applications.

- The Indian Railways were predicted to expand with government ingenuity since they were the third biggest railway industry in the world under a single management. According to the India Brand Equity Foundation, the equivalent of USD 124 billion was projected to be invested in the country's railroads between 2018 and 2022, one of 34 infrastructure sub-sectors.

- Furthermore, in the aerospace industry, bio-based PU foams and coatings can substitute conventional PU materials. According to Boeing, the size of the worldwide aerospace services industry is anticipated to exceed USD 3.6 trillion between 2022 and 2041, with the United States and Canada accounting for around 30% of that total, followed by Europe with 23.5 percent of the market.

- Therefore, the demand in the transportation industry is expected to increase the demand for bio-based polyurethane during the forecast period.

Asia-Pacific Region is Expected to be the Fastest Growing Market

- Asia-Pacific is the largest producer of bio-based polyurethane, with a high abundance of synthetic diisocyanates and a large number of bio-based polyurethane in the region.

- Bio-based polyurethane is utilized in construction. It is increasingly utilized for window and door profiles, pipes and guttering, cement, flooring, glass, sealants and adhesives, insulation, building panels, and roofing.

- China is amid a construction mega-boom. The country has the largest building market in the region and the world, making up 20% of all construction investments globally. The Chinese government is estimated to have an annual limit for new infrastructure bonds worth CNY 3.85 trillion (USD 0.54 trillion) in 2022, up from CNY 3.65 trillion (USD 0.52 trillion) in 2021.

- Bio-PU is capable of replacing polypropylene in automotive applications such as bumpers and bumper spoilers, lateral siding, roof/boot spoilers, rocker panels, body panels, dashboards and dashboard carriers, door pockets and panels, consoles, heating ventilation air conditioning, battery covers, air ducts, pressure vessels, and splash shields.

- According to Organisation Internationale des Constructeurs d'Automobiles (OICA), around 27.02 million vehicles were produced in China in 2022, compared to 26.12 million vehicles produced in 2021, witnessing a growth rate of about 3%.

- In addition to its electrical insulation, shock resistance, adhesion, and other qualities, bio-based polyurethane is also widely utilized in electrical and electronic applications such as cell phones, mobile devices, computers, and TVs.

- Similarly, in India, the electronics market witnessed a growth in demand, with market size increasing at a rapid growth rate. The Ministry of Electronics and Information Technology published the second volume of the Vision document on Electronics Manufacturing in India, which predicted that the electronics manufacturing industry in India would grow from USD 75 billion in 2020-21 to USD 300 billion by 2025-26. The growing electronics and appliances markets in India and China may push the market growth further in Asia-Pacific.

- The aforementioned factors are likely to increase the demand for bio-based polyurethane during the forecast period.

Bio-based Polyurethane Industry Overview

The bio-based polyurethane market is consolidated in nature. The major manufacturers in the market studied include BASF SE, Covestro AG, Huntsman International LLC, Mitsui Chemicals Inc., and The Lubrizol Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Construction Industry in Developing Countries

- 4.1.2 Growing Demand from Electronic Appliance Manufacturing.

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Bio-based Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Foams

- 5.1.2 Coatings

- 5.1.3 Adhesive and Sealants

- 5.1.4 Other Applications (Polyurethane Binders, Polyurethane Dispersions)

- 5.2 End-user Industry

- 5.2.1 Transportation

- 5.2.2 Footwear and Textile

- 5.2.3 Construction

- 5.2.4 Packaging

- 5.2.5 Furniture and Bedding

- 5.2.6 Electronics

- 5.2.7 Other End-user Industries (Biomedical, Fertilizer Industry)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 Saudi Arabia

- 5.3.4.3 South Africa

- 5.3.4.4 Rest of the Countries

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 BASF SE

- 6.4.3 Covestro AG

- 6.4.4 Huntsman International LLC

- 6.4.5 Miracll Chemicals Co. Ltd

- 6.4.6 Mitsui Chemicals Inc.

- 6.4.7 Stahl Holdings BV

- 6.4.8 Toray Industries Inc.

- 6.4.9 Teijin Limited

- 6.4.10 The Lubrizol Corporation

- 6.4.11 Woodbridge

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Industrial Growth in Middle-East and Africa

- 7.2 Developments in Bio-based Building Materials

02-2729-4219

+886-2-2729-4219