|

市场调查报告书

商品编码

1685751

形状记忆聚合物:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Shape-memory Polymer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

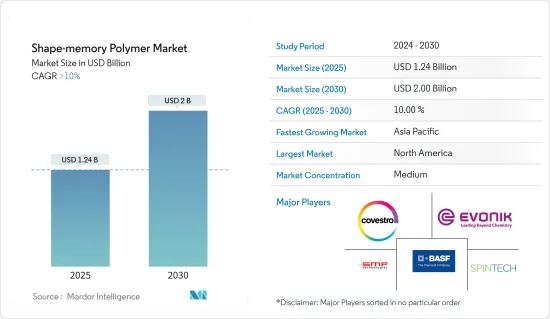

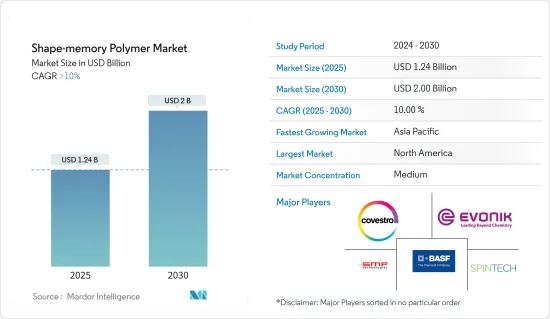

形状记忆聚合物市场规模在 2025 年预计为 12.4 亿美元,预计到 2030 年将达到 20 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 10%。

主要亮点

- 预计形状记忆聚合物在医疗保健行业的应用不断扩大以及亚太地区建设产业的需求不断增长将成为预测期内市场成长的主要驱动力。

- 形状记忆聚合物的相对较低的刚度值预计会抑制市场的成长。

- 形状记忆聚合物在生物医学应用方面的发展和创新有望为市场成长提供机会。

- 预计预测期内亚太地区市场将以最快的速度成长。

形状记忆聚合物市场趋势

温度诱导部分预计将主导市场

- 热诱导或温度诱导的形状记忆聚合物 (SMP) 是研究最多的一类 SMP,可透过直接施加热量来活化。当施加的温度高于聚合物的转变温度时,可以将瞬态形状编程到SMP中。

- 热诱导SMP的机制基于两个热转变:熔化温度和玻璃化转变温度。

- 最常见的基于熔点的SMP是聚烯、聚醚和聚酯,它们表现出熔点低的软相和即使在高温下也保持不变的结晶质硬相。

- 玻璃化转变温度为25℃以上的SMP称为基于玻璃化转变温度的材料,其形状恢復速度比基于熔点的SMP慢。然而,缓慢的形状恢復是生物医学应用中的重要特性,因为它不仅适用于正畸等临床目的,而且还能避免因插入而造成的组织损伤。

- 根据这篇题为《用于生物医学应用的形状记忆聚合物材料》的论文,用于生物医学应用的形状记忆聚合物在普通医学、药物传输、再生医学、牙科、神经病学、癌症治疗、整形外科和防腐等领域有着广泛的应用。因此,未来生物医学领域的发展可能会使温度诱导的SMP受益。

- 根据 Evaluate Ltd 的数据,到 2028 年全球药品研发总支出将达到 3,020 亿美元,比 2022 年的 2,440 亿美元成长 24%。

- 据 Mediobanca 称,到 2024年终,医疗科技产业的全球销售额预计将达到约 6,820 亿美元。医疗技术产业的持续成长也有望推动对温度诱导 SMP 的需求。

- 温度诱导SMP也因其质量轻、可恢復变形能力和生物相容性等优点,在航太工业中得到了广泛的应用。在航太工业中使用 SMP 可以提高燃油效率、减少排放气体并提高性能。

- 2023年6月,波音公司预测,到2042年,对新型商用喷射机的需求将达到42,600架,价值8兆美元。此外,这些交付中大约有一半将被更省油的机型取代,以减少排放。预计这将在预测期内推动对温度诱导 SMP 的需求。

- 因此,由于上述因素,预计温度诱导的 SMP 将在预测期内保持主导地位并占据主要市场占有率。

亚太地区预计将出现最高成长

- 由于中国、印度和日本等国家的需求不断增加,预计亚太地区对形状记忆聚合物 (SMP) 的需求将大幅增加。

- 该地区拥有汽车、建筑、医疗保健和纺织等蓬勃发展的行业的国家。例如,中国是世界上最大的建筑、汽车和纺织品市场。

- 此外,根据国际汽车工业组织(OICA)的数据,到2022年,中国、日本、印度和韩国将成为乘用车和商用车的前五大生产国。例如,中国在2023年生产了超过3000万辆乘用车和商用车。

- 随着全球持有四轮车的需求增加以及电池驱动的电动车趋势扩大,新车产量将逐年增加。根据中国汽车工程学会预测,2030年汽车销量预计将达到3,800万辆,其中电动车销量预计达到1,500万辆,占40%。这导致对中小型事务所的需求不断增加,从而推动亚太地区的快速成长。

- SMP在建设产业也被广泛采用。预计未来几年中国和印度的建设产业将快速成长,为该地区的市场成长做出重大贡献。根据牛津经济研究院预测,到 2037 年,中国、美国和印度将占全球建筑工程的 51%,价值 13.9 兆美元。

- 因此,由于上述原因,亚太地区很可能在预测期内见证最高成长。

形状记忆聚合物产业概况

全球形状记忆聚合物市场适度整合,市场占有率大部分由少数参与者瓜分。市场的一些主要企业包括BASF SE、Covestro AG、Evonik Industries AG、SMP Technologies Inc. 和 Spintech Holdings Inc.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 扩大医疗领域的应用

- 亚太地区建设产业的需求不断增长

- 其他的

- 限制因素

- 刚度值相对较低

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 刺激类型

- 温度诱导

- 光导

- 电刺激

- 其他刺激类型

- 最终用户产业

- 航太

- 车

- 建造

- 卫生保健

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 越南

- 泰国

- 印尼

- 马来西亚

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 北欧的

- 土耳其

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 奈及利亚

- 卡达

- 阿拉伯聯合大公国

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Covestro AG

- Evonik Industries AG

- Spintech Holdings Inc.

- EndoShape Inc.

- Nanoshel LLC

- SMP Technologies Inc.

- Asahi Kasei Corporation

- Composite Technology Development Inc.

- Shape Memory Medical

- MedShape Inc.

第七章 市场机会与未来趋势

- 形状记忆聚合物在生物医学应用领域的发展与创新

简介目录

Product Code: 46963

The Shape-memory Polymer Market size is estimated at USD 1.24 billion in 2025, and is expected to reach USD 2.00 billion by 2030, at a CAGR of greater than 10% during the forecast period (2025-2030).

Key Highlights

- The increasing application of shape-memory polymers in the healthcare industry and the growing demand from the Asia-Pacific construction industry are expected to be the primary drivers of market growth during the forecast period.

- The relatively low stiffness value of shape-memory polymers is expected to restrain market growth.

- Development and innovation in the biomedical uses or applications of shape-memory polymers are expected to offer market growth opportunities.

- The market is expected to witness the fastest growth rate in the Asia-Pacific region during the forecast period.

Shape Memory Polymer Market Trends

The Temperature-induced Segment is Expected to Dominate the Market

- Thermally-induced or temperature-induced types of shape-memory polymers (SMPs) are the most studied type of SMPs that can be activated by direct thermal application. When the temperature applied is higher than the polymer transition temperature, a transitory shape can be programmed to an SMP.

- The thermally-induced SMP mechanism is based on two thermal transitions: melting temperature and glass transition temperature.

- The most common melting temperature-based SMPs are polyolefins, polyethers, and polyesters, which show a low melting temperature soft phase and a crystalline hard phase that remains unchanged at high temperatures.

- SMPs whose glass transition temperature is above 25 °C are referred to as glass transition temperature-based materials, and they show a slow shape recovery compared to melting temperature-based SMPs. However, slow shape recovery is a significant property for biomedical applications because it is preferred not only for clinical purposes such as orthodontic applications but also for avoiding insertion-induced tissue damage.

- According to the article titled Shape Memory Polymeric Materials for Biomedical Applications, SMPs for biomedical applications have wide applicability in the fields of general medicine, drug delivery, regenerative medicine, dentistry, neuromedicine, cancer therapy, orthopedics, and corrosion protection. Therefore, the growth in the field of biomedical will benefit the temperature-induced type of SMPs in the future.

- According to Evaluate Ltd, the gross spending on pharmaceutical research and development worldwide will reach USD 302 billion by 2028, making a 24% growth in value over USD 244 billion in 2022.

- By the end of 2024, the worldwide revenue of the medical technology industry will likely be around USD 682 billion, according to Mediobanca. The continuous growth in the medical technology industry will also boost the demand for temperature-induced SMPs.

- Temperature-induced SMPs are also widely used in the aerospace industry because of their advantages, such as their light weight, large recoverable deformation capability, and biocompatibility. The use of SMPs in the aerospace industry leads to improved fuel efficiency, reduced emissions, and enhanced performance.

- In June 2023, Boeing forecasted that the demand for new commercial jets by 2042 will likely reach 42,600, valued at USD 8 trillion. Additionally, about half of those deliveries will replace older jets with more fuel-efficient models for reducing emissions. This is expected to boost the demand for temperature-induced SMPs during the forecast period.

- Hence, owing to the above-mentioned factors, temperature-induced SMPs are likely to account for the major market share while maintaining their market dominance during the forecast period.

Asia-Pacific is Expected to Witness the Highest Growth Rate

- Asia-Pacific is expected to witness major growth in the demand for shape-memory polymers (SMPs) owing to the increasing demand from countries like China, India, and Japan.

- The region has countries with substantially large automotive, construction, healthcare, textile, and other industries. For instance, China is the world's largest construction, automotive, and textile market.

- Moreover, according to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, China, Japan, India, and South Korea were among the top 5 countries in terms of the production volume of passenger cars and commercial vehicles. For instance, China manufactured over 30 million units of passenger cars and commercial vehicles in 2023.

- As the global demand for owning a personal four-wheeler vehicle is increasing and the trend of switching over to battery powered electric cars is expanding, the production of new cars will increase year-on-year. According to the Society of Automotive Engineering of China, car sales in 2030 are expected to reach 38 million, of which the sales of EVs are estimated to amount to 15 million, or 40%. Such factors will increase the demand for SMPs, leading to rapid growth in the Asia-Pacific.

- Also, SMPs are widely being adopted in the construction industry. With the construction industries of China and India expected to witness rapid growth in the coming years, a significant contribution to the market growth in the region is expected to be made. According to Oxford Economics, China, the United States, and India will account for 51% of global construction work done by 2037, valued at USD 13.9 trillion.

- Hence, owing to the reasons mentioned above, Asia-Pacific is likely to witness the highest growth during the forecast period.

Shape Memory Polymer Industry Overview

The global shape-memory polymer market is moderately consolidated as the majority of the market share is divided among a few players. Some of the key players in the market include BASF SE, Covestro AG, Evonik Industries AG, SMP Technologies Inc., and Spintech Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications in Healthcare

- 4.1.2 Growing Demand From the Construction Industry in Asia-Pacific

- 4.1.3 Others

- 4.2 Restraints

- 4.2.1 Relatively Low Stiffness Values

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Stimulus Type

- 5.1.1 Temperature-induced

- 5.1.2 Light-induced

- 5.1.3 Electricity-induced

- 5.1.4 Other Stimulus Types

- 5.2 End-user Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Construction

- 5.2.4 Healthcare

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Vietnam

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Malaysia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Spain

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colmbia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Nigeria

- 5.3.5.3 Qatar

- 5.3.5.4 United Arab Emirates

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Covestro AG

- 6.4.3 Evonik Industries AG

- 6.4.4 Spintech Holdings Inc.

- 6.4.5 EndoShape Inc.

- 6.4.6 Nanoshel LLC

- 6.4.7 SMP Technologies Inc.

- 6.4.8 Asahi Kasei Corporation

- 6.4.9 Composite Technology Development Inc.

- 6.4.10 Shape Memory Medical

- 6.4.11 MedShape Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development and Innovation in The Biomedical Use of Shape-memory Polymers

02-2729-4219

+886-2-2729-4219