|

市场调查报告书

商品编码

1685778

精准灌溉:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Precision Irrigation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

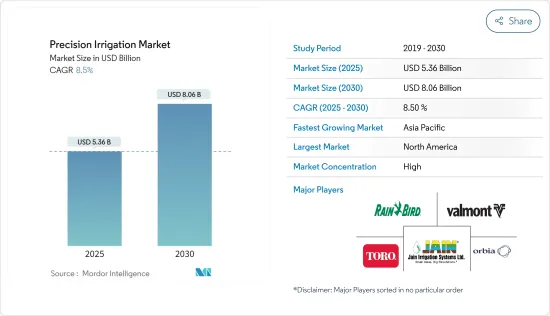

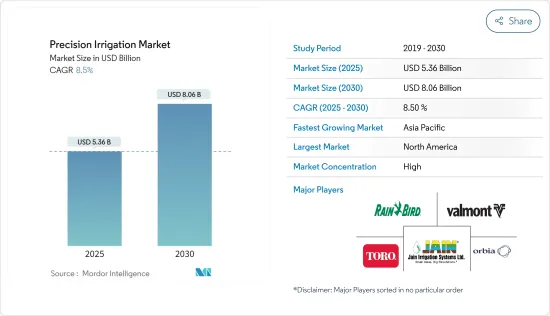

精准灌溉市场规模在 2025 年预计为 53.6 亿美元,预计到 2030 年将达到 80.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.5%。

主要亮点

- 水资源短缺是一项重大挑战,推动精准灌溉系统的长期采用。随着消费需求的上升,为确保作物产量进行的人工灌溉的需求也在急剧增加。此外,全球农地的整合使得农民能够投资精准灌溉等昂贵的系统,从而进一步推动市场的发展。

- 技术发展将进一步促进各地区的市场扩张。例如,2020 年,Nelson Irrigation Corporation 推出了 R55VT 和 R75 末端枢轴喷灌,它们可以轻鬆连接到除衝击枢轴喷灌之外的任何中心枢轴系统。随着技术变得越来越便宜和高效,精准灌溉机械的采用预计会增加。预计这将加速预测期内的市场成长。然而,滴灌、喷灌等精准灌溉系统技术复杂,安装成本高,阻碍了其广泛应用。

- 此外,由于政府对低利率贷款和采用现代先进精准灌溉系统的补贴政策,精准灌溉市场在未来几年很可能在南美洲和亚太等新兴市场迅速扩张。亚太地区对新技术的认知度不断提高和适应性高度增强,推动着市场快速成长。

精准灌溉市场趋势

温室蔬菜产量快速成长

自动滴灌对于土壤湿度管理至关重要,尤其是对于专业温室蔬菜。透过完全自动化这些系统,种植者可以精确管理土壤湿度和灌溉。此外,这种自动化预计会增加单位产量的利润。

水资源短缺是欧洲各地蔬菜种植者面临的主要挑战。因此,精准灌溉系统在该地区迅速普及起来。 2021年,比利时园艺竞标协会报告称,比利时温室蔬菜产量达40.54万吨,其中番茄产量为30.41万吨。此外,在有利的天气条件和对更高作物产量和投资收益不断增长的需求的推动下,瑞典温室番茄产量从 2020 年到 2021 年激增了 17.9%。

无土栽培主要用于美国、加拿大、日本、印度、中东和欧洲的温室蔬菜生产。由于温室蔬菜需要足够的水,农民正在转向喷灌和滴灌系统来实现更高的作物产量,而市场参与者即将推出的技术创新正在推动他们的采用。例如,2023 年 8 月,Netafim 鼓励透过位于 Shivpuri 的四个 Better Life Farming (BLF) 中心在 1,600 公顷土地上提供滴灌系统,用于番茄的保护性种植。

北美占据市场主导地位

精准灌溉系统的主要基地在北美,美国占据该地区一半以上的市场占有率。联邦、州和地方的水资源开发计划以及地下水抽取技术的进步正在大大扩展美国的灌溉面积。美国阿马里洛市德克萨斯A&M 农业生命研究与推广中心 2023 年的一项研究指出,对地面滴灌系统的评估和使用提高了德克萨斯州高原半干旱多风地区高价值蔬菜生产的用水效率。在番茄的露天种植中,可能会因生物和生物胁迫因素造成严重损失,即使采用地面滴灌系统也难以获得经济上可行的产量。

墨西哥的巴希奥地区是大麦的主要产地,以地下水消耗量大而闻名。该地区地下水位下降迫切需要开发创新节水技术。 2021 年的一项研究发现,滴灌与保护性农业实践相结合可使大麦种植的用水量减少多达 40%。这项发现支持在该地区广泛采用精准灌溉进行大麦种植。 2021年,威立雅水务技术公司旗下的阿瓜斯卡连特斯水基金会与大自然保护协会和当地市政当局进行了合作。他们的共同努力旨在支持阿瓜斯卡连特斯的弱势农民,鼓励他们投资滴灌设备,增强农场的復原力,并促进此类系统的采用。

此外,加拿大农民以其专业知识而闻名,并且能够快速采用新技术,预计将推动该地区的强劲成长。加拿大统计局称,2022 年加拿大农民的农作物灌溉用水量与 2020 年相比增加了 23%。近年来,加拿大农场采用滴灌技术的现像明显增加。根据加拿大统计局的数据,2022年采用滴灌的农场数量比2020年增加了33.2%。因此,不可预测的天气条件和创新节水技术的持续采用可能会在预测期内增加北美农业生产中精准灌溉的使用。

精准灌溉业概况

精准灌溉市场由 Orbia(Netafim Limited)、Jain Irrigation Systems Limited、The Toro Company 和 Valmont 等主要企业主导。 Orbia(Netafim Limited)的市场占有率最高,其次是Jain Irrigation Systems Limited。建立强大的分销网络是成熟市场参与者采取的关键策略。此外,一些公司与广泛的经销商签订了最终分销协议,以提高可访问性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 类型

- 喷水灌溉

- 传统喷灌

- 中心枢轴洒水喷灌

- 侧向/线性喷灌

- 滴灌

- 地面滴灌

- 地下滴灌

- 精准移动滴灌

- 其他类型

- 喷水灌溉

- 作物类型

- 田间作物

- 种植作物

- 果园和葡萄园

- 草坪和观赏作物

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 非洲其他地区

- 北美洲

第六章 竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Jain Irrigation Systems Ltd

- Lindsay Corporation

- Nelson Irrigation Corporation

- Netafim Ltd

- Rain Bird Corporation

- Rivulis Irrigation Ltd

- The Toro Company

- Valmont Industries Inc.

- Mahindra EPC Industries Limited

- Tl Irrigation Co.

- Deere & Company

第七章 市场机会与未来趋势

The Precision Irrigation Market size is estimated at USD 5.36 billion in 2025, and is expected to reach USD 8.06 billion by 2030, at a CAGR of 8.5% during the forecast period (2025-2030).

Key Highlights

- Water scarcity poses a significant challenge, driving the long-term adoption of precision irrigation systems. As consumer demand grows, the need for artificial irrigation has surged to secure high crop yields. Additionally, the consolidation of farmlands globally enables farmers to invest in costly systems like precision irrigation, further propelling the market.

- Technological developments are further catalyzing the expansion of the market across various regions. For example, in 2020, Nelson Irrigation Corporation introduced the R55VT and R75 End of Pivot Sprinklers, which can be easily attached to any center pivot system, excluding the impact pivot sprinklers. As technology is made affordable and efficient, the adoption rate of precision irrigation machinery is anticipated to increase. This is expected to increase the growth of the market during the forecast period. However, precision irrigation systems such as drip and sprinkler systems come with technical complexities, and the steep installation costs of these systems are hindering their widespread adoption.

- Moreover, due to favorable government policies regarding low-interest loans and subsidies for implementing modern and advanced precision irrigation systems, the precision irrigation market is likely to increase quickly in developing markets such as South America and Asia-Pacific in the coming years. Increasing awareness and high adaptability of new technologies in Asia-Pacific are driving market growth at a rapid pace.

Precision Irrigation Market Trends

Rapid Growth of Greenhouse Vegetable Production

Automatic drip irrigation is crucial in managing soil moisture, particularly for specialized greenhouse vegetables. By fully automating these systems, growers can precisely control soil moisture and water application. Moreover, such automation is anticipated to boost profits per yield.

Water scarcity poses significant challenges for vegetable farmers across various European nations. As a result, precision irrigation systems are rapidly gaining traction in the region. In 2021, the Association of Belgian Horticultural Auctions reported that Belgium's greenhouse vegetable production reached 405.4 thousand metric tons, with tomatoes accounting for 304.1 thousand metric tons. Additionally, bolstered by favorable climatic conditions and rising demand for enhanced crop yields and returns on investment, Sweden's greenhouse tomato production surged by 17.9% from 2020 to 2021.

Soilless cultivation is primarily used for greenhouse vegetable production in the United States, Canada, Japan, India, the Middle East, and Europe. As greenhouse vegetables require ample amounts of water, farmers are switching to sprinkler and drip irrigation systems to achieve higher crop productivity, and technological innovation by the market players in the future motivates the adoption. For instance, in August 2023, Netafim encouraged drip irrigation systems to be provided through four Better Life Farming (BLF) Centers in Shivpuri under protected cultivation for tomatoes on 1,600 hectares of land.

North America Dominates the Market

Precision irrigation systems find their primary hub in North America, with the United States leading the charge, commanding over half of the region's market share. Federal, state, and local water development initiatives and advancements in groundwater pumping technologies have significantly broadened the US irrigated landscape. In 2023, research conducted by the Texas A&M AgriLife Research and Extension Center, Amarillo, United States, stated that the evaluation and usage of Surface Drip Irrigation Systems escalated the water-use efficiency in high-value vegetable production in the semi-arid, windy region of the Texas high plains. It could be challenging for tomatoes in open-field conditions to achieve an economically viable crop, even when using a surface drip irrigation system, due to the potential for extreme losses to both biotic and abiotic stressors.

The Bajio region of Mexico is a leading producer of barley, a crop known for its substantial groundwater consumption. As groundwater levels in the region dwindle, there is an urgent call for innovative water-saving technologies. A 2021 study highlighted that a blend of drip irrigation and conservation agriculture could slash water usage in barley farming by as much as 40%. This finding is set to champion the broader adoption of precision irrigation in the region's barley farming. In 2021, the Aguascalientes Water Fund, a division of Veolia Water Technologies, collaborated with The Nature Conservancy and the local municipality. Their joint effort aimed to assist vulnerable farmers in Aguascalientes, encouraging them to invest in drip irrigation equipment, thereby bolstering farm resilience and potentially increasing the uptake of these systems.

Moreover, Canadian farmers, known for their expertise, are quick to adopt new technologies, leading to anticipated high growth rates in the region. According to Statistics Canada, Canadian farmers increased their water usage for crop irrigation by 23% in 2022 compared to 2020, which is majorly attributed to the drier climatic conditions in various regions throughout the country. In recent years, there has been a notable surge in the prevalence of drip irrigation on Canadian farms. According to Canadian statistics, in 2022, the number of farms adopting drip irrigation increased by 33.2% compared to 2020. Therefore, unpredictable climatic conditions and the growing adoption of innovative water-saving techniques may increase the use of precision irrigation in North American agricultural production during the forecast period.

Precision Irrigation Industry Overview

The precision irrigation market is consolidated with major companies such as Orbia (Netafim Limited), Jain Irrigation Systems Limited, The Toro Company, and Valmont. Orbia (Netafim Limited) held the highest market share, followed by Jain Irrigation Systems Limited. Establishing a strong distribution network is a prime strategy well-established market players follow. Moreover, some companies have signed definitive dealership agreements with a wide range of dealers to enhance accessibility.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Sprinkler Irrigation

- 5.1.1.1 Traditional Sprinklers

- 5.1.1.2 Center Pivot Sprinklers

- 5.1.1.3 Lateral Move/ Linear Sprinklers

- 5.1.2 Drip Irrigation

- 5.1.2.1 Surface Drip Irrigation

- 5.1.2.2 Sub-Surface Drip Irrigation

- 5.1.2.3 Precision Mobile Drip Irrigation

- 5.1.3 Other Types

- 5.1.1 Sprinkler Irrigation

- 5.2 Crop Type

- 5.2.1 Field Crops

- 5.2.2 Plantation Crops

- 5.2.3 Orchards and Vineyards

- 5.2.4 Turf and Ornamentals

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Jain Irrigation Systems Ltd

- 6.3.2 Lindsay Corporation

- 6.3.3 Nelson Irrigation Corporation

- 6.3.4 Netafim Ltd

- 6.3.5 Rain Bird Corporation

- 6.3.6 Rivulis Irrigation Ltd

- 6.3.7 The Toro Company

- 6.3.8 Valmont Industries Inc.

- 6.3.9 Mahindra EPC Industries Limited

- 6.3.10 T-l Irrigation Co.

- 6.3.11 Deere & Company