|

市场调查报告书

商品编码

1685788

动物生长促进剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Animal Growth Promoter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

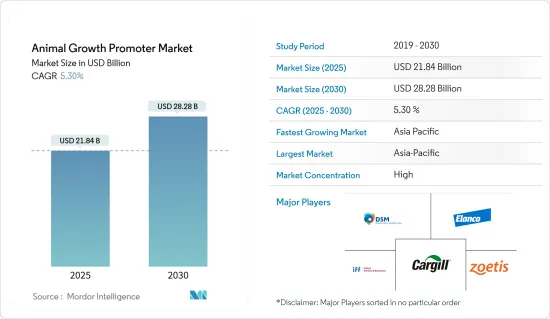

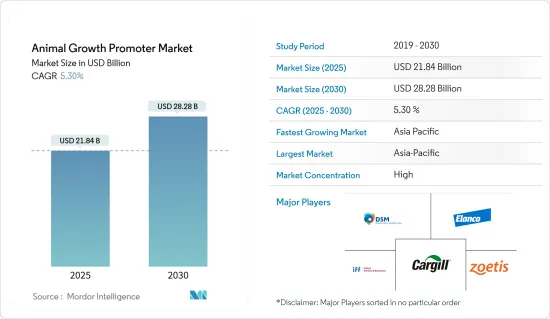

预计 2025 年动物生长促进剂市场规模为 218.4 亿美元,到 2030 年将达到 282.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.30%。

动物生长促进剂(AGP)是用于畜牧生产中以提高生长速度、提高饲料效率和改变动物整体发育的物质或化合物。这些增强剂可以是天然的或合成的,常用于农业,特别是家禽、猪和牲畜养殖。使用 AGP 的目的是提高畜牧业的生产力和盈利。

畜牧业生产已扩展到所有地区和动物类别,以满足不断变化的饮食需求,尤其是在新兴市场。特别是在亚洲和太平洋地区,虽然畜牧业的工业化程度日益提高,但印度和中国等国家仍然普遍存在小型和边际农场。预计预测期内全球肉类产量的持续成长将推动 AGP 市场的成长。根据粮农组织《肉品市场新兴趋势与2023年展望》,预计2023年全球肉类产量将达到3.701亿吨(胴体重量当量),与前一年同期比较增加1.9%。这一增长主要归因于亚洲(尤其是中国)猪肉产量的增加,以及南美洲牛肉和鸡肉产量的增加。畜牧业生产的集约化和工业化有望透过提高畜牧业生产水准进一步刺激生长促进剂市场。

有关生长促进剂(尤其是抗生素和荷尔蒙)的监管不断加强。这种法规环境正在刺激该领域的创新,并鼓励在保持生产效率的同时开发相容的替代品。在美国,FDA 致力于减少牲畜抗生素的使用,这使得人们更加关注植物来源和有机性生长促进剂的替代品。

动物生长促进剂的市场趋势

家禽是动物种类中的关键部分

家禽业是牲畜生长促进剂市场,尤其是饲料添加剂市场中最重要的部分之一。家禽养殖业是世界各地的一个庞大产业,其驱动力来自于对鸡肉和鸡蛋日益增长的需求。家禽养殖中的生长促进剂对于提高家禽的生长率、饲料转换率和整体健康状况至关重要,可以使家禽生产更有效率、更盈利。

家禽,尤其是鸡肉,是世界上消费最广泛的肉类之一。与牛肉和猪肉等红肉相比,它通常被认为是一种更实惠、更容易获得的蛋白质来源。随着世界人口的增长和消费者偏好转向红肉,对家禽产品(肉和蛋)的需求不断增加。美国、巴西、阿根廷和中国等国家的鸡肉消费量正在大幅增加,对有效的生长促进剂的需求也随之增加,以确保稳定的肉类供应。例如,根据经合组织的预测,2022年阿根廷的鸡肉消费量将达到212.89万吨,2023年将增加至215.72万吨。

此外,在一些地区,监管机构已经限製或禁止使用抗生素作为家禽的生长促进剂。例如,欧盟早已禁止使用抗生素来促进生长,迫使家禽生产者寻找更安全的替代品。同样,消费者也要求不含抗生素的鸡肉产品,迫使生产者采取替代的促进生长的策略。为了回应这些规定,草药萃取物和有机酸等天然生长促进剂在养禽业越来越受欢迎。

亚太地区占市场主导地位

亚太地区是全球牲畜生长促进剂产业最大、成长最快的市场。开发中国家收入水准的提高、对肉类品质和环境影响的日益关注,导致印度、中国、马来西亚、印尼和澳洲的肉类消费量增加。由于农地稀缺和劳动力充足,集约化畜牧业生产快速成长,进一步推动了亚太地区生长促进剂市场的发展。

中国是该地区最大的猪肉消费国,也是世界上最大的猪肉消费国之一。由于人口成长,中国的肉品消费量现在是美国的两倍。这是推动中国动物生长促进剂市场成长的主要因素。根据奥特奇饲料调查2023年,中国将占据动物饲料产量最大的国家,产量为2.6073亿吨,其次是美国,产量为2.404亿吨,巴西为8194万亿,印度为4336万亿吨。这些因素可能会推动对益生菌、益生元和其他饲料补充剂的需求,以促进未来几年牲畜的生长和效率。

根据粮农组织统计,日本是仅次于中国的第二大肉类进口国,全球肉类消费量庞大。肉类消费量的增加导致国内畜牧业对牲畜生长促进剂的需求增加,以提高肉类产品的效率和安全性。在印度市场,益生菌已成为饲料产业不可或缺的一部分。在过去的几年里,消费者对生长促进剂的认识不断提高,导致在反刍动物饲料中加入益生菌,以改善反刍动物的性能和健康,从而推动了市场的成长。

动物生长促进剂产业概况

动物生长促进剂市场相当集中,许多大型和小型国际参与者主导着整个全球市场。主要公司包括嘉吉公司、帝斯曼-芬美意公司、礼来公司、硕腾服务有限公司和杜邦公司。这些主要企业正在投资新产品创新、扩张和收购,以扩大其全球业务。公司也非常注重研发,以便以更低的价格推出新产品。许多国际市场参与者都参与合作以扩大其市场渗透率并加强其市场地位。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 肉类生产需求不断成长

- 推动畜牧业产业化

- 提高配合饲料产量

- 市场限制

- 与其他行业争夺原料

- 具有挑战性的监管条件

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 类型

- 益生菌

- 益生元

- 植物源性

- 酸味剂

- 其他类型

- 动物类型

- 反刍动物

- 家禽

- 猪

- 水产养殖

- 其他动物

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- DSM-Firmenich

- Cargill, Incorporated

- Elanco

- Zoetis Services LLC

- Alltech

- Kemin Industries Inc.

- Dupont

- Novozymes A/S

第七章 市场机会与未来趋势

The Animal Growth Promoter Market size is estimated at USD 21.84 billion in 2025, and is expected to reach USD 28.28 billion by 2030, at a CAGR of 5.30% during the forecast period (2025-2030).

Animal Growth Promoters (AGPs) are substances or compounds used in livestock production to enhance growth rates, improve feed efficiency, or alter the overall development of animals. These promoters can be either natural or synthetic and are commonly used in the agriculture industry, particularly in poultry, swine, and cattle farming. The goal of using AGPs is to improve the productivity and profitability of animal farming.

Livestock production has expanded across all regions and animal categories to meet evolving dietary requirements, particularly in developing markets. While the livestock sector, especially in Asia-Pacific, is becoming increasingly industrialized, small and marginal farmers remain prevalent in countries like India and China. The continuous rise in global meat production is anticipated to drive the growth of the AGP market during the forecast period. According to the FAO Meat Market Emerging Trends and Outlook 2023, global meat production is projected to reach 370.1 million metric tons (in carcass weight equivalent) in 2023, representing a 1.9 percent increase from the previous year. This growth is primarily attributed to increased output in Asia, specifically pig meat in China, and South America's bovine and poultry meat production. The intensification and industrialization of livestock production are likely to further stimulate the growth promoter market through increased livestock production levels.

Regulations governing growth promoters, particularly antibiotics and hormones, continue to become more stringent. This regulatory environment is driving innovation in the sector, encouraging the development of compliant alternatives while maintaining production efficiency. In the U.S., the FDA's efforts to reduce antibiotic use in livestock have increased focus on plant-based and organic growth-promoting alternatives.

Animal Growth Promoter Market Trends

Poultry is the Significant Segment by Animal Type

The poultry segment is one of the most significant areas within the animal growth promoters market, particularly when it comes to animal feed additives. Poultry farming is a large industry globally, driven by the growing demand for chicken meat and eggs. Growth promoters in poultry farming are essential for enhancing the efficiency and profitability of poultry production by improving growth rates, feed conversion ratios, and overall health.

Poultry, especially chicken, is one of the most widely consumed meats worldwide. It is often considered a more affordable and accessible source of protein compared to red meats like beef and pork. As the global population rises and consumer preferences shift toward lean meats, the demand for poultry products (meat and eggs) continues to increase. In countries like the U.S., Brazil, Argentina, and China, poultry consumption has risen significantly, which in turn drives the demand for effective growth promoters to ensure a stable supply of meat. For instance, according to the OECD, the consumption of poultry meat in Argentina was 2,128.9 thousand metric tons in 2022, which increased by 2,157.2 thousand metric tons in 2023.

Besides, in several regions, regulatory bodies are restricting or banning the use of antibiotics as growth promoters in poultry. For instance, the European Union has long banned the use of antibiotics for growth promotion, forcing poultry producers to look for safer alternatives. Likewise, consumers are increasingly demanding antibiotic-free poultry products, pushing producers to adopt alternative growth promotion strategies. In response to these regulations, natural growth promoters such as herbal extracts and organic acids are gaining popularity in the poultry sector.

Asia-Pacific Dominates the Market

Asia-Pacific is the largest and fastest-growing market in the animal growth promoter's industry globally. Owing to the improved income levels, growing concerns for quality, and the environmental impact of meat in developing countries, there has been an increase in meat consumption in India, China, Malaysia, Indonesia, and Australia. The growth promoters market in the Asia-Pacific is further driven by the rapid growth of intensive livestock production due to the shortage of farmland and an abundance of labor.

China is the largest pork consumer in the region and is the leading pork-consuming country in the world which is the main driving factor for meat production in the country. China's meat consumption is double the amount consumed in the United States, owing to its increasing population. This is a major factor motivating the growth of the animal growth promoter market in China. According to the Alltech Feed Survey 2023, China accounted largest animal feed production with 260.73 million metric tons followed by the United States with 240.40 million metric tons, Brazil with 81.94 million metric tons, and India with 43.36 million metric tons. This factor will escalate the demand for probiotics, prebiotics, and other feed supplements to promote livestock growth and efficiency in coming years.

According to FAO, Japan is the second-largest meat importer after China, with significant global consumption of meat. Such a rise in meat consumption is resulting in increased demand for animal growth promoters in the domestic livestock industry to increase efficiency and safety in meat products. Probiotics have become an integral part of the feed industry in the Indian market. Over the last few years, the rising consumer awareness toward the growth promoter has resulted in the inclusion of probiotics in the ruminant feed for improving their performance and health, which is augmenting the growth of the market.

Animal Growth Promoter Industry Overview

The animal growth promoter market is fairly consolidated, with many large and small international players occupying the overall market globally. The major players are Cargill, Incorporated., DSM-Firmenich, Elanco, Zoetis Services LLC, and DuPont. These major players are investing in new product innovation, expansions, and acquisitions for business expansions across the globe. Another major area of investment is the focus on R&D to launch new products at lower prices. Many international players in the market are involved in the partnership to increase their reach and strengthen their presence in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise In Demand For Meat Production

- 4.2.2 Increasing Industrialization Of Livestock Industry

- 4.2.3 Rising Production Of Compound Feed

- 4.3 Market Restraints

- 4.3.1 Competition For Raw Material With Other Industries

- 4.3.2 Challenging Regulatory Conditions

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Probiotics

- 5.1.2 Prebiotics

- 5.1.3 Phytogenics

- 5.1.4 Acidifiers

- 5.1.5 Other Types

- 5.2 Animal Type

- 5.2.1 Ruminant

- 5.2.2 Poultry

- 5.2.3 Swine

- 5.2.4 Aquaculture

- 5.2.5 Other Animal Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 DSM -Firmenich

- 6.3.2 Cargill, Incorporated

- 6.3.3 Elanco

- 6.3.4 Zoetis Services LLC

- 6.3.5 Alltech

- 6.3.6 Kemin Industries Inc.

- 6.3.7 Dupont

- 6.3.8 Novozymes A/S