|

市场调查报告书

商品编码

1685801

晶体振盪器:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Crystal Oscillator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

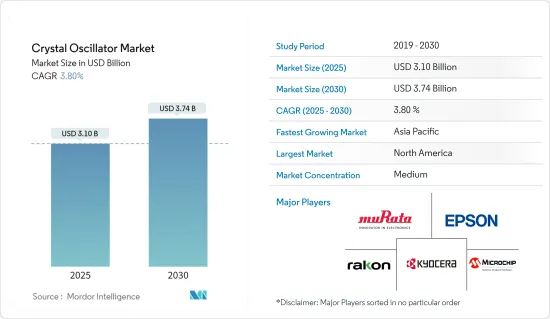

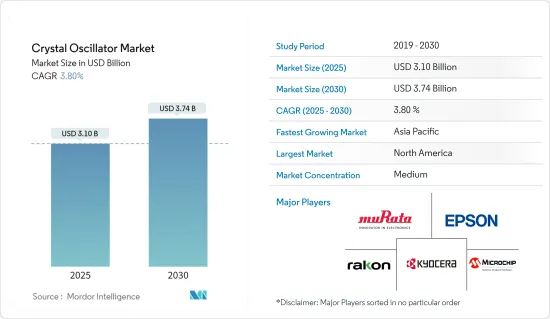

石英晶体振盪器市场规模在 2025 年预计为 31 亿美元,预计到 2030 年将达到 37.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.8%。

石英晶体共振器、晶体振盪器等石英晶体元件由于对环境变化具有很高的稳定性,被用作电子电路中的频率控制器件。

主要亮点

- 对便利性的日益增长的需求正在推动诸如遥控无钥匙进入等无线互连应用的发展。预计预测期内汽车中石英晶体共振器和晶体振盪器的使用量将会增加。

- 晶体振盪器广泛用于安全应用,例如煞车控制、防锁死系统、安全气囊和轮胎压力监测系统(TPMS)。对精度的需求、对安全应用日益增长的需求、不断完善的法规以及对高速资料传输的需求,推动了石英晶共振器和振盪器的采用。

- 随着智慧型手机应用中 WiFi 和蓝牙复合晶片晶片组的使用,对晶体振盪器的需求正在增加。鑑于消费产品中对这些应用的支持日益增加,预计家用电子电器领域在预测期内将表现出强劲的成长潜力。

- 然而,市场上有许多振盪器与石英晶体振盪器竞争,限制了市场的成长。例如,基于 MEMS共振器的振盪器比石英振盪器更坚固、更小,因此有可能在许多应用中取代石英振盪器。

晶体振盪器的市场趋势

消费性电子产业预计将占据主导地位

- 预计消费性电子产业频繁推出的新产品将推动晶体振盪器市场的发展。晶体振盪器用于有线电视系统、个人电脑、数位相机、无线系统、智慧型手机、穿戴产品等。

- 智慧型手机的日益普及也对晶体振盪器产生了巨大的需求。智慧型手机通常有一个或两个 3 x 1.5 毫米低功耗 32 kHz 晶体振盪器,一个主要用于基频处理器旁的睡眠模式定时,另一个通常用于为电源管理晶片供电。

- TXC 公司的 8N 和 8R 系列 CMOS 输出 SMD 晶体振盪器设计输出频率范围为 4 至 54 MHz,电源电压高达 3.63 V,频率稳定度为 25、50 和 100 ppm,非常适合智慧型手机和 SIP 模组等小型便携式消费产品。

- 无线资料交换已成为频率元件最重要的应用领域之一。这可以应用于向佩戴者的智慧型手机发送资料的健身腕带和智慧型手錶等可穿戴设备,以及作为物联网应用的一部分相互通讯的智慧生产机器。在这些情况下,共振器提供精确的无线电频率并确保发送器和接收器处于同一波长上。

- 对消费者来说,穿戴式装置的电池寿命是购买时的重要因素。为了最大限度地延长电池寿命,开发人员将微控制器和其他耗电组件置于低功耗睡眠状态,以利用延长的空閒时间。但即使在低功耗睡眠状态下,系统仍然需要即时时钟(RTC)来维持手錶时间并管理预定事件。

预计北美将占据较大的市场占有率

- 美国已成为晶体振盪器製造商的潜在市场。该国的半导体和其他电子元件製造业生产电子设备所需的各种输入设备,例如电路和记忆体晶片。

- 近年来,儘管海外业务不断境外外包且来自其他地区製造商的竞争日益激烈,但该行业仍持续扩张。这主要是由于国内外对工业产品的需求不断增长,以及全球电子元件短缺导致某些产品的价格上涨。这对区域研究市场供应商来说是一个巨大的机会。

- 该国是主要汽车製造商的所在地,预计对汽车设备的需求将会很大。此外,该地区电动车的普及率正在成长,为在市场上营运的供应商创造了成长机会。例如,麦格纳国际于 2022 年 10 月宣布将在密西根州开发两家新的製造工厂并扩大第三家製造工厂,以开发专门用于电动车的零件。

- 此外,该地区智慧型手机和基于物联网的设备日益普及,也推动了对晶体振盪器的需求。典型的智慧型手机或平板电脑使用多达五个振盪器。根据爱立信移动报告,北美地区的5G用户数量预计将在2022年第三季增加1.1亿,达到约8.7亿,到2022年终将达到10亿。此外,该公司预测该地区的5G普及率将最高,达91%。此外,思科预测该地区的行动用户数量将从 2018 年的 3.13 亿增加到 2023 年初的 3.29 亿。

- 航太和国防工业的不断扩大发展也将促进市场的发展。 2022 年 2 月,提供数位射频技术的无晶圆厂半导体公司 Orca Systems 宣布推出 ORC3990,这是首款用于卫星物联网 (IoT) 的无线系统晶片(SoC) 解决方案。 ORC3990 包括温度补偿晶体振盪器 (TCXO)、被动滤波器、开关等。

晶体振盪器产业概况

晶体振盪器市场半固体,由多家主要企业组成。其中包括村田製造公司、精工Epson、京瓷公司、Rakon有限公司和Vectron国际公司(微晶片技术公司)。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 京瓷 AVX 的新型 KOV 系列标准电压调节器OCXO 具有现代布局拓扑和强大的设计,可在这些应用和其他应用中提供卓越的性能。

- 2022 年 8 月-Lacon 推出了 RPT7050LG,这是一款高度稳定、低 G 灵敏度的 TCXO,封装尺寸为 7.0 x 5.0 x 1.5 毫米。这款产品保证灵敏度为 0.1ppb/g,是市面上最先进的微型低 g 灵敏度 TCXO 之一。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 在全球扩大 5G 的采用

- 先进汽车应用的需求不断成长

- 市场限制

- 技术成熟,缺乏替代方案带来的新改进

- 新冠疫情对电子产业的影响

第六章 市场细分

- 按类型

- 温度补偿晶体振盪器 (TCXO)

- 简单封装晶体振盪器 (SPXO)

- 电压调节器晶体振盪器 (VCXO)

- 频率控制晶体振盪器 (FCXO)

- 恆温晶体振盪器 (OCXO)

- 其他类型

- 按安装类型

- 表面黏着技术

- 通孔

- 按最终用户产业

- 消费性电子产品

- 车

- 通讯和网路

- 航太和国防

- 研究与测量

- 产业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Murata Manufacturing Co. Ltd

- Seiko Epson Corporation

- Kyocera Corporation

- Rakon Ltd

- Vectron International Inc.(Microchip Technology)

- TXC Corporation

- SiTime Corporation

- Daishinku Corp.

- Siward Crystal Technology Co. Ltd

- Hosonic Electronic Co. Ltd

- Nihon Dempa Kogyo(NDK)Co. Ltd

第八章投资分析

第九章:市场的未来

The Crystal Oscillator Market size is estimated at USD 3.10 billion in 2025, and is expected to reach USD 3.74 billion by 2030, at a CAGR of 3.8% during the forecast period (2025-2030).

Crystal devices like quartz crystal units and crystal oscillators have high stability against environmental changes. Therefore, they are used as frequency control devices in electronic circuits.

Key Highlights

- The increasing demand for convenience is driving the application of wireless interconnections, such as remote keyless entry. The application of crystal units and crystal oscillators in automobiles is expected to increase during the forecast period.

- Crystal oscillators, such as brake control, anti-blocking systems, airbags, and tire pressure monitoring systems (TPMS), are widely used in safety applications. The demand for precision, coupled with growing requirements, improving regulations for safety applications, and the necessity for fast data transmission, is driving the adoption of crystal units and oscillators.

- The demand for crystal oscillators has increased with the use of WiFi and Bluetooth combo chipsets in smartphone applications. Considering the increasing support for these applications in consumer products, the consumer electronics segment is expected to witness strong potential growth during the forecast period.

- However, many other variants of oscillators in the market offer strong competition to quartz crystal oscillators, restraining the market growth. For instance, MEMS resonator-based oscillators increase ruggedness and are smaller than crystal oscillators; they can potentially replace them in many applications.

Crystal Oscillator Market Trends

Consumer Electronics Segment is Expected to Hold the Prominent Share

- Frequent new launches of consumer electronic products are expected to fuel the market for crystal oscillators. Crystal oscillators are used in cable television systems, personal computers, digital cameras, radio systems, smartphones, and wearables.

- The growing penetration of smartphones is also creating significant demand for crystal oscillators. Usually, a smartphone has one or two 3 x 1.5 mm low-power 32 kHz quartz crystal oscillators, one primarily used for sleep-mode timing next to the baseband processor and the other commonly used to drive the power management chips.

- TXC Corporation's SMD Crystal Oscillators with CMOS Output, 8N, and 8R Series, are designed with specifications of an output frequency range of 4-54 MHz, supply voltage up to 3.63 V, and frequency stability at 25, 50, and 100 ppm, for making them ideal for smartphones and sip modules, among other compact portable consumer products.

- Wireless data exchange has emerged as one of the most critical application areas for frequency components. This is applicable to wearables, such as fitness wristbands and smartwatches, which transmit the data to the wearer's smartphone, and to intelligent production machines that communicate with each other as part of IoT applications. In all such cases, quartz crystals provide precise radio frequencies and ensure that the transmitter and receiver are on the same wavelength.

- For consumers, while making a purchase, the battery life of wearables is a key factor. In order to maximize the battery life, developers leverage the extended idle time by placing microcontrollers and other power-consuming components in a low-power sleep state. However, even in the lowest power sleep states, the systems need a real-time clock (RTC) to maintain the wall clock time and manage the scheduled events.

North America is Expected to Hold Significant Market Share

- The United States is emerging as a potential market for crystal oscillator manufacturers. The country's semiconductor and other electronic component manufacturing sectors produce a range of input devices necessary for electronics production, including circuits and memory chips.

- The industry has witnessed expansion over the past few years despite continued offshoring and greater competition from other regional manufacturers. The primary factor for this has been the growing demand for industry products, both domestically and abroad, and a global shortage of electronic components, which increased the prices of certain products. This offers a massive opportunity for regional studied market vendors.

- The country is home to some of the major automotive manufacturers, which is expected to create a demand for automotive equipment. Additionally, the increasing penetration of electric vehicles in the region is creating growth opportunities for the vendors operating in the market. For instance, in October 2022, Magna International announced the development of two new manufacturing facilities and the expansion of a third facility in Michigan to develop components specifically for electric vehicles.

- Moreover, the increasing penetration of smartphones and IoT-based devices in the region proliferates the demand for crystal oscillators. A typical smartphone or tablet uses up to five oscillators. According to Ericsson Mobility Report, 5G subscriptions in North America grew by 110 million during the third quarter of 2022 to around 870 million, and the number is expected to reach 1 billion by the end of 2022. Moreover, the company anticipates the region would have the highest 5G penetration at 91%. Additionally, as per Cisco, the region will have 329 million mobile users in early 2023, up from 313 million in 2018.

- The increasing development in the aerospace and defense industry also fuels the market. In Feb 2022, Orca Systems, a fabless semiconductor company delivering digital RF technology, announced its first wireless system-on-chip (SoC) solution for the satellite Internet of Things (IoT), the ORC3990. Components used in the ORC 3990 include a temperature-compensated crystal oscillator (TCXO), passive filters, and switches, among others.

Crystal Oscillator Industry Overview

The crystal oscillator market is semi-consolidated and consists of various major players. Some of the major players in the market are Murata Manufacturing Co. Ltd., Seiko Epson Corporation, Kyocera Corporation, Rakon Ltd., and Vectron International Inc. (Microchip Technology). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- July 2023 - Kyocera Corporation has released its (OCXO) products, where KYOCERA AVX's new KOV Series standard voltage-controlled OCXOs employ modern layout topologies and robust designs that deliver outstanding performance in these and other applications, enabling customers to achieve a very stable frequency which can be achieved via a sinewave or a superstable timing source such as CMOS clock output.

- August 2022 - Rakon launched the RPT7050LG, a low g-sensitivity TCXO with high stability in a 7.0 x 5.0 x 1.5 mm package size. It is one of the most advanced compact low-g-sensitivity TCXOs on the market, with a guaranteed sensitivity of 0.1 ppb/g.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of the Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing 5G Adoption Across the World

- 5.1.2 Rising Demand From Advanced Automotive Applications

- 5.2 Market Restraints

- 5.2.1 Lack of New Improvements in Addition to the Technology Getting Matured with Substitutes

- 5.2.2 COVID-19 Outbreak Influencing the Electronics Industry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Temperature Compensated Crystal Oscillator (TCXO)

- 6.1.2 Simple Packaged Crystal Oscillator (SPXO)

- 6.1.3 Voltage Controlled Crystal Oscillator (VCXO)

- 6.1.4 Frequency Controlled Crystal Oscillator (FCXO)

- 6.1.5 Oven Controlled Crystal Oscillator (OCXO)

- 6.1.6 Other Types

- 6.2 By Mounting Type

- 6.2.1 Surface Mount

- 6.2.2 Thru-hole

- 6.3 By End-user Industry

- 6.3.1 Consumer Electronics

- 6.3.2 Automotive

- 6.3.3 Telecom and Networking

- 6.3.4 Aerospace and Defense

- 6.3.5 Research and Measurement

- 6.3.6 Industrial

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Murata Manufacturing Co. Ltd

- 7.1.2 Seiko Epson Corporation

- 7.1.3 Kyocera Corporation

- 7.1.4 Rakon Ltd

- 7.1.5 Vectron International Inc. (Microchip Technology)

- 7.1.6 TXC Corporation

- 7.1.7 SiTime Corporation

- 7.1.8 Daishinku Corp.

- 7.1.9 Siward Crystal Technology Co. Ltd

- 7.1.10 Hosonic Electronic Co. Ltd

- 7.1.11 Nihon Dempa Kogyo (NDK) Co. Ltd