|

市场调查报告书

商品编码

1685811

再生包装解决方案:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Recycled Materials Packaging Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

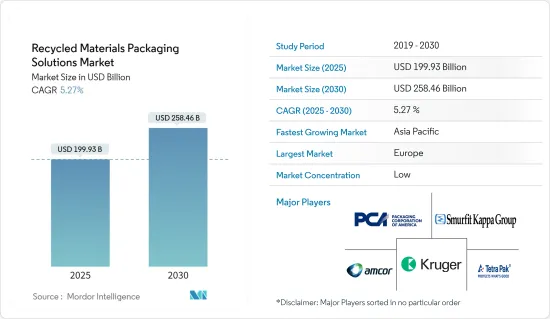

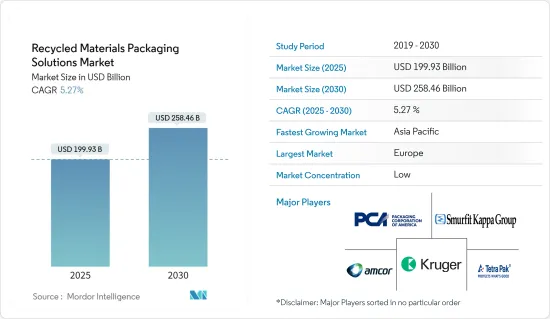

再生材料包装解决方案市场规模预计在 2025 年为 1,999.3 亿美元,预计到 2030 年将达到 2,584.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.27%。

就产量而言,预计将从 2025 年的 2.6076 亿吨增长到 2030 年的 3.3106 亿吨,预测期内(2025-2030 年)的复合年增长率为 4.89%。

主要亮点

- 再生材料包装解决方案是从製造过程中回收的材料中再加工出来的材料,并包含在最终产品或零件中。再生材料是已经完成其原定用途并用于包装的材料。

- 回收材料受到推广,因为它们可以优化製造流程,同时显着减少组织的废弃物足迹。与再生产品一样,再生材料可以提高公司的永续性,并且由于流程效率的提高还可以带来更高的成本效益。

- 此外,技术进步正在推动创新可回收包装解决方案的发展。製造商正致力于开发不仅环保而且还能为包装产品提供必要保护和功能的包装材料。因此,再生包装市场正在引入新材料、新设计和新製造工艺,以满足不同行业的需求。

- 生物分解性塑胶包装解决方案因其对环境的影响较小、对可回收性和永续性的日益关注以及政府对高效包装管理的兴趣日益浓厚,在包装行业中正日益兴起。

- 生物基材料在其生命週期内就温室气体预算和其他环境影响而言具有多种潜在优势。生物分解性材料的使用有助于永续性,并有望显着减少与石油基聚合物处置相关的生态影响。然而,预计这将抑制该市场的成长。

- 废弃物处理是地方政府和市政当局的主要成本负担。促进回收可以减少送往废弃物垃圾掩埋场的垃圾量并降低废弃物管理成本。这些节省下来的成本可以转移到教育、医疗保健和基础建设等其他重要领域。

再生材料包装解决方案的市场趋势

最大的最终用户产业是食品业

- 由于消费者对环境问题的认识不断提高以及各个行业提倡永续实践,食品业的再生包装市场正在成长。回收包装有几个好处,包括减少废弃物、节省资源和减少生产过程中的碳排放。

- 然而,循环经济的概念开始在食品业扎根,即资源被重新利用和回收,而不是在一次使用后就被丢弃。回收包装可以实现更循环的资源管理和减少废弃物的方法。

- 烘焙点心零售额的增加可以推动对环保包装解决方案的需求,从而促进再生材料包装市场的扩张。随着消费者意识和监管压力的不断增长,公司可能会优先考虑永续包装选择,从而进一步推动再生材料包装市场的成长。

- 据加拿大农业和食品部称,烘焙点心的零售额预计将从 2022 年的约 67.7 亿美元增长到 2026 年的 77.8 亿美元,这表明食品市场正在不断扩大。

- 随着烘焙点心零售额的增加,对包装材料的需求也可能增加。随着消费者环保意识的增强,他们越来越偏好使用永续包装,包括再生材料。

欧洲占主要市场占有率

- 欧洲采用再生包装材料正在重塑整个包装产业价值链,从采购和製造到分销和消费者互动。这项变革将推动材料采购、生产流程和供应链物流的创新,同时影响消费行为和法律规范,最终促进包装产业更永续和循环的经济。

- 目前,製药公司优先考虑环保解决方案,以减少碳排放并满足监管标准。

- 向再生包装的转变反映了行业更广泛的环保趋势,提高了品牌声誉和消费者信任,同时也推动了製药业的循环经济模式。

- 雅诗兰黛、Aveda 和 Origins 等全球美容公司正在製定永续性策略,以减少对塑胶包装的依赖。雅诗兰黛的目标是到 2025 年将其包装中的消费后回收 (PCR) 内容量提高 50%。 5 这些公司正在采取的策略包括低影响采购包装材料、寻求更多可回收的初级包装以及尽可能消除包装组件。

再生包装解决方案产业概览

再生材料包装解决方案市场主要企业:Amcor Group GmbH、Kruger Inc.、Smurfit Kappa Group、Packaging Corporation of America、Tetra Laval International SA 等。这些公司不断创新并建立策略合作伙伴关係以维持其市场份额。

2024年2月,安姆科与吉百利达成协议,采购约1000吨消费后再生塑料,用于其旗舰产品吉百利巧克力的包装,从而加速吉百利减少所需原生塑料量的努力。

2023 年 11 月,英国纸板和包装製造商 DS Smith 开始向飞利浦在荷兰生产的家电品牌 Versuni 供应再生材料和可回收包装。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 地缘政治因素如何影响市场

第五章市场动态

- 市场驱动因素

- 严格的政府法规推动产品回收需求

- 市场挑战

- 生物分解性塑胶的发展与进步

第六章市场区隔

- 依材料类型

- 塑胶

- 纸

- 玻璃

- 金属

- 按最终用户产业

- 食物

- 饮料

- 家庭和个人护理

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Amcor Group GmbH

- Kruger Inc.

- Smurfit Kappa Group

- Packaging Corporation of America

- Tetra Laval International SA

- International Paper Company

- Mondi Group

- DS Smith PLC

- WestRock Company

- Sealed Air Corp.

第八章投资分析

第九章:未来市场展望

The Recycled Materials Packaging Solutions Market size is estimated at USD 199.93 billion in 2025, and is expected to reach USD 258.46 billion by 2030, at a CAGR of 5.27% during the forecast period (2025-2030). In terms of production volume, the market is expected to grow from 260.76 million tons in 2025 to 331.06 million tons by 2030, at a CAGR of 4.89% during the forecast period (2025-2030).

Key Highlights

- Recycled material packaging solutions are the materials that have been reprocessed from a recovered material using a manufacturing process and then included in a final product or component. Recycled material is any material that has already served the use that it was initially intended for and is being used for packaging.

- Recycled content is promoted as it significantly reduces organizational waste footprints while optimizing the manufacturing process. As with recycled products, recycled content will improve a company's sustainability, and due to the efficiency of the process, it is also associated with increased cost benefits.

- Additionally, technological advancements are leading to the development of innovative recyclable packaging solutions. Manufacturers are concentrating on creating packaging materials that are not only environmentally friendly but also offer the required protection and functionality for the products being packaged. As a result, the recycled packaging market is witnessing the introduction of new materials, designs, and manufacturing processes that cater to diverse industry needs.

- Biodegradable plastic packaging solutions are witnessing a rise in the packaging industry owing to their low environmental impact, growing focus on recyclability and sustainability, and governments' focus on efficient packaging management.

- Bio-based materials have several potential advantages for greenhouse gas balances and other environmental impacts over life cycles. It is anticipated that using biodegradable materials will contribute to sustainability and a high reduction in the ecological effects related to the disposal of oil-based polymers. However, it is expected to restrain the growth of the market studied.

- Waste management is a major cost burden for municipalities and governments. Promoting recycling decreases the volume of waste sent to landfills, reducing waste management costs. These cost savings can be diverted to other critical areas, such as education, healthcare, and infrastructure development.

Recycled Materials Packaging Solutions Market Trends

Food Industry to be the Largest End-user Industry

- The market for recycled packaging in the food industry has grown due to increasing consumer awareness of environmental issues and the push for sustainable practices across various sectors. Recycled packaging offers several benefits, including reducing waste, conserving resources, and lowering carbon emissions associated with production.

- However, the concept of a circular economy, where resources are reused and recycled rather than discarded after a single use, is gaining traction in the food industry. Recycled packaging enables a more circular approach to resource management and waste reduction.

- The growth in retail sales of baked goods can contribute to expanding the recycled material packaging market by driving demand for environmentally friendly packaging solutions. As consumer awareness and regulatory pressures continue to increase, businesses are likely to prioritize sustainable packaging options, further increasing the growth of the recycled material packaging market.

- According to Agriculture and Agri-Food Canada, the projected growth in retail sales of baked goods, from approximately USD 6.77 billion in 2022 to a forecasted USD 7.78 billion by 2026, indicates an expanding market for food products.

- With a rise in retail sales of baked goods, there will likely be an increased demand for packaging materials. As consumers become more environmentally conscious, there is a growing preference for sustainable packaging options, including recycled materials.

Europe to Hold the Major Market Share

- The adoption of recycled packaging materials in Europe is reshaping the entire value chain of the packaging industry, from procurement and manufacturing to distribution and consumer engagement. The shift drives innovation in material sourcing, production processes, and supply chain logistics while influencing consumer behavior and regulatory frameworks, ultimately fostering a more sustainable and circular economy within the packaging sector.

- Introducing recycled glass packaging in Europe's pharmaceutical market is revolutionizing sustainability efforts, as pharmaceutical companies prioritize environmentally friendly solutions to reduce their carbon footprint and meet regulatory standards.

- The shift toward recycled material packaging reflects a broader industry trend toward eco-conscious practices, enhancing brand reputation and consumer trust while promoting a circular economy model within the pharmaceutical sector.

- Global cosmetic companies like Estee Lauder, Aveda, and Origins have developed sustainability strategies to reduce dependence on plastic packaging materials. Estee Lauder is working toward increasing the amount of post-consumer recycled (PCR) material in its packaging by up to 50% by 2025.5. Some strategies these companies employ include low-impact sourcing for packaging materials, pursuing more recycled primary packaging, and eliminating packaging components wherever possible.

Recycled Materials Packaging Solutions Industry Overview

The recycled materials packaging solutions market is fragmented with major players such as Amcor Group GmbH, Kruger Inc., Smurfit Kappa Group, Packaging Corporation of America, Tetra Laval International SA, etc. The corporations continue to innovate and form strategic partnerships to maintain their market share.

In February 2024, Amcor agreed with Cadbury to procure approximately 1,000 tonnes of post-consumer recycled plastic to be used in the packaging of Cadbury's core range of Cadbury chocolates, helping to accelerate Cadbury's efforts to reduce their virgin plastic requirements.

In November 2023, Paperboard and packaging manufacturer DS Smith, based in the United Kingdom, started providing recycled content and recyclable packaging to Philips Home Appliance brands manufactured in the Netherlands by Versuni.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Geo-political Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Government Regulations Driving the Demand for Recycling of Products

- 5.2 Market Challenges

- 5.2.1 Growth and Advancement in Biodegradable Plastics

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Glass

- 6.1.4 Metal

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Home and Personal Care

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Kruger Inc.

- 7.1.3 Smurfit Kappa Group

- 7.1.4 Packaging Corporation of America

- 7.1.5 Tetra Laval International SA

- 7.1.6 International Paper Company

- 7.1.7 Mondi Group

- 7.1.8 DS Smith PLC

- 7.1.9 WestRock Company

- 7.1.10 Sealed Air Corp.