|

市场调查报告书

商品编码

1685813

双碳电池:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Dual Carbon Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

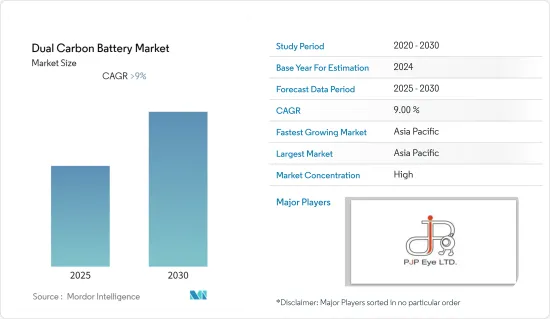

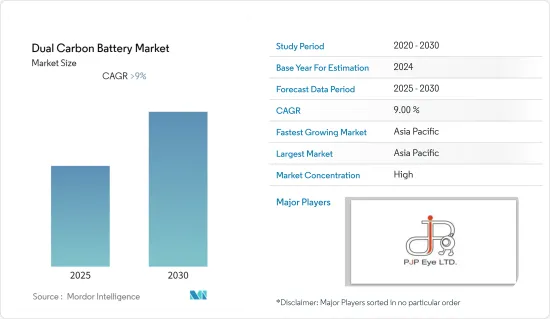

预计双碳电池市场在预测期内的复合年增长率将超过 9%。

预计汽车电池领域在预测期内将出现显着需求,因为汽车行业仍然是电池最大的终端用户之一,随着汽车市场的成长,它可能会推动双碳电池市场的发展。

电动车 (EV) 市场的成长可能会在未来创造重大机会,因为电动车为内燃机汽车 (ICE) 提供了更干净的替代品,并有助于减少燃料燃烧造成的空气污染和噪音。

预计亚太地区将主导市场,大部分需求来自印度、中国和日本等国家。

双碳电池市场趋势

汽车领域需求强劲

双碳电池可望显着延长充电时间和整体寿命,同时大幅降低成本、充电时间和环境影响。此外,这些电池的高能量密度预计将在未来几年增加汽车产业的需求。

电动车(EV)对高阶电池的需求不断增加也是推动双碳电池市场发展的主要因素。该电池製造商表示,它将使现代电动车的续航里程达到近 500 公里(300 英里)。

双碳电池有望彻底改变汽车电池产业,然而,由于这些电池的生产率低以及锂离子电池等替代品占据市场主导地位,预计未来几年市场成长将放缓。双碳技术尚未大规模应用,製造商正在努力在汽车领域取得进展。

此外,Power Japan Plus (PJP) 等公司正在将双碳电池引入医疗设备领域、卫星以及汽车产业。

因此,由于上述因素,汽车产业在预测期内可能会显着成长。

亚太地区可望大幅成长

由于亚太地区电气化活动的活性化,预计未来十年整个亚太电池市场将大幅成长。双碳电池尚未在市场上取得重大进展。

该地区的电池市场主要受到印度、中国、日本和韩国等国家的电子製造、发电、通讯和资讯产业发展的推动。

印度等新兴国家缺乏强大的电网基础设施,导致频繁发生停电和断电事件,主要发生在农村地区。因此,由于缺乏发达的电网基础设施、对稳定电力的需求高以及对电源备份解决方案的需求,预计工业双碳电池的需求将会上升。此外,各国政府正在采取措施资助能源储存计划,以满足其国家的能源需求。中国和几个南亚国家正在开发新的经营模式和相关融资工具,以利用电池能源储存计划。

然而,短期内,该地区可能会面临挑战,因为双碳电池製造过程中使用的关键原料石墨碳的价格上涨。石墨碳价格上涨主要是因为中国石墨电极供应量急剧下降。在当前情况下,石墨电极的需求量远高于供应量。

该地区也正在进行双碳电池技术的研究。例如,2021年4月,印度海得拉巴理工学院的研究人员开发出双碳电池,不仅环保,还能将整体电池成本降低20-25%。此外,目前正在进行提高电池能量密度的研究。

因此,基于上述因素,预计亚太地区在预测期内将显着成长。

双碳电池产业概况

双碳电池市场正在整合。主要企业为PJP Eye Ltd.,截至2017年6月30日,Power Japan Plus已将包括电池製造在内的所有资产及业务转让给PJP Eye Ltd.。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概述

- 介绍

- 2027 年市场规模与需求预测

- 比较分析:双碳电池与其他电池技术

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 应用

- 汽车电池

- 工业电池

- 便携式电池

- 其他用途

- 地区

- 北美洲

- 亚太地区

- 欧洲

- 南美洲

- 中东和非洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- PJP Eye Ltd

第七章 市场机会与未来趋势

The Dual Carbon Battery Market is expected to register a CAGR of greater than 9% during the forecast period.

The automotive battery segment is expected to witness significant demand over the forecast period, as the automotive industry remains one of the largest end users of batteries, along with the growing market for vehicles, which, in turn, is likely to boost the dual carbon battery market.

Growth in the electric vehicles (EVs) market can create immense opportunities in the future as they offer clean alternatives to vehicles with internal combustion engines (ICE), which helps reduce air pollution resulting from fuel combustion and limit noise.

Asia-Pacific is expected to dominate the market, with the majority of the demand coming from countries like India, China, and Japan.

Dual Carbon Battery Market Trends

The Automotive Segment is Expected to Witness Significant Demand

Dual carbon batteries are expected to significantly extend the length of charge and the overall lifetime while greatly reducing cost, charge times, and environmental impact. Moreover, the high energy density of these batteries is expected to increase the demand in the automotive industry in the coming years.

The increasing demand for high-end batteries from electric vehicles (EVs) is another major factor driving the dual carbon battery market. The manufacturers of these batteries have stated that the batteries could give a modern electric vehicle a range of almost 500 kilometers (300 miles).

Although dual carbon batteries promise to revolutionize the automotive battery segment, the low production rate of these batteries and the dominance of alternatives, such as lithium-ion batteries, in the market are expected to slow down the market growth for the next few years. The dual carbon technology has not yet been deployed on a large scale, and manufacturers are still struggling to penetrate into the automotive sector.

Moreover, companies such as Power Japan Plus (PJP) are planning to introduce their dual carbon batteries to the medical device segment and satellites and eventually into the automotive industry.

Thus, based on the above-mentioned factors, the automotive segment is likely to experience significant growth during the forecast period.

Asia-Pacific is Set to Experience Significant Growth

The Asia-Pacific battery market as a whole is expected to grow significantly over the coming decade due to increased electrification activities in the region. The dual carbon battery has not yet penetrated the market on a significant level.

The battery market in this region is mainly driven by developments in the electronics manufacturing, power generation, communication, and information industries in countries like India, China, Japan, and South Korea.

Developing countries, like India, lack a firm grid infrastructure, which causes power cuts and blackouts frequently, mostly in rural areas. Thus, the lack of grid infrastructure, high demand for steady power, and the need for power backup solutions are expected to drive the demand for industrial dual carbon batteries. Moreover, the governments of various countries have taken initiatives to finance energy storage projects to fulfill the energy requirements in their countries. China and a few South Asian countries are coming up with new business models and associated financing instruments to invest capital in battery energy storage projects.

In a short-term scenario, however, the region is likely to witness challenges from rising prices of graphite carbon, which is a major raw material used in the dual carbon battery manufacturing process. Rising prices of graphite carbon are majorly a result of a sharp cut in the supply of graphite electrodes from China. In the present scenario, the demand for graphite electrodes is significantly higher compared to the supply.

Research on dual carbon battery technology is also underway in the region. For instance, in April 2021, researchers at IIT Hyderabad, India, developed a dual carbon battery that can cut the overall battery cost by as much as 20-25%, along with being environment-friendly. Further research is underway to increase the energy density of the battery.

Therefore, based on the above-mentioned factors, Asia-Pacific is expected to witness significant growth during the forecast period.

Dual Carbon Battery Industry Overview

The dual carbon battery market is consolidated. The key player is PJP Eye Ltd. As of June 30, 2017, Power Japan Plus had transferred all its assets and businesses, including battery manufacturing, to PJP Eye Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Comparative Analysis: Dual Carbon Battery Vs Other Battery Technologies

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Automotive Batteries

- 5.1.2 Industrial Batteries

- 5.1.3 Portable Batteries

- 5.1.4 Other Applications

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Asia-Pacific

- 5.2.3 Europe

- 5.2.4 South America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 PJP Eye Ltd