|

市场调查报告书

商品编码

1685825

直链烷基苯 (LAB) -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Linear Alkyl Benzene (LAB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

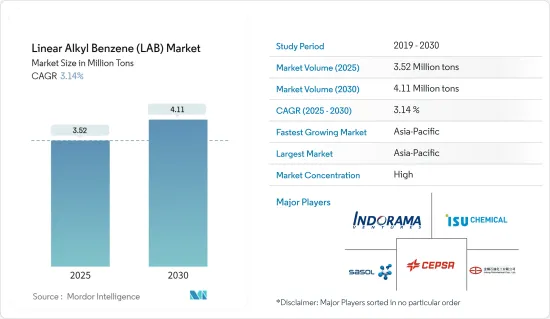

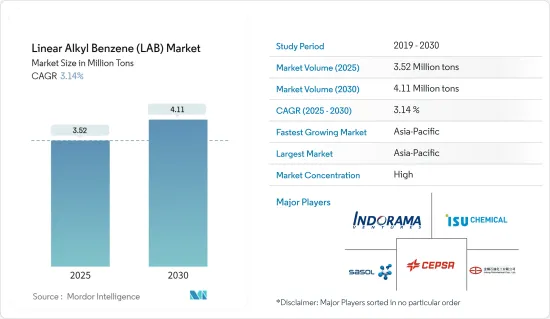

线性烷基苯市场规模预计在 2025 年为 352 万吨,预计到 2030 年将达到 411 万吨,预测期内(2025-2030 年)的复合年增长率为 3.14%。

2020年,由于供应链中断和各类机构/场所关闭,市场受到了COVID-19疫情的不利影响。然而,随着人们对清洁和卫生意识的不断增强,家用清洁产品对乳酸菌的需求也随之增加。预计市场将在 2021 年大幅復苏,并在预测期内以新冠疫情之前的成长率成长。

主要亮点

- 从中期来看,清洁剂和清洁业对线性烷基苯磺酸盐的需求不断增加,预计将推动市场研究。

- 然而,人们对健康问题、环境法规和新兴替代品的日益担忧预计将阻碍市场成长。

- 在预测期内,对生物基 LAB 的需求不断增长可能会为市场带来机会。

预计亚太地区将主导市场并在预测期内见证最高成长。

线性烷基苯市场趋势

清洁剂市场可望占据主导地位

- 直链烷基苯用于直链烷基苯磺酸盐(LAS)的商业性生产。这些是用于製造洗衣精的细胞毒性合成阴离子界面活性剂。

- 当这些阴离子界面活性剂溶解在水中时,它们会在界面活性剂的亲水部分形成带负电荷的阴离子。

- 含有 LAS 的洗衣精混合在一起时会产生大量泡沫,对去除油性污渍最有效。

- 印度、中国和日本等国家是洗衣精的主要生产国。

- 例如,最近印度成为世界上最大的肥皂和清洁剂生产国之一。诸如清洁印度运动等政府倡议促进了人们的健康和卫生。这些努力促进了製造业的成长以及肥皂和清洁剂使用量的增加,进一步刺激了该国对 LABS 的需求。

- 2023年12月,Godrej Consumer推出了一款针对南印度大众消费市场的新型液态清洁剂。该产品名为 Godrej Fab,在泰米尔纳德邦、安得拉邦、卡纳塔克邦和喀拉拉邦销售。

- 根据日本经济产业省预测,2022年日本粉状清洁剂产量将达105.31千吨,而前一年为124.39千吨。

- 2023 年 1 月,Lion Corporation(日本肥皂和清洁剂製造商)在全国各地的商店推出了全新超柔软洗衣精Acron Smart Care 系列。 Acron Smart Care 是一种织物柔软剂,经过特殊配製,即使对最精緻的衣物也是安全的。

- 根据澳洲卫生署的报告,家用清洁剂占 LAS消费量的 85% 以上,其中消费者洗衣精是 LAS 的最大来源。

- 欧洲是烷基苯磺酸盐的第二大消费国。由于烷基苯磺酸盐的生产,预计线性烷基苯的需求将会增加。

- 由于都市化的快速发展以及消费者对环保表面活性剂和清洗产品的偏好转变,对 LAB 的需求预计会增加。

- Menage 清洁剂、清洁剂、洗衣液、洗衣剂和其他清洁产品含有约 83-87% 的线性烷基磺酸盐(LAS)。

- 预计所有这些因素将在预测期内推动对线性烷基苯磺酸盐的需求。

亚太地区可望主导市场

- 亚太地区占据全球市场占有率的主导地位,因为中国、印度和日本等国家对清洗的需求不断增长,支持了该地区对直链烷基苯的使用。

- 以直链烷基苯为原料,透过液相中与硫酸反应、气相中与三氧化硫反应,生成直链烷基苯磺酸盐(LABSA)。中国主要的LAB和LABSA生产商和供应商包括中石油抚顺石化、上海化工、叶瑟化工、河南金河实业等。

- LABSA 被认为是清洁剂和液体清洁剂行业用于生产液体、饼状和粉末状合成清洁剂的最便宜和最常见的表面活性剂之一。

- 沙乌地阿拉伯法拉比石化公司是烷基苯生产的领先企业,该公司宣布将于 2023 年 6 月收购大东方化工私人有限公司 50% 的股份。大东方化工私人有限公司是大东方化工太仓的唯一股东,后者在中国太仓拥有一家直链烷基苯工厂。

- 根据中国界面活性剂工业联合会统计,预计2022年,界面活性剂产业67家规模以上企业的界面活性剂年产量合计将达426.2万吨。销量超过420万吨,与前一年同期比较成长3.6%。

- 根据中国清洁剂和界面活性剂製造商湖南日生科技介绍,日生从事界面活性剂和清洁剂产品的研究、生产和销售。 2023年1-9月,日生销售收入与前一年同期比较增7.42%至人民币29.96亿元(4.2亿美元),界面活性剂占总销售额的92.23%,凸显国内需求强劲。

- 根据化学和石化工业协会 (CPMA) 的数据,2022 年印度的线性烷基苯 (LAB) 安装产能将达到约 5,44,790 吨。

- 2022 年,印度石油公司的 LAB 工厂进行了维修,年产能从 12 万吨提高到 16.2 万吨。随着LAB产能的扩大,IOC将成为印度最大的LAB供应商。

- 因此,预计这些因素将在预测期内导致该地区对线性烷基苯 (LAB) 的需求增加。

直链烷基苯产业概况

线性烷基苯(LAB)市场本质上处于整合状态。市场的主要企业(不分先后顺序)包括 Cepsa、Sasol、Indorama Ventures Public Limited、ISU Chemical 和金通石油化学有限公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 清洁剂和清洁剂产业对直链烷基苯磺酸盐的需求不断增加

- 其他驱动因素

- 限制因素

- 人们对健康问题和环境法规的担忧日益增加

- 替代品的出现

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 价格趋势分析

第五章 市场区隔

- 应用

- 界面活性剂

- 直链烷基苯磺酸盐(LAS)

- 其他用途(溶剂、涂料)

- 界面活性剂

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 合併、收购、合资、合作和协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Cepsa

- Egyptian Petrochemicals Holding Company(ECHEM)

- ENASPOL AS

- Farabi Petrochemicals Co.

- Formosan Union Chemical Corp.

- Indian Oil Corporation Ltd

- Indorama Ventures Public Limited

- ISU Chemical

- Jintung Petrochemical Corp. Ltd

- Kineff

- NIRMA LIMITED

- PT Unggul Indah Cahaya Tbk

- Qatar Chemical & Petrochemical Marketing & Distribution Company(Muntajat)QPJSC

- Reliance Industries Limited

- Sasol

- SBK HOLDING

- Tamilnadu Petroproducts Limited

- Thaioil Group(LABIX Company Limited)

第七章 市场机会与未来趋势

- 对生物基实验室的需求不断增加

- 其他机会

The Linear Alkyl Benzene Market size is estimated at 3.52 million tons in 2025, and is expected to reach 4.11 million tons by 2030, at a CAGR of 3.14% during the forecast period (2025-2030).

In 2020, the market was negatively impacted by the COVID-19 pandemic due to disruptions in supply chains and closures of various institutions/offices. However, the demand for LAB has increased for use in house cleaning products, considering the increased awareness of cleanliness and hygiene. The market recovered significantly in 2021, and it is expected to grow at the pre-COVID rate during the forecast period.

Key Highlights

- Over the medium term, the growing demand for linear alkyl benzene sulfonic acid from the detergent and cleaning industry is expected to boost the market studied.

- However, increasing concerns over health issues, environmental regulations, and the emergence of substitutes are expected to hinder market growth.

- The growing demand for bio-based LAB is likely to act as an opportunity for the market during the forecast period.

Asia-Pacific is likely to dominate the market and witness the highest growth during the forecast period.

Linear Alkyl Benzene Market Trends

The Laundry Detergents Segment is Expected to Dominate the Market

- Linear alkylbenzene is used to manufacture linear alkyl benzene sulphonates (LAS) commercially. These are cytotoxic synthetic anionic surfactants used to produce laundry detergents.

- When dissolved in water, these anionic surfactants form anions with a negative charge on the hydrophilic part of the surfactant.

- Laundry detergents containing LAS form a lot of foam when mixed and are most effective at removing oily and greasy stains.

- Countries such as India, China, and Japan are the leading manufacturers of laundry detergents.

- For instance, in recent times, India has been one of the largest producers of soaps and detergents globally. Government initiatives like the Swachh Bharat Mission promote health and hygiene. Such initiatives, along with the growing usage of soaps and detergents, have led to the growth of the manufacturing industry, further boosting the demand for LABS in the country.

- In December 2023, Godrej Consumer launched a new liquid laundry detergent for mass-market consumers in South India. The product is called Godrej Fab and is available in Tamil Nadu, Andhra Pradesh, Karnataka, and Kerala.

- According to the METI (Japan), the production volume of laundry detergent powders in Japan accounted for 105.31 kilotons in 2022, compared to 124.39 kilotons in the previous year.

- In January 2023, Lion Corporation (Japan-based manufacturer of soaps and detergents) launched its new Acron Smart Care, a new, ultra-soft laundry detergent, in stores nationwide. Acron Smart Care is a softening agent specially formulated for delicate-safe laundry.

- According to an Australian Department of Health report, household detergents account for more than 85% of LAS consumption, with consumer laundry products having the highest volume of use.

- Europe is the second-largest consumer of alkylbenzene sulfonate. The demand for linear alkylbenzene is projected to rise for the production of alkylbenzene sulfonate.

- The demand for LAB is expected to grow due to rapid urbanization and changing consumer preferences toward eco-friendly surfactants and cleansers.

- Menage cleansers, dishwashing liquids, laundry liquids, laundry maquillages, and other cleanser products use approximately 83-87% of linear alkyl sulfonate (LAS).

- All these factors are likely to boost the demand for linear alkylbenzene sulfonate over the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific dominated the global market share as the increasing need for cleaners in countries such as China, India, and Japan supported the use of linear alkylbenzene in the region.

- Linear alkyl benzene is used as a raw material to manufacture linear alkyl benzene sulphonic acid (LABSA) by reacting with sulfuric acid in the liquid phase or sulfur trioxide in the gaseous phase. Some of the country's major manufacturers and suppliers of LAB and LABSA include PetroChina Fushun Petrochemical, Shanghai Chemex, Yeser Chemicals, and Henan Jinhe Industry Co. Ltd.

- LABSA is considered one of the cheapest common surfactants used in the powder and liquid detergent industries to manufacture synthetic detergents in liquid, cake, or powder form.

- Saudi Arabia's Farabi Petrochemicals Company, a top player in LAB production, announced the acquisition of a 50% stake in Great Orient Chemical Pte Ltd in June 2023. Great Orient Chemical Pte Ltd is the sole shareholder of Great Orient Chemical Taicang Co. Ltd, which has a linear alkyl benzene facility in Taicang, China.

- According to the statistics of the China Surfactant Industry Alliance, in 2022, the total annual surfactant production of 67 large-scale enterprises in the surfactant industry was estimated to have reached 4.262 million tons. In contrast, the sales volume crossed the mark of 4.2 million tons, with a Y-o-Y increase of 3.6%.

- According to HUNAN RESUN Co. Ltd, a Chinese manufacturer of detergents and surfactants, RESUN conducts research and manufactures and sells surfactants and detergent products. In the first nine months of 2023, RESUN generated revenue of CNY 2.996 billion (USD 0.42 billion), up by 7.42% from the previous year, with surfactants representing 92.23% of the total revenue, highlighting their strong demand in the country.

- According to the Chemical and Petrochemical Manufacturers Association (CPMA), in 2022, India's linear alkylbenzene (LAB) installed capacity was approximately 544,790 metric tons.

- In 2022, the IOCL LAB plant underwent a revamp to increase its capacity to 162 kilotons from 120 kilotons per annum. The increased capacity of LAB makes the IOC the largest LAB supplier in India.

- Therefore, such factors are expected to contribute to the increased demand for linear alkyl benzene (LAB) in the region during the forecast period.

Linear Alkyl Benzene Industry Overviiew

The linear alkyl benzene (LAB) market is consolidated in nature. The major companies (not in any particular order) in the market include Cepsa, Sasol, IndoramaVentures Public Limited, ISU Chemical, and Jintung Petrochemical Corp. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Linear Alkyl Benzene Sulfonic Acid from the Detergent and Cleaning Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Concerns Over Health Issues and Environmental Regulations

- 4.2.2 Emergence of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Trend Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Surfactants

- 5.1.1.1 Linear Alkylbenzene Sulfonate (LAS)

- 5.1.2 Other Applications (Solvents and Paints)

- 5.1.1 Surfactants

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Malaysia

- 5.2.1.6 Thailand

- 5.2.1.7 Indonesia

- 5.2.1.8 Vietnam

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 NORDIC

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Nigeria

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 United Arab Emirates

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Cepsa

- 6.4.2 Egyptian Petrochemicals Holding Company (ECHEM)

- 6.4.3 ENASPOL AS

- 6.4.4 Farabi Petrochemicals Co.

- 6.4.5 Formosan Union Chemical Corp.

- 6.4.6 Indian Oil Corporation Ltd

- 6.4.7 Indorama Ventures Public Limited

- 6.4.8 ISU Chemical

- 6.4.9 Jintung Petrochemical Corp. Ltd

- 6.4.10 Kineff

- 6.4.11 NIRMA LIMITED

- 6.4.12 PT Unggul Indah Cahaya Tbk

- 6.4.13 Qatar Chemical & Petrochemical Marketing & Distribution Company (Muntajat) Q.P.J.S.C

- 6.4.14 Reliance Industries Limited

- 6.4.15 Sasol

- 6.4.16 SBK HOLDING

- 6.4.17 Tamilnadu Petroproducts Limited

- 6.4.18 Thaioil Group (LABIX Company Limited)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Bio-based LAB

- 7.2 Other Opportunities