|

市场调查报告书

商品编码

1685879

德国太阳能-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Germany Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

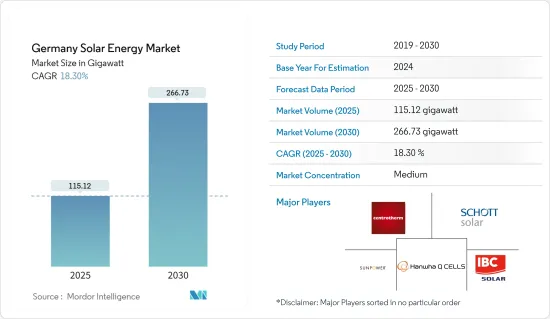

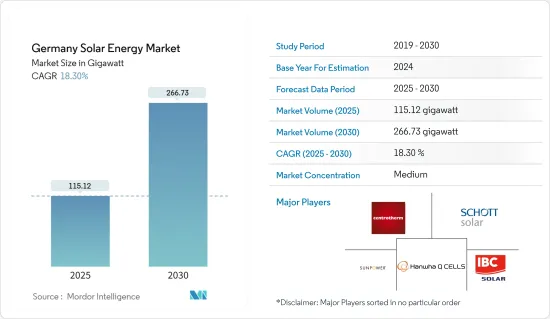

预计2025年德国太阳能市场规模为115.12吉瓦,至2030年预计将达到266.73吉瓦,预测期间(2025-2030年)的复合年增长率为18.3%。

主要亮点

- 从中期来看,太阳能基础设施成本下降加上传统能源来源电价上涨预计将推动德国太阳能市场的成长。

- 另一方面,替代能源的日益普及预计将阻碍市场成长。

- 然而,太阳能电池技术正在不断进步,包括太阳能电池组件效率的提高。这些倡议正在为德国太阳能市场创造巨大的机会。

德国太阳能市场的趋势

光伏发电(PV)预计将占据市场主导地位

- 近年来,德国太阳能市场发生了重大变化。作为世界领先的可再生能源供应国之一,德国一直优先发展太阳能产业。这项努力植根于该国雄心勃勃的能源转型目标,即“能源转型”,旨在减少碳排放,逐步淘汰核电,走向永续能源的未来。

- 太阳能技术,尤其是太阳能发电面板成本的下降,对德国市场的扩张发挥着至关重要的作用。太阳能板价格越来越便宜,提高了太阳能装置的投资收益,对消费者和企业来说吸引力也越来越大。太阳能设备价格的稳定下降也使得太阳能比传统能源来源更具竞争力。

- 2023 年 7 月,全球太阳能发电工程开发商和营运商 Emeren Group Ltd 宣布将 11.5 MWp 太阳能发电工程出售给瑞士能源公司 MET Group。该计划将在「准备建造」(「RTB」)阶段出售,预计 MET 集团将建造和营运该发电厂。该太阳能发电厂将位于德国梅克伦堡-西波美拉尼亚州肯茨林。预计商业营运将很快开始。

- 根据国际可再生能源机构《2024年再生能源容量》的资料,德国太阳能发电装置容量将从2022年的67,477兆瓦成长到2023年的81,737兆瓦,仅在一个财政年度就增加14,260兆瓦。

- 2023年9月,Uniper做出策略决策,在德国埃尔斯弗莱特建立一座300MWp太阳能发电厂。该计划用地面积约281公顷。所选地点靠近亨德多夫和威廉港的资产所在地。根据「Photovoltaik Wesermarsch」区域能源概念,该发电厂预计将对永续能源生产做出重大贡献。

- 此外,德国太阳能市场展现出强大的国际竞争力。德国拥有多家领先的光伏技术製造商和供应商,在全球光伏产业中发挥关键作用。德国太阳能光电产品和技术的出口对该国经济成长和贸易顺差贡献巨大。

- 总之,德国太阳能光电市场是一个充满活力且快速扩张的产业,得益于政府的支持政策、技术成本的下降、对永续性的承诺、创新的资金筹措模式和强大的国际竞争力,该市场正在经历令人瞩目的成长。

电价上涨透过传统机制推动市场

- 德国拥有巨大的太阳能潜力,可再生能源公司正在利用这一潜力继续增加其在可再生能源结构中的份额。然而,由于近年来使用石化燃料技术发电以及电力销售管道多样化,电力价格大幅上涨。

- 因此,石化燃料发电的高成本可以帮助德国过渡到更便宜的可再生能源,例如太阳能。预计这将成为消费者、公共产业、商业和工业相关人员采用太阳能发电基础设施的成长动力,从而增加德国太阳能市场的渗透率。

- 2024年3月,德国能源部也宣布关闭7座燃煤褐煤发电厂。该国计划在未来十年内彻底淘汰燃煤发电,并转向利用太阳能和风能等更传统的能源来获取电力。

- 2023年5月,德国政府宣布将放宽太阳能发电的官僚障碍。德国政府的目标是到 2030 年在德国安装 215 吉瓦的太阳能发电设施,七年内将现有容量增加两倍以上。

- 2022年6月德国家庭电费为每度电0.3279欧元,2023年6月上涨至0.4125欧元,涨幅为25.8%。由于这些原因,德国对更便宜的太阳能电力的需求日益增长。

- 此外,德国政府的「德国太阳能一揽子计画」旨在到2030年安装215GW的太阳能板。 2022年6月,德国政府将把住宅太阳能发电厂的上网电价提高到750kW,同时鼓励终端消费者安装太阳能屋顶发电厂,透过将电力注入传统电网来赚取收入。预计政府的这种干预措施将从长远来看推动太阳能市场的发展。

- 在当前的市场情势下,电价上涨迫使钢铁、水泥、食品和饮料等能源密集型产业停产或减产。这凸显了在德国整合太阳能等可再生能源的重要性。

- 因此,在公用事业和独立电力生产商销售的电价上涨的背景下,这些因素预计将推动德国太阳能市场的成长。

德国太阳能产业概况

德国太阳能市场相当分散。市场的主要企业(不分先后顺序)包括 IBC Solar AG、Centrotherm International AG、SunPower Corporation、Energie Baden-Wurttemberg AG 和 Hanwha Corporation。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 德国太阳能装置容量及2029年预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 市场驱动因素

- 透过常规机制提高电价

- 太阳能基础设施成本下降

- 市场限制

- 与其他替代能源的竞争

- 市场驱动因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 按类型

- 太阳能发电

- 聚光型太阳光电

- 按应用

- 实用工具

- 商业/工业

- 住宅

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- BayWa re AG

- Centrotherm International AG

- Sun Power Corporation

- AE Alternative Energy GMBH

- Hanwha Corporation

- IB Vogt GmbH

- Energie Baden-Wurttemberg AG

- IBC SOLAR AG

- Vattenfall AB

- Solnet Green Energy OY

第七章 市场机会与未来趋势

- 太阳能製造的技术进步

简介目录

Product Code: 48882

The Germany Solar Energy Market size is estimated at 115.12 gigawatt in 2025, and is expected to reach 266.73 gigawatt by 2030, at a CAGR of 18.3% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the decreasing cost of solar energy infrastructure, coupled with the increasing electricity prices from conventional energy sources, are expected to drive the growth of the German solar energy market.

- On the other hand, the increasing adoption of alternate energy sources is expected to hinder the market's growth.

- Nevertheless, there is a rise in technological advancements in solar technology, such as increasing solar module efficiency. These measures present tremendous opportunities for the German solar energy market.

Germany Solar Energy Market Trends

Solar Photovoltaic (PV) Expected to Dominate the Market

- The German solar energy market has undergone significant transformations in recent years. As one of the leading countries in adopting renewable energy, Germany has consistently prioritized the development of its solar sector. This commitment is rooted in the country's ambitious energy transition goals, known as the "Energiewende," which seek to reduce carbon emissions, phase out nuclear power, and shift toward a sustainable energy future.

- The declining costs of solar technology, particularly photovoltaic panels, have played a pivotal role in expanding the market in Germany. As solar panels have become more affordable, the return on investment for solar installations has improved, making them increasingly appealing to consumers and businesses. The steady decrease in solar equipment prices has also led to an increase in the competitiveness of solar power against traditional energy sources.

- In July 2023, Emeren Group Ltd, a global solar project developer and operator, announced the successful sale of an 11.5 MWp PV project to the Swiss-based energy company MET Group. The project was sold at the Ready-to-Build ("RTB") stage, and MET Group is expected to complete the construction and operate the power plant. The solar PV power plant will be located in Kentzlin, Germany, in the state of Mecklenburg-Western Pomerania. Commercial operations are expected to start soon.

- According to data from the International Renewable Energy Agency RE Capacity 2024, the solar energy PV installations in Germany increased from 67,477 MW in 2022 to 81,737 MW in 2023, adding 14,260 MW in just one financial year, thus promising strong growth in the market.

- In September 2023, Uniper made a strategic decision to establish a 300 MWp photovoltaic plant in Elsfleth, Germany. This project is expected to cover an area of approximately 281 hectares. The chosen location is near the Huntorf and Wilhelmshaven asset locations. By aligning with the regional energy concept "Photovoltaik Wesermarsch," this plant is expected to contribute significantly to sustainable energy production.

- Furthermore, the German solar energy market has exhibited robust international competitiveness. The country is home to several leading solar technology manufacturers and suppliers, making it a key player in the global solar industry. Germany's export of solar products and technology contributes significantly to the country's economic growth and trade surplus.

- In conclusion, Germany's solar PV market is a dynamic and rapidly expanding sector that has witnessed remarkable growth due to supportive government policies, declining technology costs, a commitment to sustainability, innovative financing models, and strong international competitiveness.

Increase in Prices of Electricity Procured from Conventional Mechanisms Expected to Drive the Market

- Germany has vast solar energy potential, and accordingly, renewable energy companies have continued to leverage this potential to ramp up their share in the renewable energy mix. However, electricity generation from fossil-fuel technologies and various means of selling electricity have substantially increased prices in recent years.

- Hence, the high cost of electricity generation from fossil fuels could help Germany transition to cheaper renewable energy resources, such as solar energy. This is anticipated to act as a growth driver for consumers, utilities, commercial, and industrial stakeholders to install solar energy generation infrastructure, thereby increasing the market penetration of solar energy in Germany.

- In March 2024, the German Energy Ministry also announced shutting down seven coal-lignite-fired power plants. The country aims to fully phase out coal power by the end of the decade and switch to Electricity Procurement from Conventional Mechanisms like Solar and Wind.

- In May 2023, the German government announced that it would ease bureaucratic hurdles for solar power as the country set a new record for photovoltaic installations during the first quarter. The government aims to have 215 GW of solar installed in Germany by 2030, more than tripling existing capacity in seven years.

- In June 2022, household electricity prices in Germany were EUR 0.3279 per kilowatt Hour, which increased to EUR 0.4125 per kilowatt Hour in June 2023, citing a 25.8% increase. Such reasons invite a demand for more electricity offtake from cheaper solar energy resources in Germany.

- Moreover, the Germany Solar Package, which the government rolled out, aims to install 215 GW of solar panels by 2030. In June 2022, the Government of Germany increased the feed-in tariff for solar energy power plants up to 750 kW for residential areas, which also encourages end-consumers to install solar PV rooftop power plants and earn revenue by injecting electricity into the conventional grid. These government interventions are expected to enhance the solar energy market in the long term.

- In the current market scenario, the high electricity prices have forced high-energy-intensive industries such as steel, cement, food, and beverage to either shut down or curtail the rate of production. This has highlighted the importance of the integration of renewable energy resources such as solar in Germany.

- Hence, such factors are expected to drive the growth of the solar energy market in Germany in a scenario where electricity prices sold by utility or independent power producers are shooting up.

Germany Solar Energy Industry Overview

The German solar energy market is moderately fragmented. Some of the major players in the market (in no particular order) include IBC Solar AG, Centrotherm International AG, SunPower Corporation, Energie Baden-Wurttemberg AG, and Hanwha Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 German Solar Energy Installed Capacity and Forecast, in GW, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.1.1 Increase in Prices of Electricity Procured from Conventional Mechanisms

- 4.5.1.2 Decline in Cost of Solar Energy Infrastructure

- 4.5.2 Market Restraints

- 4.5.2.1 Competition from Other Alternative Energy Sources

- 4.5.1 Market Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Solar Photovoltaic

- 5.1.2 Concentrated Solar Power

- 5.2 By Application

- 5.2.1 Utility

- 5.2.2 Commercial/Industrial

- 5.2.3 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BayWa r.e. AG

- 6.3.2 Centrotherm International AG

- 6.3.3 Sun Power Corporation

- 6.3.4 AE Alternative Energy GMBH

- 6.3.5 Hanwha Corporation

- 6.3.6 IB Vogt GmbH

- 6.3.7 Energie Baden-Wurttemberg AG

- 6.3.8 IBC SOLAR AG

- 6.3.9 Vattenfall AB

- 6.3.10 Solnet Green Energy OY

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Solar PV Manufacturing

02-2729-4219

+886-2-2729-4219