|

市场调查报告书

商品编码

1685881

双酚A(BPA) -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Bisphenol A (BPA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

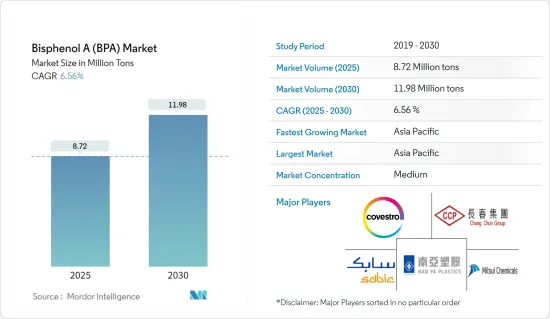

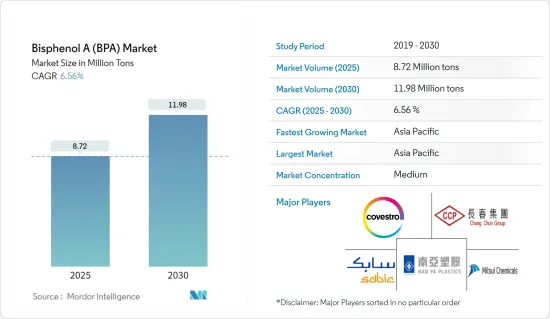

预计 2025 年双酚 A 市场规模为 872 万吨,2030 年将达到 1,198 万吨,预测期间(2025-2030 年)的复合年增长率为 6.56%。

主要亮点

- 从中期来看,聚碳酸酯产业需求的成长和环氧树脂生产需求的增加预计将推动双酚 A 的需求。

- 然而,食品和饮料行业对双酚 A 使用的监管日益严格,对受调查市场的成长构成了重大限制。

- 另一方面,生物基双酚 A 的潜在市场需求可能会在未来几年创造有利可图的市场机会。

- 预计亚太地区将主导市场,并在预测期内实现最高的复合年增长率。

双酚A市场趋势

聚碳酸酯树脂需求不断成长

- 聚碳酸酯主要由双酚A与光气的界面反应生成。在所有其他应用领域中,聚碳酸酯树脂的使用对双酚 A (BPA) 产生了巨大的市场需求。

- 双酚A在增强聚碳酸酯树脂的性能方面起着重要作用。 BPA 有助于提高聚碳酸酯塑胶的强度和耐用性。含有 BPA 的聚碳酸酯因其抗衝击性而闻名,适用于安全玻璃、防弹窗和医疗设备等应用。

- 含有BPA的聚碳酸酯具有较高的玻璃化转变温度,可以承受高温而不会翘曲或熔化。这种特性使其成为食品容器和可重复使用的水瓶的理想选择。

- 聚碳酸酯天然透明,BPA 有助于维持这种透明度。这使得可以生产透明的容器和镜片。

- 聚碳酸酯是一种高性能热塑性塑料,广泛用于建筑应用。使用聚碳酸酯製造的板材被广泛用作各种窗户和天窗应用中的玻璃替代品。此外,它们还可用作筒形拱顶、不透明覆层层板、座舱罩、建筑幕墙、标誌、半透明墙壁、体育场屋顶、百叶窗和屋顶圆顶。

- 近年来,温室对聚碳酸酯材料的使用增加。德国、法国、荷兰、西班牙等欧洲国家都有大面积的温室种植。

- 聚碳酸酯市场的主要企业包括三菱工程塑胶株式会社、科思创股份公司、沙乌地阿拉伯基础工业公司、乐天化学株式会社和帝人株式会社。这些公司正在大力投资併购和业务扩张,预计将推动聚碳酸酯对 BPA 的需求。例如,2024年3月,全球领先的高品质聚合物材料製造商之一科思创股份公司在比利时安特卫普运作了其第一家工业规模生产聚碳酸酯共聚物的工厂。

- 2023年9月,沙乌地阿拉伯化工巨头沙乌地基础工业公司(SABIC)和中国石油燃气公司中石化宣布,由其合资企业中石化沙乌地基础天津石油化工有限公司(SSTPC)建设一座新的聚碳酸酯(PC)工厂。新聚碳酸酯工厂年产能为26万吨,是SABIC中国聚碳酸酯成长策略的核心部分,并将为SABIC与全球和本地客户提供进一步的合作机会。

- 2023年3月,科思创扩大了在泰国的聚碳酸酯薄膜产能。聚碳酸酯薄膜主要用于身分证、汽车显示器以及电气和电子应用。这些发展使该公司每年的生产能力增加了10多万吨。

- 因此,预计上述因素将在预测期内影响聚碳酸酯应用中对 BPA 的需求。

亚太地区可望主导市场

- 亚太地区是双酚 A (BPA) 的最大生产地和消费地,涉及各个终端用户产业。因此,预计它将占据市场主导地位。

- 近年来,受多种经济和产业因素推动,中国各地对双酚A(BPA)新生产装置的投资呈现明显增加趋势。例如,2024年1月,台塑集团子公司南亚塑胶位于中国宁波的BPA生产工厂重启营运。该工厂每年生产约 17 万吨 BPA。该公司生产的 BPA 主要用于聚碳酸酯塑胶。

- 双酚A主要用于聚碳酸酯树脂和塑胶製品中,由于其在汽车、电子和建筑等行业的应用不断扩大,中国对双酚A的需求也不断增长。 2023 年 9 月,沙乌地阿拉伯化学公司 SABIC 和中国石油燃气公司中石化宣布透过其合资企业中石化沙乌地阿拉伯基础天津石油化工有限公司 (SSTPC)推出新的聚碳酸酯 (PC) 工厂。 SABIC 在 SSTPC 生产的 PC 材料组合将以 Lexan 树脂品牌出售。

- 印度长期进口BPA,价格波动和区域贸易问题为印度BPA市场带来了问题。印度政府和一些公司正在积极在印度生产 BPA。例如,Deepak Chem Tech Limited 于 2024 年 2 月与古吉拉突邦政府签署了一份谅解备忘录,旨在在古吉拉突邦赫杰建立计划。该公司计划建造一座世界级的先进聚合物树脂生产设施,包括聚碳酸酯树脂。

- 近年来,由于竞争激烈、收益低等原因,日本的BPA生产工厂出现倒闭潮,对产业带来了较大衝击。例如,日本三菱化学公司于2024年2月宣布,计划在2024年3月底前永久停止其位于日本南部福冈县黑崎工厂生产BPA,主要原因是来自中国的供应过剩。该工厂每年生产约 12 万吨 BPA。

- 因此,预计上述因素将影响亚太地区对 BPA 的需求。

双酚A行业概况

双酚A(BPA)市场本质上是部分整合的。市场的主要企业(不分先后顺序)包括科思创股份公司、沙乌地阿拉伯基础工业公司、长春集团、三井化学公司和南亚塑胶株式会社。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 聚碳酸酯的需求正在快速成长

- 环氧树脂需求不断成长

- 限制因素

- 食品饮料业监管趋严

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 原料分析

- 技术简介

- 贸易概况

- 价格概览

- 监理政策分析

第五章市场区隔

- 按应用

- 聚碳酸酯树脂

- 环氧树脂

- 不饱和聚酯树脂

- 阻燃剂

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 合併、收购、合资、合作和协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Altivia Petrochemicals

- Chang Chun Group

- China National Bluestar(Group)Co. Ltd

- China Petroleum & Chemical Corporation(SINOPEC)

- Covestro AG

- Dow

- Hexion

- Idemitsu Kosan Co. Ltd

- Kumho P&B Chemicals Inc.

- LG Chem

- Lihua Yiweiyuan Chemical Co. Ltd

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- Nan Ya Plastics Industry Co. Ltd

- Nippon Steel Chemical & Material Co. Ltd

- PTT Phenol Company Limited

- SABIC

- Samyang Holdings Corporation

- Teijin Limited

- Zhejiang Petroleum & Chemical Co. Ltd

第七章 市场机会与未来趋势

- 生物基 BPA 的潜在市场需求

简介目录

Product Code: 48890

The Bisphenol A Market size is estimated at 8.72 million tons in 2025, and is expected to reach 11.98 million tons by 2030, at a CAGR of 6.56% during the forecast period (2025-2030).

Key Highlights

- In the medium term, soaring demand from the polycarbonate sector and increasing demand for epoxy resin production are likely to drive the demand for Bisphenol-A.

- However, increasing regulations in the food and beverage industry on the use of Bisphenol-A pose major restraints to the growth of the market studied.

- On the other hand, potential market demand for bio-based Bisphenol-A is likely to create lucrative market opportunities in the coming years.

- Asia-Pacific is expected to dominate the market and is anticipated to witness the highest CAGR during the forecast period.

Bisphenol-A Market Trends

Increasing Demand for Polycarbonate Resins

- Polycarbonate is mainly formed after the reaction of Bisphenol-A with carbonyl chloride in an interfacial process. Among all other application areas, polycarbonate resin application provides a significant market demand for Bisphenol-A (BPA).

- Bisphenol-A plays a critical role in enhancing the properties of polycarbonate resins. BPA contributes to the strength and durability of polycarbonate plastics. Polycarbonates made with BPA are known for their impact resistance, which makes them suitable for applications such as safety glasses, bulletproof windows, and medical devices.

- Polycarbonates containing BPA have a high glass transition temperature, meaning they can withstand high temperatures without warping or melting. This property makes them ideal for food containers and reusable water bottles.

- Polycarbonates are naturally transparent, and BPA helps to maintain this clarity. This allows the production of clear containers and lenses.

- Polycarbonates are high-performing thermoplastics that are widely used in construction applications. Sheets manufactured using Polycarbonates are widely used as a substitute for glass in a variety of window and skylight applications. Additionally, they are used as barrel vaults, opaque cladding panels, canopies, facades and signage, translucent walls, sports stadium roofs, louvers, and roof domes.

- The application of polycarbonate materials in greenhouses has increased in recent years. European countries, such as Germany, France, the Netherlands, and Spain, have larger areas for greenhouse cultivation.

- Some of the key companies in the polycarbonate market include Mitsubishi Engineering-Plastics Corporation, Covestro AG, SABIC, Lotte Chemical Corporation, and Teijin Limited. These companies are investing heavily in mergers, acquisitions, and expansion, which are projected to boost the demand for BPA in polycarbonates. For instance, in March 2024, Covestro AG, one of the world's leading manufacturers of high-quality polymer materials, inaugurated its first plant to produce polycarbonate copolymers on an industrial scale at its Antwerp, Belgium site.

- In September 2023, Saudi Arabian chemical giant SABIC and Chinese oil and gas corporation Sinopec announced the launch of a new polycarbonate (PC) plant through their joint venture named Sinopec SABIC Tianjin Petrochemical (SSTPC). With an annual designed capacity of 260 kilotons, the new PC plant is intended as a central piece of SABIC's PC growth strategy in China, providing opportunities for further collaborations with global and local customers.

- In March 2023, Covestro expanded its production capacity for polycarbonate films in Thailand, primarily used in identity documents, automotive displays, and electrical and electronic applications. With these developments, the company's additional capacity now exceeds 100,000 metric tons annually.

- Therefore, the factors mentioned above are expected to impact the demand for BPA in polycarbonate applications during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is the largest manufacturer and consumer of Bisphenol-A (BPA) in different end-user industries. Hence, it is expected to dominate the market.

- In recent years, there has been a noticeable trend of increasing investments in new Bisphenol-A (BPA) production facilities across China, driven by various economic and industrial factors. For instance, in January 2024, Nan Ya Plastics, a subsidiary of Formosa Group, restarted operations of the BPA production plant in Ningbo, China. This plant produces about 170,000 tons of BPA per annum. The BPA produced by the company is majorly used in the polycarbonate resins that the company produces.

- The demand for BPA in polycarbonate resins and plastic products in China is growing due to its expanding use in industries like automotive, electronics, and construction. In September 2023, Saudi Arabian chemical company SABIC and Chinese oil and gas corporation Sinopec announced the launch of a new polycarbonate (PC) plant through their joint venture, Sinopec SABIC Tianjin Petrochemical (SSTPC). SABIC's portfolio of PC materials produced at SSTPC is marketed under its Lexan resin brand.

- India has been importing BPA for a long time, and the fluctuations in prices and trade issues among the regions are creating a problem for the Indian BPA market. The government and a few companies have taken initiatives to manufacture BPA in India. For instance, in February 2024, Deepak Chem Tech Limited signed an MoU with the government of Gujarat with an intent to invest around INR 90,000 million to establish projects at Dahej, Gujarat. The company plans to build world-scale production facilities for advanced polymer resins, such as polycarbonate resins.

- In recent years, Japan has seen a trend of BPA manufacturing plants closing down due to intense competition and low profitability, significantly impacting the industry. For instance, in February 2024, Japan's Mitsubishi Chemical planned to permanently halt the production of BPA by the end of March 2024 at its Kurosaki plant in south Japan's Fukuoka prefecture, citing oversupply, mainly from China. This plant produces about 120,000 tons of BPA per annum.

- Hence, the above-mentioned factors are expected to impact the demand for BPA in Asia-Pacific.

Bisphenol A Industry Overview

The Bisphenol-A (BPA) market is partially consolidated in nature. Some of the key players (not in any particular order) in the market include Covestro AG, SABIC, Chang Chun Group, Mitsui Chemical Inc., and Nan Ya Plastics Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Soaring Demand from Polycarbonate Sector

- 4.1.2 Increasing Demand from Epoxy Resin Production

- 4.2 Restraints

- 4.2.1 Increasing Regulations in the Food and Beverage Industry

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

- 4.6 Technological Snapshot

- 4.7 Trade Overview

- 4.8 Price Overview

- 4.9 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Application

- 5.1.1 Polycarbonate Resins

- 5.1.2 Epoxy Resins

- 5.1.3 Unsaturated Polyester Resins

- 5.1.4 Flame Retardants

- 5.1.5 Other Applications

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 ASEAN Countries

- 5.2.1.6 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Altivia Petrochemicals

- 6.4.2 Chang Chun Group

- 6.4.3 China National Bluestar (Group) Co. Ltd

- 6.4.4 China Petroleum & Chemical Corporation (SINOPEC)

- 6.4.5 Covestro AG

- 6.4.6 Dow

- 6.4.7 Hexion

- 6.4.8 Idemitsu Kosan Co. Ltd

- 6.4.9 Kumho P&B Chemicals Inc.

- 6.4.10 LG Chem

- 6.4.11 Lihua Yiweiyuan Chemical Co. Ltd

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 Mitsui Chemicals Inc.

- 6.4.14 Nan Ya Plastics Industry Co. Ltd

- 6.4.15 Nippon Steel Chemical & Material Co. Ltd

- 6.4.16 PTT Phenol Company Limited

- 6.4.17 SABIC

- 6.4.18 Samyang Holdings Corporation

- 6.4.19 Teijin Limited

- 6.4.20 Zhejiang Petroleum & Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential Market Demand for Bio-Based BPA

02-2729-4219

+886-2-2729-4219