|

市场调查报告书

商品编码

1685885

汽车安全气囊充气机:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Automotive Airbag Inflator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

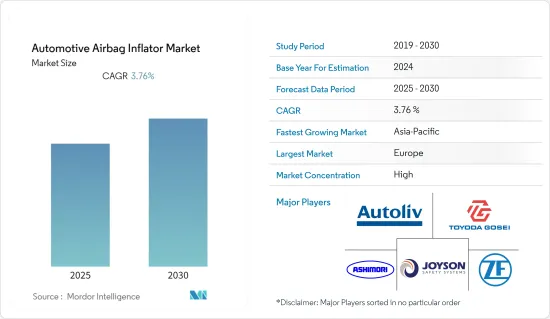

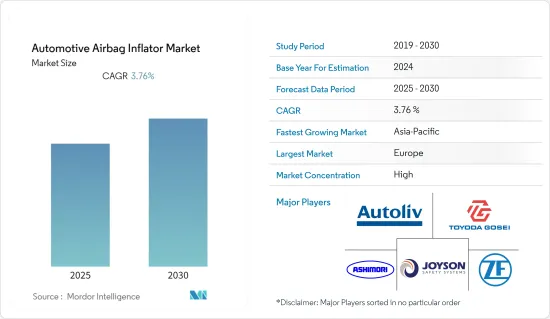

预计预测期内汽车安全气囊充气机市场复合年增长率为 3.76%。

新冠疫情爆发后,全球多个主要经济体被迫封锁,经济活动停滞,供应链中断,市场受到重创。所有製造和OEM工厂都已停止生产,以遵守社交距离规范并限制病毒的传播。在此期间,乘用车需求也大幅下降。然而,随着经济逐渐开放,需求正在復苏,随着消费者偏好从公共运输转向私家车,中国和印度等市场对乘用车的需求庞大。预计这一趋势将在预测期内持续下去。

从长远来看,汽车安全监管要求的不断提高以及消费者安全意识的不断增强正在推动全球汽车安全气囊充气机市场的发展。

此外,侧面碰撞安全气囊和侧气囊的普及率不断提高、汽车产量不断增加以及每辆车安装的气囊数量不断增加是推动汽车安全气囊充气机市场成长的主要因素。

主要亮点

- 2022 年 5 月,在花费近一年时间研发出修復缺陷安全气囊充气装置的方案后,通用汽车准备为 2021 年 7 月召回的 41 万辆卡车更换有缺陷的安全气囊充气装置。

然而,预计到预测期结束时,亚太地区将引领市场,其中印度和中国等国家预计将在汽车产业中实现较高的复合年增长率。

汽车安全气囊充气机市场趋势

烟火充气机占最大市场占有率

在烟火充气装置中,固体推进剂(通常是迭氮化钠,一种与氧化剂混合的化学物质)以可控的速率燃烧产生气体(主要是氮气)。这使得安全气囊能够在不到二十分之一秒的时间内充气。在撞击瞬间,烟火式充气气囊的展开速度比混合式充气气囊的展开速度更快。因此,烟火式气体发生器主要用于车辆正面安全气囊,例如驾驶座安全气囊、乘客安全气囊和侧边安全气囊。

由于世界各国政府强制使用正面安全气囊,预计在预测期内烟火式安全气囊的需求将很高。

烟火式气体发生器比混合式气体发生器具有体积更小、重量更轻的优势,因此吸引了OEM在其安全气囊中采用它们。

Takata目前正对史上最大的汽车召回事件负责。由于安全气囊存在爆炸风险,可能会将弹片射入驾驶人或前座乘客的脸部或身体,Takata已召回 12 个汽车品牌的 4,000 万辆汽车。其中一个主要原因是充气装置的烟火设计有缺陷。 2018年4月,Takata被美国市场第五大安全气囊供应商Key Safety Systems(KSS)收购,更名为Joyson Safety Systems。

此外,废弃的烟火发生器因含有迭氮化钠而被发现具有毒性。因此,安全气囊製造商一直在寻求提供有毒推进剂的替代品。例如,海拉设计了使用不含迭氮化物的其他燃料作为推进剂的安全气囊。这些燃料不仅排放氮气,还会排放二氧化碳(~20%)和水蒸气(~25%)。

在预测期内,烟火产业预计将继续成长,并且由于技术进步预计将呈现最高的成长率。

亚太地区加速市场成长

亚太地区乘用车和商用车先进安全性的成长主要得益于消费者对安全性和舒适性的偏好不断提高、中檔车广泛采用侧面和侧气囊和侧气帘、以及对高檔和豪华车的需求不断增长。此外,政府为确保乘客安全而采取的措施以及系统和零件成本的下降,正在推动整个估计和预测期内对安全气囊充气机的需求。

中国是全球最大的汽车市场之一,2020年国内乘用车销量超过2,017万辆,年比2019年全年销量下降5.89%。儘管受到疫情影响,中国仍然是全球最大的汽车销售国之一。

印度是一个新兴经济体,正在逐步在乘用车中实施先进的安全和驾驶辅助功能。随着印度逐步涉足电动车、自动驾驶汽车和人工智慧汽车产业,并推出许多新产品,安全气囊充气机市场充满潜力和机会。例如

- 2021 年,Morris Garage 推出了其新款 SUV Gloster 和 Hector 的拉皮版本。这两款车型在市场上一直畅销,并且这些车的顶级版本标配 6 个安全气囊。

- Mahindra 于 2021 年推出了 XUV 700。根据最近的新闻稿,XUV 700 的 70% 以上的预订都是顶级配置。该车在前几个月就收到了超过 50,000 份预订单,目前已向客户交付了超过 78,000 辆。

- 2021 年,玛鲁蒂铃木推出了 Baleno、Ertiga 和 XL6 的拉皮版本。所有车型均标配四个和六个安全气囊。

预计在预测期内,对更安全车辆的需求不断增加将推动亚太地区安全气囊充气机市场的发展。

汽车安全气囊充气机产业概况

汽车安全气囊充气机市场高度整合,主要参与者占全球65%以上的市占率。

市场的主要企业包括 Autoliv Inc.、Joyson Safety Systems、ZF Friedrichshafen AG、Toyoda Gosei 和工业。

- 2022年5月,大型汽车零件供应商延锋与美国公司、汽车安全气囊全程序充气机系统的全球製造商ARC Automotive宣布成立新的合资企业,生产安全气囊充气机。

- 2021年1月,DAICEL株式会社将在清奈设立安全气囊充气机製造厂。第一阶段将投资约 23 亿卢比。这将是DAICEL在印度的首家安全气囊充气机生产厂。该公司透过位于泰国和其他国家的生产基地满足印度市场的需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 安全气囊类型

- 驾驶座安全气囊

- 乘客安全气囊

- 侧边气帘

- 膝部安全气囊

- 行人保护气囊

- 侧边安全气囊

- 充气机类型

- 烟火製造术

- 储气

- 杂交种

- 车辆类型

- 搭乘用车

- 商用车

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 其他欧洲国家

- 世界其他地区

- 巴西

- 南非

- 其他国家

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Autoliv Inc.

- ZF Friedrichshafen AG

- Joyson Safety Systems(Key Safety Systems)

- HUAYU Automotive Systems

- Toyoda Gosei Co., Ltd.

- Daicel Corporation

- Nippon Kayaku Co.,Ltd

- Ashimori Industry;Co., Ltd

第七章 市场机会与未来趋势

The Automotive Airbag Inflator Market is expected to register a CAGR of 3.76% during the forecast period.

During the outbreak of pandemic COVID-19, the market was hit adversely because of the disruptions caused in the supply chain as several major economies of the world were forced into lockdown and economic activities were halted during this period. All the manufacturing units and OEM plants stopped their production to adhere the social distancing norms and restrict the spread of virus. The demand for passenger vehicles also fell drastically during this period. Yet with the gradual opening up of economies the demand returned to the market and markets like China and India witnessed huge demand for passenger cars as the consumer preference changed from public transport to personal vehicles. The trend is expected to continue during the forecast period.

Over the long term, Increasing regulatory requirements regarding vehicle safety and rising awareness about customer safety, globally, are driving the automotive airbag inflator market.

Furthermore, the increase in the penetration of side-impact and curtain airbags, and vehicle production, the introduction of more bags per car, are the major factors that drive the growth of the automotive airbag inflator market.

Key Highlights

- In May 2022, After almost a year spent developing a fix for faulty airbag inflators, General Motors is getting ready to replace faulty airbag inflators in 410,019 trucks that were recalled in July 2021.

However, Asia-Pacific is expected to lead the market by the end of forecast period, because of countries, like India and China are anticipated to record high CAGR in the automotive industry

Automotive Airbag Inflator Market Trends

Pyrotechnic Inflator to Holds the Highest Market Share

In a pyrotechnic inflator, solid propellant (typically a chemical material - sodium azide mixed with oxidizers) burns at a controlled rate to produce gas (majorly nitrogen gas). This, in turn, inflates the airbag in less than one-twentieth (1/20) of a second. At the moment of a crash, the deployment of a pyrotechnic inflator airbag is faster, as compared to that of a hybrid inflator airbag. Thus, pyrotechnic inflators have been majorly deployed in the vehicle's frontal airbags, such as driver airbags, passenger airbags, and side airbags.

With governments around the world making frontal airbags compulsory, Pyrotechnic airbags are expected to see high demand during the forecasted period.

Pyrotechnic inflators have an added advantage of small size and low weight compared to that of hybrid inflators which is attracting OEMs to use them for airbags.

Takata is now responsible for the largest auto recall in history. Takata has already recalled 40 million vehicles across 12 vehicle brands for "Airbags that could explode and potentially send shrapnel into the face and body of both the driver and front seat passenger". One of the major reason was detected to be a flaw in pyrotechnics design which is used in the inflator. In April 2018, Takata was acquired by the fifth largest airbag supplier in the United States market, Key Safety Systems (KSS), and renamed as Joyson Safety Systems.

Additionally, the disposal of pyrotechnic inflators have turned out to be toxic due to the presence of sodium azide. Thus, airbag manufacturers have been trying to provide other alternatives to replace the toxic propellant. For instance, Hella has been designing airbags with other azide-free fuels as propellants. They do not just release nitrogen gas, but also CO2 (~20%) and water vapor (~25%).

During the forecast period, the pyrotechnic segment is anticipated to continue to grow, and with technological advancements it is expected to see highest growth rate.

Asia-Pacific to Witness Faster Market Growth

The growth of advanced safety in passenger cars and commercial vehicles in the Asia-Pacific region is mainly attributed to increasing consumers' preferences for safety and comfort features, increasing penetration of Side and Curtain airbags in mid-level cars, and growing demand for premium and luxury cars. Furthermore, government initiative toward passenger safety and decreasing system and component costs is estimated to fuel the demand for airbag inflators over the forecast period.

China is one of the largest automotive markets across the world, and more than 20.17 million passenger cars were sold in the country in 2020 and recorded a 5.89% of the yearly decline in sales compared to 2019. Despite the pandemic, China is still one of the largest sellers of automobiles globally.

India is an emerging economy where the implementation of advanced safety and driver assistance features in passenger cars is taking place gradually. India has a potential and opportunity for airbag inflator market as India is stepping gradually into the electric, autonomous and artificial intelligence oriented automotive industry along with many new product launches. For instance,

- In 2021, Morris Garage has launched its new SUV Gloster and the facelifted version of the Hector. Both the vehicle models have gained good sales in the market and the top-spec variant of these cars get 6-airbags as standard.

- Mahindra in 2021 has launched the XUV 700. The top-spec variant of the car features 7-airbags and in a recent press release, it was identified that, more than 70% of the bookings for the XUV 700 have been the top-spec trim. The vehicle has received more then 50,000 bookings within the first few months and has more than 78,000 units to delivered to customers.

- Maruti Suzuki in 2021 has launched the facelifted versions of the Baleno, Ertiga, and the XL6. All the models on the to-spec variants get 4-airbags and 6-airbags as standard.

With increasing demand for safe cars, the market for airbag inflators over the forecast period in Asia-Pacific is expected to grow.

Automotive Airbag Inflator Industry Overview

The automotive airbag inflator market is fairly consolidated, with the major companies capturing more than 65% of the global market studied.

Some of the prominent players in the market, includes Autoliv Inc., Joyson Safety Systems, ZF Friedrichshafen AG, Toyoda Gosei Co., Ltd., and Ashimori Industry;Co., Ltd.

- In May 2022, Yanfeng, a leading global automotive supplier, and U.S.-based company ARC Automotive, a global manufacturer that offers a full program of inflation systems for vehicle airbags, announced the formation of a new joint venture for the production of airbag inflators for airbag applications.

- In January 2021, Daicel Corporation will set up an airbag inflator manufacturing plant in Chennai. The company will invest around Rs 230 crore during the phase-I. This will be Daicel Corporation's first airbag inflator manufacturing plant in India. The company was catering to Indian market from its production site in Thailand and other countries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Airbag Type

- 5.1.1 Driver Airbag

- 5.1.2 Passenger Airbag

- 5.1.3 Curtain Airbag

- 5.1.4 Knee Airbag

- 5.1.5 Pedestrian Protection Airbag

- 5.1.6 Side Airbag

- 5.2 Inflator Type

- 5.2.1 Pyrotechnic

- 5.2.2 Stored Gas

- 5.2.3 Hybrid

- 5.3 Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Asia-Pacific

- 5.4.2.1 China

- 5.4.2.2 Japan

- 5.4.2.3 India

- 5.4.2.4 South Korea

- 5.4.2.5 Rest of Asia-Pacific

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 South Africa

- 5.4.4.3 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Autoliv Inc.

- 6.2.2 ZF Friedrichshafen AG

- 6.2.3 Joyson Safety Systems (Key Safety Systems)

- 6.2.4 HUAYU Automotive Systems

- 6.2.5 Toyoda Gosei Co., Ltd.

- 6.2.6 Daicel Corporation

- 6.2.7 Nippon Kayaku Co.,Ltd

- 6.2.8 Ashimori Industry;Co., Ltd