|

市场调查报告书

商品编码

1685886

润滑脂:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Grease - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

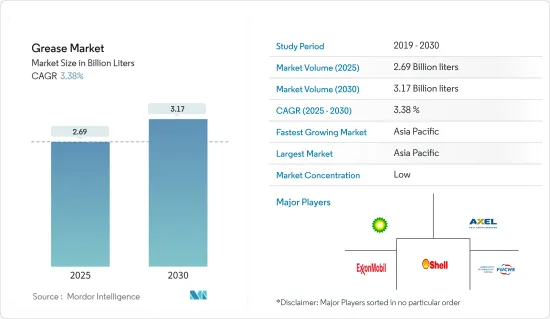

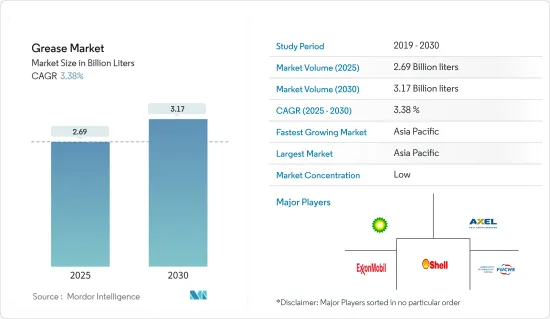

预计2025年润滑脂市场规模为26.9亿公升,到2030年预计将达到31.7亿公升,预测期内(2025-2030年)的复合年增长率为3.38%。

主要亮点

- 汽车保有量的快速成长、发电投资的强劲成长是拉动油脂市场需求的主要因素。

- 然而,有关润滑脂使用的环境法规预计会阻碍市场成长。

- 然而,技术进步、产品创新和聚脲润滑脂使用量的增加有望为所研究的市场创造新的机会。

- 预计亚太地区将主导全球市场,其中中国和印度将占据大部分需求。

润滑脂市场趋势

汽车和其他运输业将主导市场

- 汽车和运输业作为润滑脂市场的推动者发挥着至关重要的作用。随着汽车产业OEM和 RMO 市场的扩大,它们将在未来几年直接影响润滑脂需求。

- 润滑脂需求量大主要是由于新兴市场对轻量化、高性能汽车的需求不断增长、汽车轮毂数量不断增加以及可支配收入不断提高。

- 国际汽车製造商组织(OICA)报告称,2023年全球新车销量将呈现稳健成长,较2022年成长11.9%,超过9,270万辆。其中,新乘用车销量与前一年同期比较增11.3%至6,530万辆,高于2022年的5,860万辆。同时,2023年全球新商用车註册量将为2,750万辆,较2022年的2,420万辆成长13.3%。

- 在北美,预计2023年汽车销量为1,919万辆,较2022年的1,693万辆成长13.4%。总销量1919万辆中,乘用车398万辆,商用车1521万辆,其余为重型卡车、客车和长途客车。

- 此外,根据欧洲汽车工业协会的资料,预计2023年欧洲新车註册量与前一年同期比较成长18.7%。预计2023年乘用车销售量将达到1,500万辆,商用车销售量将达290万辆,而2022年分别为1,264万辆及244万辆。

- 航太部门正在经历快速的技术进步,从而增强了飞机製造能力。波音公司对 2023-2042 年商用飞机的展望显示,受国际和国内航空旅行復苏的推动,到 2042 年全球对新商用飞机的需求将达到 48,575 架。 2023年,波音公司将交付528架飞机,并获得1,314份净新订单,较2022年的480架交付和774份订单大幅增加。虽然该公司实现了交付超过375架窄体737飞机的修订目标,但仍未达到400至450架的最初目标。

- 空中巴士提供的资料显示,2023年该公司向全球87家客户交付了735架民航机,在复杂的商业环境中表现出强劲的业绩。该公司「民航机」业务同年录得2,319架新订单。

- 由于这些趋势,预计未来几年润滑脂消费量将会增加。

亚太地区占市场主导地位

- 亚太地区将引领油脂消费,其次是北美和欧洲。预计预测期内中国、印度和印尼等国家将推动强劲的润滑脂需求。

- 目前,中国是润滑油和润滑脂的最大消费国。其在各个领域的广泛製造活动,加上工业和汽车领域的快速成长,巩固了其作为全球领先的润滑脂消费和生产者的地位。

- 一些领先的润滑脂製造商正在积极推行扩大策略,以期进入新市场,从而增加所研究市场的需求。例如

- 2024年6月,壳牌完成了位于曼谷的润滑脂製造厂的大规模扩建,生产能力提高了两倍。此次扩建使该工厂能够满足泰国一半的油脂需求,年产量从 5,000 吨增加到 15,000 吨。

- 壳牌印尼公司于2024年3月宣布,计划在印尼勿加泗建造第一家润滑脂製造厂(GMP),年产能为12千吨。该设施将对现有的 Maroondah 润滑油调配厂 (LOBP) 进行补充。

- 中国汽车业是润滑油的主要消费产业,反映出汽车持有强劲成长和技术进步。根据中国工业协会的资料,2023年中国汽车产销量将分别突破3,000万辆,与前一年同期比较实现两位数成长。

- 预计预测期内中国发电产业对润滑脂的需求将保持强劲。根据社区利益公司 Ember 的报告显示,中国发电产业正在快速成长,不久的将来很可能会实现 10% 以上的成长。

- 2023年中国电力需求成长4%以上,2022年成长3%以上。中国目前运作核能发电厂47座,总设备容量4876万千瓦。总合11座新核能发电厂建,总装置容量为1,175.9万千瓦。

- 2023年,印度乘用车销量将首度突破400万辆大关。收入增加、SUV 的普及以及优惠的贷款利率都是促成因素。根据印度汽车工业协会(SIAM)的资料,2020年乘用车、轿车和多用途车的销量将从2022年的379万辆增长8.2%至410多万辆,其中多用途车占销量的57.4%。

- 在不断增长的能源需求和永续性愿望的推动下,印尼的发电行业正处于变革之中。目前,煤炭占电力供应的 60% 以上,但正在努力实现可再生能源多样化并扩大其作用。水力发电潜力接近 75 吉瓦,西爪哇省的 1,040 兆瓦发电厂等计划已在利用这项资源。地热能源目标雄心勃勃,到 2025 年达到 5GW,到 2035 年达到 9.3GW,彰显了该国致力于利用其巨大的可再生能源潜力的决心。

- 预计上述因素将增加亚太地区对润滑脂的需求。

油脂业概况

油脂市场比较分散。主要公司(排名不分先后)包括壳牌公司、埃克森美孚公司、英国石油公司、福斯公司和阿克塞尔·克里斯蒂恩森。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 汽车保有量快速成长推动润滑脂需求

- 发电业投资强劲成长

- 其他驱动因素

- 市场限制

- 有关润滑脂使用的环境法规

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按增稠剂

- 锂基

- 钙基

- 铝基

- 聚脲

- 其他增稠剂

- 按最终用户产业

- 发电

- 汽车和其他交通工具

- 重型机械

- 食品和饮料

- 冶金与金属加工

- 化学製造

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Axel Christiernsson

- BECHEM Lubrication Technology LLC

- BP PLC

- Carl Bechem Gmbh

- Chevron Corporation

- China Petroleum & Chemical Corporation

- ENEOS Corporation

- ETS

- Exxon Mobil Corporation

- FUCHS

- Gazprom Neft PJSC

- Kluber Lubrication

- Lukoil

- Orlen Oil Ltd

- Penrite Oil

- Petromin

- PETRONAS Lubricants International

- Shell PLC

- TotalEnergies

第七章 市场机会与未来趋势

- 技术进步与产品创新

- 扩大聚脲润滑脂的用途

- 其他机会

简介目录

Product Code: 48925

The Grease Market size is estimated at 2.69 billion liters in 2025, and is expected to reach 3.17 billion liters by 2030, at a CAGR of 3.38% during the forecast period (2025-2030).

Key Highlights

- The surging vehicle population and the robust growth of investments in power generation are the major factors driving the demand for the grease market.

- However, environmental regulations concerning the usage of grease are expected to hinder the market's growth.

- Nevertheless, technological advancements, product innovations, and the growing usage of polyurea greases are expected to create new opportunities for the market studied.

- Asia-Pacific is expected to dominate the global market, with the majority of demand coming from China and India.

Grease Market Trends

Automotive and Other Transportation Segment to Dominate the Market

- The automotive and transportation sector plays a pivotal role in driving the grease market. As the OEM and RMO markets in the automotive industry expand, they are poised to directly influence grease demand in the coming years.

- The major reasons for the high demand for grease are the growing demand for lightweight, high-performance cars in emerging markets, increasing automotive hubs, and rising disposable income.

- In 2023, global new vehicle sales saw a robust growth of 11.9% over 2022, totaling over 92.7 million units, as reported by the Organisation Internationale des Constructeurs d'Automobiles (OICA). Specifically, new passenger vehicle sales climbed by 11.3% year-over-year, hitting 65.3 million units, up from 58.6 million units in 2022. Concurrently, new commercial vehicle registrations worldwide rose to 27.5 million units in 2023, marking a notable 13.3% increase from the 24.2 million units recorded in 2022.

- In North America, motor vehicle sales in 2023 accounted for 19.19 million units, an increase of 13.4% compared to 16.93 million units sold in 2022. Out of the total 19.19 million units, passenger cars accounted for 3.98 million units, commercial vehicles made up 15.21 million units, and the remaining units were a combination of heavy trucks, buses, and coaches.

- Furthermore, as per the data from the European Automobile Manufacturers Association, in Europe, the overall registration of new motor vehicles increased by 18.7% in 2023 compared to the previous year. In 2023, passenger car and commercial vehicle sales reached 15 million units and 2.90 million units, respectively, compared to 12.64 million units and 2.44 million units in 2022.

- The aerospace sector is witnessing swift technological advancements, bolstering aircraft manufacturing. Boeing's Commercial Outlook for 2023-2042 anticipates global demand for 48,575 new commercial jets by 2042, driven by a rebound in international and domestic air travel. In 2023, Boeing delivered 528 aircraft and secured 1,314 net new orders, a significant rise from 480 deliveries and 774 orders in 2022. Notably, while it met its revised goal of delivering at least 375 narrowbody 737 jets, it fell short of its initial target of 400 to 450 jets.

- As per the data provided by Airbus, in 2023, the company delivered 735 commercial aircraft to 87 customers around the world, demonstrating strong performance despite a complex operating environment. The company's "Commercial Aircraft" business registered 2,319 gross new orders during the same year.

- Given these dynamics, grease consumption is set to rise in the coming years.

Asia-Pacific to Dominate the Market

- Asia-Pacific leads in grease consumption, with North America and Europe following. Countries like China, India, and Indonesia are poised to drive strong grease demand during the forecast period.

- Currently, China stands as the dominant consumer of lubricants and greases. Its extensive manufacturing activities across various sectors, coupled with rapid growth in both industrial and automotive domains, have solidified its position as a major global consumer and producer of grease.

- Some of the key grease manufacturers are actively pursuing expansion strategies, eyeing entry into new markets, thereby augmenting the demand for the market studied. For instance,

- In June 2024, Shell completed a significant expansion at its grease manufacturing plant in Bangkok, tripling its production capacity. This enhancement positions the plant to meet half of Thailand's grease demand, boosting its annual output from 5,000 to 15,000 metric tons.

- Shell Indonesia unveiled plans in March 2024 to construct its inaugural Grease Manufacturing Plant (GMP) in Bekasi, Indonesia, with a capacity of 12 kilotonnes per annum. This facility will complement the company's existing Marunda Lubricants Oil Blending Plant (LOBP).

- China's automotive industry stands out as the leading consumer of lubricants, reflecting its robust vehicle fleet growth and technological advancements. In 2023, both automobile sales and production in China reached a milestone, hitting 30 million units each, marking a double-digit increase from the previous year, as per the data from the China Association of Automobile Manufacturers (CAAM).

- The demand for grease in China's power generation sector is likely to perform well during the forecast period. According to reports by Ember, a community interest company, the country's power generation industry is growing rapidly and may register over 10% growth in the near future.

- China's electricity demand rose by over 4% in 2023 and by over 3% in 2022. There are 47 nuclear power stations in service in China, with a total installed capacity of 48.76 GW. A total of 11 new nuclear power plants with an installed capacity of 11.759 GW were being built.

- In 2023, India's passenger vehicle sales crossed the 4 million mark for the first time, driven by rising incomes, a surge in sport-utility vehicles, and favorable loan rates. As per the data from the Society of Indian Automobile Manufacturers (SIAM), over 4.1 million cars, sedans, and utility vehicles were sold, marking an 8.2% uptick from 3.79 million units in 2022, with utility vehicles making up 57.4% of the sales.

- Indonesia's power generation sector is in a state of evolution, spurred by escalating energy demands and ambitious sustainability aspirations. While coal currently dominates, accounting for over 60% of the electricity supply, there is a determined effort to diversify and amplify the role of renewables. With a hydropower potential nearing 75 GW, projects like the 1,040 MW facility in West Java are already capitalizing on this resource. Geothermal energy targets stand at 5 GW by 2025, with an ambitious leap to 9.3 GW by 2035, underscoring the nation's commitment to harnessing its vast renewable energy potential.

- The above-mentioned factors are likely to increase the demand for grease in Asia-Pacific.

Grease Industry Overview

The grease market is fragmented in nature. The major players (not in any particular order) include Shell PLC, Exxon Mobil Corporation, BP PLC, FUCHS, and Axel Christiernsson.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Surging Vehicle Population to Drive the Demand for Grease

- 4.1.2 Robust Growth of Investments in the Power Generation Sector

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Environmental Regulations Concerning Usage of Grease

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Thickeners

- 5.1.1 Lithium-based

- 5.1.2 Calcium-based

- 5.1.3 Aluminium-based

- 5.1.4 Polyurea

- 5.1.5 Other Thickeners

- 5.2 By End-user Industry

- 5.2.1 Power Generation

- 5.2.2 Automotive and Other Transportation

- 5.2.3 Heavy Equipment

- 5.2.4 Food and Beverage

- 5.2.5 Metallurgy and Metalworking

- 5.2.6 Chemical Manufacturing

- 5.2.7 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Axel Christiernsson

- 6.4.2 BECHEM Lubrication Technology LLC

- 6.4.3 BP PLC

- 6.4.4 Carl Bechem Gmbh

- 6.4.5 Chevron Corporation

- 6.4.6 China Petroleum & Chemical Corporation

- 6.4.7 ENEOS Corporation

- 6.4.8 ETS

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 FUCHS

- 6.4.11 Gazprom Neft PJSC

- 6.4.12 Kluber Lubrication

- 6.4.13 Lukoil

- 6.4.14 Orlen Oil Ltd

- 6.4.15 Penrite Oil

- 6.4.16 Petromin

- 6.4.17 PETRONAS Lubricants International

- 6.4.18 Shell PLC

- 6.4.19 TotalEnergies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements and Product Innovation

- 7.2 Growing Usage of Polyurea Greases

- 7.3 Other Opportunities

02-2729-4219

+886-2-2729-4219