|

市场调查报告书

商品编码

1685906

中国上游石油天然气市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030年)China Oil And Gas Upstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

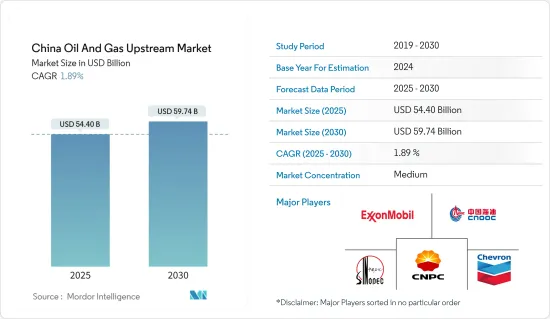

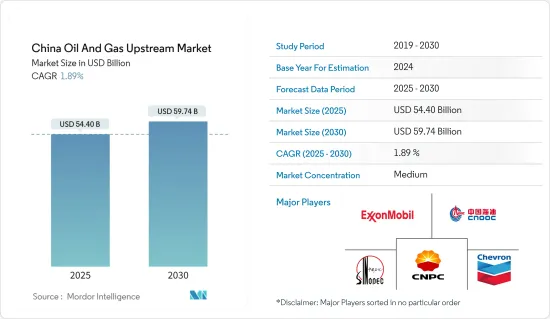

预计2025年中国上游油气市场规模为544亿美元,预计2030年将达597.4亿美元,预测期内(2025-2030年)复合年增长率为1.89%。

主要亮点

- 从中期来看,预计新油气天然气田发现以及油气投资增加等因素将在预测期内推动中国上游油气市场的发展。

- 然而,可再生能源产业的权重不断增加以及石油和天然气生产成本的上升预计将在预测期内阻碍市场成长。

- 然而,中国尚未开发的石油和天然气潜力预计将在未来几年为中国上游石油和天然气市场带来巨大机会。

中国上游油气市场趋势

离岸风电领域预计将占市场主导地位

- 中国储存油气蕴藏量丰富,为国家能源生产提供了巨大潜力。为了提高石油和天然气的生产能力,这些海上资源的探勘和开采已成为中国企业的重点。

- 此外,中国加大海上石油和天然气产量的努力对于满足该国日益增长的能源需求和减少对进口石化燃料的依赖至关重要。透过投资海上资源开发,中国旨在加强能源安全并支持经济成长。先进技术和策略的发展使中国企业能够更有效地利用这些海上储存,促进中国能源工业的发展。

- 自2018年以来,中国天然气和石油产量持续成长,并持续向南海深水区扩张。三大国家石油公司-中国海洋石油总公司(中海油)、中国石油化学集团公司(中石化)和中国石油天然气集团公司(中石油)在南海资源开发中扮演重要角色。据雷斯塔德能源公司称,2023年,中国每天从南海生产41万桶石油液体和4,890亿立方英尺天然气。

- 南海是具有重要战略意义的地区,拥有丰富的石油和天然气蕴藏量。南海的石油生产潜力吸引了石油公司的大量投资,并导致在该地区运营的油田服务公司的合约增加。

- 例如,2024年3月,中国国营石油巨头中国海洋石油总公司(中海油)在南海东部发现一个亿吨级油田。

- 根据贝克休斯的报告,截至2024年7月,中国共有50座海上钻机投入运作,其中46座为石油钻机,3座为天然气钻井平台,数量远超过其他国家。大量的石油钻机凸显了中国在海上钻井活动中对石油开采的重视。

- 2024年3月,中国在渤海发现油田,探明蕴藏量1.04亿吨。秦皇岛27-3油田位于华北地区天津以西200公里处,井深1,570米,油层厚度48.9公尺。蕴藏量超过1亿吨原油当量,经测试,该油田日产原油约110吨,是极具前景的勘探领域。

- 因此,上述发展可能会增加海上领域的活动,在预测期内对中国上游石油和天然气市场产生正面影响。

石油和天然气投资增加推动市场需求

- 中国是世界第二大油气消费国、第六大油气生产国。中国上游油气市场由国营油气公司主导,它们推动中国的油气探勘和生产活动。

- 由于各行各业的需求不断增长,中国的天然气产量大幅增加。根据中国国家统计局报告显示,2023年中国天然气产量达2,324.3亿立方米,创历史新高,比前一年大幅增加1,20多亿立方米,巩固了近年来天然气产量高峰的地位。预计此类发展将吸引大规模投资以满足需求。

- 中国也越来越重视石油和天然气资源的探勘和开采,特别是在沙漠地区。中国石油和天然气公司正致力于在这些干旱盆地钻探超深井。油田服务公司之间的合约竞争日益激烈。

- 2024年3月,中国西北部新疆维吾尔自治区的一个超深钻孔深度将超过10,000米,并且还有计画进一步挖掘。这项成果标誌着中国地球深部探勘事业取得重大飞跃。 「申迪塔克1号」钻孔位于塔里木盆地塔克拉玛干沙漠腹地,计画深度为11100公尺。

- 中国海洋石油集团有限公司(中海油)公布了2024年营运策略与发展规划,该公司2024年净产量目标为7亿桶油当量至7.2亿桶油当量。预计中国将占产量的69%左右,其余31%来自海外。该公司的净生产量目标将进一步提高,到2025年达到7.8亿至8亿桶油当量,到2026年进一步提高到8.1亿至8.3亿桶油当量。

- 因此,预计预测期内国内外公司增加投资将推动中国上游石油和天然气市场的发展。

中国上游油气产业概况

中国上游石油和天然气市场正在变得半固体。主要公司(排名不分先后)包括中国石油天然气集团公司、中国石化、中国海洋石油总公司(中海油)、埃克森美孚公司、雪佛龙公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2029 年市场资本支出及预测

- 至2029年的石油产量和消费量预测(单位:千桶/天)

- 至2029年的天然气产量和消费量预测(单位:十亿立方英尺/天)

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 发现新的油气天然气田

- 增加石油和天然气投资

- 限制因素

- 油价波动剧烈

- 驱动程式

- 供应链分析

- PESTLE分析

- 投资分析

- 主要石油和天然气统计数据

- 2023年原油产量与消费量

- 天然气产量及消费量(截至2023年)

- 运作钻机数量(截至2024年5月)

- 采矿场数(2024年3月)

- 采矿场数(2024年3月)

- 采矿场数(2024年3月)

第五章 按部署位置分類的市场区隔

- 陆上

- 海上

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- China National Petroleum Corporation(CNPC)

- China Petroleum & Chemical Corporation(Sinopec)

- China National Offshore Oil Corporation(CNOOC)

- ExxonMobil Corporation

- Chevron Corporation

- BP PLC

- Shell PLC

- List of Other Prominent Companies(Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- Market Ranking/Share(%)Analysis

第七章 市场机会与未来趋势

- 中国尚未开发的石油和天然气潜力

简介目录

Product Code: 49190

The China Oil And Gas Upstream Market size is estimated at USD 54.40 billion in 2025, and is expected to reach USD 59.74 billion by 2030, at a CAGR of 1.89% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the discovery of new oil and gas fields and rising oil and gas investments are expected to drive the Chinese oil and gas upstream market during the forecast period.

- On the other hand, rising emphasis on the renewable energy industry and higher oil and gas production costs are expected to hinder market growth during the forecast period.

- Nevertheless, the country's untapped oil and gas potential is expected to create immense opportunities for the Chinese oil and gas upstream market over the coming years.

China Oil And Gas Upstream Market Trends

Offshore Segment Projected to Dominate the Market

- China has significant oil and gas reserves located in offshore reservoirs, which present a substantial potential for the country's energy production. The exploration and extraction of these offshore resources have become a focus for Chinese companies as they strive to enhance their oil and gas production capabilities.

- Further, China's efforts to enhance offshore oil and gas production are crucial for meeting the country's increasing energy demands and reducing its reliance on imported fossil fuels. By investing in the development of offshore resources, China aims to strengthen its energy security and support its economic growth. The development of advanced technologies and strategies has enabled Chinese companies to tap into these offshore reservoirs more efficiently, contributing to the growth of the country's energy industry.

- China's natural gas and oil production has grown since 2018. It has continued to advance into deepwater areas in the South China Sea. The three major national oil companies (NOC), China National Offshore Oil Corporation (CNOOC), China Petroleum & Chemical Corporation (Sinopec), and China National Petroleum Corporation (CNPC), are significantly responsible for developing the South China Sea's resources. In 2023, China produced 410,000 barrels per day of petroleum liquids and 489 billion cubic feet of natural gas from the South China Sea, according to Rystad.

- The South China Sea is a region of strategic importance due to its significant oil and natural gas reserves. The potential for oil production in the South China Sea has attracted significant investment from oil companies, leading to an increase in contracts for oilfield service companies operating in the region.

- For instance, in March 2024, China's national oil giant, China National Offshore Oil Corporation (CNOOC), made an oilfield discovery with a volume of 100 million tons in the eastern South China Sea.

- As of July 2024, China boasted 50 operational offshore rigs, with oil rigs dominating at 46, while gas rigs numbered three, as reported by Baker Hughes. The significant number of oil rigs highlights China's focus on oil extraction in its offshore drilling activities.

- In March 2024, China discovered an oilfield in the Bohai Sea with proven oil reserves of 104 million tons. The Qinhuangdao 27-3 oilfield, located 200 kilometers west of North China's Tianjin, is a 48.9-meter-thick oil layer in a 1,570-meter-deep well. With reserves exceeding 100 million tons of oil equivalent, testing has shown that the oilfield can produce about 110 tons of crude oil per day, showing promising exploration prospects.

- Therefore, owing to the abovementioned developments, activities in the offshore segment are likely to increase and positively impact the Chinese oil and gas upstream market over the forecast period.

Rising Oil and Gas Investments Driving Market Demand

- China is the second-largest consumer of oil and gas and the sixth-largest producer of oil and gas globally. The Chinese oil and gas upstream market is dominated by state-owned oil and gas companies that are driving the country's domestic oil and gas exploration and production activities.

- China's natural gas production has seen significant growth with rising demand from numerous industries. In 2023, China's natural gas production reached a record high of 232.43 billion cubic meters, as reported by the National Bureau of Statistics of China. This marked a notable surge of more than 12 billion cubic meters from the preceding year, solidifying its position as the peak production year in recent memory. Such developments are expected to attract major investments to meet the demand.

- China has also been increasingly focused on the exploration and extraction of oil and gas resources, particularly in its desert regions. The country's oil and gas companies have been directing their efforts toward drilling ultra-deep wells in basins located within these arid landscapes. There is a heightened level of competition among oilfield service companies to secure contracts.

- In March 2024, the superdeep borehole in northwest China's Xinjiang Uygur Autonomous Region breached the 10,000 m mark, with plans to delve even deeper. The achievement signified a tremendous advancement in China's deep-Earth exploration efforts. The borehole "Shenditake 1," situated in the heart of the Taklimakan Desert in the Tarim Basin, is on track to reach its intended depth of 11,100 m.

- China National Offshore Oil Corporation (CNOOC) announced its business strategy and development plan for 2024. The company's net production target ranges from 700 MMboe to 720 Mmboe for 2024. China is expected to contribute around 69% of the production, with the remaining 31% coming from overseas. The company's net production target is also set to increase, reaching 780 MMboe to 800 MMboe in 2025 and further climbing to 810 MMboe to 830 MMboe in 2026.

- Hence, increasing investments from domestic and foreign firms are expected to drive the Chinese oil and gas upstream market during the forecast period.

China Oil And Gas Upstream Industry Overview

The Chinese oil and gas upstream market is semi-consolidated. Some of the major players (not in any particular order) include China National Petroleum Corporation, China Petroleum & Chemical Corporation (Sinopec), China National Offshore Oil Corporation (CNOOC), Exxon Mobil Corporation, and Chevron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Capex and Forecast in USD Billion, till 2029

- 4.3 Crude Oil Production and Consumption Forecast in Thousand Barrels per day, till 2029

- 4.4 Natural Gas Production and Consumption Forecast in Billion Cubic Feet per day, till 2029

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Discovery of New Oil and Gas Fields

- 4.7.1.2 Rising Oil and Gas Investments

- 4.7.2 Restraints

- 4.7.2.1 High Volatility of Crude Oil Prices

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 PESTLE Analysis

- 4.10 Investment Analysis

- 4.11 Key Oil and Gas Statistics

- 4.11.1 Crude Oil Production and Consumption, till 2023

- 4.11.2 Natural Gas Production and Consumption, till 2023

- 4.11.3 Active Rig Count, till May 2024 (Includes Onshore, Offshore, Drilled for, etc.)

- 4.11.4 Extraction Sites Count, March 2024 (Includes Discovered, in Development, Operating, etc.)

- 4.11.5 Extraction Sites Count, March 2024 (Includes Discovered, in Development, Operating, etc.)

- 4.11.6 Extraction Sites Count, March 2024 (Includes Discovered, in Development, Operating, etc.)

5 MARKET SEGMENTATION - BY LOCATION OF DEPLOYMENT

- 5.1 Onshore

- 5.2 Offshore

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 China National Petroleum Corporation (CNPC)

- 6.3.2 China Petroleum & Chemical Corporation (Sinopec)

- 6.3.3 China National Offshore Oil Corporation (CNOOC)

- 6.3.4 ExxonMobil Corporation

- 6.3.5 Chevron Corporation

- 6.3.6 BP PLC

- 6.3.7 Shell PLC

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 China's Untapped Oil and Gas Potential

02-2729-4219

+886-2-2729-4219