|

市场调查报告书

商品编码

1685915

汽车自动变速箱:市场占有率分析、行业趋势和成长预测(2025-2030 年)Automotive Automatic Transmission - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

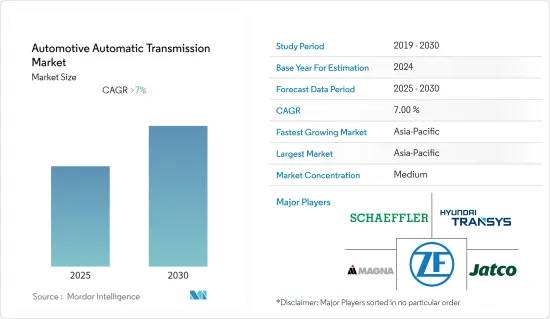

预计预测期内汽车自动变速箱市场的复合年增长率将超过 7%。

受新冠疫情对汽车产业影响,变速箱市场因汽车销售减少或接近零,或出现新的需求,市场占有率出现下降。虽然美国约有 90% 的车辆都采用自动变速箱,但像印度这样对里程敏感的庞大市场尚未逐步过渡到自动变速箱系统。随着世界各地的驾驶员越来越多地选择自动变速箱,该行业可能会适应疫情和后疫情时代。

汽车的传动系统除了简单地将引擎动力传输到车轮之外,还有许多好处。过去三年来,由于交通量大、交通拥堵和道路拥挤,对自动变速箱汽车的需求不断增加,尤其是在印度和中国等新兴国家。

车上采用的自排变速箱主要有手自排变速箱、无段变速箱、双离合器变速箱。

通用汽车表示,日益增长的环境问题和更严格的燃油经济性法规可能会导致手排变速箱汽车数量的下降,从而增加对自动变速系统的需求。此外,该地区各国政府正在寻求透过激励措施、扣除额和省油车来促进替代燃料汽车的销售,预计这将推动该地区对汽车自动变速箱的需求。

汽车自排变速箱市场趋势

OEM专注于开发先进的自动变速箱

德国自动变速箱供应商ZF开发了一款新型8速自排变速箱。该公司主要致力于透过使用轻量化技术来提高燃油效率。

新型齿轮组由四个行星齿轮组和五个换檔元件组成,最大限度地减少了阻力并提高了传动效率。选购的液压脉衝油储存器 (HIS) 提供启动/停止功能,以节省更多燃料。

这款新型自动变速箱相容于混合动力,可与所有 AWD Dive Concepts 一起使用,包括整合式AWD 系统和 Hang-on AWD。

ZF 每年平均为阿斯顿马丁、FCA、JLR 和大众集团生产 350 万台 8 速自排变速箱。 2019年,该公司赢得了BMW10亿美元的合约。预计 ZF 将为BMW系列车型提供这款八速自排变速箱的升级版本,这些车型最早可能在 2022 年推出。

此外,随着物流业恢復成长,商业领域对变速箱的需求也预计将增加。 2021年2月,采埃孚宣布将投资2亿美元用于商用车变速箱製造,以满足北美日益增长的需求。从 2023 年开始,ZF 将在南卡罗来纳州格雷考特生产 PowerLine 8 速自排变速箱,为美国创造 500 个就业机会。

采埃孚 (ZF) 也正在检验自动驾驶乘用车占比较高的中国和美国开始生产该技术的可能性。

亚太地区预计将创下最快成长

预计亚太地区将在预测期内实现最快的成长率。在亚太地区,中国、印度和东南亚国协等国家预计将出现高汽车需求,尤其是印度,其汽车保有量正在增加。

在印度,自动挡汽车和SUV的需求在过去三年大幅成长。

自动驾驶汽车销量从2011年的仅1.4%成长至2019年的17.3%。这一增长主要是由于大都会圈的交通量增加和驾驶条件不佳,而手排变速箱仍然是印度农村地区首选的交通方式。玛鲁蒂铃木是印度最大的自动挡汽车製造商,2020 年销量超过 132,000 辆。

印度销售的汽车中近80%的价格分布低于120万卢比。在这个价格分布,Maruti Suzuki Vitara Brezza、Dzire、Baleno、Hyundai Verna 和 Honda City 是最畅销的自动挡车。

虽然大多数印度买家更喜欢手排 SUV,但过去两年对自动变速箱 SUV 的需求有所增加。印度市场上销售的大多数高檔 SUV 车型都标配自动变速箱,包括斯柯达科迪亚克、大众途观、奥迪 Q 系列和宝马 X 系列。

考虑到道路状况的恶化、技术的进步、对经济性和便利性的日益增长的偏好以及对省油汽车的需求不断增长,预计印度对自动变速箱汽车的需求将在预测期内快速增长。

儘管市场发展缓慢,但双离合器自动变速箱正变得越来越受欢迎,因为它们换檔速度快,使用极为方便,并且大多数高性能汽车和超级跑车都配备了双离合器自动变速箱。因此,现代、Skoda、Volkswagen、塔塔等许多汽车製造商都开始采用 DCT 技术。

2022年3月,塔塔汽车在印度推出了一款搭载双离合器变速箱DCA的高阶掀背车。

汽车自排变速箱产业概况

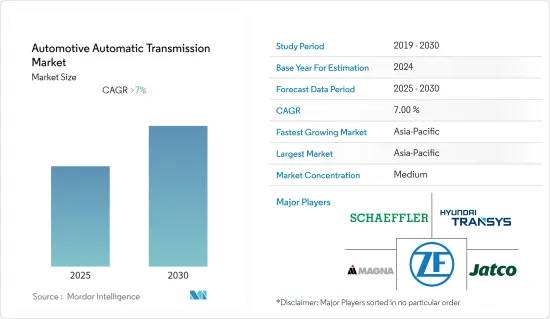

汽车自动变速箱市场高度分散,参与者包括采埃孚股份公司、舍弗勒股份公司、现代坦迪斯公司、麦格纳国际公司和加特可有限公司。变速箱系统製造商致力于在不影响车辆性能的情况下提供具有成本效益的解决方案。经销商正致力于全球化和创新产品以符合排放法规。为此,经销商正与本土合作伙伴合作,而OEM则专注于开发新技术,以节省製造成本,同时为市场提供有效的技术。

例如,麦格纳将于2022年5月开始为BMW集团生产全新七速轻度混合动力双离合器变速箱。麦格纳是BMW集团平台上所有前横置应用的唯一轻度混合动力变速箱供应商。这种轻度混合变速箱技术显着减少了内燃机产生的二氧化碳排放。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 类型

- 自排变速箱(AT)/变矩器(TC)

- 自动手排变速箱(AMT)

- 无段变速器(CVT)

- 双离合器变速箱(DCT)

- 燃料类型

- 汽油

- 柴油引擎

- 杂交种

- 车辆类型

- 搭乘用车

- 轻型商用车(LCV)

- 重型商用车(HCV)

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Aisin Seiki Co Ltd

- Allison Transmission Holdings

- BorgWarner Inc.

- Continental AG

- Daimler AG

- Delphi Automotive

- Eaton Corporation PLC

- Fiat Powertrain Technologies

- Jatco Ltd.

- Magna International Inc.

- NSK Ltd.

- Valeo

- ZF Friedrichshafen AG

第七章 市场机会与未来趋势

The Automotive Automatic Transmission Market is expected to register a CAGR of greater than 7% during the forecast period.

With the COVID-19 pandemic affecting the automotive industry, the Transmission Market saw a dip in market share due to low or almost zero automotive sales or new requirements. Although the United States has around 90% of the vehicles running with automatic transmission, mileage-sensitive and huge-scale markets like India are yet to gradually transform into automatic transmission systems. The growing trend towards opting the automatic transmission by drivers worldwide is set to help the industry service the pandemic and come out with good numbers post Covid-19.

The automotive transmission system has many advantages, apart from performing the simple purpose of transferring an engine's power to the wheels. The demand for automotive automatic transmission vehicles has been growing over the past three years, especially in developing countries, such as India and China, due to heavy traffic, congestion, and overcrowded streets.

The major types of automatic transmission systems used in the vehicles are automated manual, continuously variable transmission, and dual-clutch transmission, among others.

According to General Motors, with the growing environmental concerns and strict fuel economy norms, the available manual transmission system cars may decline, in turn, resulting in the rise in demand for automatic transmission systems. Governments in the region are also trying to promote the sales of alternative fuel vehicles through incentives and tax deductions, and fuel-efficient vehicles, which is expected to propel the demand for automotive automatic transmission in the region.

Automotive Automatic Transmission Market Trends

OEMs Focusing on Developing Advanced Automatic Transmission

The German automatic transmission supplier ZF developed a new 8-speed automatic transmission. The company mainly focused on improving fuel efficiency by using lightweight technology.

The new gear set design consists of four planetary gear sets and five shift elements that help minimize drag and improve transmission efficiency. The optional hydraulic impulse oil storage (HIS) offers a start/stop function, which can increase fuel savings.

This new automatic transmission is hybrid compatible and can be used across all AWD dive concepts, which include AWD center differential integrated, integrated AWD system, and hang-on AWD.

On average, ZF manufactures 3.5 million units of its 8-speed automatic transmission for Aston Martin, FCA, JLR, and the Volkswagen group yearly. In 2019, the company received a billion-dollar contract from BMW. ZF is expected to supply its latest version of this 8-speed automatic transmission for a BMW series of models that may be launched in 2022.

Additionally, as the logistics industry is gaining back its pace, the demand for transmission in the commercial sector is expected to increase. Hence, in February 2021, ZF announced a USD 200 million investment in commercial vehicle transmission manufacturing to cater to the increased demand in North America. Beginning in 2023, ZF will manufacture its PowerLine 8-speed automatic transmission in Gray Court, South Carolina, creating 500 jobs in the United States.

Furthermore, ZF is also testing the possibilities of starting the production of this technology for China and the United States, where the shares of automatic passenger cars are high.

Asia-Pacific is Expected to Witness the Fastest Growth Rate

Asia-Pacific is expected to witness the fastest growth rate during the forecast period. In the Asia-Pacific region, countries such as China, India, and the ASEAN countries, are anticipated to witness high demand for automatic cars, especially in India, with the continually growing vehicle population.

In India, the demand for automatic transmission cars and SUVs has significantly increased over the past three years.

Automatic vehicle sales have risen from a meager 1.4% in 2011 to 17.3% in 2019. This increase is primarily due to increased traffic and exhausting driving conditions in metropolitan regions, but manual transmissions are still the preferred mode of transportation in rural India. Maruti Suzuki was India's largest producer of automatic cars, with sales accounting for over 132,000 units in 2020.

Almost 80% of the cars sold in India are under the price range of 12 lakhs. Within this price range, Maruti Suzuki's Vitara Brezza, Dzire, Baleno, Hyundai Verna, and Honda City are the top-selling automatic transmission cars in the country.

Although most Indian buyers prefer a manual SUV, the demand for automatic transmission SUVs has increased over the past two years. Most of the premium SUV models available in the Indian market, such as Skoda Kodiaq, Volkswagen Tiguan, Audi Q-Series, BMW X-Series, etc., have an automatic transmission as a standard system.

In the light of the worsening road conditions, advancements in technology, growing preference toward economy and convenience, and rising demand for fuel-efficient cars, the demand for automatic transmission vehicles in India are expected to grow rapidly during the forecast period.

Although the market is running slow, the Dual Clutch Automatic Gearbox is gaining popularity because of its high-speed gearshift rate, which is very useful and is employed in most performance cars and supercars. Hence, many car makers like Hyundai, Skoda, Volkswagen, Tata, and others have started incorporating DCT technology.

In March 2022, Tata Motors launched its premium hatchback with a dual-clutch transmission called the DCA in India.

Automotive Automatic Transmission Industry Overview

The automotive automatic transmission market is fairly fragmented, with players, like ZF Friedrichshafen AG, Schaeffler AG, Hyundai Transys Inc., Magna International Inc., JATCO Ltd, and others. Transmission system manufacturers are motivated to provide cost-effective solutions without compromising the vehicle's performance. Dealers are focusing on globalization and innovating products to obey the emission norms. For this reason, dealers are working with native partners, and OEMs are focusing on developing new technologies to save manufacturing costs while offering effective technologies in the market.

For instance, in May 2022, Magna commences production of a new 7-speed, mild hybrid dual-clutch transverse transmission for BMW Group. Magna is the only mild hybrid transmission supplier for the BMW Group platform for all front-transverse applications. This mild hybrid gearbox tech cuts CO2 emissions from an internal combustion engine by a significant amount.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Driver

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Automatic Transmission (AT)/Torque Converter (TC)

- 5.1.2 Automatic Manual Transmission (AMT)

- 5.1.3 Continuous Variable Transmission (CVT)

- 5.1.4 Dual Clutch Transmission (DCT)

- 5.2 Fuel Type

- 5.2.1 Gasoline (Petrol)

- 5.2.2 Diesel

- 5.2.3 Hybrid

- 5.3 Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles (LCVs)

- 5.3.3 Heavy Commercial Vehicles (HCVs)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of the Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Aisin Seiki Co Ltd

- 6.2.2 Allison Transmission Holdings

- 6.2.3 BorgWarner Inc.

- 6.2.4 Continental AG

- 6.2.5 Daimler AG

- 6.2.6 Delphi Automotive

- 6.2.7 Eaton Corporation PLC

- 6.2.8 Fiat Powertrain Technologies

- 6.2.9 Jatco Ltd.

- 6.2.10 Magna International Inc.

- 6.2.11 NSK Ltd.

- 6.2.12 Valeo

- 6.2.13 ZF Friedrichshafen AG