|

市场调查报告书

商品编码

1685929

光电感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Photonic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

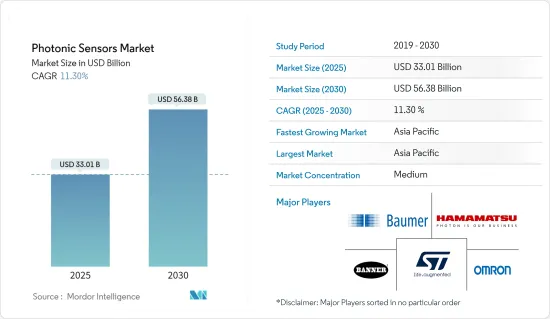

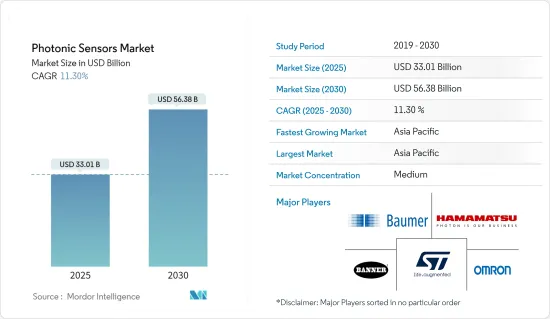

光电感测器市场规模在 2025 年估计为 330.1 亿美元,预计到 2030 年将达到 563.8 亿美元,在市场估计和预测期(2025-2030 年)内以 11.3% 的复合年增长率增长。

光电感测器对工业製程至关重要,用于光纤通讯系统、基于雷射的医疗设备、环境感测器和检测器等设备。

主要亮点

- 光电感测器具有灵敏度高、响应快、抗电磁干扰等优点。此外,其非接触式测量和宽动态范围使其适用于从通讯到医学影像和环境监测的各种应用。此外,光电感测器功耗低,通常在恶劣环境下工作,使其用途广泛且高效,可用于广泛的领域。

- 随着自动驾驶汽车的兴起以及依赖精确计时的全球定位系统 (GPS) 的进步,精确测量变得越来越重要。光电感测器被视为 GPS 的首选技术,同时也能为新兴的自动驾驶汽车产业做出贡献,从而在预测期内产生巨大的需求。

- 对安全和保障的需求不断增长,推动了对光电感测器的需求,光子感测器可在航太和国防、运输、製造、医疗保健、能源和电力等各种应用领域实现高精度、高速侦测和非侵入式监控。

- 光电感测器正在逐渐获得商业性认可。然而,对于光子感测器的操作却很少有既定的标准。光电感测器使用多种技术,包括雷射、光纤和生医光电。这些技术各不相同且不相容。低认知度、低接受度以及感测器提供的影像品质不合理也可能阻碍市场成长。影像品质和价格之间的不平衡导致了竞争加剧和製定最优价格的压力。

- 美国衝突促使投资转移,印度和一些东南亚国家正成为製造业和工业企业的投资目的地。这种转变主要是由于中国企业寻求扩大其製造足迹。这些不断发展的动态将在研究市场中开闢新的道路。此外,终端用户产业支出的增加将在未来几年推动光电感测器的成长。 IHME 预测全球医疗支出将大幅增加,预计到 2050 年人均医疗支出将达到 1,515 美元(购买力平价 2,050 美元)。

光电感测器市场趋势

最大的终端用户产业是消费性电子产品

- 光电感测器在消费性电子产业中发挥着至关重要的作用,提供广泛的应用,以增强使用者体验和改善设备功能。这些感测器支援智慧型手机、平板电脑和笔记型电脑中的触控萤幕、环境光感应器和接近感测器,从而改善用户互动和显示性能。它们在数位相机、智慧型手机和无人机中发挥着至关重要的作用,实现高解析度影像处理、自动对焦和低照度摄影。

- 智慧型手机、穿戴式装置和其他消费性电子设备使用虹膜扫描和指纹认证来实现安全、便利的认证。智慧型手机普及率的提高可能会推动市场成长。例如,根据爱立信预测,2022年全球智慧型手机行动网路用户数量将达到近64亿,预计到2028年将超过77亿,其中中国、印度和美国的智慧型手机行动网路用户数量最多。

- 光电感测器可以支援穿戴式装置中的心率监测、脉搏血氧计和血糖值测量,为使用者提供有价值的健康资料。消费性电子产品支出的增加也刺激了穿戴式装置的成长。此外,由于人口成长和生活方式的改变而导致的都市化不断加快,人们的健康和安全意识也不断增强。这是刺激健身追踪器、耳戴式装置和智慧型手錶等穿戴式装置成长的主要因素。近年来,穿戴式装置的销量大幅成长。

- 智慧家庭设备等消费性电子产品正在使用光电感测器来侦测环境光、温度和湿度,实现自适应显示亮度和智慧气候控制。这些感测器也用于游戏机、智慧电视和智慧家居系统中的非接触式手势姿态辨识。

亚太地区占主要市场占有率

- 预计亚太地区将在预测期内实现显着成长,这主要归因于中国和印度国防和军事开支的增加,以及这些国家的工业自动化趋势的上升。例如,由于中国共产党实施了改革,中国政府拨出了大量军事预算来采用现代技术。

- 政府消息人士透露,国防部已设定目标,到 2025 年实现航太和国防製造业的销售额达到 260 亿美元,其中包括 50 亿美元的出口。印度国防工业的扩张以及对本土生产和现代化的日益重视,推动了对此类感测器的需求,以满足该国不断变化的安全和技术需求。预计上述因素将在未来几年推动全部区域市场的成熟。

- 该地区拥有重要的製造地,并且正在经历工业自动化的蓬勃发展。光电感测器,包括光学编码器、视觉系统和雷射感测器,对于精密製造、品管和机器人自动化至关重要。根据中国国家统计局的数据,到2025年中国製造业销售额将达到8,856.8亿美元。

- 据 IBEF 称,到 2030 年,印度有潜力出口价值 1 兆美元的商品,并有望成为世界领先的製造业中心之一。製造业在印度经济中发挥着至关重要的作用,占GDP的17%,僱用了超过2,730万人。印度政府透过实施各种计画和政策,预计2025年製造业将占该国经济产出的25%。

光电感测器市场概览

光电感测器市场处于半固体状态,主要参与者正在采用合资、新产品推出和合作等各种策略,以扩大其在该市场的影响力并长期维持这种影响力。主要市场参与者包括 Banner Engineering Corp.、Baumer Holding AG、STMicroelectronics NV、Hamamatsu Photonics K.K. 和Omron Corporation。

- 2024 年 2 月-Schick 推出「世界上第一款」带触控萤幕的光电感测器。 Sick W10 是世界上第一款内建触控萤幕显示器的光电感应器。 W10 专为「通用和易于部署」而设计,为数百种食品和饮料 (F&B) 应用提供「无与伦比的高精度检测技术」和「无可比拟的多功能性」。光电 W10 使用根据从行业最常见应用中获得的知识构建的智慧板载演算法,以实现「全面的高重复性」。

- 2024 年 1 月——意法半导体 (ST) 与 Sphere Entertainment Co. 合作,为 Sphere 的 Big Sky 系统开发了世界上最大的影像感测器——3.16 亿像素的 Big Sky 相机感测器。 ST 与 Sphere Studios 合作开发了首款 18K 感测器,能够产生 Sphere 显示器所需的解析度和保真度的影像。 Big Sky 的 316 万像素解析度约为全片幅感光元件的 7 倍、全片幅商用相机解析度的 40 倍。晶粒尺寸为 9.92cm x 8.31cm2,是皮夹大小照片的两倍。 300 毫米晶圆上只能容纳四个晶粒。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 新冠肺炎疫情及其他宏观经济因素对市场的影响

第五章 市场动态

- 市场驱动因素

- 製造业对自动化的需求不断增加

- 对安保和安全的需求日益增加

- 增加对光纤通讯的投资

- 市场限制

- 缺乏业界标准

- 初期成本高

第六章 市场细分

- 依产品类型

- 光纤感测器

- 影像感测器

- 生物光学感测器

- 其他产品类型

- 按最终用户产业

- 航太和国防

- 车

- 产业

- 卫生保健

- 能源和电力

- 消费性电子产品

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 供应商定位分析

- 公司简介

- Banner Engineering Corp.

- Baumer Holding AG

- STMicroelectronics NV

- Hamamatsu Photonics KK

- Omron Corporation

- Sick AG

- Keyence Corporation

- Pepperl+Fuchs GmbH

- Rockwell Automation Inc.

- Autonics Corporation

第八章投资分析

第 9 章:未来趋势

The Photonic Sensors Market size is estimated at USD 33.01 billion in 2025, and is expected to reach USD 56.38 billion by 2030, at a CAGR of 11.3% during the forecast period (2025-2030).

Photonic sensors are crucial in industrial processes and are used in devices like fiber optic communication systems, laser-based medical instruments, environmental sensors, and optical detectors.

Key Highlights

- These sensors offer advantages, including high sensitivity, fast response times, and immunity to electromagnetic interference. They also enable non-contact measurements, have a wide dynamic range, and are suitable for various applications, from telecommunications to medical imaging and environmental monitoring. Additionally, photonics sensors often exhibit lower power consumption and can function in harsh environments, making them versatile and efficient in diverse fields.

- With the growing adoption of autonomous cars, precision metrology has gained significant importance with advancements in the global positioning system (GPS), which relies on precision timing. Photonic sensors are being viewed as a suitable technology for GPS and can benefit the budding autonomous car industry, thereby creating significant demand over the forecast period.

- Increasing requirements for security and safety drive the demand for photonics sensors primarily due to their ability to provide high precision, rapid detection, and non-intrusive monitoring in various applications, including aerospace and defense, transportation, manufacturing, healthcare, energy and power, and many others.

- Photonic sensors are slowly witnessing commercial acceptance. However, there are few established standards for their operation. Photonic sensors also use numerous technologies, such as laser, fiber optics, and biophotonic. These technologies are distinct from each other and lack compatibility. Lack of awareness, less acceptability, and the unjustifiable image quality offered by the sensors may also hinder market growth. The imbalance between image quality and price has led to increased competition and peer pressure regarding optimal pricing.

- The U.S. and China dispute has prompted a shift in investments, with countries like India and select Southeast Asian nations emerging as attractive destinations for manufacturing and industrial ventures. This shift is mainly due to Chinese companies seeking to broaden their manufacturing footprint. These evolving dynamics are poised to create new avenues within the studied market. Furthermore, heightened expenditures in end-user industries are set to bolster the growth of photonic sensors in the coming years. IHME projects a significant increase in global health spending, estimated to reach USD 1,515 (2.050 PPP dollars) per person by 2050.

Photonic Sensors Market Trends

Consumer Electronics to be the Largest End-user Industry

- Photonic sensors play a crucial role in the consumer electronics industry, offering a wide range of applications that enhance user experience and improve device functionality. These sensors enable touchscreens, ambient light sensors, and proximity sensors in smartphones, tablets, and laptops, enhancing user interaction and display performance. They play a key role in digital cameras, smartphones, and drones, enabling high-resolution imaging, autofocus, and low-light photography.

- In consumer electronics like smartphones and wearables, iris scanning and fingerprint sensing are used for secure and convenient authentication. The increasing adoption of smartphones is likely to aid the market's growth, which has been studied significantly. For instance, according to Ericsson, the number of smartphone mobile network subscriptions globally reached almost 6.4 billion in 2022. It is forecasted to exceed 7.7 billion by 2028. China, India, and the United States have the highest smartphone mobile network subscriptions.

- Photonic sensors support heart rate monitoring, pulse oximetry, and blood glucose measurement in wearable devices, providing valuable health data to users. Increasing spending on consumer electronic products is also stimulating the growth of wearable devices. Further, the growing population's increasing urbanization and changing lifestyle have raised its health and safety awareness. This has been a major factor in stimulating the growth of wearable devices, such as fitness trackers, earwear, and smartwatches. There has been a significant increase in the number of wearable devices sold over the past few years.

- Consumer electronics like smart home devices use photonic sensors to detect ambient light, temperature, and humidity, enabling adaptive display brightness and smart climate control. These sensors are also used in touchless gesture recognition in gaming consoles, smart TVs, and home automation systems.

Asia-Pacific to Hold Major Market Share

- Asia-Pacific is expected to witness a significant growth rate over the forecast period, primarily due to the increasing defense/military spending in China and India and the industrial automation trend in these nations. For instance, the Chinese government offers considerable military budgets for incorporating modern technology, owing to reforms by the Chinese Communist Party.

- According to the official source, the Ministry of Defence has set a target of achieving a turnover of USD 26 billion in aerospace and defense manufacturing by 2025, which includes USD 5 billion in exports. The expansion of India's defense industry and its emphasis on indigenization and modernization have driven the demand for these sensors to meet the country's evolving security and technological needs. The above factors will expand the market maturation across the region in the upcoming years.

- The region is home to significant manufacturing hubs and is witnessing a surge in industrial automation. Photonics sensors, including optical encoders, vision systems, and laser sensors, are crucial for precision manufacturing, quality control, and robotic automation. According to the National Bureau of Statistics of China, the manufacturing revenue in China will amount to USD 885.68 billion by 2025.

- According to IBEF, India may export goods worth USD 1 trillion by 2030 and is on the route to becoming a prominent global manufacturing hub. With 17% of the country's GDP and over 27.3 million workers, manufacturing plays a significant role in the Indian economy. By implementing different programs and policies, the Government of India expects 25% of the economy's output to come from manufacturing by 2025.

Photonic Sensors Market Overview

The photonic sensors market is semi-consolidated, and the major players have used various strategies, such as joint ventures, new product launches, partnerships, and others, to increase their footprints in this market to sustain in the long run. Some of the key market players are Banner Engineering Corp., Baumer Holding AG, STMicroelectronics NV, Hamamatsu Photonics KK, and Omron Corporation.

- February 2024 - Sick announced the "world's first" photoelectric sensor equipped with a touchscreen. The Sick W10 is a "world-first" photoelectronically powered sensor with an integrated touchscreen display. Designed for "universal use and ease of deployment," the W10 offers "unrivaled precision detection technology" and "unmatched versatility" for hundreds of food and beverage (F&B) applications. The photoelectronically-powered W10 uses smart onboard algorithms built on the knowledge gained from the industry's most common applications to deliver "high reproducibility across the board."

- January 2024 - STMicroelectronics (ST) collaborated with Sphere Entertainment Co. to develop the world's largest image sensor, the 316-megapixel Big Sky camera sensor for Sphere's Big Sky system. ST collaborated with Sphere Studios to develop an 18K sensor, the first of its kind, capable of producing images at the resolution and fidelity needed for Sphere's display. The 316-megapixel resolution of the Big Sky is nearly 7x larger than a full-frame sensor and 40x more resolution than full-frame commercial cameras. The die is 9.92 cm x.8.31 cm 2, which is twice the size of a wallet-size photograph. Only four full die fits on a 300 mm wafer.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Automation Demand in Manufacturing Industry

- 5.1.2 Increasing Requirement for Security and Safety

- 5.1.3 Increasing Investment in Fiber Optic Communications

- 5.2 Market Restraints

- 5.2.1 Lack of Industry Standards

- 5.2.2 High Initial Cost

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Fiber Optic Sensors

- 6.1.2 Image Sensors

- 6.1.3 Biophotonic Sensors

- 6.1.4 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Aerospace and Defense

- 6.2.2 Automotive

- 6.2.3 Industrial

- 6.2.4 Healthcare

- 6.2.5 Energy and Power

- 6.2.6 Consumer Electronics

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Positioning Analysis

- 7.2 Company Profiles

- 7.2.1 Banner Engineering Corp.

- 7.2.2 Baumer Holding AG

- 7.2.3 STMicroelectronics NV

- 7.2.4 Hamamatsu Photonics KK

- 7.2.5 Omron Corporation

- 7.2.6 Sick AG

- 7.2.7 Keyence Corporation

- 7.2.8 Pepperl+Fuchs GmbH

- 7.2.9 Rockwell Automation Inc.

- 7.2.10 Autonics Corporation