|

市场调查报告书

商品编码

1685935

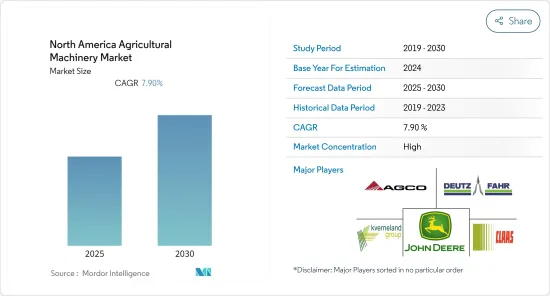

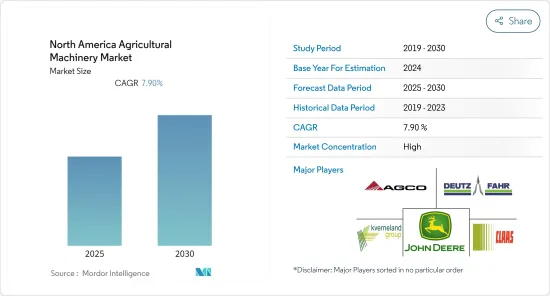

北美农业机械:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预测期内北美农业机械市场预计复合年增长率为 7.9%

主要亮点

- 农场整合的不断增加、光明的经济前景、庞大的生产基地以及政府透过补贴不断增加的支持正在推动大容量农业机械和设备的销售。根据设备工业协会(AEM)的数据,2021年北美销售的拖拉机和联合收割机总数为36万台。今年,美国和加拿大几乎所有类型的农业拖拉机和联合收割机的销售量都增加了 10% 或更多。

- 大片农田的存在,农业机械化的需求很高。此外,北美越来越多地使用配备监控技术的智慧联合收割机来提高农业产量。预计人事费用上升、拖拉机和收割机采用机器人系统和 GPS、大型农场对大容量机械的需求增加以及自行式机械的日益普及将在预测期内推动市场成长。美国农业机械巨头约翰迪尔 (John Deere) 已着手收购人工智慧Start-UpsBlue River Technology,以加强其基于人工智慧的拖拉机创新流程。这些技术创新有望从长远来看推动对技术先进的拖拉机的需求。

- 现在,全国各地的农民都可以及时获得农机贷款补贴,贷款利率和还款计画灵活。因此,即使是小农户现在也能够投资大型农业机械。美国政府透过美国农业部直接经营贷款、美国农业部经营小额贷款和美国农业部担保经营贷款为农业设备提供融资。信贷宽鬆和农民转向技术来提高生产力使得一系列机器获得了两位数的利润,刺激了该地区的市场成长。

北美农业机械市场趋势

农业机械普及率高、创新能力强

拖拉机技术的快速发展正在彻底改变北美农业。随着对作物的需求不断增加,农业成本不可避免地上升,拖拉机成为高效农业不可避免的一部分。根据加拿大农业人力资源委员会预测,到2029年,加拿大农业劳动力短缺数量预计将翻倍,达到12.3万人。 2020-21年,农业劳动力短缺对该国农民造成约29亿美元的损失,预计未来几年短缺情况将进一步扩大。加拿大的平均农场规模也逐年扩大,这可能会促进农业机械(拖拉机、联合收割机等)的销售。

近年来,农场管理的永续性需求引发了对高度发展和高效机械的需求,推动了所研究市场的成长。例如,根据设备製造商协会的数据,2020年6月自走式联合收割机的销售量从125台增加到143台,累计销售量(2020年1月至2020年10月)达264台,比去年同期成长3.1%。

因此,拖拉机已经处于技术前沿,拥有基于人工智慧的工具,可用于资料传输和更好的决策流程。 2022年,加拿大农业和食品部宣布透过农业科学计画提供超过100万美元的资金,帮助生产者改善农场管理和收益。预计这些技术进步将从长远来看推动对技术先进的拖拉机的需求,从而在未来几年推动市场发展。

美国主导市场

大规模农场经营、劳动力减少以及提高农业生产率的需求是研究期间该地区农业机械销售的主要驱动力。农业是美国的主要职业之一,农业机械化被认为是提高生产力、销售和出口的重要原因。

美国市场以低功率拖拉机的销售为主,其中40匹马力以下的拖拉机占有很大的份额。据估计,在一个技术先进的农场,一个农民可以生产足够的粮食来养活近 1,000 人。然而,在20世纪,这个限制是25,比例为1:130。目前,技术进步主要集中在农田拖拉机的使用。

在美国等已开发国家,更换週期较短,仅9年,这导致对新型拖拉机的需求增加,带动了北美市场的发展。例如,约翰迪尔在萨尔蒂约生产 105-140 马力的拖拉机,而 CNH Industrial 的 New Holland 分部在克雷塔罗生产 90-115 马力的拖拉机。 John Deere、New Holland、Valtra 和 Pauny 是领先的拖拉机製造商。

北美农机产业概况

北美农业机械市场格局趋于稳定,大型企业占据主导地位。市场的主要企业包括迪尔公司、爱科集团、Same Deutz-Fahr Deutschland GmbH、CLAAS 集团、Kverneland 集团等。各公司正在创新新型机械以满足不断变化的消费者需求,提供使农业更有效率、更容易的新技术。在所研究的市场中,许多国际参与者正在与国内参与者合作,以扩大其影响力并扩展其高端、价值导向多功能拖拉机产品系列的服务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 类型

- 联结机

- 小于40马力

- 40至100马力

- 超过100马力

- 四轮驱动农用拖拉机

- 装置

- 犁

- 光环

- 耕耘机和耕耘机

- 其他设备

- 灌溉机械

- 喷水灌溉

- 滴灌

- 其他灌溉机械

- 收割机

- 联合收割机

- 青贮收割机

- 其他收割机械

- 牧草和饲料机械

- 草坪修剪机

- 打包机

- 其他牧草和饲料机械

- 其他类型

- 联结机

- 地区

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

第六章竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- AGCO Corporation

- CLAAS Group

- CNH Industrial NV

- Deere & Company

- Kubota Corporation

- Kverneland Group

- Morris Industries Ltd

- Netafim Irrigation Inc.

- Same Deutz-Fahr Deutschland GmbH

- Vaderstad Industries Inc.

第七章 市场机会与未来趋势

The North America Agricultural Machinery Market is expected to register a CAGR of 7.9% during the forecast period.

Key Highlights

- Increased farm consolidation, positive economic outlook, large production base, and greater government support through subsidies are driving sales of high-capacity agricultural machinery and equipment. According to the Association of Equipment Manufacturers (AEM), the total number of tractors and combines sold in 2021 in North America was 360,000 units. That year, there was a sale increase of over 10% in nearly every segment of agricultural tractors and combines in the United States and Canada.

- The presence of extensive farmland has led to high demand for farm mechanization. Furthermore, the North American region is experiencing a rise in the use of smart combine harvesters equipped with monitoring technologies to boost farm production. Rising labor costs, the incorporation of robotic systems and GPS in tractors and harvesters, increased demand for high-capacity machinery due to large farms, and the increasing popularity of self-propelled machines are expected to drive market growth during the forecast period. The US-based agricultural machinery giant, John Deere, began enhancing the AI-based innovation process in tractors by acquiring an AI start-up, Blue River Technology. Such innovations are expected to drive the demand for technologically advanced tractors in the long term.

- Farmers in the country have been able to avail timely subsidies in the form of agriculture equipment loans at flexible interest rates and repayment schedules. This, in turn, has helped even small-scale farmers to invest on primary agricultural equipment. The US government extends loans for farm equipment through USDA Direct Operating Loans, USDA Operating Microloans, and USDA Guaranteed Operating Loans. The farmers inclinination toward technology due to easy loans and to enhance productivity has resulted in double-digit gains for various machineries, thus is fuelling the market growth in the region.

North America Agricultural Machinery Market Trends

High Adoption of and Innovations in Farm Machinery

Rapid technological developments in tractors are currently revolutionizing farming in North America. Farm costs are inevitably higher with the increasing demand for food crops, thus, making tractors an inevitable part of efficient farming. According to the Canadian Agriculture Human Resource Council, Canada's farm labor deficit is anticipated to double by 2029 and lead to a 123,000-worker shortage. During 2020-2021, the farm labor shortage cost around USD 2.9 billion for farmers in the country, and this shortage is anticipated to grow over the coming years. This will boost agricultural machinery sales (tractors, combines, etc.) as the average farm size in Canada is also growing every year.

The need for sustainability in the management of farm operations has induced the demand for highly developed and efficient machinery in recent years and is driving the growth of the market studied. For instance, according to the Association of Equipment Manufacturers, the sale of self-propelled combine harvesters in June 2020 increased from 125 units to 143 units, resulting in year-to-date sales (January 2020 - October 2020) of 264 units, which was 3.1% higher when compared to the same period in the previous year.

Thus, the wave of modern technology has already been witnessed in tractors with the application of Artificial Intelligence-based tools for data transmission and precise decision-making processes in cultivation. In 2022 Canada, The Ministry of Agriculture and Agri-Food, announced over USD 1 million in funding for SomaDetect Inc. and Vivid Machines Inc. through the AgriScience Program to help producers improve farm management and their bottom line. Such innovations are projected to induce the demand for technologically developed tractors, in the long run, thus also boosting the market over the coming years.

United States Dominates the Market

Large-scale farming operations, a decline in labor, and the need to enhance the productivity of agriculture are the factors that are mainly driving the sales of agricultural machinery in the region during the study period. Agriculture is one of the major occupations in the United States, where the mechanization of farming is considered an important reason for increased productivity, sales, and export.

The United States market is driven by the sale of low-engine-power tractors with tractors of power less than 40 HP accounting for a major share of the market. It is estimated that on a technologically advanced farm, one farmer can produce enough cereals to feed almost a thousand people. However, in the twentieth century, that was limited to 25 people, with the ratio standing at 1:130. Technological advancements are now directed toward the use of tractors in agricultural fields.

The shorter replacement cycles of 9 years in advanced economies like the United States increase the demand for new tractors, and hence, drive the market in North America. For instance, John Deere manufactures tractors in the 105-140 HP range in Saltillo and CNH Industrial's New Holland division manufactures tractors in the 90-115 HP range in Queretaro. John Deere, New Holland, Valtra, and Pauny are the top tractor manufacturers.

North America Agricultural Machinery Industry Overview

The North American agricultural machinery market is consolidated, with the major players occupying the majority share. The major players in the market are Deere and Co., AGCO Corporation, Same Deutz-Fahr Deutschland GmbH, CLAAS Group, and Kverneland Group, among others. Companies are innovating new types of machinery as per the changing consumer demand and are offering new technologies to bring more efficiency and ease agricultural operations. Many international players in the market studied have also been collaborating with domestic players to increase their reach and expand their services for high-end and value-oriented utility tractor range.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Tractor

- 5.1.1.1 Less than 40 HP

- 5.1.1.2 40 to 100 HP

- 5.1.1.3 Above 100 HP

- 5.1.1.4 4 WD Farm Tractors

- 5.1.2 Equipment

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Cultivators and Tillers

- 5.1.2.4 Other Equipment

- 5.1.3 Irrigation Machinery

- 5.1.3.1 Sprinkler Irrigation

- 5.1.3.2 Drip Irrigation

- 5.1.3.3 Other Irrigation Machinery

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Other Harvesting Machinery

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers

- 5.1.5.2 Balers

- 5.1.5.3 Other Haying and Forage Machinery

- 5.1.6 Other Types

- 5.1.1 Tractor

- 5.2 Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Mexico

- 5.2.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AGCO Corporation

- 6.3.2 CLAAS Group

- 6.3.3 CNH Industrial NV

- 6.3.4 Deere & Company

- 6.3.5 Kubota Corporation

- 6.3.6 Kverneland Group

- 6.3.7 Morris Industries Ltd

- 6.3.8 Netafim Irrigation Inc.

- 6.3.9 Same Deutz-Fahr Deutschland GmbH

- 6.3.10 Vaderstad Industries Inc.