|

市场调查报告书

商品编码

1685947

日本风力发电-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Japan Wind Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

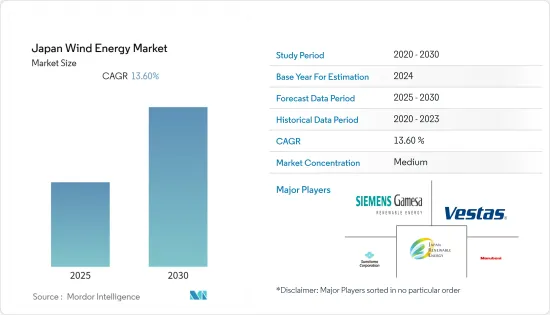

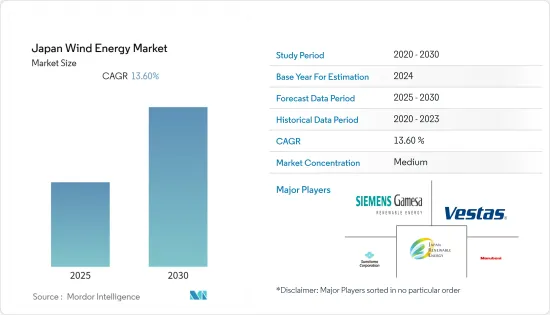

预计日本风力发电市场在预测期内的复合年增长率将达到 13.6%

主要亮点

- 从长远来看,政府政策、增加对即将开展的风发电工程的投资以及降低风力发电成本等因素预计将推动市场发展。

- 另一方面,天然气和太阳能等替代能源的日益普及可能会阻碍市场成长。

- 然而,预计该国不断增长的电力需求将很快为风电发展提供市场机会。巨大的风电潜力和风力发电成本的下降预计将在未来几年为市场创造广泛的商机。

- 预计在预测期内,有利的政府政策和对海上风力发电领域的不断增加的投资将推动市场发展。

日本风力发电市场趋势

预计土地市场将占据主导地位

- 预计在预测期内,陆上风力发电将占据市场主导地位。风力发电是日本实现净零目标和钢铁、航运等重工业脱碳的重要支撑来源。

- 2022年,该国每年新增装置容量为149兆瓦,陆上风力发电装置容量将从2021年的4,523兆瓦达到2022年的4,668兆瓦,领先该国陆上风力发电市场。

- 据经济产业省透露,2024年度陆上风力发电上网电价(FIT)制度的购买价格定为每千瓦时14日圆。过去10年来,这一价格一直在稳定下降。

- 根据全球风力发电理事会(GWEC)的预测,到2022年,该国风电总装置容量将达到480万千瓦,其中大部分新增装置容量来自陆上风电设施。日本计划兴建多个风力发电工程,预计在预测期内将进一步增加。

- 2022年11月,经济产业省宣布,计画更新标准,并于2022年12月对离岸风力发电计画进行公开招标,以鼓励更多业者加入,加速基础建设。竞标计画涵盖四个地点,总合容量为180万千瓦。

- 此外,日本政府于 2023 年 5 月宣布了安装 40 吉瓦陆上风电场的目标。预计试运行时间为 2023 年第二季。 Dohoku 风电场综合体是一个 339.7 兆瓦的风电场综合体,由位于北海道的四个计划组成。它由79风力发电机组成。

- 因此,由于现有的陆上风电容量和即将开展的计划,预计该行业将在预测期内占据主导地位。

政府政策和不断增加的投资推动市场

- 政府的优惠政策将推动日本风力发电市场的发展。日本政府已推出各种政策和措施来支持可再生能源和风力发电的发展。例如,日本政府公布了「离岸风电产业愿景」。该愿景概述了到2030年每年分配1GW离岸风力发电容量的计划。

- 此外,政府正在规划供应链发展和成本降低路径,以实现2035年LCOE达到8-9日圆/千瓦时,到2040年累积装置容量达30-45吉瓦。

- 根据能源研究所《2023 年世界能源统计评论》预测,2022 年风力发电量将达到 8.2TWh,高于 2020 年的 7.8TWh。此外,根据亚洲风力发电协会的数据,日本的陆域风力发电潜力估计为 144GW,离岸风电潜力为 608GW。

- 由于政府努力向清洁能源来源转型以及可再生能源技术的不断进步,日本的风力发电产业预计将在不久的将来实现成长。近年来,日本为实现碳中和设定了各种气候变迁目标。

- 此外,由于日本计划在2040年建成世界第三离岸风力发电电场,一些欧洲能源公司正在日本投资。此外,日本政府计划提供税收优惠政策,以刺激1.7兆日圆(159亿美元)的私人投资。预计此类倡议也将对市场研究产生正面影响。

- 此外,2022年9月,美国通用电气公司风力发电机製造部门GE再生能源与绿色电力投资公司在日本联合开发陆上风电场。该风力发电厂位于西津轻郡深浦町,装置容量为79.8兆瓦。作为合作的一部分,通用电气公司将向该发电厂提供 19 台 4.2-117 陆上风力发电机。

- 因此,预计预测期内政府支持和对可再生能源的投资增加将推动风力发电市场的成长。

日本风力发电产业概况

日本的风力发电市场已经巩固。市场的主要企业(不分先后顺序)包括维斯塔斯、西门子歌美飒再生能源、住友商事、丸红和日本再生能源。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 风力发电装置容量及2028年预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 加大对即将启动的风发电工程的投资

- 政府优惠政策

- 限制因素

- 越来越多地采用替代能源,例如天然气发电

- 驱动程式

- 供应链分析

- PESTLE分析

第五章市场区隔

- 部署位置

- 土地

- 海上

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Vestas AS

- Siemens Gamesa Renewable Energy

- Japan Renewable Energy Co. Ltd

- Marubeni Corporation

- Sumitomo Corporation

- Eurus Energy Holdings Corporation

- Synera Renewable Energy Co., Ltd.

第七章 市场机会与未来趋势

- 日本离岸风力发电领域的进展

简介目录

Product Code: 49729

The Japan Wind Energy Market is expected to register a CAGR of 13.6% during the forecast period.

Key Highlights

- Over the long term, factors like government policies, the increasing investment in upcoming wind power projects, and the reduced cost of wind energy, are expected to drive the market. which has led to increased adoption of wind energy

- On the other hand, The growing adoption of alternative energy sources such as gas-based power and solar power will likely hinder the market growth.

- Nevertheless, Increased demand for electricity in the country is expected to provide market opportunities for wind power development shortly. The massive wind power potential and a decline in the cost of wind energy are expected to provide widespread business opportunities to the market in the coming years.

- Favorable government policies and increasing investments in the offshore wind energy sector are expected to drive the market during the forecast period.

Japan Wind Energy Market Trends

Onshore Segment is Expected to Dominate the Market

- Onshore wind energy is expected to dominate the market during the forecast period. Wind energy has become a major source of support for Japan to reach its net-zero target and decarbonize its heavy industries, such as steel manufacturing and shipping.

- With a new annual installation of 149 MW in 2022, onshore wind energy installed capacity in the country reached 4668 MW in 2022, up from 4523 MW in 2021, driving the onshore wind energy market in the country.

- According to the Ministry of Economy, Trade and Industry (METI), for the fiscal year 2024, the FIT (feed-in tariff (FIT)) purchase price for onshore wind electricity was set at JPY 14 per kilowatt hour. The price has decreased continuously throughout the past decade.

- As of 2022, the country's total installed wind capacity reached 4.8 GW, according to the Global Wind Energy Council (GWEC), and the majority of the new capacity came from onshore wind installations. It is further expected to grow during the forecast period, as several wind power projects are planned in Japan.

- In November 2022, the Ministry of Economy, Trade, and Industry announced plans to begin public auctions for offshore wind generating projects in December 2022 under updated criteria to promote a broader range of operators and speed infrastructure construction. The auction is planned to cover four sites with a combined capacity of 1.8 GWs.

- Moreover, in May 2023, the Government of Japan announced its aim to install 40 GW of onshore wind farms. Also, it is expected to be commissioned in Q2 2023. The Dohoku wind farm cluster, a 339.7 MW wind farm cluster, consists of four projects located on the island of Hokkaido. The complex consists of 79 units of wind turbines.

- Hence, with existing onshore wind energy capacity and upcoming projects, the segment is expected to dominate during the forecast period.

Government Policies and Increasing Investments to Drive the Market

- .Favorable government policies will drive the wind energy market in Japan. The government has launched various government policies and initiatives to support the growth of renewable energy and wind energy deployment in the country. For instance, the Japanese government unveiled its Offshore Wind Industry Vision. This vision outlines a plan to allocate 1 GW of offshore wind capacity annually through 2030.

- Additionally, the government has plans for supply chain development and cost reduction pathways to reach JPY 8-9/kWh of LCOE by 2035 and 30-45 GW of cumulative capacity by 2040.

- According to the Energy Institute Statistical Review of World Energy 2023, electricity generated from wind was 8.2 TWh in 2022, which was increased from 7.8 TWh in 2020. Also, according to the Asia Wind Energy Association, Japan has an estimated wind energy potential of 144 GW for onshore wind and 608 GW of offshore wind capacity.

- Japan's wind energy sector is expected to grow in the near future, owing to government initiatives to transition to cleaner energy sources and continual advancements in renewable technologies. In recent years, the country has established various climate goals in order to reach carbon neutrality.

- Moreover, Several European energy companies are investing in Japan as the country aims to create the world's third-largest offshore wind power fleet by 2040. Further, the government is expected to provide tax incentives to stimulate JPY 1.7 trillion (USD 15.9 billion) in private investment. Such initiatives are expected to have a positive impact on the market studied.

- Furthermore, in September 2022, GE Renewable Energy, an American wind turbine manufacturer division of General Electric, and Green Power Investment collaborated to develop an onshore wind farm in Japan. The wind farm is located in FukauraTown, Nishi Tsugaru District, with an installed capacity of 79.8 MW. As a part of the collaboration, GE will supply 19 units of GE's 4.2-117 onshore wind turbines to the power plant.

- Hence, government support and rising investments in renewable energy are expected to drive the wind energy market growth during the forecast period.

Japan Wind Energy Industry Overview

The Japan wind energy market is consolidated. Some of the key players in the market (in no particular order) include Vestas, Siemens Gamesa Renewable Energy, Sumitomo Corporation, Marubeni Corporation, and Japan Renewable Energy Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Energy Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Investment in Upcoming Wind Power Projects

- 4.5.1.2 Favorable Government Policies

- 4.5.2 Restraints

- 4.5.2.1 The Growing Adoption of Alternative Energy Sources Such as Gas-Based Power

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vestas AS

- 6.3.2 Siemens Gamesa Renewable Energy

- 6.3.3 Japan Renewable Energy Co. Ltd

- 6.3.4 Marubeni Corporation

- 6.3.5 Sumitomo Corporation

- 6.3.6 Eurus Energy Holdings Corporation

- 6.3.7 Synera Renewable Energy Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress In Japan's Offshore Wind Power Sector

02-2729-4219

+886-2-2729-4219