|

市场调查报告书

商品编码

1685949

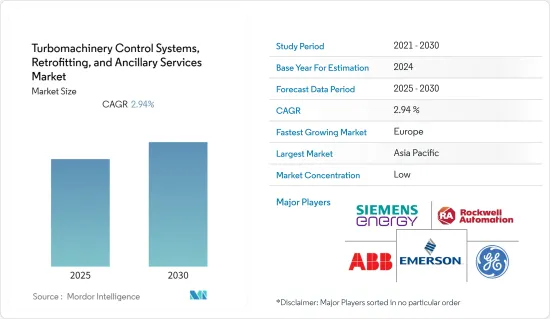

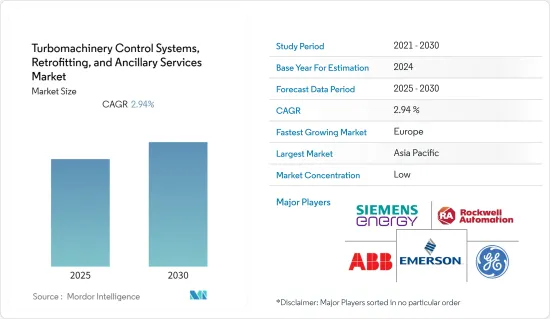

涡轮机械控制系统、改装和辅助服务—市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Turbomachinery Control Systems, Retrofitting, and Ancillary Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计涡轮机械控制系统、改装和辅助服务市场在预测期内的复合年增长率将达到 2.94%。

预计在预测期内,工业领域和新发电工程越来越多地采用自动化技术,将对涡轮机械控制系统、改造和辅助服务产生巨大的需求。然而,人们对再生能源来源的日益偏好导致近年来对涡轮机械控制系统的投资和需求下降。

涡轮机械控制系统技术的进步,特别是液化天然气工厂使用的气体膨胀涡轮机,预计将为未来的市场创造许多机会。由于印度和中国的经济成长、大型化学工业的存在、低劳动力工资以及製造业的成长等因素,亚太地区预计将主导市场。

涡轮机械控制系统、改造与辅助服务市场趋势

电力产业可望主导市场

在电力领域,涡轮机械控制系统用于发电的涡轮机和压缩机等设备,为发电厂的气动阀门和致动器提供所需的稳定压力。在传统的发电系统(蒸气、燃气)中,涡轮机械控制系统对于提高涡轮机械设备的生产率和安全性至关重要。

世界人口快速成长和工业扩张正在推动电力需求快速成长。新兴国家可支配收入的增加预计将导致人均电力消耗量增加,从而在不久的将来对扩大电力基础设施产生巨大需求。

受交通运输业电气化和工业活动不断扩大的推动,电力需求预计将继续增长。一些国家已订定目标,逐步淘汰以石化燃料为动力的乘用车的销售。挪威是最早设定目标的国家之一,计划在2025年将所有新车转换为零排放汽车。丹麦、爱尔兰、荷兰和瑞典也设定了2030年逐步淘汰内燃机汽车的目标。英国则设定了2040年为所有新型重型车辆实现零排放的最后期限。中国将对新车销售实施电动车配额制,从2019年的10%提高到2025年的15%,容纳700万辆电动车。

包括印度和中东国家在内的各国政府机构都制定了多项支持政策,以增加电动车的普及率。技术的进步、电动车价格的下降以及相关基础设施的完善,使得电动车的普及率激增。

由于传统发电技术在发电成本方面面临来自替代能源的日益严峻的挑战,涡轮机械控制系统的使用变得越来越重要。涡轮机械控制系统的使用可以提高使用传统燃料发电过程的效率,预计这将在预测期内推动市场成长。

因此,由于上述因素,预计电力部门将在预测期内主导市场成长。

亚太地区预计将主导市场

亚太地区是全球成长最快的地区之一,因为该地区有印度和中国等新兴经济体以及日本和澳洲等已开发国家。推动市场成长的因素是印度、中国和日本等亚太国家的投资增加。预计大量化工厂、发电厂、石油和气体纯化以及其他製造中心的存在将在预测期内推动市场成长。

印度正在投资炼油厂和石化产品。由于遭到强烈反对,在马哈拉斯特拉邦邦拉特纳吉里建造世界最大炼油厂的计划失败了,但中央政府正在考虑在全国各地建立较小的炼油厂。政府计画在2021年将精製能力从每天479.2万桶提高到479.2万桶。

中国等国家正持续发展燃料发电产业。 2022年第一季,中国许多省份的地方政府核准了新增8.3吉瓦燃煤电厂的计画。其中包括湖南、陕西、甘肃、安徽、浙江和福建。 2022年2月,AGC集团计划在泰国建立氯碱製造公司。该公司将持有新公司约 65% 的股份,其余股份由 PTT 全球化学上市公司持有。

因此,由于上述因素,预计亚太地区将在预测期内主导涡轮机械控制系统、改造和辅助服务市场。

涡轮机械控制系统、维修和辅助服务业概况

涡轮机械控制系统、改装和辅助服务市场比较分散。主要企业(排名不分先后)包括通用电气、西门子能源、艾默生电气、ABB、罗克韦尔自动化。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2027 年市场规模与需求预测

- 2027年涡轮机及压缩机市场规模及需求预测

- 近期趋势和发展

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁产品/服务

- 竞争对手之间的竞争

第五章市场区隔

- 按应用

- 涡轮机控制

- 蒸气涡轮控制

- 燃气涡轮机控制

- 压缩机控制

- 涡轮机控制

- 按最终用户产业

- 力量

- 石油和天然气

- 化学

- 金属和采矿

- 其他最终用户产业

- 按服务类型

- 新型涡轮机械控制系统

- 改造涡轮机械控制系统与辅助服务

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Turbomachinery Automation Vendors

- ABB Ltd

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens Energy AG

- Yokogawa Electric Corporation

- STORK, A Fluor Company

- Turbine Technology Services Corporation

- Energy Controls Technology Inc.

- PetroTech Oil & Gas Inc.

- HollySys Automation Technologies Ltd

- Control-care BV

- Automation System Original Equipment Manufacturers

- Voith GmbH & Co. KGaA

- Woodward Inc.

- MAN Diesel & Turbo SE

- Mitsubishi Electric Corporation Ltd

- Compressor Controls Corporation

- Solar Turbines Incorporated

- Ingersoll Rand Inc.

- Turbomachinery Automation Vendors

第七章 市场机会与未来趋势

The Turbomachinery Control Systems, Retrofitting, and Ancillary Services Market is expected to register a CAGR of 2.94% during the forecast period.

The growing adoption of automation technologies in the industrial sector and the new power generation projects are expected to create a huge demand for turbomachinery control systems, retrofitting, and ancillary services during the forecast period. However, the constantly increasing preference for renewable energy sources resulted in a reduction in the investment and demand for turbomachinery control systems in recent years.

The advancements in turbomachinery control systems technology, with a special focus on gas expansion turbines used in LNG plants, are expected to create several opportunities for the market in the future. Asia-Pacific is expected to dominate the market studied due to factors such as the growing economies of India and China, the presence of a large chemical industry, low labor wages, and a growing manufacturing sector.

Turbomachinery Control Systems, Retrofitting, & Ancillary Services Market Trends

Power Segment is Expected to Dominate the Market

In the power sector, turbomachinery control systems are used in equipment like turbines used for power generation and compressors that provide consistent pressure required for the operation of pneumatic valves and actuators in the power plant. In traditional power generation systems (steam, gas), turbomachinery control systems are integral in enhancing the turbomachinery equipment's productivity and safety.

The demand for electricity is growing rapidly due to a surge in population and industrial expansion across the world. The increasing disposable income in developing countries led to a rise in per capita power consumption, which is expected to create huge demand for expanding power infrastructure in the near future.

The electricity demand is expected to increase in the future, fueled by the electrification of the transportation sector and growing industrial activities. Several countries have adopted targets of phasing out the sale of passenger cars running on fossil fuels. Among the first to set targets is Norway, transitioning to an entirely zero-emission fleet of new cars, with 2025 as a target. Denmark, Ireland, the Netherlands, and Sweden have set 2030 to phase out internal combustion engine vehicles. The United Kingdom set 2040 as the deadline to have an entirely zero-emission fleet of new heavy vehicles. China has introduced an electric car quota for new car sales, rising from 10% in 2019 to 15% in 2025, corresponding to seven million electric cars.

Various government bodies, including those from India and countries in the Middle East, have formulated several supportive policies to increase the adoption of electric vehicles. Technological advancements, price reductions pertaining to electric vehicles, and their associated infrastructure have led to a surge in the popularity of electric cars.

The use of turbomachinery control systems gained importance as conventional power generation technologies are facing increasing challenges from alternate sources of energy in terms of the cost of power generation. Using turbomachinery control systems leads to efficiency improvement in the power generation process from conventional fuel, which is expected to boost the market's growth during the forecast period.

Therefore, due to the above-mentioned factors, the power segment is expected to dominate the market's growth during the forecast period.

Asia-Pacific is Expected to Dominate the Market

Asia-Pacific is one of the fastest-growing regions across the world due to the presence of emerging countries, like India and China, and developed countries, such as Japan and Australia. Factors driving the market's growth are increasing investments in the Asia-Pacific countries, such as India, China, and Japan. The presence of a large number of chemical manufacturing plants, power generation plants, oil and gas refining plants, and other manufacturing centers is anticipated to propel the market's growth during the forecast period.

India is investing in its refinery and petrochemical business. Although the plans for the world's largest refinery in Ratnagiri, Maharashtra, were dropped due to fierce opposition, the country's central government is looking to set up smaller refineries at different locations around the country. The country's government plans to boost the refining capacity, which stood at 4792 thousand barrels per day in 2021.

Countries like China are still developing the fuel-based power generation sector. In the first quarter of 2022, the provincial governments of many states in China approved new plans to add 8.3 GW of coal-based power generation plants. The states include Hunan, Shaanxi, Gansu, Anhui, Zhejiang, and Fujian. In February 2022, AGC group planned to establish a new chlor-alkali manufacturing company in Thailand. The company will hold around 65% share in the newly formed company, and the rest will be held by PTT Global Chemical Public Company.

Therefore, due to the above-mentioned factors, Asia-Pacific is expected to dominate the turbomachinery control systems, retrofitting, and ancillary services market during the forecast period.

Turbomachinery Control Systems, Retrofitting, & Ancillary Services Industry Overview

The turbomachinery control system, retrofit, and ancillary services market is fragmented. Some of the key companies (in no particular order) are General Electric Co., Siemens Energy AG, Emerson Electric Co., ABB Ltd, and Rockwell Automation Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Market Size and Demand Forecast for Turbines and Compressors in USD billion, until 2027

- 4.4 Recent Trends and Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Turbine Controls

- 5.1.1.1 Steam Turbine Controls

- 5.1.1.2 Gas Turbine Controls

- 5.1.2 Compressor Controls

- 5.1.1 Turbine Controls

- 5.2 By End-user Industry

- 5.2.1 Power

- 5.2.2 Oil and Gas

- 5.2.3 Chemical

- 5.2.4 Metals and Mining

- 5.2.5 Other End-user Industries

- 5.3 By Service Type

- 5.3.1 New Turbomachinery Control System

- 5.3.2 Retrofit Turbomachinery Control System and Ancillary Services

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Turbomachinery Automation Vendors

- 6.3.1.1 ABB Ltd

- 6.3.1.2 Emerson Electric Co.

- 6.3.1.3 General Electric Company

- 6.3.1.4 Honeywell International Inc.

- 6.3.1.5 Rockwell Automation Inc.

- 6.3.1.6 Schneider Electric SE

- 6.3.1.7 Siemens Energy AG

- 6.3.1.8 Yokogawa Electric Corporation

- 6.3.1.9 STORK, A Fluor Company

- 6.3.1.10 Turbine Technology Services Corporation

- 6.3.1.11 Energy Controls Technology Inc.

- 6.3.1.12 PetroTech Oil & Gas Inc.

- 6.3.1.13 HollySys Automation Technologies Ltd

- 6.3.1.14 Control-care BV

- 6.3.2 Automation System Original Equipment Manufacturers

- 6.3.2.1 Voith GmbH & Co. KGaA

- 6.3.2.2 Woodward Inc.

- 6.3.2.3 MAN Diesel & Turbo SE

- 6.3.2.4 Mitsubishi Electric Corporation Ltd

- 6.3.2.5 Compressor Controls Corporation

- 6.3.2.6 Solar Turbines Incorporated

- 6.3.2.7 Ingersoll Rand Inc.

- 6.3.1 Turbomachinery Automation Vendors