|

市场调查报告书

商品编码

1685951

奈米碳管-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Carbon Nanotubes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

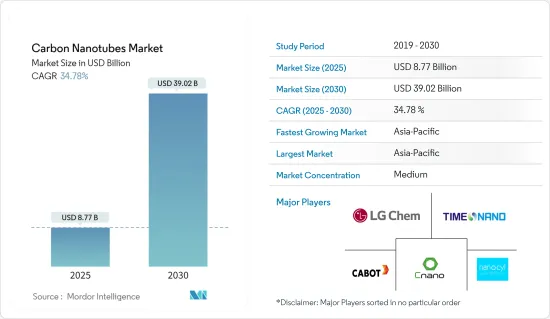

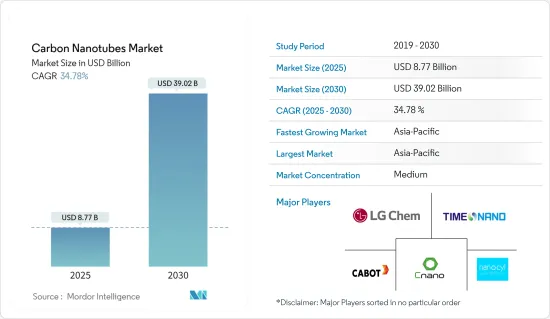

预计 2025 年奈米碳管市场规模为 87.7 亿美元,到 2030 年预计将达到 390.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 34.78%。

新冠疫情为奈米碳管市场带来了各种挑战,但也为某些领域提供了成长机会。随着世界从疫情中復苏,奈米碳管市场正在逐渐恢復势头,预计在预测期内将继续成长。

由于能源、汽车、电子、航太和其他工业应用等各行业的应用不断增加,市场需求也随之增加。

从中期来看,电动车中奈米碳管的使用量不断增加以及许多应用对先进材料的需求不断增长是推动市场发展的关键因素。

另一方面,环境和健康安全问题预计会抑制市场成长。

预计未来几年对能源储存设备的需求不断增长将为市场带来机会。

亚太地区贡献了最大的市场占有率,预计在预测期内将占据市场主导地位。

奈米碳管市场趋势

能源领域占市场主导地位

- 由于其高表面积和电导率,奈米碳管(CNT) 已引起人们的关注,主要作为太阳能电池、燃料电池催化剂和储氢等能源应用的触媒撑体。这些独特的特性使得 CNT 可用作能量转换和储存设备中的补充材料。

- 可再生能源的成长受到主要市场更雄心勃勃的扩张政策的推动,部分原因是为了应对当前的能源危机。过去五年可再生能源的扩张速度加快主要归因于两个因素。

- 首先,全球能源危机导致石化燃料和电力价格飙升,使得可再生能源发电技术更具经济吸引力。

- 其次,俄罗斯入侵乌克兰导致石化燃料进口国,尤其是欧洲国家,更重视可再生能源的能源安全效益。

- 儘管对风能和太阳能的补贴正在逐步取消,但中国仍计划在未来五年内加速成长,并在 2022 年至 2027 年期间安装全球近一半的可再生能源发电产能。 「十四五」规划中雄心勃勃的可再生能源目标、市场改革以及地方政府的大力支持,为可再生提供了长期收益保障。

- 欧盟是继中国之后全球第二大成长市场。 2010年至2015年,欧盟可再生能源产能扩张速度在过去五年中趋于稳定。然而,预计2022年至2027年期间,欧盟可再生能源产能扩张速度将增加一倍以上。一些欧盟成员国在俄罗斯入侵乌克兰之前就已製定雄心勃勃的目标和政策,以加速再生能源的采用。而欧盟则在再生能源一揽子计画下提案了更积极的目标,即到2027年完全停止进口俄罗斯石化燃料。

- 在美国,可再生能源的部署在过去五年中几乎翻了一番。 《个人退休帐户法》于 2022 年 8 月通过,将再生能源的税额扣抵抵免延长至 2032 年,为风能和太阳能发电工程提供了前所未有的长期可见性。在印度,预计预测期内新增装置容量将翻一番,其中太阳能光电发电将占主导地位,这得益于竞争性竞标,有助于政府实现到 2030 年安装 500 吉瓦可再生能源的雄心勃勃的目标。

- 因此,这些因素有望推动奈米碳管在能源产业的消费。

亚太地区占市场主导地位

- 中国是亚太地区最大的碳奈米材料生产国和消费国。丰富的原材料和低廉的生产成本支撑着该国碳奈米材料市场的成长。

- CNT 卓越的电气性能使其能够应用于光伏、感测器、半导体装置、显示器、导体、燃料电池、收集器和电池等电气和电子应用。

- 中国拥有全球最广泛的电子产品生产基地,为韩国、新加坡和台湾等现有的上游生产商带来了激烈的竞争。智慧型手机、OLED 电视和平板电脑等电子产品是成长最快的家用电子电器领域。随着中阶可支配收入的增加,电子产品的需求预计将成长,这将很快推动CNT市场的发展。

- 印度政府正在与主要半导体公司讨论推出本地製造工厂。印度政府已根据修改后的「印度半导体计画」邀请新一轮招标,自 2023 年 6 月起在印度建立半导体和显示器工厂,总投资额为 7,600 亿印度卢比(约 100 亿美元)。

- 在印度,汽车产业已经进行了大规模的投资。汽车领域近期的投资与发展趋势包括:

- 2023年1月,MG 马达 India宣布将投资1亿美元扩大产能。 2022 年 12 月,Mahindra & Mahindra 宣布计划投资 1,000 亿印度卢比(12 亿美元)在普纳建立电动车製造厂。这项投资凸显了电动车产业日益增长的重要性。

- 日本电子产业是日本半导体销售需求最重要的驱动力。日本约有30家半导体工厂,涉及各种半导体晶片的製造。预计2021年日本半导体产量将与前一年同期比较增13%,2022年将成长10%,产值将达到3.746兆日圆(233.1亿美元)。预计2023年的成长率为1%。

- 根据日本汽车工业协会(JAMA)的报告,2022年日本的乘用车产量将为7,427,179辆,卡车产量将为1,286,414辆。这可能会对CNT市场产生影响。

- 因此,由于上述原因,预计亚太地区将在预测期内推动市场成长。

奈米碳管产业概况

全球奈米碳管市场本质上是部分整合的,由不同地区的少数国际和国内参与者组成。市场的主要企业包括 LG 化学、成都有机化学(Timesnano)、卡博特公司、江苏天奈科技和 Nanocyl SA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 奈米碳管在电动车的应用不断扩大

- 许多应用领域对先进材料的需求不断增加

- 限制因素

- 环境问题与健康与安全问题

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 专利分析

第五章市场区隔

- 按类型

- 多壁奈米碳管(MWCNT)

- 单壁奈米碳管(SWCNT)

- 其他类型(扶手椅奈米碳管、锯齿形奈米碳管管)

- 按最终用户产业

- 电子产品

- 航太与国防

- 车

- 卫生保健

- 活力

- 其他终端用户产业(纺织品、塑胶和复合材料、建筑)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Arkema

- Cabot Corporation

- CHASM

- Chengdu Organic Chemicals Co. Ltd(Timesnano)

- Hyperion Catalysis International

- Jiangsu Cnano Technology Co. Ltd

- Kumho Petrochemical

- LG Chem

- Meijo Nano Carbon

- Nano-C

- Nanocyl SA

- Ocsial

- Raymor Industries Inc.

- Showa Denko KK(Resonac Holdings Corporation)

第七章 市场机会与未来趋势

- 对能源储存设备的需求不断增加

- 製药业备受追捧的材料

The Carbon Nanotubes Market size is estimated at USD 8.77 billion in 2025, and is expected to reach USD 39.02 billion by 2030, at a CAGR of 34.78% during the forecast period (2025-2030).

The COVID-19 pandemic posed various challenges in the Carbon nanotubes market but also represented opportunities for growth in specific areas. The industry has adapted to the changing landscape in the automotive sector and various other advanced applications, As the world is recovering from the pandemic, the carbon nanotubes market is gradually regaining its momentum and will continue to grow during the forecast period.

The market saw a rise in demand with the increase in applications in various industries, including energy, automotive, electronics, aerospace, and other such industrial applications.

In the medium term, the major factors driving the market studied are the growing usage of carbon nanotubes in electric vehicles and the increasing demand for advanced materials in numerous applications.

On the flip side, environmental concerns and health safety issues are anticipated to restrain the market growth.

Increasing demand for energy storage devices is expected to act as an opportunity for the market in the coming years.

Asia-Pacific accounted for the highest market share, and the region is expected to dominate the market during the forecast period.

Carbon Nanotubes Market Trends

Energy Segment to Dominate the Market

- Carbon nanotubes (CNTs) received much attention as catalyst support for energy applications, primarily solar cells, fuel cell catalysts, and hydrogen storage, due to their high surface area and conductivity. These unique properties allow CNTs to be used as supplemental material for energy conversion and storage devices.

- Renewable growth is propelled by more ambitious expansion policies in critical markets, partly in response to the current energy crisis. The accelerated adoption of renewable energy in the last five years' expansion rate results primarily from two factors.

- First, high fossil fuel and electricity prices resulting from the global energy crisis made renewable power technologies much more economically attractive,

- Second, Russia's invasion of Ukraine increasingly caused fossil fuel importers, especially in Europe, to value renewable energy's energy security benefits.

- China plans to install almost half of new global renewable power capacity over 2022-2027, as growth accelerates in the next five years despite the phaseout of wind and solar PV subsidies. Ambitious renewable energy targets in the 14th Five-Year Plan, market reforms, and provincial solid government support provide long-term revenue certainty for renewables.

- The European Union, the second-largest growth market after China, had stable renewable capacity expansion in the past five years compared to 2010-2015. But its pace of development is expected to more than double during 2022-2027. While several EU member countries had already introduced ambitious targets and policies to accelerate renewable energy deployment before Russia invaded Ukraine since then, the European Union proposed even more aggressive goals under the REPowerEU package to eliminate Russian fossil fuel imports by 2027.

- In the United States, renewable energy expansion almost doubled in the last five years. The IRA passed in August 2022 extended tax credits for renewables until 2032, providing unprecedented long-term visibility for wind and solar PV projects. In India, new installations are set to double over our forecast period, led by solar PV and driven by competitive auctions implemented to achieve the government's ambitious target of 500 GW of renewable power by 2030.

- Therefore, these factors are projected to boost the consumption of carbon nanotubes in the energy industry.

Asia-Pacific to Dominate the Market

- China is the largest producer and consumer of carbon nanomaterials in Asia-Pacific. The abundance of available raw materials and the low cost of production supported the growth of the carbon nanomaterials market in the country.

- Because of CNT's extraordinary electrical properties, CNT finds applications in electrical and electronic applications such as photovoltaics, sensors, semiconductor devices, displays, conductors, fuel cells, harvesters, and batteries.

- China includes the world's most extensive electronics production base and offers tough competition to existing upstream producers, such as South Korea, Singapore, and Taiwan. Electronic products, such as smartphones, OLED TVs, tablets, etc., include the highest growth in the market in the consumer electronics segment. With the increase in the disposable income of the middle-class population, the demand for electronic products is estimated to grow, thereby driving the CNT market shortly.

- The Indian government is talking with significant semiconductor companies to set up local manufacturing. The government invited new applications for setting up Semiconductor Fabs and Display Fabs in India from June 2023 under the Modified Semicon India Programme with an outlay of INR 76,000 crore (~10 billion USD).

- The country saw large investments in the automotive sector. Recent and planned investments and developments in the automobile sector include

- In January 2023, MG Motor India announced a USD 100 million investment to expand capacity. In December 2022, Mahindra & Mahindra revealed plans to invest INR 10,000 crore (USD 1.2 billion) in an EV manufacturing plant in Pune. This investment emphasizes the growing significance of the EV sector.

- Japan's electronic products industry is the most significant factor driving demand for semiconductor sales in Japan. Japan includes about 30 semiconductor fab industries that are involved in the manufacturing of various semiconductor chips. Japan's semiconductor production registered a 13% y-o-y in 2021 and 10% in 2022, with production value reaching JPY 3,074.6 billion (USD 23.31 billion). The growth for the year 2023 is forecasted at 1%.

- As per the reports by the Japan Automobile Manufacturers Association (JAMA), the country produced 7,427,179 units of passenger cars and 1,286,414 units of trucks in 2022. It is likely to impact the CNT market.

- Hence, due to the reasons mentioned above, Asia-Pacific is anticipated to drive the market's growth during the forecast period.

Carbon Nanotubes Industry Overview

The global carbon nanotube market is partially consolidated in nature, with a few international and domestic players across different regions. Some of the major companies in the market include LG Chem, Chengdu Organic Chemicals Co. Ltd (Timesnano), Cabot Corporation, Jiangsu Cnano Technology Co. Ltd, and Nanocyl SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage of Carbon Nantotubes in Electric Vehicles

- 4.1.2 Increasing Demand for Advance Materials in Numerous Applications

- 4.2 Restraints

- 4.2.1 Environmental Concerns and Health Safety Issues

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 By Type

- 5.1.1 Multi-walled Carbon Nanotubes (MWCNT)

- 5.1.2 Single-walled Carbon Nanotubes (SWCNT)

- 5.1.3 Other Types (armchair carbon nanotubes and zigzag carbon nanotubes)

- 5.2 By End-user Industry

- 5.2.1 Electronics

- 5.2.2 Aerospace and Defense

- 5.2.3 Automotive

- 5.2.4 Healthcare

- 5.2.5 Energy

- 5.2.6 Other End-user Industries (Textiles, Plastics and Composites, and Construction)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Cabot Corporation

- 6.4.3 CHASM

- 6.4.4 Chengdu Organic Chemicals Co. Ltd (Timesnano)

- 6.4.5 Hyperion Catalysis International

- 6.4.6 Jiangsu Cnano Technology Co. Ltd

- 6.4.7 Kumho Petrochemical

- 6.4.8 LG Chem

- 6.4.9 Meijo Nano Carbon

- 6.4.10 Nano-C

- 6.4.11 Nanocyl SA

- 6.4.12 Ocsial

- 6.4.13 Raymor Industries Inc.

- 6.4.14 Showa Denko KK (Resonac Holdings Corporation)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Energy Storage Devices

- 7.2 Highly Desired Material in the Pharmaceutical Sector