|

市场调查报告书

商品编码

1686172

汽车感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Automotive Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

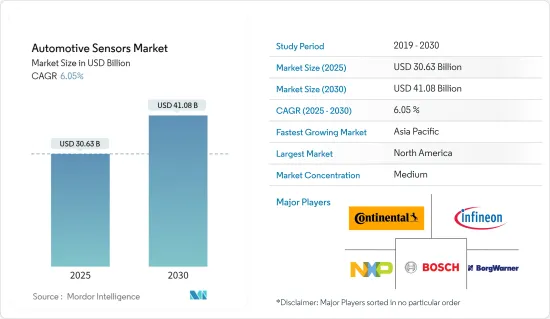

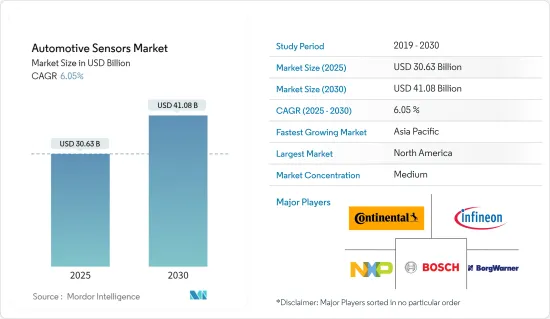

预计 2025 年汽车感测器市场规模为 306.3 亿美元,到 2030 年将达到 410.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.05%。

COVID-19 疫情对汽车产业产生了重大影响,包括汽车感测器市场。疫情期间,许多汽车製造厂关闭,导致汽车产量减少,从而导致汽车感测器的需求下降。此外,疫情导致全球供应链中断,造成原材料和零件短缺,进一步影响汽车感测器的生产。

不过,目前汽车感测器市场正在復苏,随着汽车产业的復苏,感测器的需求预计会增加。疫情也加速了高级驾驶辅助系统(ADAS)和自动驾驶汽车的采用,这些系统严重依赖车载感测器。从长远来看,ADAS(高级驾驶辅助系统)和自动驾驶汽车的需求不断增长等因素预计将推动汽车感测器市场的成长。

汽车感测器是用于检测、传输、分析、记录和显示来自车辆内部和外部环境的车辆性能资讯的车辆部件。预计预测期内汽车感测器的需求将大幅成长。这是由于汽车自动化的广泛应用和全球对联网汽车的需求不断增长。

此外,客户越来越了解新的安全系统和技术,并越来越多地选择具有改进安全功能的车辆。人们对乘客安全的担忧日益加剧,迫使汽车製造商为车辆配备驾驶辅助系统等功能。这些因素正在推动对感测器的需求。

使用多个汽车感测器(例如电动方向盘(EPS))有助于为驾驶提供额外的安全保障。此外,政府采取严格的燃油经济性标准和国际安全措施是先进感测器密集系统(如 EPS)扩展和发展的主要驱动力。

随着技术的进步和不断发展与突破,汽车产业对这些用于位置感测的电子感测器的需求正在不断增长。因此,预计整个预测期内汽车感测器市场将大幅成长。

近年来,汽车产业专注于电气化、自动驾驶等技术发展,这导致对感测器的需求增加。同时,随着汽车製造商越来越倾向于在其车辆中加入位置感测器,市场预计将继续成长。

配备自动驾驶系统(尤其是 4 级和 5 级)的自动驾驶汽车通常会处理大量资料并向汽车系统提供反馈,以遵循交通标誌、清除障碍物、执行转弯操作并平稳行驶。这就需要在这类车辆中加入更多的感测器,预计这将推动这一领域的市场发展。

汽车感测器市场趋势

政府措施和对更安全汽车系统的日益关注正在推动市场

全球每年平均约有124万人死于道路交通事故,其中一半是摩托车骑士和行人等弱势道路使用者,另一半则是方面碰撞的受害者。

根据世界卫生组织 (WHO) 的数据,全球销售的 80% 的汽车不符合基本安全要求。对车辆安全最重要的七项法规目前仅 40 个国家尚未采用。

事故数量大幅增加,促使最终用户采取更好的安全措施。在所有第一世界国家,由于道路和汽车设计的改进,受伤和死亡率一直在稳步下降。

由于一些开发中国家的事故率仍然很高,已开发国家正致力于执行严格的安全法规,并鼓励在车辆中采用各种子系统,如感测器等来增强安全性。

这些因素促使汽车製造商在其车辆上添加更多的安全感测器。现代汽车配备了尖端的安全功能。随着消费者对安全系统和技术的兴趣越来越大,他们越来越多地选择具有更好安全系统的汽车。

此外,世界许多国家都通过了有关车辆污染和燃油效率的严格规定。美国NHTSA(运输部公路交通安全管理局)和欧洲ICCT(国际清洁交通委员会)等监管机构都采用了车队级要求。这些规范规定了汽车製造商必须遵守的最低排放气体水准。

考虑到以上所有因素,预计市场在预测期内将显着成长。

亚太地区占市场主导地位

预计预测期内亚太地区将在收益方面占据主要市场占有率。预计全部区域汽车销量的成长将推动车载感测器的需求。此外,全部区域对电动车的需求不断增长也推动了市场成长。中国、印度和日本拥有大量製造业,为市场成长创造了机会。

由于都市化加速和经济状况稳定,新兴经济体的汽车产量成长速度快于已开发经济体。在印度和东南亚国协等新兴经济体中,安全性越来越受到消费者的关注,促使汽车製造商在低成本汽车中安装更多的感测器。预计这将在短期内推动汽车感测器的需求。

世界上成长最快的经济体中有一些位于亚太地区,其中中国和印度位居前列。因此,拥有更多财务资源的中产阶级消费者更有可能购买具有 ADAS 等先进功能的汽车。

该地区许多政府为缓解交通拥堵、提高道路安全而采取的倡议,推动了 ADAS(高级驾驶辅助系统)和其他依赖汽车感测器的安全功能的采用。许多亚太地区的国家的法规环境有利于采用先进的汽车技术,因为进入门槛低于其他地区。

此外,一些全球最大的电动车(EV)市场都位于该地区。电动车严重依赖感测器来控制电力传输和监控电池性能,这一事实推动了该地区对汽车感测器的需求。

因此,由于汽车需求旺盛、经济快速成长、政府倡议鼓舞人心、法规环境有利以及对电动车的日益关注,亚太地区是汽车感测器最重要的市场。

汽车感光元件产业概况

研究涉及的市场主要企业包括大陆集团、罗伯特·博世有限公司、博格华纳公司、英飞凌科技、恩智浦半导体、电装株式会社等。这些积极的产品创新、联盟以及主要企业之间日益增长的伙伴关係正在推动市场大幅成长。例如

- 2023年1月,恩智浦半导体(NXP)在CES 2023宣布将参与VinFast新汽车计划的早期开发阶段。 VinFast 致力于利用 NXP 处理器、半导体和感测器,NXP 提供一流的解决方案来加快产品上市时间。基于恩智浦的参考评估平台和软体层,VinFast 将专注于开发设计和製造尖端电动车的解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 类型

- 温度感测器

- 压力感测器

- 速度感测器

- 液位/位置感知器

- 磁感测器

- 气体感测器

- 惯性感测器

- 应用

- 动力传动系统

- 车身电子

- 车辆安全系统

- 远端资讯处理

- 车辆类型

- 搭乘用车

- 商用车

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 世界其他地区

- 巴西

- 阿拉伯聯合大公国

- 其他国家

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- DENSO Corporation

- Infineon Technologies AG

- Robert Bosch GmbH

- Texas Instruments Inc.

- Sensata Technologies Holding PLC

- Aptiv PLC(Delphi Automotive)

- CTS Corporation

- Maxim Integrated Products Inc.

- NXP Semiconductors NV

- Analog Devices Inc.

- Continental AG

- Littelfuse Inc.

- Hitachi Automotive Systems Americas Inc.

第七章 市场机会与未来趋势

The Automotive Sensors Market size is estimated at USD 30.63 billion in 2025, and is expected to reach USD 41.08 billion by 2030, at a CAGR of 6.05% during the forecast period (2025-2030).

The COVID-19 pandemic had a significant impact on the automotive industry, including the automotive sensors market. During the pandemic, many automotive manufacturing plants were shut down, which led to a reduction in the production of vehicles and consequently, a decrease in demand for automotive sensors. Additionally, the disruption in the global supply chain due to the pandemic resulted in a shortage of raw materials and components, which further affected the production of automotive sensors.

However, the market for automotive sensors is now recovering, and the demand for sensors is expected to increase as the automotive industry recovers. The pandemic has also accelerated the adoption of advanced driver assistance systems (ADAS) and autonomous vehicles, which rely heavily on automotive sensors. This is expected to drive the growth of the automotive sensors market in the coming years, as manufacturers increasingly incorporate these features into their vehicles.Over the long term, the automotive sensors market is expected to grow driven by the factors such as increasing demand for advanced driver assistance systems (ADAS) and autonomous vehicles.

Automotive sensors are components of a vehicle that are designed to detect, transmit, analyze, record, and display vehicle performance information from the vehicle's internal and external environments. The demand for automotive sensors is expected to rise significantly during the forecast period, owing to the growing popularity of vehicle automation and the growing demand for connected cars around the world.

Additionally, customers are also becoming more aware of new safety systems and technology, and they are increasingly selecting vehicles with improved safety features. Automotive manufacturers have been forced to equip their vehicles with features such as driver assistance systems, as passenger safety concerns have grown. Such factors are pushing the demand for sensors.

The use of several automobile sensors such as electric power steering (EPS) helps to provide the driver with extra safety benefits. Furthermore, the adoption of stringent fuel efficiency standards by government and international safety measures, are seen as major drivers for the expansion and development of advanced systems (such as EPS), which make extensive use of sensors.

The demand for electronic sensors for these position sensors in the automotive industry is expanding as a result of the increasing and continuous developments and breakthroughs in technology. As a result, the automotive sensor market is expected to increase significantly throughout the forecast period.

The automotive industry's recent shift in attention to technical developments such as electrification and autonomous driving has raised the demand for sensors. At the same time, the manufacturers' preference for integrating position sensors into vehicles suggests that the market will continue to grow.

Autonomous vehicles (especially level 4 and level 5) that feature self-driving systems generally process huge amounts of data to give feedback to the automotive system to drive smoothly clearing obstacles or performing turning maneuvers as per traffic signs. Due to this, it is expected that a greater number of sensors need to be incorporated into these types of vehicles, which is expected to drive the market for this segment.

Automotive Sensors Market Trends

Government Initiatives And The Growing Emphasis On Safer Automotive Systems Driving The Market

Around 1.24 million people die in road accidents each year on average around the world, half of whom are vulnerable road users like motorcyclists and pedestrians, and the other half are victims of side-impact collisions.

80% of cars sold worldwide, according to the World Health Organization (WHO), do not meet the essential safety requirements. The complete set of the seven most crucial regulations for auto safety has only been adopted by 40 nations.

The number of accidents has significantly increased, which has prompted end users to adopt better safety measures. In all first-world nations, injury and death rates have steadily decreased thanks to advancements in road and vehicle design.

Governments are concentrating on enforcing strict safety regulations and encouraging the adoption of various subsystems such as sensors in vehicles that enhance the aspects of safety because accident rates are still higher in some developing countries.

These factors are motivating automakers to add a number of safety sensors to their vehicles. Modern cars can now be found with cutting-edge security and safety features. Consumers are now more interested in choosing vehicles that are outfitted with better safety systems as a result of their increased concern for safety systems and technologies.

Additionally, a number of nations around the world have passed strict regulations governing vehicle pollution and fuel efficiency. Regulatory bodies including the National Highway Traffic and Safety Administration (NHTSA) in the United States, the International Council on Clean Transportation (ICCT) in Europe, and other organizations have adopted fleet-level requirements. These specifications set a minimum emission level that automakers must follow.

Based on the aforementioned points, the target market is expected to grow at a significant rate during the forecast period.

Asia-Pacific Dominates the market

Asia-Pacific held a major market share in terms of revenue during the forecast period. A rise in vehicle sales across the region is likely to increase the demand for sensors in the vehicle. The rise in demand for electric vehicles across the region is also propelling the growth of the market. The major presence of manufacturing industries across China, India, and Japan is creating market growth opportunities.

Due to increasing urbanization and stable economic conditions, automotive production in developing economies is growing faster than in developed economies. With an increase in the safety concerns among the consumers in the developing economies of India and the ASEAN countries, automobile manufacturers are incorporating more sensors in low-cost vehicles. It is expected to drive the demand for automotive sensors in the foreseeable future.

Some of the world's fastest-growing economies are located in the APAC region, with China and India leading the way. As a result, consumers in the middle class are more likely to purchase vehicles with advanced features like ADAS because they have more money to spend.

The adoption of advanced driver assistance systems (ADAS) and other safety features that rely on automotive sensors has been driven by initiatives implemented by numerous governments in the region to reduce traffic congestion and enhance road safety. With lower entry barriers than in other regions, the regulatory environment in many APAC nations is favorable for the adoption of advanced automotive technologies.

Additionally, some of the world's largest markets for electric vehicles (EVs) are located in the region. The fact that EVs heavily rely on sensors to control power delivery and monitor battery performance is driving regional demand for automotive sensors.

Hence, APAC region is the most important market for automotive sensors because of its high demand for vehicles, rapidly expanding economy, encouraging government initiatives, favorable regulatory environment, and growing emphasis on electric vehicles.

Automotive Sensors Industry Overview

Some of the major players in the studied market include Continental AG, Robert Bosch GmbH, Borgwarner Inc, Infineon Technologies, NXP Semiconductors, Denso Corporation, and Others In addition to these active product innovations, collaborations, etc., the market is experiencing significant growth due to the growing partnership between major players. expected to give the market a good outlook over the forecast period. For instance,

- In January 2023, NXP Semiconductors N.V. (NXP) announced its participation in the early development phases of new VinFast automotive projects at CES 2023. VinFast will strive to leverage NXP's processors, semiconductors, and sensors, while NXP will provide top-tier solutions to speed time-to-market. The joint expert collaboration will focus on developing solutions for designing and producing cutting-edge EVs based on NXP's recognized reference assessment platforms and software layers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Temperature Sensors

- 5.1.2 Pressure Sensors

- 5.1.3 Speed Sensors

- 5.1.4 Level/Position Sensors

- 5.1.5 Magnetic Sensors

- 5.1.6 Gas Sensors

- 5.1.7 Inertial Sensors

- 5.2 Application

- 5.2.1 Powertrain

- 5.2.2 Body Electronics

- 5.2.3 Vehicle Security Systems

- 5.2.4 Telematics

- 5.3 Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Asia-Pacific

- 5.4.2.1 China

- 5.4.2.2 Japan

- 5.4.2.3 India

- 5.4.2.4 South Korea

- 5.4.2.5 Rest of Asia-Pacific

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 DENSO Corporation

- 6.2.2 Infineon Technologies AG

- 6.2.3 Robert Bosch GmbH

- 6.2.4 Texas Instruments Inc.

- 6.2.5 Sensata Technologies Holding PLC

- 6.2.6 Aptiv PLC (Delphi Automotive)

- 6.2.7 CTS Corporation

- 6.2.8 Maxim Integrated Products Inc.

- 6.2.9 NXP Semiconductors NV

- 6.2.10 Analog Devices Inc.

- 6.2.11 Continental AG

- 6.2.12 Littelfuse Inc.

- 6.2.13 Hitachi Automotive Systems Americas Inc.