|

市场调查报告书

商品编码

1686179

光伏(PV) -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Solar Photovoltaic (PV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

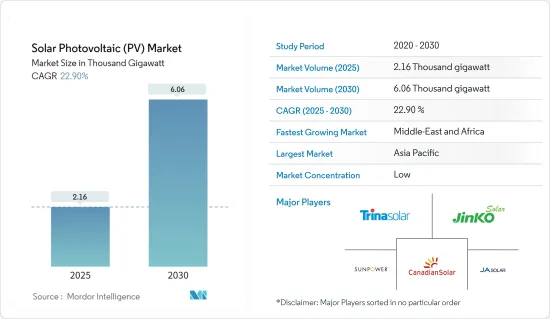

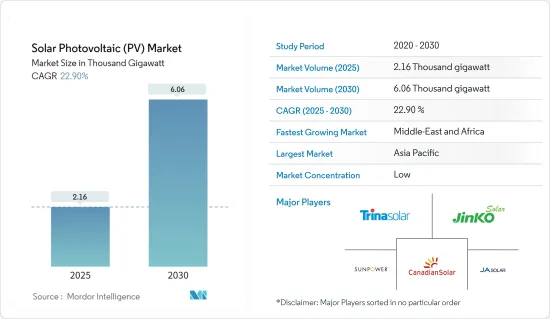

预计 2025 年太阳能市场规模为 2,160 吉瓦,到 2030 年将达到 6,060 吉瓦,预测期内(2025-2030 年)的复合年增长率为 22.9%。

主要亮点

- 从中期来看,有利的政府政策、太阳能发电系统的日益普及以及太阳能电池板价格和安装成本的下降可能会在预测期内支持全球太阳能市场的成长。

- 相反,风能和生质能源等其他可再生技术的成长等因素预计会阻碍市场成长。

- 然而,非洲和东南亚等地区的一些新兴政府努力为偏远地区提供 100% 的电力供应,再加上离网应用和太阳能光伏组件的技术进步,预计将在不久的将来创造充足的机会。

太阳能市场趋势

地面太阳能发电占市场主导地位

- 2022年,地面安装的太阳能光电将占全球太阳能光电容量的60%以上,中国、美国、德国和印度等国家将引领市场成长。

- 地面安装太阳能光电领域的主导地位可以归因于公用事业规模计划的增加、太阳能目标以及太阳能光电安装成本下降等因素。

- 世界各国正计划开发大规模太阳能发电工程,以减少对石化燃料发电的依赖,并实现能源结构多样化。

- 2023年5月,英国独立电力生产商萨凡纳能源公司(Savannah Energy Plc)的全资子公司萨凡纳能源尼日尔太阳能有限公司(Savannah Energy Niger Solar Ltd.)与尼日尔政府签署了谅解备忘录,将开发两座太阳能发电厂。该发电厂的总合装置容量将达到200MW。提案的太阳能发电厂将与尼日尔电网南部和中部连接。计划预计将于明年获得批准,并在未来两到三年内开始运作。

- 此外,在美国,公共产业规模的太阳能产业在装置容量方面领先于整个太阳能市场,占2022年装置容量的近60%。到2028年的未来五年内,计画兴建467个太阳能发电工程,总价值达980亿美元。此外,未来十年美国地面太阳能发电工程投资最多的州是德克萨斯州(270亿美元)、纽约州(70亿美元)、印第安纳州(60亿美元)、加州(60亿美元)、俄亥俄州(60亿美元)和内华达州(60亿美元)。

- 鑑于上述情况,随着大型太阳能发电工程安装量的增加,地面安装太阳能发电预计将在预测期内占据主导地位。

亚太地区占市场主导地位

- 截至 2022 年,亚太地区是全球最大的太阳能光电市场,占全球太阳能光电装置容量的大部分。截至2022年,中国、日本和印度是该地区装置容量最大的主要市场。

- 过去几年,中国太阳能产业的成长速度比该地区任何其他国家都要快。预计2022年中国太阳能发电装置容量将达392.436吉瓦,与前一年同期比较增28.08%。

- 随着电力和绿色能源需求的不断增长,新德里政府于12月核准了雄心勃勃的「2022太阳能政策」草案。该政策将在两年后将装置容量从2,000万千瓦调整至6,000万千瓦。该政策旨在创建一个统一的、单一窗口的国家入口网站,由德里太阳能电池公司管理,提供有关太阳能发电系统优势的资讯。

- 此外,2022年3月,阿里巴巴集团旗下物流部门菜鸟网路开始使用中国保税仓库屋顶安装的太阳能板所产生的分散式太阳能电力。该公司在其10万平方公尺仓库的屋顶上安装了太阳能发电系统,可储存786.2万千瓦的电能,每年每小时发电量超过800万千瓦时,足以为3000多户家庭供电。太阳能发电系统产生的电力足以满足菜鸟仓库的业务,多余的电力将输送回电网。此外,菜鸟及其合作伙伴今年也计划在菜鸟保税仓库安装屋顶太阳能发电系统,总合达50万平方公尺。

- 预计在预测期内,即将推出的太阳能发电工程、政府支持政策以及太阳能光电模组和相关系统成本的下降将推动该地区太阳能发电市场的发展。

太阳能产业概况

太阳能光伏(PV)市场较为分散。在这个市场运作的主要企业(不分先后顺序)包括 SunPower Corporation、JinkoSolar Holding、Canadian Solar Inc.、Trina Solar Ltd 和 JA Solar Holdings。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 光伏(PV)装置容量及2028年预测

- 2022年太阳能发电出货量(吉瓦)

- 2022年太阳能光电出货量(依技术份额)

- 2022年太阳能模组平均售价(美元/瓦)

- 2022年太阳能光电安装成本(美元/千瓦):主要国家

- 2022年主要国家太阳能发电平均成本

- 主要计划资讯

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 政府的优惠政策和太阳能发电系统的日益普及

- 因电费上涨,推动引进自用太阳能发电系统

- 限制因素

- 风能和生质能源等其他可再生能源技术的成长

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 类型

- 薄膜

- 多晶硅

- 单晶硅

- 最终用户

- 住宅

- 商业的

- 实用工具

- 扩张

- 地面安装

- 屋顶太阳能

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- First Solar Inc.

- Sharp Corporation

- Suntech Power Holding Co. Ltd.

- JinkoSolar Holding Co. Ltd.

- JA Solar Holdings Co. Ltd.

- Trina Solar Ltd.

- Hanwha Q Cells Co. Ltd.

- Acciona SA

- Canadian Solar Inc.

- SunPower Corporation

- LONGi Green Energy Technology Co. Ltd.

第七章 市场机会与未来趋势

- 新兴国家(尤其是非洲和东南亚)的多个政府正在努力实现 100% 电力供应

简介目录

Product Code: 50109

The Solar Photovoltaic Market size is estimated at 2.16 thousand gigawatt in 2025, and is expected to reach 6.06 thousand gigawatt by 2030, at a CAGR of 22.9% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, favorable government policies and increasing adoption of solar PV systems, with the declining price of solar panels and installation costs, will likely support the growth of the global solar energy market during the forecast period.

- Conversely, factors like the growth of other renewable technologies, such as wind and bioenergy, are expected to hinder market growth.

- Nevertheless, the efforts by several governments across emerging nations in the regions like Africa and Southeast Asia to provide 100% electricity access in remote areas coupled with off-grid applications and technological advancements in solar PV modules are expected to create ample opportunities in the near future.

Solar Photovoltaic Market Trends

Ground-mounted Solar PV to Dominate the Market

- In 2022, ground-mounted solar PV accounted for more than 60% of the global solar PV capacity, with countries like China, the United States, Germany, and India leading the market growth.

- The ground-mounted solar PV segment's dominance can be attributed to the factors such as the increasing number of utility-scale projects, solar energy targets, and declining costs of solar PV installations.

- Countries worldwide plan to develop large-scale solar PV projects to reduce their reliance on fossil fuel-based power generation and diversify their energy mix.

- In May 2023, Savannah Energy Niger Solar Ltd., the wholly-owned subsidiary of British independent power company Savannah Energy Plc, signed a memorandum of agreement (MoA) with the Niger government to develop two solar photovoltaic power plants. The power facilities will have a combined installed power capacity of up to 200 MW. The proposed solar plants will be connected to the South-Central section of Niger's electricity grid. The projects will likely receive sanctions next year and achieve operational status over next two to three years.

- Moreover, in the United States, the utility-scale solar PV sector has led the overall solar market regarding installed capacity, accounting for nearly 60% of installed capacity in 2022. There are 467 solar projects slated for the next five years until 2028, with a total value of USD 98 Billion. Also, the regions in the USA spending the most on Ground-mounted solar power projects over the next ten years are Texas (USD 27 billion), New York (USD 7 billion), Indiana (USD 6 billion), California (USD 6 billion), Ohio (USD 6 billion), and Nevada (USD 6 billion).

- Therefore, owing to the above points, the increasing installations of large-scale utility solar PV projects are expected to make ground-mounted solar PV a dominating segment during the forecast period.

Asia-Pacific to Dominate the Market

- As of 2022, Asia-Pacific was the largest solar PV market globally, accounting for a major share of the global installed solar PV capacity, and it is expected to continue its dominance during the forecast period. China, Japan, and India were the key markets in the region with the largest installed capacities as of 2022.

- The Chinese solar photovoltaic industry has grown faster than any other country in the region over the past few years. As of 2022, China's solar PV installed capacity reached 392.436 GW, representing an increase of 28.08% compared to the previous year's value.

- With the increasing demand for electricity and green energy, in December 2022, the New Delhi Government approved the draft of its ambitious Solar Policy 2022, which revises the installed capacity of 6,000 MW from 2,000 MW in two years; the policy aims to create a unified single-window state portal managed by the Delhi Solar Cell that will provide information on the benefits of solar PV systems.

- Moreover, in March 2022, Alibaba Group's logistics arm Cainiao Network started to use distributed solar power generated by rooftop solar panels installed in its bonded warehouses in China to power its operations. The company had installed the PV power generation systems on 100,000 square meters of warehouse rooftops that can store 7.862 MW of energy, with an annual power output of over 8 million kilowatts per hour, enough to power more than 3,000 homes. The power generated by the solar power system will be sufficient to power Cainiao's warehouse operations, and excess electricity will be diverted to the grid. Further, Cainiao and its partners expect to install rooftop PV generation systems on Cainiao's bonded warehouses spanning a combined 500,000 square meters, this year.

- Factors such as upcoming solar PV projects, supportive government policies, and declining costs of solar PV modules and associated systems are expected to drive the solar PV market in the region during the forecast period.

Solar Photovoltaic Industry Overview

The solar photovoltaic (PV) market is fragmented. Some of the major players operating in the market (in no particular order) include SunPower Corporation, JinkoSolar Holding Co. Ltd., Canadian Solar Inc., Trina Solar Ltd, and JA Solar Holdings Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Solar Photovoltaic (PV) Installed Capacity and Forecast, till 2028

- 4.3 Annual Solar PV Shipments in GW, till 2022

- 4.4 Share of Solar PV Shipments (%), by Technology, 2022

- 4.5 Average Selling Price of Solar PV Modules in USD/W, till 2022

- 4.6 Utility-Scale Solar PV Installation Cost in USD/kW, by Major Countries, 2022

- 4.7 Solar PV Average Electricity Cost, by Major Countries, 2022

- 4.8 Information on Key Projects

- 4.9 Recent Trends and Developments

- 4.10 Government Policies and Regulations

- 4.11 Market Dynamics

- 4.11.1 Drivers

- 4.11.1.1 Favorable Government Policies and Increasing Adoption of Solar PV Systems

- 4.11.1.2 Soaring Electricity Prices Incentivized Installing Solar PV Systems for Self-Consumption

- 4.11.2 Restraints

- 4.11.2.1 The Growth of Other Renewable Technologies Such as Wind and Bioenergy

- 4.11.1 Drivers

- 4.12 Supply Chain Analysis

- 4.13 Porter's Five Forces Analysis

- 4.13.1 Bargaining Power of Suppliers

- 4.13.2 Bargaining Power of Consumers

- 4.13.3 Threat of New Entrants

- 4.13.4 Threat of Substitute Products and Services

- 4.13.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Thin film

- 5.1.2 Multi-Si

- 5.1.3 Mono-Si

- 5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Utility

- 5.3 Deployment

- 5.3.1 Ground-mounted

- 5.3.2 Rooftop Solar

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States of America

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Asia-Pacific

- 5.4.2.1 China

- 5.4.2.2 India

- 5.4.2.3 Japan

- 5.4.2.4 Rest of Asia-Pacific

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 First Solar Inc.

- 6.3.2 Sharp Corporation

- 6.3.3 Suntech Power Holding Co. Ltd.

- 6.3.4 JinkoSolar Holding Co. Ltd.

- 6.3.5 JA Solar Holdings Co. Ltd.

- 6.3.6 Trina Solar Ltd.

- 6.3.7 Hanwha Q Cells Co. Ltd.

- 6.3.8 Acciona SA

- 6.3.9 Canadian Solar Inc.

- 6.3.10 SunPower Corporation

- 6.3.11 LONGi Green Energy Technology Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Efforts by Several Governments Across the Emerging Nations in the Regions Like Africa and Southeast Asia to Provide 100% Electricity Access

02-2729-4219

+886-2-2729-4219