|

市场调查报告书

商品编码

1686184

日本可再生能源:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Japan Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

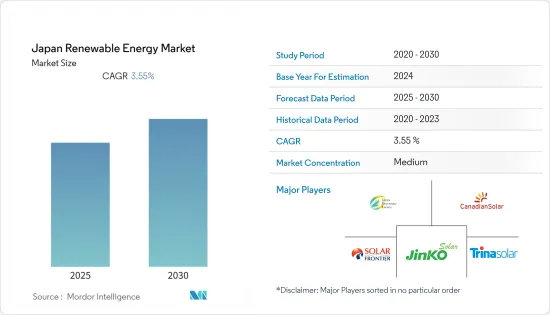

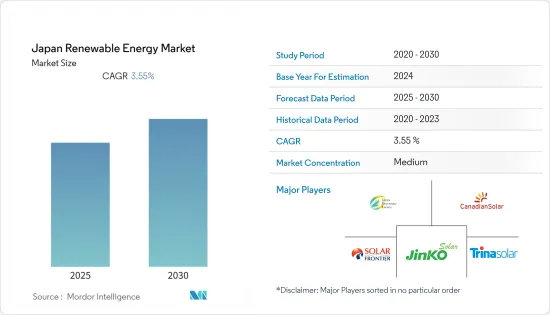

预计日本可再生能源市场在预测期内的复合年增长率将达到 3.55%

主要亮点

- 从长远来看,清洁能源来源需求的不断增长预计将刺激日本可再生能源市场的成长。此外,政府的支持措施和可再生能源技术的进步也有望推动市场成长。

- 另一方面,预计在预测期内,天然气发电的使用量不断增长将抑制日本可再生能源发电市场的发展。

- 然而,太阳能光伏製造技术的进步可能会在预测期内为日本可再生能源市场提供有利的成长机会。

日本可再生能源市场的趋势

太阳能产业显着成长

- 由于太阳能电池组件成本的下降以及系统可用于发电和热水加热等各种应用的多功能性,预计太阳能领域将在预测期内占据最大的市场占有率。

- 截至2022年,日本已安装7,883万千瓦的太阳能容量,全部为光伏发电,成为太阳能应用成长最快的国家。日本是全球太阳能市场的领导者,45% 的太阳能电池都是在日本製造的。

- 据日本环境省和国际贸易产业省称,日本的目标是2030年实现太阳能发电容量达到108吉瓦。该国计划透过在50%的中央政府和市政建筑、企业建筑和停车场安装太阳能电池板来实现这一目标。

- 2022年4月,日本电力公司Jera Corporation与国内可再生能源工程公司West Holdings签署协议,在新兴市场开发及兴建至少1GW的太阳能发电工程。该合约涉及在该总部位于东京的公用事业公司拥有的新建和旧发电厂所在地安装太阳能光伏 (PV) 园区,预计建设工期为四年。

- 此外,2023年2月,道达尔能源开始在三重县津市商业营运51兆瓦的太阳能发电设施。该设施与能源发行系统相连。它将向中部电力未来津供电。该公司与日本中部电力的子公司中部电力Miraiz签订了为期17年的购电协议。

- 因此,预计预测期内对太阳能领域的投资增加将有助于日本可再生能源市场的成长。

政府支持政策可望推动市场

- 日本政府已经推出了多项支持政策,以实现2030年可再生能源电力供应占36-38%的目标。预计这些政策将有助于在预测期内实现这些目标。

- 截至 2022 年,日本的可再生能源装置容量为 117.5 吉瓦,预计年增长率与 2012 年相比为 5%。由于即将实施的计划和政府的绿色能源目标,可再生能源容量预计会增加。

- 2022年2月,经济产业省透过三个不同的竞标分配了2021年675MW的太阳能光电容量。平均得标价格从10.31日圆/千瓦时到10.82日圆/度不等,最低中标价格为10.23日圆/千瓦时。因此,在预测期内,鼓励国家太阳能发展的政府计画可能会推动市场发展。

- 此外,东京于2022年12月通过的新法规要求大型住宅建筑商在2025年4月后在东京建造的所有新住宅都必须配备太阳能发电面板,以减少家庭二氧化碳排放。首都政府的目标是到 2030 年将温室气体排放在 2000 年的基础上减少一半。

- 因此,政府努力增加再生能源来源在国家总发电量的份额,主要透过风能和太阳能竞标,预计将在预测期内推动日本可再生能源市场的发展。

日本可再生能源产业概况

日本的可再生能源市场本质上是中等分散的。市场上的主要企业(不分先后顺序)包括日本再生能源、阿特斯阳光电力、晶科能源控股、天合光能和 Solar Frontier Corporation。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 可再生能源结构(日本,2022年)

- 可再生能源装置容量及2028年预测(单位:吉瓦)

- 政府法规和政策

- 近期趋势和发展

- 市场动态

- 驱动程式

- 对清洁能源来源的需求不断增加

- 政府支持计划和可再生能源技术的进步

- 限制因素

- 扩大天然气发电利用

- 驱动程式

- 供应链分析

- PESTLE分析

第五章市场区隔

- 类型

- 太阳的

- 风

- 水力发电

- 生质能源

- 其他类型

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Japan Renewable Energy Co. Ltd.

- Canadian Solar Inc.

- JinkoSolar Holding Co. Ltd.

- Trina Solar Co. Ltd.

- Solar Frontier KK

- INFINI Japan Solar Co. Ltd.

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems AS

- First Solar Inc.

第七章 市场机会与未来趋势

- 太阳能製造的技术进步

简介目录

Product Code: 50165

The Japan Renewable Energy Market is expected to register a CAGR of 3.55% during the forecast period.

Key Highlights

- Over the long term, the growing demand for clean energy sources is expected to stimulate the market growth of Japan's renewable energy market. Furthermore, supportive government programs and advancements in renewable energy technologies are also expected to drive the market's growth.

- On the other hand, increasing penetration of natural gas for power generation is expected to restrain Japan's renewable energy market during the forecast period.

- Nevertheless, the technological advancements in solar PV manufacturing will likely create lucrative growth opportunities for the Japanese renewable energy market in the forecast period.

Japan Renewable Energy Market Trends

Solar Energy Segment to Witness Significant Growth

- The solar energy segment will likely hold the largest market share during the forecast period, owing to the declining costs of solar modules and the versatility of these systems for various applications, like electricity generation, water heating, etc.

- As of 2022, Japan installed 78.83 GW of solar energy capacity, all of which comes from solar PV, and the country is the fastest-growing nation in promoting solar PV. It leads the world's photovoltaic market, with 45% of photovoltaic cells manufactured in Japan.

- According to Japan's Environment and Trade Ministries, the country aims to have 108 GW of solar capacity by 2030. The country plans to achieve the target by installing solar panels on 50% of the central government and municipality buildings, corporate buildings, and car parks.

- In April 2022, Japanese utility Jera Co. Inc. and domestic renewable engineering firm West Holdings finalized a deal for developing and constructing at least 1 GW of solar projects on the local market. Under the agreement, the tie-up will install photovoltaic (PV) parks at new and former power plant sites owned by the Tokyo-based electric company, and the work is expected to be carried out over four years.

- Additionally, In February 2023, TotalEnergies began commercial operation of a 51-MW solar power facility in Tsu, Mie Prefecture, Japan. The facility is connected to the energy distribution system. It will supply electricity to Chubu Electric Power Miraiz Co. Inc., a subsidiary of the regional utility company, under a 17-year power purchase agreement.

- Hence, increasing investments in the solar energy sector are expected to aid the growth of the Japanese renewable energy market during the forecast period.

Supportive Government Policies Expected to Drive the Market

- The Japanese Government has introduced numerous supportive policies to achieve 36-38% of its power supply from renewable sources by 2030. These policies are expected to help achieve the targets during the forecast period.

- As of 2022, the country had an installed capacity of 117.5 GW of renewable energy, which projected an annual growth of 5% compared to 2012. With the upcoming projects and government green energy targets, the renewable installed capacity is expected to increase.

- In February 2022, the Ministry of Economy, Trade, and Industry (METI) allocated 675 MW of PV capacity across three different auctions in 2021. The average bid price ranged from JPY 10.31/kWh to JPY 10.82/kWh, with the lowest bid price at JPY 10.23/kWh. Thus, such government programs to encourage solar energy growth in the country will likely drive the market during the forecast period.

- Moreover, in December 2022, according to new regulations passed in Tokyo, all new houses in Tokyo built by large-scale homebuilders after April 2025 must install solar power panels to cut household carbon emissions. The Government in the capital aims to halve greenhouse gas emissions by 2030 compared with 2000 levels.

- Therefore, efforts from the Government to boost the share of renewable energy sources in the total electricity generation mix of the country, primarily through wind and solar power auctions, are expected to drive the renewable energy market in Japan during the forecast period.

Japan Renewable Energy Industry Overview

The Japanese renewable energy market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Japan Renewable Energy Co. Ltd., Canadian Solar Inc., JinkoSolar Holding Co. Ltd, Trina Solar Co. Ltd, and Solar Frontier KK.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, Japan, 2022

- 4.3 Renewable Energy Installed Capacity and Forecast in GW, till 2028

- 4.4 Government Policies and Regulations

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 The Growing Demand for Clean Energy Sources

- 4.6.1.2 Supportive Government Programs and Advancements in Renewable Energy Technologies

- 4.6.2 Restraints

- 4.6.2.1 Increasing Penetration of Natural Gas for Power Generation

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Solar

- 5.1.2 Wind

- 5.1.3 Hydro

- 5.1.4 Bioenergy

- 5.1.5 Other Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Japan Renewable Energy Co. Ltd.

- 6.3.2 Canadian Solar Inc.

- 6.3.3 JinkoSolar Holding Co. Ltd.

- 6.3.4 Trina Solar Co. Ltd.

- 6.3.5 Solar Frontier KK

- 6.3.6 INFINI Japan Solar Co. Ltd.

- 6.3.7 Siemens Gamesa Renewable Energy SA

- 6.3.8 Vestas Wind Systems AS

- 6.3.9 First Solar Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Technological Advancements in Solar PV Manufacturing

02-2729-4219

+886-2-2729-4219